A Billionaire’s Fall, FTX Crypto Contagion & 6 Red Flags to Heed Before You Invest in Anything.14/11/2022

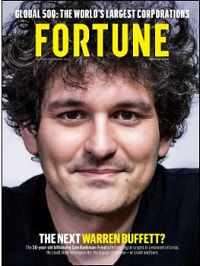

A Billionaire’s Fall, FTX Crypto Contagion & 6 Red Flags to Heed Before You Invest in Anything. On November 11, 2022, FTX filed for bankruptcy. Sam Bankman-Fried went from the cover of Fortune magazine in August/September 2022 as a “billionaire” to public enemy #1 on his Twitter feed. His companies, FTX and Alameda Research are in bankruptcy. A last minute bailout by Binance was scuttled due to “mishandled customer funds and alleged US agency investigations,” according to a Tweet by Binance CEO Changpeng Zhao. The FTX and Alameda bankruptcies are also affecting Solana, a coin that Alameda Research had an alleged 10% stake in. As Francisco Memoria with Cryptoglobe wrote on Nov. 10, 2022, “A Solana whale is in liquidation and currently has over 2.4 million SOL in collateral backing a 44.87 million USDC debt. With the price of Solana rapidly plunging, the whale’s forced sale could lead to further downside.” Solana has already slid -94% this year, right in stride with FTX’s token FTT. By comparison, Bitcoin and Ethereum are down -74% year over year (a fall that will definitely cause more fallout in the cryptosphere). There have been a lot of allegations of illicit self-dealing between SBF’s companies, but also between companies that he “rescued,” including a $377 million loan from Voyager Digital to FTX. In a tweet sent by Binance CEO Changpeng Zhao, he writes, “FTX didn’t ‘bail [Voyager] out’ or return the money.” It’s very early in the game, and we’re likely to hear a lot more about what happened in the months ahead (or in a Netflix documentary in two years). Everyone is wondering whether SBF and FTX “should be compared to the fall of Enron, Lehman Brothers, Bernie Madoff or MF Global,” i.e. was the disaster a result of fraud, leverage or just a terrible investment strategy? And where is the missing money? Crypto Contagion The implosion of the Terra not-so stablecoin, and the collapse of Three Arrows Capital and Voyager Digital in May of this year began the ripple effect. However, SBF, FTX, Alameda and Solana are unlikely to be the only victims of the crypto winter. Savers who were told their deposits at Voyager were FDIC-insured have learned that they are not. Although CZ has been very vocal recently about the failings of SBF, Binance was an early investor in FTX’s seed and Series A rounds, according to Coindesk. It is unclear how much Binance still has; CZ says Binance still has "a bag" of FTT. (Binance’s attempt to cash out on November 6, 2022 precipitated the run on FTT.) Users and investors alike are all waiting in line for the new trustee, who oversaw Enron’s bankruptcy, to return their money. Sequoia Capital has already written down their $213.5 million investment to zero. How does the average investor avoid a sketchy business before the bankruptcy? How do you know to question a claim that your funds are FDIC-insured (such as happened at Voyager)? Below are a few common investing mistakes. You can learn even more in the 2nd edition of Put Your Money Where Your Heart Is.

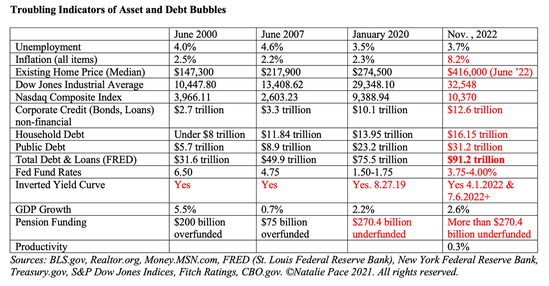

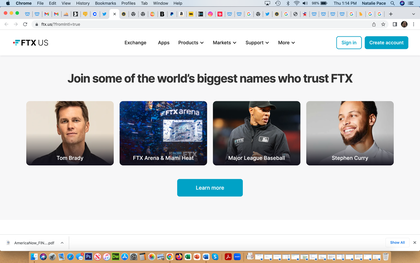

Before we get into the details on each of the above red flags (all of which were present with FTX and SBF), let’s talk about the prognosis for cryptocurrency in general. Fiat Currency and Safe Havens At this time the strength of the dollar and the resilience of the US economy are negative for assets that sell themselves as a safe haven. After being burned by safe havens, the idea of getting a decent Return on Investment for a T-Bill is enticing. (Learn more about this in my blog, “Crypto, Gold, Silver: The Not So Safe Havens” and my videoconference with a special warning on T-Bills. Click to access.) However, the theory behind decentralized money and the concerns about the U.S. debt are not unfounded. As you can see in the chart below, the U.S. (and the world) are in the nethersphere in terms of leverage. In the Federal Reserve Financial Stability Report, it was noted that borrowing by businesses and citizens were at high levels. At this time, businesses still have a lot of cash and consumer debt is concentrated in people with good credit scores. However, a recession, inflation and higher borrowing rates with tighter terms, could spark a disaster. Also, U.S. Central Bank losses began in September of 2022, and are expected to continue for the next few years. This will likely mean that the Federal Reserve Central Bank will suspend payments to the U.S. Treasury, resulting in about $115 billion not being paid in annually (based upon 0.05% of 2021 GDP). However, it could also mean that the central bank will ask for support from the government. The Federal Reserve Board had an emergency closed board meeting on Oct. 3, 2022, likely to discuss this. On that same day, Fitch Ratings issued a press release. Currently, the U.S. has an AAA credit rating with Fitch Ratings. However, the rating agency notes that should the bank seek indemnity for large losses or to recapitalize with government funds, that may impact “its policy credibility.” It’s important to remember that gold and silver soared to all-time highs in 2011, after S&P Global downgraded the U.S. from AAA to AA+. Should the AAA rating of the U.S. be called into question or put on a negative outlook, safe havens should become popular again. And here is more information on each of the common investor mistakes listed above. 1. Read the Fine Print Although Voyager Digital made false and misleading statements that depositors’ money was FDIC-insured, it was not. Click if you’d like to understand why the FDIC and SEC issued a Cease and Desist Order to Voyager. How would you have known before depositing your money? Banks are FDIC-insured, while exchanges and brokerages are not. Voyager Digital was not an FDIC-insured bank; they had a relationship with one. It’s not uncommon for brokerages to have an agreement with a bank that is FDIC-insured. However, if the brokerage itself goes belly-up, then the FDIC doesn’t come to the rescue. This only happens if the bank does. So, knowing the creditworthiness of your brokerage, how long it’s been in business, and whether or not it is making or losing money is key. If the brokerage is publicly traded, that information should be easy to find. In a world with so many companies at or near junk bond status, it pays to know the credit score of every financial institution that you deal with. 2. The Bahamas Why would a company move operations from Hong Kong to the Bahamas, like FTX did? For less oversight. (Hong Kong was under British rule for a century and has a strong background in finance.) When you have C-level executives who want less scrutiny that’s a red flag. An inside source told Coindesk that ““The whole operation was run by a gang of kids in the Bahamas.” 3. Young Founder/CEO with no Babysitter Once an entrepreneur hits a certain milestone, and certainly before they reach billionaire status, there needs to be an experienced team on board. While the CEO/founder might understand the product or service that they are innovating, they will not have all of the skills necessary to navigate governance, liquidity, crypto winters and a series of unfortunate events. Larry & Sergey had Dr. Eric Schmidt (Novel) and Arthur Levinson (Genentech). Mark Zuckerberg had Marc Andreessen (Netscape) and Sheryl Sandberg (Google & Larry Summers). Who was babysitting SBF and the FTX billions? 4. Celebrity Endorsements Kim Kardashian was quite infamously fined $1.26 million by the SEC on Oct. 3, 2022 for a crypto pump-and-dump scheme that she was paid to promote. Ambassadors and influencers are compensated. Tom Brady and Gisele may have received FTX equity with little or no investment. FTX paid to be the name sponsor of the Miami Heat and the FTX Arena. 5. Board Issues FTX’s board included Lucas Moskowitz, the Deputy Legal Counsel of Robinhood, with a CV that includes the SEC. Moskowitz is surely engaged in some heated conversations with some of his former colleagues at the SEC, as is the chairman of the board Larry E. Thompson. While the board was heavy on regulators and derivatives traders, the board was missing business experience and acumen. (Moskowitz had regulatory not business experience.) 6. Never Confuse a Bull Market With Wisdom SBF was called a “trading wunderkind” by Fortune magazine. However, he’s only 30 years old. He was in high school the last time the U.S. (and world) experienced an extended contraction. We’ve been in a secular bull market since March of 2009. (Thanks to trillions printed and passed out to everyone with a pulse, the pandemic recession was the shortest on record, at just two months.) It’s easy to make money in bull markets and easy to lose money (and go bankrupt) in the winter of an asset’s discontent. Crypto Winter How will the crypto contagion affect Coinbase, Binance, Square, Tesla and other companies that are involved with Bitcoin and decentralized finance? We’re already seeing severe revenue fallout in Coinbase and Marathon Digital Assets and a revenue decline at Robinhood. These companies are down in revenue by -53%, -75% and -1.08% respectively. Year-over-year revenue growth is still positive at Nvidia (+3%), Paypal (+11%), Block (+17%), Goldman Sachs (+22%), Tesla (+56%) and Interactive Brokers (+114%). However, will the crypto winter and contagion cause a blight? I am personally underweighting crypto, financial services and companies that are still carrying a lofty P/E, which takes most of these companies off my plate. BOTTOM LINE Regulators are crawling all over the wreckage of FTX, Alameda Research and Sam Bankman-Fried. The recovery and distribution of the companies’ assets are in the hands of the same person who oversaw the Enron restructuring (John J. Ray). Will Sam see the same fate as Jeffrey Skilling? Are we looking at the sequel of Bernie Madoff? My heart is with anyone tainted by this scandal. (We offer need-based scholarships to our Financial Empowerment Retreats.) My hope is that if you weren’t, that you’ll heed this cautionary tale to skirt the scene of the next investing disaster. Full Disclosure: I own crypto, gold and silver assets. However, I use a diversified system to help me capture gains at the highs and add more at a lower price at the lows -- something anyone can learn at our Financial Empowerment Retreats. How much have you lost this year (in your paper assets)? If you are over 50 and you've lost more than 10%, then your plan is not properly protected and diversified. Click to access our free easy-as-a-pie-chart web app, where you can personalize your own sample pie chart. If you're interested in learning 21st Century time-proven investing strategies for protecting your wealth and managing the bear market from a No. 1 stock picker, join us for our Jan. 20-22, 2023 Financial Freedom Retreat. Email [email protected] to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master, to get pricing information and to read testimonials Get the best price when you register with family and friends. Register now to access your free 4-part Protect Your Wealth Now webinar that will get you started immediately.  Join us for our New Year, New You Financial Freedom Retreat. Jan. 20-22, 2023. Email [email protected] to learn more. Register with family and friends to receive the best price. You'll also receive a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed