|

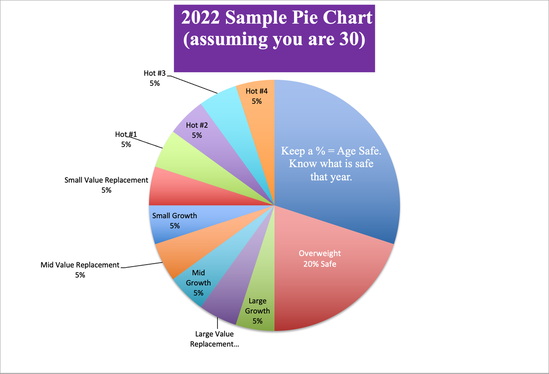

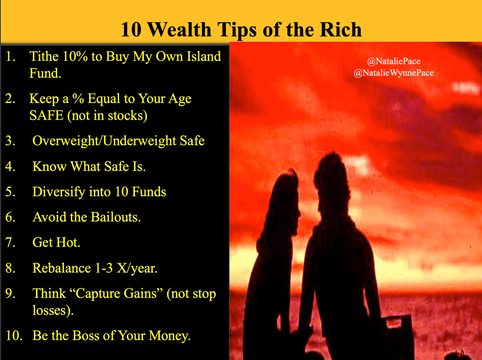

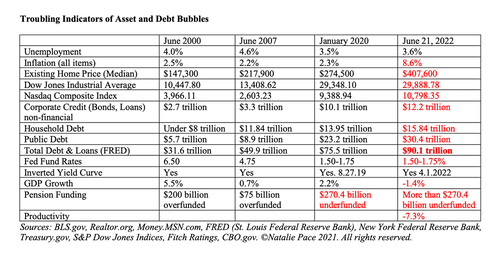

If inflation has made it hard to make ends meet, or if the bear market has you concerned about your wealth, the solution lies in adopting the wealth strategies of the 1%. (These strategies are all legal, but are seldom taught, and can lift each of us out of a rut.) It’s easy to get caught up in headlines, tangled in worry, led by fear and then suckered into get rich quick schemes that fleece us. The best plan is to lean into wisdom and strategies. That may sound like a pipedream. And I’m not saying it will be without painful choices. However, once we know what to do, if we’re brave enough to do it, then we can lift ourselves above the flotsam and become part of the solution. 10 Wealth Strategies of the Rich The strategies below have been employed by wealthy people throughout the centuries. Adopting them means that we can stop making everybody else rich at our own expense, start keeping the money in the family and improve everyone’s lot in life – from our elders to our infants. Many of these lessons are what Asian Americans employed to lift themselves from the lowest rung of society in the 19th Century to the top income earners in the United States today. 10 Wealth Strategies of the Rich 1. Deposit 10% of Income Into Tax-Protected Retirement Accounts 2. Keep a Percentage Equal to Your Age Safe 3. Know What is Safe in a Debt World 4. Overweight or Underweight Safe Based on Market Conditions. 5. Diversify Our At-Risk Side Into 10 funds 6. Add in Hots 7. Avoid the Bailouts 8. Rebalance Regularly 9. Think Capture Gains, Not Stop Losses 10. Be the Boss And here is more information on each point. 1. Deposit 10% of Income Into Tax-Protected Retirement Accounts Peter Thiel has $4 billion in his Roth I.R.A. (source: ProPublica). Are we neglecting to fund our IRAs and 401ks? He’s been able to accumulate his wealth without paying capital gains taxes, which is one of the best benefits of retirement plans. (Many salesmen focus on “pre-tax” without mentioning the benefits of capital gains-free accumulation.) Thiel’s Roth also ensures that he won’t pay income tax when he withdraws the money. It’s important to put 10% of our income into tax protected retirement plans – even when we are in debt or worried about paying our bills. Here’s the best formula.

Do not wait until you’re out of debt to start paying yourself first. Debt is a budgeting problem, and it shouldn’t be solved by shortchanging our future. Learn innovative strategies to make ends meet in an inflationary world that doesn’t add up by reading the Thrive Budget and Debt sections of The ABCs of Money (5th edition). Parents, if you feel that you’ve got your budgets under control, consider reading these section for your adult children’s sake. Wealthy people plan 100 years in advance and include their children in all of the financial education and legacy blueprint. Let’s start thinking of intergenerational wealth, instead of having each generation live in a silo. 2. Keep a Percentage Equal to Your Age Safe Always keep a percentage equal to your age safe. As you get older, you can’t afford to have as much riding on the Wall Street rollercoaster. 3. Know What is Safe in a Debt World Bonds are losing money. Money market funds are vulnerable, and have redemption gates and liquidity fees. In 2022, aiming for any yield at all can put us at risk of capital loss. However, by 2023, it could be easy to get a midterm creditworthy bond that pays us about 5% or higher. There is a U.S. Treasury I bond that is offering a 9.62% yield. The amount you can invest is limited to $10,000. FYI: the rate of return is only guaranteed for six months. Learn more at the TreasuryDirect.com website. 4. Overweight or Underweight Safe Based on Market Conditions. This is better than a risk tolerance quiz. If it looks like a recession is highly likely, as many economists believe today, overweight 10-20% safe. If you’re 50 and you overweight an additional 20% safe, the total amount of aggregate losses today would be about 6% rather than over 20%. Overweighting safe is a very efficacious tool, whereas risk tolerance tests can exacerbate losses by putting us on the wrong side of the trade. Most people are gleefully aggressive when markets are high, and we have no appetite for investing when we feel like we’re in an Apocalypse. That means our emotions (and the test) are prompting us to buy high and sell low. 5. Diversify Our At-Risk Side Into 10 funds Being diversified into small, medium, large, value and growth funds, with four hots, allows us to increase our performance, while limiting our risk. Normally, small caps are the top performers. However, over the last 10 years large caps have been the winners. Rather than try to guess, it’s a better plan to diversify and have the potential to gain no matter which slice increases in value. This pie-chart plan also makes it easy to see and capture your gains, while the “everything in the kitchen sink” funds tend to ride the Wall Street rollercoaster up and down. Those target date retirement funds and other Buy and Hope strategies are last-century products that have been a disaster in the 21st Century.  Create your own sample pie chart. Simply email [email protected] for a link to our free web app or go to NataliePace.com and click on the free web app badge. 6. Add in Hots Hot industries allow us to potentially increase our performance. This plan also gives us parameters for those tempting YOLO memes. There are always sophisticated marketing (Snake Oil) schemes designed to sell you the panacea for troubled times. Rather than betting the farm, if you really believe in it, invest a hot slice (after your due diligence). Regular rebalancing (#8 below) will assist us in being on the right side of the trade, particularly in volatile investments like cryptocurrency, and even technology and biotech. 7. Avoid the Bailouts The higher the dividend, the higher the risk. Most people are not aware that over half of the S&P500 is at or near junk bond status. In a highly leveraged world, it’s important to invest in the most creditworthy companies. G.E. investors are keenly aware of what happens when you swoon over your dividends, only to lose the majority of your principal. Many investors are completely unaware that Ford Motor company is a junk bond, or that 8 of the 30 Dow Jones Industrial Average have BBB credit ratings (source: S&P500). Boeing has a BBB- rating with a negative outlook. 8. Rebalance Regularly Have at least one date on the calendar for your investment rebalancing each year. If you’re rebalancing three times a year, calendar the end of April, the end of September, and the end of December. With the volatility of today’s market, particularly in the hot slices, it’s important to do a little babysitting so that you’ll know when something has come into favor. Rebalancing regularly with the pie chart system is a buy low, sell high blueprint that puts your emotions on the right side of the trade. When stocks and crypto are high, everyone wants to buy. However, when a hot slice becomes two or more, it is prompting you to sell high and capture gains. That makes it easier to have the money and the emotional fortitude to buy low, when the slice becomes a sliver. We’ve seen this in cryptocurrency and Chinese, technology and biotech equities, to name just a few. 9. Think Capture Gains, Not Stop Losses It’s important to have a “capture gains” mindset. Are you the type of person who avoids looking at your account? Are you afraid to learn just how much you’ve lost? Overweighting safe (step #4) is the best way to protect your wealth from a bear market. As I indicated above, people who do this early, don’t have to fret. It’s still quite early in the current cycle. It’s equally important to be rebalancing regularly to keep your plan in alignment – to capture gains rather than watch them evanesce in a downturn. If you haven’t re-balanced recently, now is the time to do it. If someone discourages you from doing this, saying that you’ll be selling low, chances are you are being roped into the Buy & Hope strategy, which could wipe out your wealth. You can also incorporate “capture gains” limit orders to maximize your rebalancing. This is a strategy that you’ll get better at with time and education. It’s something we teach at the retreats, and also something I work with private clients on with my coaching. 10. Be the Boss It’s tempting to want to have somebody else handle things for us. However, there is little else in our lives where we would hand things over and have blind faith, without the smallest amount of due diligence. Would you hand your children over to a nanny without checking references? What’s the easiest way to do a background check on your financial planner? Ask for a performance chart of your portfolio over the last 15 years compared to the S&P500. If your gains track the S&P, then your portfolio could be at risk of 55% or more losses in a recession. Again, it’s important to get our plan in place now. If we wait for the headlines that we’re in a recession, it will be too late to protect our wealth. If you wait because you think the markets are already low, and should come back, you’re putting your wealth on a roulette wheel. Wisdom and time-proven systems are essential and the sooner you do this, the better off you’ll be. The volatility suggests that the “informed” money already know that we’re in a recession (or that one is very near on the horizon). We’ll know where things stand on July 28th at 8:30 AM ET, when the 2nd quarter 2022 GDP results will be released. Bottom Line We must adopt strategies of the wealthy now to protect our wealth and stop making everybody else rich at our own expense. Wisdom is the cure. You can read about it in my bestselling books. You can learn and implement it at our online investor educational retreat. You can also email or ring our office for an unbiased 2nd opinion on your current plan that will include a blueprint to safety which you can adopt immediately, should you choose to. You’re the boss of your money, whether you choose to accept the role or not. If someone else loses our money, it’s our loss, not theirs. That expert may actually move onto a different profession, as many broker-salesman do at the bottoms of recessions.  Join us for our Financial Freedom Retreat. June 10-12, 2022. Email [email protected] to learn more. Register by July 15, 2022 to receive the best price and a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, FinancialLiteracy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Moderna & Biotech Trade at 2-Year Lows. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The Economy Contracted -1.4% in 1Q 2022. The Dow Dropped 2000 Points. Is Plant-Based Protein Dying? Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed