|

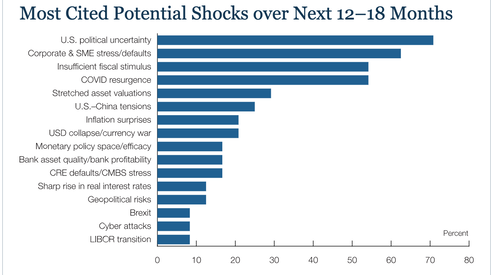

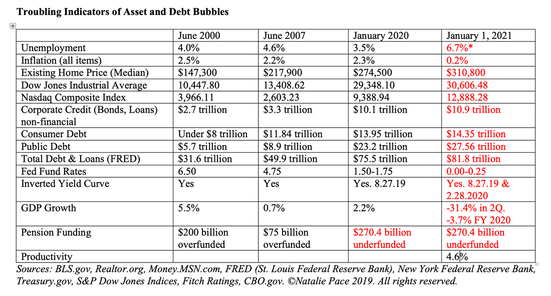

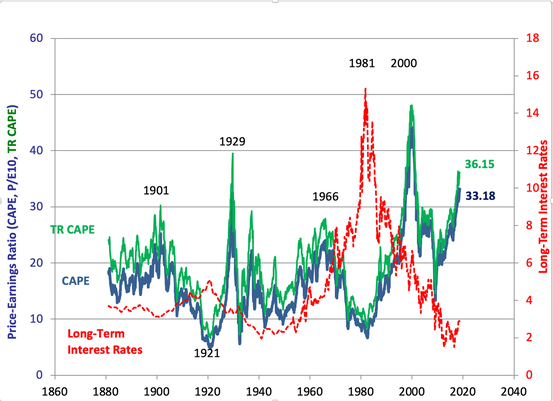

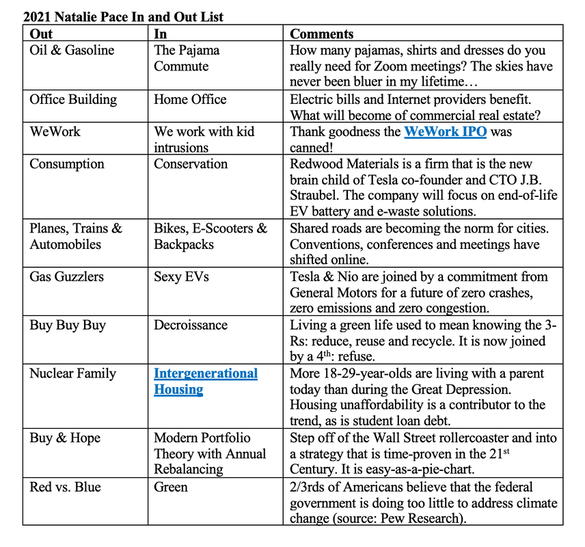

Wondering where real estate, stocks, Bitcoin, cryptocurrency, bonds, gold, the U.S. dollar and the economy are headed in 2021? Learn what's in and what's out, so that you can make your best move now, while asset prices are at all-time highs (for many of the assets). Economic Recovery in 2021? The economy is predicted to have contracted about -2.4% in 2020. (We’ll get the first look at this on Jan. 28, 2021.) If the current projections turn out to be right (and the vaccine curtails the pandemic), then global growth could be about 4% in 2021 (source: The World Bank). The Federal Reserve Board governors believe that the U.S. will achieve 4.2% GDP growth in 2021. GDP growth above 4% has only happened once in the past decade, in the 1st quarter of 2015. Of course, it’s hard to imagine any year worse than 2020. The bounce off the bottom should help 2021 look better than 2020 – particularly if we are successful in reining in the pandemic. China is predicted to ring in 8.2% GDP growth in 2021 (source: IMF). As you can see in the graph below, the strongest growth will be in China and southern Asia. 2020 has been a very difficult year, but you wouldn’t know it by looking at asset prices. Bitcoin, stocks, real estate and gold are all at all-time highs. It’s tempting to think that all you have to do is buy in and you get a trip to the moon. Bitcoin has doubled in just one month! Since the Nov. 3, 2020 election, the Biden Rally has pushed the NASDAQ Composite Index up 20%. However, the problem with soaring fast and high is that the crash can be a killer. You only have to look back to March, and the last two 21st Century Recessions, to sober up. The Dow Jones Industrial Average dropped 35% between February 19, 2020 and March 23, 2020. That was the fastest about-face from bull to bear in history. Even though 2021 should be a recovery year (if we tame COVID19), that premise has already been priced into most assets. That is why “stretched asset valuations” are listed in the top 5 Potential Shocks by the Federal Reserve Board of Governors in their most recent Financial Stability Report. While it is certainly possible that blue skies continue for investors in 2021, there are a lot of economic storms on the horizon. What could possibly go wrong? Our worst nightmare never seems to end. Many of the potential shocks cited above have already become realities, including political uncertainty, business stress, COVID resurgence and stretched asset valuations. We are embroiled in a troublesome 2nd wave of COVID19 that has many European nations and some U.S. states locked down. A spike of cases in the U.S. has severely and negatively impacted non-essential corporations, along with small and medium businesses. The Retail Apocalypse has been joined by a host of other industries in peril, such as airlines, casinos, commercial real estate, oil and gas companies and more. PPP loans and bond purchases helped get us through 2020, but how long can we keep printing cash like there is no tomorrow? Given that we enter a recovery year in 2021 with “stretched” asset valuations, it will be difficult to know which way the investment winds will blow. That is why most investors will benefit from battening down the hatches of their financial home. Protect your wealth from a downturn, while being properly diversified, with some hot industries, if assets continue a bull run into the recovery year. I will teach this time-proven strategy at the Jan. 16-18, 2021 Investor Educational Retreat this weekend. Call 310-430-2397 or email [email protected] to register. You can try our free web apps to get started. Just click on the button on the home page at https://www.NataliePace.com/. Stock prices. Would you pay $50 for a café latte? Stocks are in bubble territory. Yes, they can go higher. However, when bubbles pop, the drop is far and fast. As you can see in the chart below, the only two times in history when stock prices have been higher than they are today was in 1929 and 2000. 1929 was the year before the Great Depression. 2000 marked the zenith before Dot Com stocks dropped up to 78%. Click to read a blog that explains this in greater detail. Bonds are illiquid and negative yielding. Bonds are losing money. The safe side of your portfolio isn’t supposed to put your principal at risk. Think like Roy Rogers, who once said, “I’m more concerned with the return of my money than the return on my money.” Click to read a blog that explains this in greater detail. Money market funds have redemption gates and liquidity fees and they are not FDIC-insured. Additionally, because it is a fund, it can lose value. Again, the safe side of your portfolio is not supposed to have capital risk. Click to read a blog that explains this in greater detail. Even if you have a 401K and believe your options are limited, there are likely solutions that you haven’t put on the table. Gold prices are near an all-time high. Silver, which typically shadows gold, is still trading quite low, however. What are the problem areas of gold, and is silver the opportunity? Learn more in my Gold and Silver blogs. Real estate prices are unaffordable in 59% of US cities. Buying high in real estate can be a decade-long nightmare it. If you’re purchasing a home, you need to make sure it is affordable, that you are buying it for a good price and that you are looking at a 7-10-year horizon, at minimum. If you are buying real estate, you owe it to yourself to get this process right. Don’t just trust the broker-salesman to have your best interests at heart. It’s your life and livelihood that can be heaven or hell, not the realtor’s. Join me at my Real Estate Master Class on Jan. 23, 2021. Call 310-430-2397 to register now. Click to read a blog that explains real estate in greater detail. Bitcoin is on fire. It is more of a trader’s platform than a currency, however. You can’t have a currency that is worth $40,000 one month and $4000 just a few months prior. Additionally, there is a lot of sketchy activity, and downright ruses, in this space. Ripple isn’t the only (alleged) crypto criminal. Click to learn more. Cannabis was decriminalized by the House on Dec. 4, 2020. Over the last few months, cannabis companies, like Aphria, have quadrupled in price. With a Blue Senate, will the U.S. legalize weed, like Canada did, and Mexico is in the process of doing? Will we have a North American continent that considers the herb on par with alcohol? That will be a positive for all cannabis companies. The company that has the best hot product will shine like a star above the rest, however. Learn more in this blog. The U.S. dollar is predicted to weaken against other currencies. The slide has already started. Fundamental Shifts Below is an In and Out List. So much has changed over the past year, many of which could turn out to be lasting and fundamental lifestyle and business modifications. These shifts will impact industries and the economy, offering a new set of winners and losers. What’s On Your In & Out List? Tag us on social with your suggestions at https://twitter.com/NataliePace, https://www.instagram.com/NatalieWynnePace/ and https://www.facebook.com/TheABCsofMoney/. We’d love to see your observations. The Bottom Line As Jerome Powell stated quite candidly on Dec. 16, 2020 in prepared remarks during the FOMC press conference, “The current economic downturn is the most severe of our lifetimes. It will take a while to get back to the levels of economic activity and employment that prevailed at the beginning of this year, and it may take continued support from both monetary and fiscal policy to achieve that.” Rather than bet on a continued bull market, or lay odds on the Apocalypse, a more prudent plan would be to protect your wealth from economic weakness, while keeping an appropriate amount at risk that is properly diversified. Underweight weak, out-of-date industries and lean into innovation and strength (like technology). This plan, when rebalanced 1-3 times a year, is a buy low, sell plan on auto-pilot that outperforms bull and bear markets. Now is the time to know what you own and why. If you wait for the headlines, it’s always too late. Call our office at 310-430-2397 or email [email protected] to learn more about how you can receive a 2nd opinion, join our next retreat or, at minimum, read the 4th edition of The ABCs of Money.  Natalie Pace New Year, New You Wealth Empowerment Retreat. Jan. 16-18, 2021. Call 310-430-2397 or email [email protected] to learn more. Other Blogs of Interest Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Movie Theaters are in Trouble Airbnb Should Have a Spectacular IPO Today. Cannabis is Decriminalized. Stocks Triple. Airbnb's IPO. Should Hosts Invest? Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. 26/9/2021 06:49:48 am

Glad to know about the economy growth and that looks quite interesting as well. I’m sure various people are getting the tremendous updates online and enjoy while having them here. Please continue to bring here trusted updates these are wise. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed