|

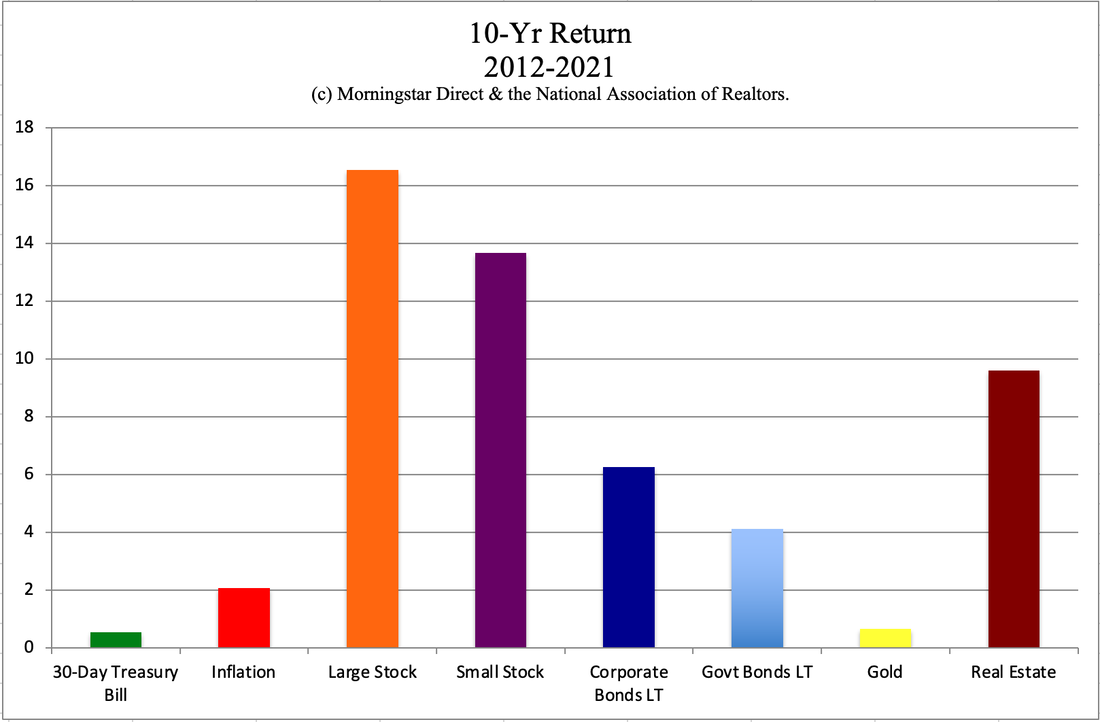

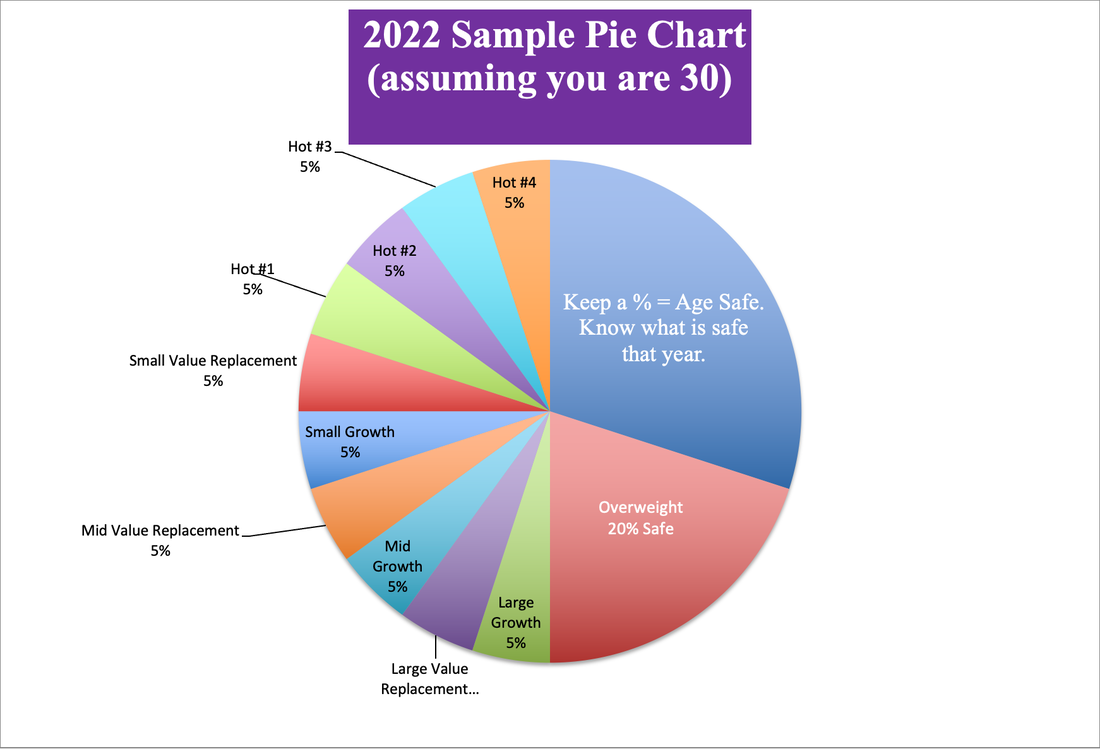

Crypto, Gold and Stocks All Crash. 6 important ways to protect yourself now. 3 Common Investing Mistakes. Why are crypto and gold crashing, along with stocks? Shouldn't they be strengthening as equities weaken? Are you befuddled and confused about what to do? Below are 6 important ways to protect your wealth, with 3 additional reminders on Common Investing Mistakes. 1. Get a Performance Chart of Your Current Stock and Bond Portfolio for the Past 15 years It’s easy to earn gains in a bull market, and it is easy to lose money in a recession. (Click to read my blog, “6 Warnings Signs of a Recession.”) We’ve been in a secular bull market for so long, since 2009, that many people have gotten complacent. We might sincerely believe that we (or our financial advisor) are doing a great job. However, it is never a good idea to confuse a bull market with wisdom. Feeling complacent could actually put us at risk of losing up to half of our portfolio. Knowing whether your plan is truly designed to protect you is actually quite easy (and a lot less expensive than having blind faith). Simply ask your financial advisor for a performance chart of your portfolio compared to the S&P 500 for the last 15 years. Most people shadow the returns of the general market, performing about 2% under, due to fees. If this is you, that’s a red flag. Plans that simply ride the volatility of the stock market are subject to losses of more than half in 21st Century recessions. Be careful of being lured into a plan that you’re told will protect you better. You need to learn the basics of what a time-proven, 21st Century plan looks like, and why bonds are risky in today’s Debt World. (“Conservative” plans are typically overweighted into bonds.) Preserving our wealth means our money is protected from recessions, while profiting from the bull markets. That plan is not rocket science, or day-trading. Nor does it require sophisticated economics training. It’s as easy as a pie chart, which is why we call it the life math that we all should have received in high school. 2. Keep a Percentage Equal to Your Age Safe I was recently included on a conversation that a 72-year-old retiree was having with her broker-salesman. She was worried about the volatility in stocks and wanted to make sure that her investments were protected. The broker-salesman recommended that they change the allocation to 50% bonds and 50% stocks. What the retiree didn’t know is that her broker was having her act like a working 50-year-old. As you get older, you can’t risk having that much of your principal investment. A 72-year-old should have 72% of her wealth protected from losses, as a general rule – more if she is risk-averse (not 50%). Also, bonds lose value when interest rates rise, meaning there is a potential for wealth depletion in 2022 from bonds, too. Typically, interest rates are cut in recessions, which helps bonds. We are currently in a monetary tightening cycle, with interest rate hikes projected to take the Fed Fund rate to up to 2.85% this year (from zero at the beginning of 2022). The more rapidly rates are raised, the more probability of continued economic weakness. There are many other problems with bonds this year, which you can learn about in my webinar at YouTube.com/NataliePace or in my Spotify podcast. Getting safe these days is tricky. Safe haven investments, like gold and crypto, typically tank with stocks in the early stage of recessions. (They also tend to recover more quickly, and even shoot the moon.) That’s why we spend a full day discussing “What’s Safe in a Debt World” at our Investor Educational Retreats. 3. Overweight 10 to 20% Safe Another thing that 72-year-old was missing, is that if she’s really worried about things she should be overweighting safe and acting older than she is. If this 72-year-old overweighted 15% safe, then her loss exposure could be limited to 6% or less. When you’re not actively earning income, it’s quite important to protect your wealth. You’re not going to be able to work longer while you wait to recover losses. 4. Know What Is Safe in Today’s Debt World When interest rates rise, bonds lose value. There are multiple risks with bonds in 2022, including interest rate risk, credit risk, liquidity risk, duration risk, opportunity costs and much more. We must be selective about choosing creditworthy bonds with a short duration. The patient investor who focuses more on liquidity than yield should be in a position to purchase creditworthy, better performing bonds in 2023 and 2024. Don’t be sold into an illiquid, negative-yielding investment that could have you losing principal, as well as buying power. A lot of folks are falling for the “your money isn’t keeping up with inflation” sales pitch, without realizing (until it’s too late) that they are at risk of losing actual money, in addition to purchasing power. Bonds are very vulnerable in 2022. Be sure to listen to my podcast and/or watch my webinar on this topic. 5. Get Control and Be the Boss. You’re the boss of your money. Now is the time to know exactly what you own and why. Don’t trust that anyone else is protecting your wealth without knowing the forensics. It’s easy to like our financial advisor in a bull market, and easy to resent them (or fire them) in a bear market. You’re the boss. No one loses your money without your consent. Also, if you’re over the age of 59 1/2, roll over your 401(k) or RSP into a self-directed IRA or TFSA, so that you have greater choice of what you invest in. This is an important tool for protecting your wealth. Those limited-choice retirement accounts don’t offer the safest options, and the limited choices make it difficult to include safe haven investments and other potentially hot industries that might keep your portfolio more buoyant. If you have any retirement plans that are still being hosted by previous employers, roll those over into self-directed plans as soon as possible as well, so that you can take appropriate action to be properly diversified and as safe as possible. If you would like additional information on what kind of brokerage is going to offer you the safest investments and greater freedom of equity choice, consider attending our Investor Educational Retreat June 10-12, 2022 (attend online from anywhere). I also offer an unbiased second opinion through my private coaching program. Email [email protected] for pricing and information. 6. Safe Haven Strategies Are you tempted to buy into something you think is going to shoot the moon? A lot of people are being sold into cryptocurrency, gold, silver, etc. under the premise that those assets will be the only thing of value when the dollar becomes worthless. With Bitcoin trading at under $31,000/coin (after hitting a high of $69,000 on Nov. 9, 2021) and with gold performing the worst of any investment of the last decade, it’s pretty clear that hot slices are a better strategy than betting the farm. What’s a Hot Slice? Our easy-as-a-pie-chart system with 1-3 times a year rebalancing is a buy low, sell high system on auto-pilot. If you think something is super hot, then assign a hot slice or two of that strategy in your nest egg (liquid assets). The system itself prompts you to capture gains when crypto shoots the moon, and to buy low when it crashes. This well-designed wealth plan assists us in surfing the waves of volatility that are inherent in every asset class – particularly when economies contract. I cover these safe haven investments in the 5th edition of The ABCs of Money. You can get updated with the most current research and information at our June 10-12, 2022 Retreat. I will also be discussing Bitcoin and other meme stocks in my free webinar and podcast on Thursday, May 12, 2022. If you’d like to join me live, just email [email protected] with WEBINAR in the subject line. (If you’re already on the VIDEOCON list, you’ll automatically receive the logon instructions the day before the webinar.) 3 Common Investing Mistakes 1. Market Timing Doesn’t Work Whenever there are signs of a recession, there are some of us who think we can outsmart the system by selling everything, and then buying back in when the market crashes. Market timing is statistically proven not to work. One of the biggest problems is that what feels like the Apocalypse is often the market bottom, when we should be buying low. At this point, many investors get fed up and instead sell low. Many people who tried market timing in the Great Recession sold for losses (near the bottom), missed most of the bull market and were then wanting to buy in (high) in 2019 (or only a year or two earlier). Another reason market timing doesn’t work is that there is a lot of financial engineering that goes on from the central banks. We would have been in an economic crisis to rival the Great Depression in 2020, if the Feds hadn’t saved the day with their lending programs, while the U.S. Treasury handed out cash like candy. (FYI: that’s not likely to happen in 2022.) Our easy-as-a-pie-chart nest egg strategy with regular rebalancing is a time-proven 21st Century plan. Learn and implement it now, while we’re still in the early stages of the current correction. 2. Emotions Are Not an Ally of Investing As you can see in the chart below, emotions often prompt you to do the exact opposite of what you should be doing. At the point when you think you’re in the Apocalypse, that’s usually the best time to buy low. At the point when you think the party is going to rage forever, like a lot of people felt in 2021, that’s typically when you should be selling high. Rather than be at the mercy of your emotions, it’s far better to be driven by the data and have a well-designed, well-diversified plan that can protect you from recessions and also prompts you to trim high and add low (Liz Ann Sonders’ term). You can learn and implement this plan by joining us at our June 10-12, 2022 Retreat (online, from your living room). 3. Limit Hot Investments to 4 Slices One of our more seasoned investors wanted to take on a lot more risk in cryptocurrency, even though he knows investing most of his assets in crypto runs against a well-diversified plan. He took about half of his nest egg and bought high in Bitcoin at about $55,000 a coin. There are many problems with this, in addition to the obvious one of losing almost half of his money. When we assign our sure shots to hot slices in our pie chart strategy (rather than going all in), the system itself will help to prompt us to sell high and buy low. When your slice gets too large, trim it back to where it should be. Capture gains. If we buy high and the slice gets smaller, it prompts us to buy more at a lower price. The fact that we are overweighting safe means that we still have a substantial amount protected from losses. That liquidity will help us to buy low. The reason most people don’t buy low is that they can’t. There’s no money to access for the transaction. When we take a large portion of our nest egg and dump it into one idea, then it’s difficult to have the emotional fortitude or the liquidity to take advantage of volatility. If we lose half of our wealth investing in Bitcoin at $55,000, we have to hope and pray that we recover from the losses. At that point, if we have a life partner, they might become angry with our choices. Losses can be very hard on relationships. Bottom Line Now is the time to be the boss of our money and to make sure that we are adhering to time proven, 21st-century investing strategies. Most financial plans soar in bull markets and crash in bear markets. Buy & Hope doesn’t work in the 21st Century, when the recessions are resulting in market crashes of 55% or more. As discussed above, we can see what’s at stake with a simple 15-year chart of our portfolio performance. Learning what a better plan looks like will require financial education. However, that is an investment that always yields better returns, and could save your assets.  Join us for our Financial Freedom Retreat. June 10-12, 2022. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out my Podcast on Spotify. Watch videoconferences and webinars on Youtube. Other Blogs of Interest The Economy Contracted -1.4% in 1Q 2022. The Dow Dropped 2000 Points. Is Plant-Based Protein Dying? Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed