|

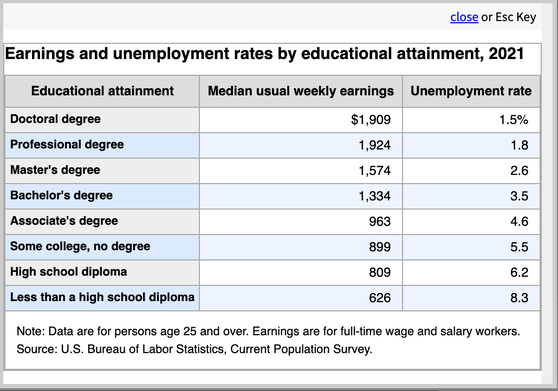

Fix Your Money. Improve Your Marriage/Partnership. 5 ways to improve your love relationship by solving some of the core issues that cause fights. If we’re arguing about money a lot more these days, we’re not alone. Inflation has made life very stressful for most of us. Waiting for politicians to fix things can be a very frustrating endeavor. Fortunately, there is more power in our hands then we might realize. Below are five ways to improve our money challenges, so that we can enjoy a summer of love, instead of bickering and stress. 1. Working & Commute Costs 2. Getting a Raise & Promotion 3. Budgeting 4. Investing 5. Should You Have Your Own Money and Accounts? You’ll notice below that I include multiple options in each of these points. That’s because each situation is unique. While there may be suggestions that aren’t appropriate for your circumstances, there are likely to be at least a few that are worth mulling over. In tough times, those who look for the out-of-the-box solutions are going to be happy they did. It’s easy to just keep moving in the same, old familiar direction – even if inflation has now made that route untenable, or the risk of recession has made asset prices vulnerable. So, let’s summon the courage to consider how we can stop making everyone else rich at our own expense – including the landlord, the mortgage company, the bank, the gas station, the utility, Wall Street and the insurance companies – by adopting a better game plan (instead of just complaining and feeling victimized). And here is a little more information on each topic. 1. Working & Commute Costs There are a lot of expenses associated with working. If you have to be there physically, your commute may be siphoning off your take-home pay. If you have kids, does all of one parent’s income go for childcare? Reducing the Cost of the Commute Is there some way that you can reduce your commute? Can you work from home at least a few days of the week? Can you take public transportation, ride a bike or carpool? Should you consider moving closer to work, if it’s a high-paying career that you really love? Curtailing the Cost of Childcare If one parent’s salary is going for childcare, have you considered just having that person stay at home? Once the kids are in school, it’s much easier for both parents to work. Until then, if parents can find alternative solutions to high-cost childcare – including free preschool programs or enlisting the grandparents – the savings can be astonishing. If a parent can stay home with the kids, s/he will likely find other ways to cut costs, including by cooking healthy meals. Have you networked with other local parents, looked into hosting an au pair or considered a cooperative child-care arrangement? Get creative. 2. Getting a Raise & Promotion Increasing income is one way to solve a budgeting problem. If you’re hitting your head on the glass ceiling, education might be the answer. If you have an MBA, it’s going to be easier to climb the career ladder. Nurse practitioners get paid more than nurses. Education is the highest correlating factor with income, and is the easiest way to get a raise and promotion. As you can see in the chart above, someone with a master’s or Ph.D. is typically going to make a lot more than those with just a bachelor’s degree or a high school diploma. They are also more likely to be employed – even during periods of higher unemployment. Many entry-level and service jobs do not pay a living wage, as wages have lagged far behind the cost of housing, transportation, health care, gas prices and more. You don’t want to just throw a lot of money at a degree without being sure that it will pay off for you. It’s important to do the math, and to harness everything in your power to reduce the cost. Consider downloading The ABCs of Money for College for important money-saving tips on advanced degrees, college planning and even trade school certifications. 3. Budgeting When I talk about budgeting, most people immediately say, “I’m very frugal. I’ve cut out everything!” However, few of us are shopaholics, and that isn’t the reason that life doesn’t add up for most of us. The real problem isn’t that we’re drinking too many café lattes or eating too much avocado toast. (If you are, then you could save hundreds by making these at home.) It is that the cost of basic needs has spiraled into the nethersphere. Rethink Our Transportation So how do you fix that? Time-proven systems and bold choices are the only way to fix a world that just doesn’t add up. As one example, did you know that the average person spends about $7,500 per year owning a car, including the car payment, the insurance, the maintenance and the gasoline? Carpooling, working from home, commuting by bike or taking public transportation mean we have a lot of money for things we like a lot more than gassing up our vehicles – even if we do have to take a taxi or rent a car occasionally. Many cities have bike lanes. Health Insurance Are you spending an arm and a leg on health insurance? If you’re healthy, you could get a high deductible plan and save thousands annually (sometimes tens of thousands). You can also open up a Health Savings Account, where you sock away the savings and take a tax credit for your contributions. Once you get a couple of years’ worth of deductibles in the HSA, you can even start investing. HSAs are the best long-term health care plan in the U.S. Save Thousands With Smarter Energy Choices If you own your own home, smarter energy and water choices can save you tens of thousands of dollars every single year. Homeowners with solar often pay just $35/month on their electric bill. LED lighting saves 85% of lighting costs. Insulation, a timer on your water heater and smarter usage of large appliances can also dramatically cut the cost of our electric bill. Grey water can hydrate our landscapes, and native plants can reduce the amount of water needed. Many cities offer incentives to reduce water usage, and to replace the water-hogging lawn for something that is more appropriate for the climate we live in. Some of these fixes require only a small investment to achieve a great deal of savings. Others require a smart plan, so be sure to read The ABCs of Money 5th edition for the resources and tips you’ll need to successfully embark on your home improvement journey. This might sound like a long list of things to fix. However, once you do it, it becomes the way life is – with much more room in your budget for adventure, date nights and yoga. Housing Costs Is there any way to monetize your home? Should you consider building an additional dwelling unit in your backyard and moving your parents in or renting it out? (That might also help out with childcare.) Think about keeping the money in the family, looking out a few generations. Very wealthy people have always planned generations in advance, and are keenly aware of keeping the money in the family, rather than making the landlord rich. Rent is even more expensive than home ownership these days. So what is the solution? Be careful here. There are few experiences worse than purchasing real estate at an all-time high. There might be better buying opportunities in a year or two. While interest rates are rising in 2022 and 2023, it is expected that they will go back down again in a few years. Is there a way that you can downsize now so that you can save up for a down payment, and purchase real estate if prices drop? Home prices sank by half or more in many markets in the Great Recession and the Dot Com Recession. That isn’t the current projection. However, if there are homeowners who are desperate to sell in the coming years, they might be forced to take less. That is already happening in overheated markets. Click to read my blog “24% of Home Sales Cancelled in the 2nd Quarter.” Thinking bigger is key. The nuclear family is a thing of the past. Having your own small dwelling is very expensive. Getting a much larger place to share can actually save everybody money. That’s why intergenerational housing is higher today than in the Great Depression. Get more tips in the Thrive Budget section of The ABC’s of Money. Be sure to get the most recent edition by visiting NataliePace.com and clicking on the book cover there. 4. Investing It’s easy to make money in bull markets, and it’s easy to lose money in recessions. If your wealth plan only works when stocks rise or you are counting on recovering very quickly if they go down, you are far more at risk than you might realize. Buy & Hope is a last-century strategy that has been a disaster in the 21st Century. Additionally, with rising interest rates and also because there is so much debt and leverage in the world, traditionally safe investments are vulnerable and losing money. Be wary of bonds, annuities, high-yield investments and even money market funds (redemption gates and liquidity fees). Now is the time to know exactly what you own and why, and to be the boss of your money – particularly if you have lost more 6% on your plan since January (a red flag that you are not properly protected and diversified). You can read about our time-proven, 21st-century investing strategies in The ABC’s of Money. There is an entire section devoted to stocks and bonds. You can learn and implement these strategies at our next investor educational retreat. Go to NataliePace.com to see what’s coming up. If you’d like to know exactly what you owe now, and which assets are very vulnerable to losses, then get an unbiased 2nd opinion from me personally. Simply email [email protected] with 2nd Opinion in the subject line. It’s difficult to be the boss of your money if you don’t understand what you own, the risk level of your assets and what a better plan looks like (what the 2nd opinion can provide you with). If we were concerned about our physical health, we’d want to understand the diagnosis and treatment well, so let’s be as concerned about our fiscal health. 5. Should You Have Your Own Money and Accounts? A lot of couples ask whether or not they should have separate bank accounts and retirement plans. With regard to retirement plans, the answer is, “Yes.” The more money that you can get into tax-protected vehicles, the better. So maximize everything that you can (including the HSA) for each family member who qualifies. There is a 9.62% yielding Treasury I Savings Bond that many couples are getting for each family member. Wealthy people understand that earned income pays the highest taxes. Passive income is much lower, and can even be zero. As one example, ProPublica reported that Peter Thiel has over $4 billion in his Roth IRA. He didn’t have capital gains taxes, nor will he have income taxes. So, get as much of your investing capital into retirement accounts and college funds as you can, where the capital gains will not be taxed. Once your teen starts working, you can even open up a dependent IRA for her. Bottom Line You might be amazed at how much your love relationship improves by finding the solutions to the things that you’re arguing about, and by adopting a budgeting, investing and earning plan that works in the 21st Century. However, if you also need help on communication and other issues, be sure to watch my interview with relationship guru, Allana Pratt, at YouTube.com/NataliePace. Wisdom and right action are essential now to rise above the challenges of inflation and a weak economy. The sooner we make brave choices to reduce our big-ticket budget expenses, and to stop making everybody else rich, the sooner we will have room in our budget for the experiences that make life worth living. When we wait for the headlines that the economy is in trouble, it’s too late to protect our wealth. So, now is the time to fix the roof and prepare for the economic storms on the horizon – while the sun is still shining. If you're interested in learning 21st Century time-proven investing strategies for protecting your wealth and managing the bear market from a No. 1 stock picker, join us for our Oct. 8-10, 2022 Financial Freedom Retreat. Email [email protected] or call 310-430-2397 to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master. Get the best price when you register with friends and family. Register now to access your free 4-part Protect Your Wealth Now webinar that will get you started immediately.  Join us for our Financial Freedom Retreat. Oct. 8-10, 2022. Email [email protected] to learn more. Register with friends and family to receive the best price and a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, FinancialLiteracy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Moderna & Biotech Trade at 2-Year Lows. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The Economy Contracted -1.4% in 1Q 2022. The Dow Dropped 2000 Points. Is Plant-Based Protein Dying? Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed