|

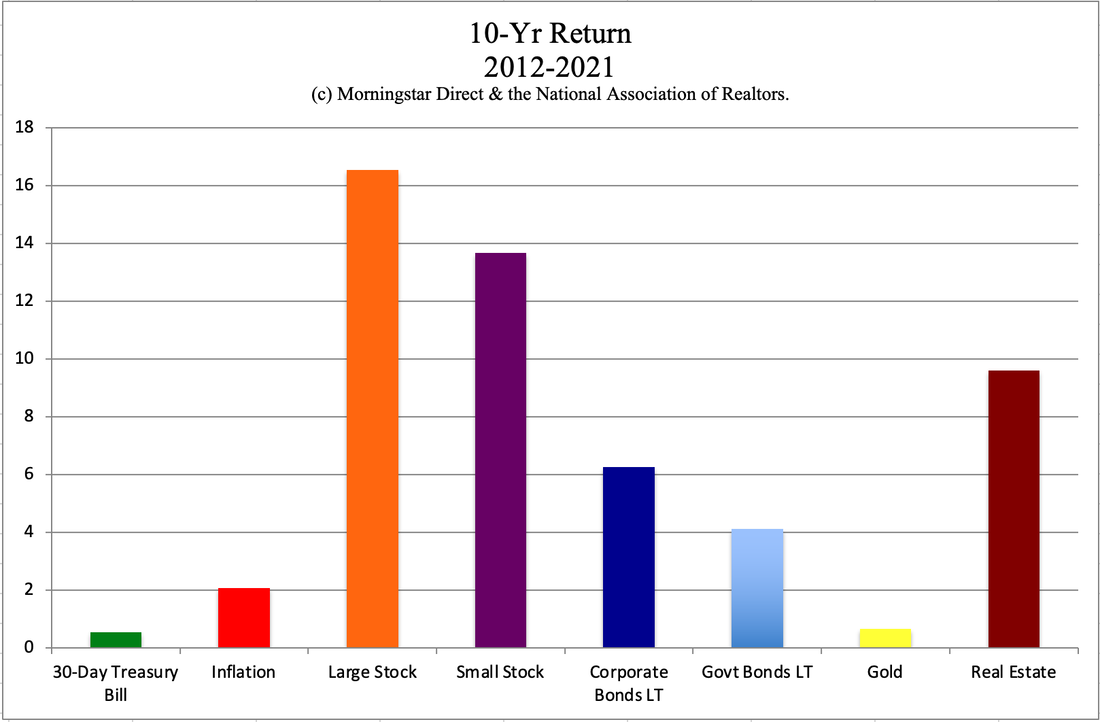

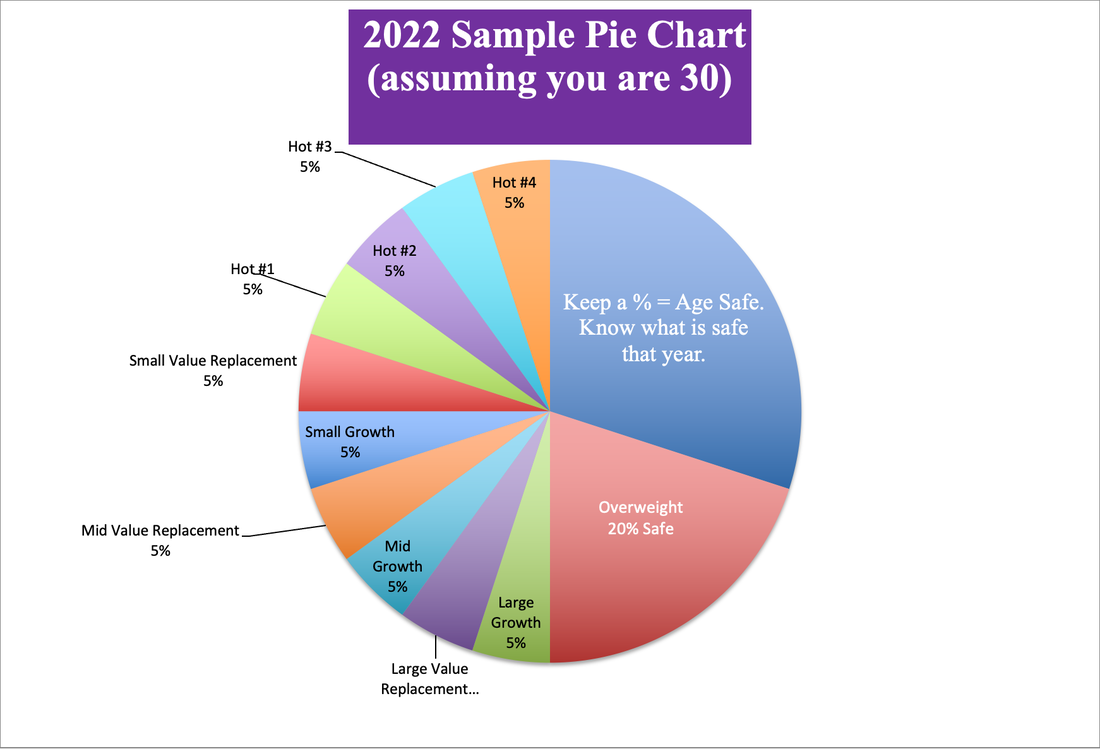

Bitcoin Crashes. Answers to 6 Common Crypto Questions. If you were getting your altcoin tips from a young trader on Tiktok or Youtube, you probably loved listening/watching in November and are now ready to unsubscribe. A spot check on a few of the Youtube gurus reveals that at Bitcoin’s high, views were in the hundreds of thousands. The same self-proclaimed prophets are now seeing about a quarter or less of that traffic. Is crypto flawed? Are these gurus inexperienced? Do charts work? I’ll answer these questions and more below. 420K Bitcoin in 60 Days! Worst Crash in Crypto History! SUPER BULLISH PREDICTION! LUNA COULD HIT $200+ IN 30 DAYS! Guess which headline was popping up everywhere around November 9, 2021, when Bitcoin hit $69,000/coin, and which one is circulating today. Bitcoin sank to a one-year low today of $28,122.44 (May 12, 2022). The Luna prediction was made last November. In all fairness, Terra (LUNA) did go up after the prediction to a high of $119.18. However, today it is virtually worthless. Not all coins are what they are hyped up to be. Coin clubs can be even riskier. Some are outright scams. Good marketers lure you in with headlines like those above. However, hype-monster marketers are not necessarily great analysts. Remember to always grade your guru before you listen to their advice. (This is true of your financial planner/broker-salesman, too. Be sure to check out my webinar and podcast “Is Your Conservative Plan Safe?” and the chapter in Put Your Money Where Your Heart Is entitled “Brokers are Salesmen.”) Will Prices Keep Plunging? We’ve seen a few crypto crashes over the years. In December of 2017, Bitcoin hit $20,000 in mid-December of 2017, and then crashed to $11,000 on January 19, 2018. That was the beginning of a plunge that sank to the $3,000-range by the end of 2018. This wiped out many crypto millionaires. This kind of devastation is not just hard on a wallet. There were suicides. Bitcoin had a reasonable recovery in 2019, but never came close to $20,000 and stayed mostly in the $7,000-$10,000 range. However, in the pandemic, the price plunged again to under $5,000. While the waves of Bitcoin can run independent from stocks, we’ve seen that stock market corrections can drag down safe havens. The recovery of Bitcoin, gold and silver can be more robust and speedier than stocks after a crash. However, in the early stages, everything tends to fall. That’s why having a capture gains strategy is key with this volatile investment. You can’t do that when you are drinking the Kool-Aid that cryptocurrency will be the only thing of value when the dollar collapses. What does a “capture gains” strategy look like? Keep reading. Does the Crypto Crash Mean Crypto is Doomed? No. However, it does reveal a fundamental aspect of all cryptocurrency. It’s a trader’s delight, not a currency (at this time). If you’ve got Diamond Hands and are HODLing (Holding On for Dear Life), the whales are going to eat your lunch. The average hold time of most crypto is less than 4 months. (You can easily see these statistics on Coinbase.) Statistics show that the beginning of crypto crashes are sparked from hedge fund and large investors selling. As the fallout becomes unbearable, Main Street investors might be forced to sell low just to pay their housing costs. Volatility favors sophisticated traders, not Diamond Hands (Buy & Hold investors). That’s not to say that isn’t a place for crypto in the monetary system. NFTs are gaining in popularity and most are paid for in Bitcoin, Ethereum or altcoins. (There is not a lot of crypto purchasing outside of this sphere at this time.) However, you can’t have a currency that loses half or more of its value every year or two. That’s not a currency. It’s a casino, which means you should limit your betting to something you can afford to lose. Is Crypto a Good Safe Haven Investment? As I mentioned, in the beginning of a correction/recession, even safe haven investments are vulnerable to losses. There does come a point, however, when the bad news on the status quo makes alternative investments look like Nirvana. Things can pick up steam fast when people feel like they are in an Apocalypse. However, the volatility of cryptocurrencies and the exceptionally weak returns of gold over the past decade are reminders that these safe haven investments work best as a slice of our strategy – not the entire plan. Using our pie chart system will also help you to capture gains at the high and buy back in at the low (without day-trading). You can learn this system by reading The ABCs of Money (5th edition), or you can learn and implement this system now by attending our June 10-12, 2022 Retreat. Email [email protected] to learn more. Is Crypto an Energy Hog (Like Elon Musk Warned)? Yes. According to the University of Cambridge’s Cambridge Centre for Alternative Finance, Bitcoin’s annual network power demand is 147 Twh. That is more electricity than the countries of Sweden, Norway or Ukraine burn. Some Altcoins are designed to be faster and greener, in order to compete with VISA and Mastercard, and to meet the social demands of climate action. The altcoins are in a crash, too. However, in a future that is getting ever more concerned about energy efficiency and reducing CO2 emissions, the altcoins have a potential to become a meme hot topic, once the recovery starts generating some steam. Here are some of the altcoins with interesting stories: Cardano (ADA), Solana (SOL), and Polygon (MATIC). You can access their descriptions and white papers on Coinbase.com. Can a Main Street Investor Surf the Waves of Crypto Successfully? A well-designed investment plan allows you the freedom of investing in a few hot industries, like cryptocurrency – within reason. The 21st Century has proven itself to be volatile over and over again. So, it’s important to have a time-proven plan that you rebalance regularly (at least once a year) that also prompts you to capture gains and buy into weakness. The pie chart plan does just that. Again, you can read about it in The ABCs of Money. You can learn and implement it at our next Financial Empowerment Retreat. You can also consider getting an unbiased second opinion from me – particularly if you were too aggressive about your belief in crypto and/or purchased near the top. This easy, time-proven plan is the life math that we all should have received in high school. The sooner you learn and implement it, the faster your life transforms. Should You Transfer Your Retirement Plan Into an LLC IRA That Invests in Crypto? IRAs have tax advantages. Betting your entire IRA on an investment that has a history of shooting the moon and then sinking into the sea is not worth the tax advantage. If you have enough in your nest egg that a couple of slices can be put into an LLC IRA that allows you to invest in crypto, then you might have the best of both worlds. If your slices are still a bit small, then it’s a better idea to build your wealth on a traditional, reliable platform like Coinbase. When you pay taxes, it’s only on the capital gains. If you’ve held the position for longer than a year, it could be taxed at 15% or less (for most people). Bottom Line Cryptocurrency is better thought of as a hot slice of a well-designed system, not the entire wealth plan. Regular rebalancing is key to being on the right side of the trade and to successfully riding the waves of volatility. This is still a highly speculative play. Capturing gains and buying low is not day-trading. Ideally, you’ll have 2-3 times a year on the calendar to consider your positions, while also having a strategy to deploy if the volatility lands in between those dates. If you’re invested in crypto, you’re going to hear when it soars and crashes. It makes headlines. The trick is being on the right side of those headlines, rather than being crushed by them. Proper diversification with regular rebalancing is your bunker. If you'd like to learn 21st Century time-proven investing strategies to protect your wealth from a No. 1 stock picker, join us for our June 10-12, 2022 retreat. Email [email protected] or call 310-430-2397 to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master.  Join us for our Financial Freedom Retreat. June 10-12, 2022. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out my Podcast on Spotify.

Watch videoconferences and webinars on Youtube. Other Blogs of Interest Crypto, Bold and Stocks All Crash. The Economy Contracted -1.4% in 1Q 2022. The Dow Dropped 2000 Points. Is Plant-Based Protein Dying? Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed