|

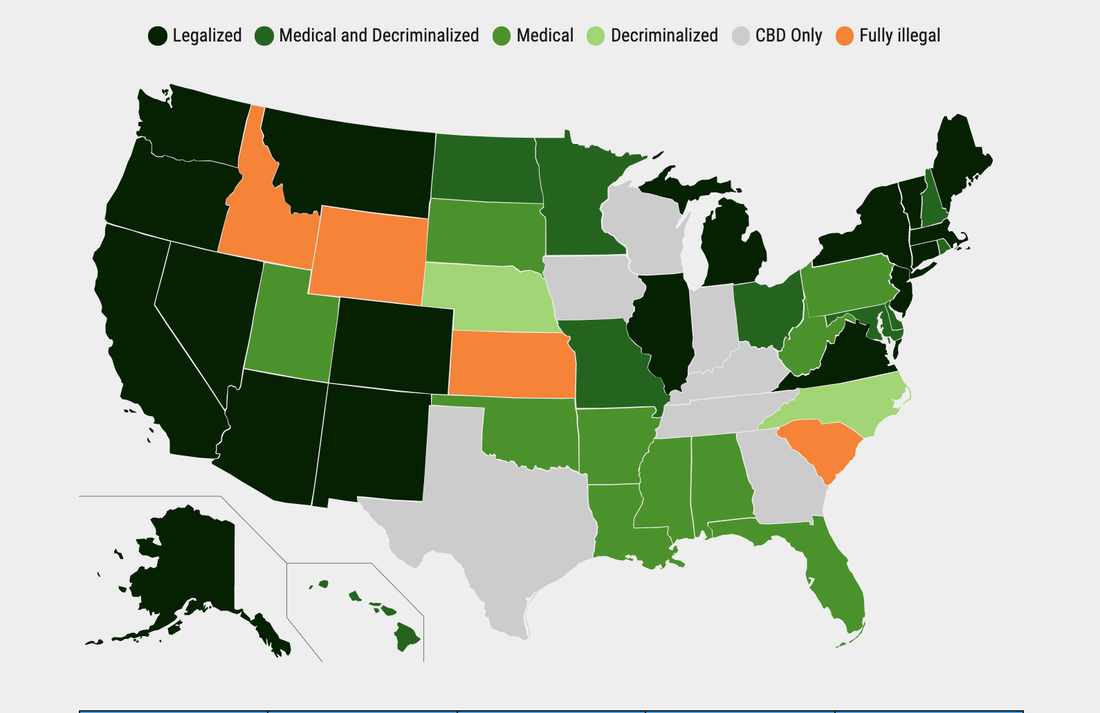

Cannabis may have gone out of favor with investors, but it is still very popular with its customers. So, why are so many of publicly-traded cannabis companies trading very close to all-time lows? Will the cannabis industry come back, or will investor exodus and cash bleed carry some of the companies into the crypt? The Meme Stock Phenomenon Tilray soared as high as $67 and is now at $6.72/share. HEXO was at $11 and is now 69 cents. Canopy Growth rose to $59. It’s now under $9/share. Cannabis has been a boom and bust investor rollercoaster since weed legalization in Canada in October of 2018. In 2021, many cannabis stocks were meme stocks, adding an extra layer of volatility. Which, if any, of the cannabis companies are a good investment in this price range? Is there a fundamental problem with the industry? As you can see in the chart above, some investors are calling for a $420 price for Tilray. You might think that’s a little outlandish until you consider that those same optimists took GameStop from $5/share to over $350/share. If you’re interested in that kind of Shoot the Moon ride, it’s important to babysit your payload. You’ll need to monitor the news and price swings, and have a rapid-fire profit-taking strategy. It’s a good idea to load up your cannabis stock symbols onto your favorite smart phone stock app. Once a company shoots the moon, it might stay there for just a few hours, only to drop precipitously near the market close that same day. Decriminalization One of the triggers for cannabis climbs tends to be when a major country legalizes. Cannabis shot the moon in September 2018, the month before Canada decriminalized. Tilray soared from $8 to $67 after the House of Representatives voted to decriminalize cannabis in the MORE Act on Dec. 4, 2020. The legislation never got a vote in the Senate. After both events, cannabis stocks dropped back precipitously. Why Has Cannabis Legislation Stalled in the United States? We all had hopes that the USA would make weed completely legal in 2020 or 2021. Those hopes seem to be stuck behind a stalled out Build Back Better plan and bickering over banking, criminal justice reform and recreational use. According to John Hudak, a senior fellow at the Brookings Institute, a supermajority of Americans supports full-scale cannabis reform. However, Congressional bills that include social equity and racial justice in a more comprehensive overhaul of the U.S. cannabis policy are threatened with a Senate filibuster. In the meantime, it looks like Germany might be the next major country to legalize. Even Texas Governor Greg Abbott has become dovish about reform. Stay tuned. $72 Billion Cannabis Market by 2028 Illegal weed takes a bite out of the corporate cannabis Mecca. Nonetheless, the legal market is predicted to grow from $13.5 billion in 2021 to $70.6 billion in 2028 (source GrandviewResearch). Tilray has a goal of hitting $4 billion in revenue by the end of fiscal 2024. That would be about a six-fold increase from their current sales. Tilray is in active acquisition mode with an experienced C-Suite and Board of Directors, so that is not an outlandish goal. Which Cannabis Companies are in Trouble? Most cannabis companies are losing money and trying to expand and innovate to keep up with demand. Cash burn is a serious concern. It can be difficult to separate the winners from the losers because cannabis companies have to be based out of Canada, rather than the U.S., in order to have a bank account. (Yes, that’s how ridiculous the U.S. laws are.) There are legitimate cannabis companies that are trading off the boards in the U.S., with others that are not true contenders. Penny stocks are like a 1000-piece puzzle, where you must turn over 10 times the amount of information you would normally review when evaluating a company. Don’t invest blindly. There could be a shakeout in the industry this year. Some companies may fold. Others might get bought on the cheap, or lag the competition. Canopy Growth has struggled for years -- leading the industry with losses. The fiscal 2021 net loss was $1.7 billion, with $1.3 billion lost the prior year. Canopy Growth's former founder CEO was canned in July of 2019, and replaced by Constellation Brands CFO David Klein. In November of 2021, there was another executive exodus, with the CFO and Chief Product Officer leaving the company. Meanwhile, the Green Organic Dutchman appointed Olivier Dufourmantelle as the president of U.S. Operations. (Dufourmantelle is the former COO of Canopy Growth.) John Bell, who was the chair of the board of Canopy Growth between 2014 and 2020, is now the chair of HEXO's board.) Canopy Growth, Aurora Cannabis and Charlotte’s Web are all cannabis companies that are losing revenue on a year-over-year basis. HEXO’s revenue increased 70% year over year, while The Green Organic Dutchman saw its sales soar by 142%. Email [email protected] with "Cannabis Stock Report Card" in the subject line if you'd like to receive our Cannabis Stock Report Card. The Power of Innovation (and Acquisition) The company that innovates the hottest product tends to be the one that will become 10 times as valuable very quickly. Tilray is betting on a 420 branded craft brewery to be able to take them into the CBD market. HEXO partnered with Molson Coors to create a CBD sparkling beverage brand that is getting five-star reviews. Canopy Growth has bet big on a sports drink called Bio Steel. The Green Organic Dutchman’s product angle is organic farming. Which Cannabis Companies are Ripe for Buying? Most cannabis companies are trading at a multi-year low price. However, that doesn’t mean that all of them are ripe to buy. You might wish to create your own cannabis fund with the companies that you believe are poised for that great product breakthrough, who are also run by executives that can take the company through the end zone. I’ll discuss my favorites and why in an upcoming videoconference. Email [email protected] with VIDEOCON in the subject line to join us live (or receive a link to watch it back). Innovative Properties continues to show impressive revenue growth, but is quite overvalued, with a P/E of 44. Who is Running the Show and Who is On the Team? Tilray is led by Irwin Simon, the former CEO and chairman of Hain/Celestial. Tilray’s team includes the former co-CEO of Whole Foods. The Green Organic Dutchman is surprisingly strong for a microcap, and is clearly on the move, as exhibited by its sales growth and talent acquisition. This penny stock is looking to compete. HEXO’s CEO was ousted on Nov. 19, 2021 and replaced by the Chief Innovation Officer of Molson Coors who had overseen the Truss CBD Beverage launch. HEXO has a new “Path Forward” that will be more conscious about capital preservation. Should You Purchase a Cannabis Fund? The funds that are readily available are offered by lesser-known financial services providers. With the amount of debt and leverage in the world, I would be cautious about investing in a cannabis fund from a company without knowing how well it was capitalized. Smaller fund companies almost folded in March of 2020. The ETFMG Alternative Harvest Fund (symbol: MJ) dropped 77% from its 2019 high to its March 2020 low. The Cambria Cannabis Fund (symbol: TOKE) sank by 66%. Building your own fund will require you babysitting the companies and understanding how to trade meme stocks. If the stocks shoot the moon, the trouble should be worth it. What Can the Company Do? What Can the Industry Do? What Will the Market Do? In the late stage of the business cycle, whenever you are purchasing individual stocks it’s important to also consider what the macro environment is going to do. It’s very difficult for even a strong fish to swim upstream against a crashing tide. While no one is predicting a Wall Street rout in 2022, few are anticipating a roaring bull. (Click to read my 2022 Crystal Ball blog and to watch Schwab’s Chief Investment Strategist’s two cents on equities for the year.) We’ve already determined that the cannabis industry itself should experience tremendous growth, and that there is a strong and swift global shift toward pot legalization. So, the hottest cannabis companies should be experiencing potential tailwinds from the industry itself. There has been a dearth of good news in the headlines. However, when that changes, such as if Germany or Texas legalizes, ready your engines for the rocket ship ride. The low prices of today could put investors on the right side of the trade as the world moves toward decriminalizing cannabis on a more massive scale. We discuss how to add cannabis to your wealth plan without betting the farm, and how to evaluate stocks using our time-proven system, for one full day at our Investor Educational Retreats. You can learn and implement a time-proven, 21st Century investment plan by attending our February 11-13, 2022 Financial Empowerment Retreat. A small investment of time and money could save your nest egg! These time-proven 21st Century strategies earned gains in the Dot Com and Great Recessions, and outperformed the bull markets in between. Call 310-430-2397 or email [email protected] to learn more now. You can also click on the banner ad below to get testimonials, to learn the 15 things you’ll learn at the retreat, and to get pricing and hours information. It’s going to be conducted online, so it feels like it’s you and I talking directly in your living room. It’s a great way to learn, and you have no travel or lodging expenses.  Join us for our New Year New You Financial Empowerment Retreat. Feb. 11-13, 2022. Email [email protected] to learn more. Register with a friend or family member to receive the best price. Click for testimonials & details. Other Blogs of Interest 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Investor IQ Test 2021. Investor IQ Test Answers 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed