Almost 5 Million Americans are Behind on Rent & Mortgages, While Home Prices Hit New Highs.14/5/2021

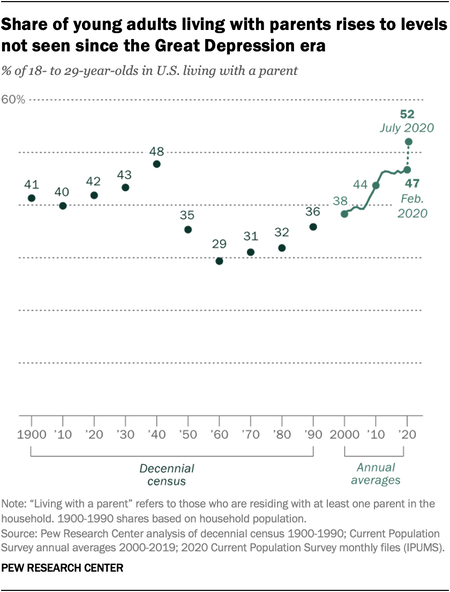

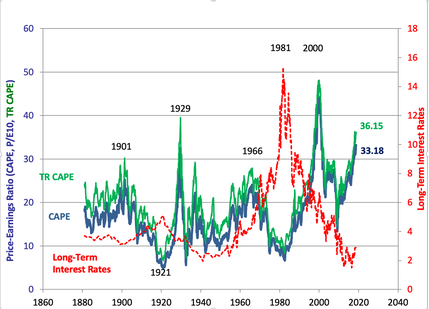

Almost 5 Million Americans are Behind on Rent & Mortgages, While Home Prices Hit New Highs. Real Estate: Beyond the Looking Glass. 11 Critically Important Facts to Factor in if You’re Considering Purchasing or Selling Real Estate 2.56 million renters and 2.33 million homeowners are behind on their payments (households). Missed rental payments are at about $35 billion, with missed mortgages at about $68 billion. In addition, 41.4% of student debt borrowers (26 million) have missed payments on their college loans, totaling $122.3 billion in missed payments (source: RIHA). The U.S. Treasury has been busy writing checks to try and slow down any foreclosures and evictions. On May 13, 2021, the department announced that $742 million has been distributed to a Homeowner Assistance Fund, while $21.6 billion has been allocated for Emergency Rental Assistance. If you are in need of assistance, click on the blue highlighted links to get additional information. Be aware, however, that the HAF and ERA funds are going to “governmental entities,” not directly to landlords or renters. If you qualify, then you should be able to apply for assistance through your state agency. The new funding came just at a time when the rental and foreclosure moratoria was slated to end on June 30, 2021. (A federal judge threw out the moratoria last week as well.) We all know someone who is touched by these missed payments. However, the news is telling us that real estate is on fire – creating a thirst for buying among Millennials, who are bidding up already unaffordable home prices. These new bailouts, alongside the moratoria, have kept a massive amount of shadow inventory, all of this distressed property, from hitting the multiple listing services. That would have been devastating to real estate, causing a plunge in prices, which could sink the economy back into a crisis. That is something the Feds, U.S. Treasury and The Administration are all trying to prevent. New homebuyers are simply not factoring the big picture into their decisions, but are being seduced into purchasing at an all-time high from the sexy ads and sophisticated real estate broker/salesmen. Almost 1/3 of purchasers are first-time home buyers (31%). It’s a seller’s market.  As Lawrence Yun said in our interview in late March of this year, “Understand that the market that has been hot will not be hot for very long. If you want to consider selling, now may be a good time because it should be easy to find buyers.” Check out my interview with Lawrence Yun, the chief economist of the National Association of Realtors, for additional information on the housing market. The high price of real estate is helping with the land value of commercial real estate, even if malls, hotels and office buildings are still largely vacant. Despite what you hear about real estate that puts you in a frenzy to own a new home, it pays to understand what is really going on and to be patient about a purchase that will affect your life for the next decade or longer. Real estate is not a short-term investment. If you buy high and the price drops, it becomes an illiquid nightmare with octopus arms that reach into every vein of wealth you might have, making your FICO score plunge and draining your nest egg dry. As a warning of how quickly things can head south, a Times Square mixed-use building plunged 80% in value over the last few years. Below are some Beyond the Looking Glass facts and indicators that tell a richer story than what you are seeing and hearing in the mainstream media. Factoring this data into the mix will help you to understand how to navigate your own home and real estate investments, with a view beyond the near-term. Just how could the economy and a general repricing affect your retirement and stock/bond portfolio, in addition to the value of your home? 11 2021 Real Estate Facts Landlords are hitting a wall Renters get another bailout Intergenerational Housing Hotels Malls are turning into Amazon warehouses Earnings are everything but Office buildings are incorporating social distancing Shadow inventory Exodus Credit ratings High price-earnings ratios And here is more color on each point. 11 2021 Real Estate Facts Landlords are hitting a wall. Some have had to reduce the rent for struggling tenants. Others have tenants that haven’t paid at all since the pandemic started. The arrears are technically due. However, will the money ever be collected? Can the landlords afford to write off the unpaid rent, or will they lose their property? Renters get another bailout. Renters may qualify for relief. However, many understand this is a short-term fix for housing costs that were unaffordable to begin with. As a result, we’re seeing a dramatic increase in intergenerational housing. Intergenerational Housing. 18% of the homes that Gen Z are purchasing, and 12% overall, are multigenerational homes – pushing up the prices of larger homes. Folks are thinking, while I’m getting an extra room or two for my Work-from-Home office, why not move the parents in (who can help out with the mortgage)? Vice-versa, when a young professional gets behind, their first call might be to the parents for room at the inn until the financial trouble subsides. As you can see in the chart below, intergenerational housing has hit a record high – higher than it was during the Great Depression (another time of necessity). Hotels. Hotels are hoping for a renaissance in the 2021 summer vacation market. Others are remodeling to become multi-unit housing. In the meantime, revenue was down by 50% or more in many casinos and hospitality/travel companies. Despite that fundamental weakness, many companies are trading near their all-time highs and unsustainably high prices. Booking Holdings (Priceline) has a 65 forward price-earnings ratio, while Las Vegas Sands Corp’s P/E is 389. Malls are turning into Amazon warehouses. Amazon has been buying up empty malls and turning them into fulfillment centers. The concept has struggling mall REITs, like Simon Property Group, trading near 52-week highs, though revenue is still down (and being propped up by earnings that are everything but sales). Earnings are everything but When S&P Global downgraded Cushman & Wakefield from BB- to B+ on March 21, 2021, the note included a revealing fact. “The majority of the company's EBITDA came from add-backs for interest expense ($197.6 million) and depreciation and amortization ($263.6 million), which we view as lower quality compared with core earnings,” S&P reported. Office buildings and malls are vacant and empty, so how are they reporting earnings at all? The answer lies in add-backs and other financial engineering. In other words, be careful about investments in REITs and other distressed property that is undergoing a structural shift in its business model. Office buildings are incorporating social distancing. Work-from-Home and the pandemic changed the business model for office buildings overnight, and look to be a structural shift going forward. Salesforce’s President Brent Snyder announced on February 9, 2021, that ”the 9-to-5 workday is dead.” According to Snyder, most of their staff will work remotely or “flex,” coming into the office only 1-3 days/week for “team collaboration, customer meetings and presentations.” This “work-from-anywhere model” means that Salesforce will be able to reduce its real estate footprint. I reported on this more in depth while I was in New York City in March. Click to read that blog. Shadow inventory. According to AttomData, 1/3 of mortgaged homes are considered to be equity-rich. (If this describes you, be sure to read my Equity-Rich blog, to be sure you can withstand a world where housing takes a downward spiral.) However, 2.6 million homes are also severely underwater (where the loans are 25% higher than the home value). 2.3 million households are behind on their mortgage, with probably some cross-over in the two. This distress is not showing up on the MLS. However, these homes are vulnerable to foreclosure and auction. (If you’re in this position, contact our office at [email protected] or 310-430-2397 for some key information that might save your life boat.) Patient home buyers who purchase in the shadow inventory, where prices can be discounted by up to 1/3, will find better bargains than those relying solely upon a broker-salesman. Exodus. California’s population fell by 182,000 in 2020, costing it one Congressional seat. New York City’s population fell by 108,000 in 2020. Sadly, part of the drops were due to COVID-19 deaths. However, unaffordable housing costs in both areas are pushing residents to more affordable areas, particularly now that employers have become more flexible with working from home. Areas like Sacramento and Modesto have attracted former San Francisco residents, according to Lawrence Yun. Credit ratings. REIT investors should be alerted that many have very high debt and very low credit scores. Companies in junk bond status include: Cushman & Wakefield, Wynn Resorts and Beazer Homes, among many others. High price-earnings ratios. Revenue growth in 2021 could start to look good even for severely distressed companies, simply because it’s not difficult to look better than 2020 – the worst year, economically speaking, of our lifetime. 2021 is projected to produce the best year in decades, with 6.4% GDP growth. However, this is already priced into the stock market. The forward outlook for price-earnings ratios are historically high… As you can see in the chart below, the only two times in history when price-earnings ratios have been this high were before the Dot Com Recession (2000) and before the Great Depression (1929). Now would be a good time to know exactly what you own in your managed brokerage account and your retirement account, and to be sure that you are comfortable with the amount of risk that you have. Bottom Line There has been a massive, historic effort by the U.S. Treasury and the Federal Reserve Board to keep prices of real estate and stocks right where they are. This has resulted in the bull market we are enjoying in both markets, even while the economic fallout of the pandemic is still swirling in the clouds, soil and shadow inventory. In the short-term, if you purchase a home or any real estate right now, it might look like you are a genius. However, buying high in any hard asset can be a decades-long nightmare. Here are a few key strategies that should pay off.

Also, read the Real Estate Blogs & Interviews below. Interview with Lawrence Yun, the Chief Economist of the National Association of Realtors Blog Videoconference Times Square Building Plunges 80% in Value Real Estate Prices are Going Up Real Estate Challenges & Opportunities Real Estate: Feeling Equity-Rich? Real Estate Solutions We spend one full day mastering time-proven real estate investment strategies, including income-producing property, at the Financial Empowerment Retreat June 4-6, 2021. Join us! Join us for our June 4-6, 2021 Financial Empowerment Retreat. (Click to learn more.) In 3 days, you'll learn how to pick great companies (like Beyond Meat, The Very Good Food Co., Oatly, Zoom Video, Tesla, Aphria, Veritone and Nio), and incorporate them into a well-diversified wealth plan. You'll discover how to protect your wealth and save thousands annually in your budget with smarter big-ticket choices. The retreat is a complete Money Makeover that will transform your life forever. Bring your friends, family and teens for an unbelievably low group rate. Call 310-430-2397 or email [email protected] to learn more now. Get the best price when you register by Saturday, May 15, 2021. Call 310-430-2397 or email [email protected] to learn more. Other Blogs of Interest Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Movie Theaters are in Trouble Airbnb Should Have a Spectacular IPO Today. Cannabis is Decriminalized. Stocks Triple. Airbnb's IPO. Should Hosts Invest? Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed