|

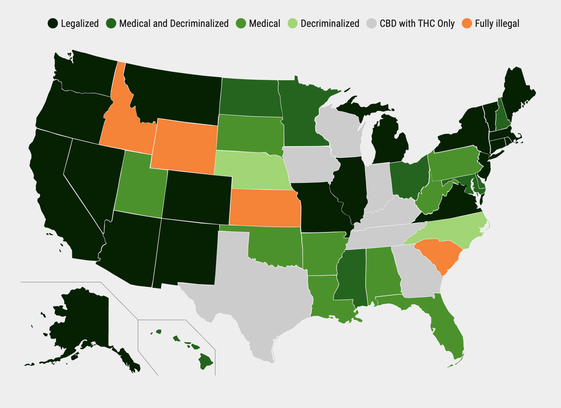

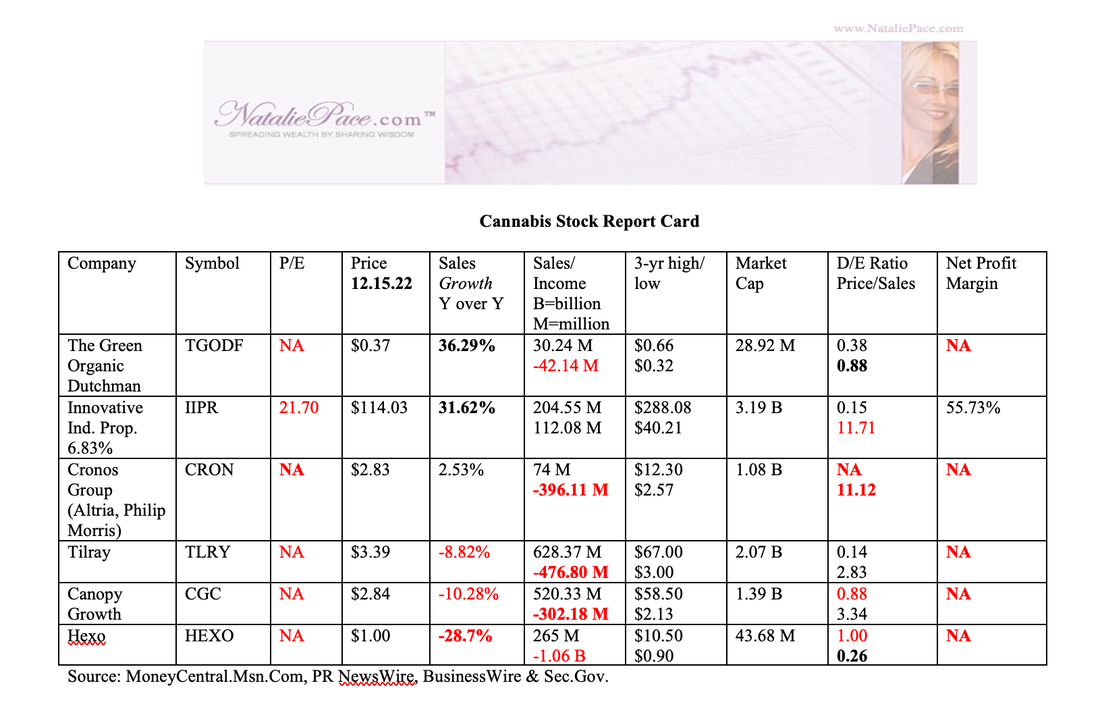

Tilray: The Constellation Brands of Cannabis Tilray announces their earnings on Monday, Jan. 9, 2023 at 8:30 am ET Everyone has been talking about the Crypto Winter, but few are discussing the complete annihilation of cannabis. There are still a few technical traders hoping for rebounds due to the massive selloff. Otherwise, Reddit and the Twittersphere are radio silent on investing in cannabis. So, with share prices down 90% in a lot of these brands, is now a good time to buy low? What’s Going On? Cannabis has notoriously been a boom and bust investment. Whenever news of a country decriminalizing makes headlines, pretty much all of the cannabis companies will shoot the moon, rising to heights that are sometimes hundreds of times higher than their sales. One of the biggest problems today is that the United States has dropped the ball on legalization. A few members of the Senate, including Senators Chuck Schumer and Cory Booker, keep promising that legislation is a high priority and that they are building bipartisan support, and then nothing happens. With the Republicans in control of the house, there’s even less hope for full legalization over the next two years, though incremental progress seems to be inching forward. Germany was supposed to be the next country to make recreational marijuana fully legal. (Medicinal cannabis is already legal in many EU countries.) However, the country has run into EU regulations that have slowed the process down. It’s worth it to keep an ear to the ground on progress, as any legalization in Germany could mean more EU countries will follow. In the meantime, Tilray reported that their medical cannabis sales increased 16% in Europe (removing the negative impact of the euro weakening against the dollar). Tilray sales were up 22% in Germany. While national legislation has slowed down in the U.S., states continue to open up. There is also a great deal going on within the companies themselves. One of the most exciting developments is that one company in particular has been on an M&A buying spree and could post up to 40-64% increase in year-over-year adjusted EBITDA growth as soon as next week. This is important because all small companies need to worry about their pathway to profitability. Capital is getting more difficult to raise, and the interest costs are elevated. M&A Canopy Growth has a CEO who came from Constellation Brands. However, it is Tilray that is becoming the diversified spirits brand of the cannabis space. Tilray acquired Sweetwater Brewing (and their popular 420 craft beer) in December of 2020. On Nov. 10, 2022, they added Montauk Brewing to their spirits brands, which also include Breckenridge Distillery, Green Flash Brewing and Alpine Beer. Most of the new acquisitions by Tilray have been in the craft-beverage space. M&A will increase revenue. Of course, it’s also important to purchase companies with their own expansion potential and fiscal husbandry. According to Carl Merton (CFO), Tilray’s craft and wellness brands are “strong, high-margin businesses.” During the earnings call conference on Oct. 12, 2022, Tilray CEO Irwin Simon reported that “SweetWater is available in 42 states across the U.S., including most recently in California, which is the number one beer market in the U.S.” The West Coast expansion for SweetWater is still in the early stages. Tilray’s next earnings report will be Jan. 9, 2022, before the market opens. The last quarter saw a 9% decline in revenue year over year. There were strikes, cyberattacks and price compression to deal with, which Tilray anticipates making up in the quarterly results that will be reported on Monday. The company doesn’t provide revenue guidance other than that. However, with the acquisitions and resolution of the last quarter’s challenges, there could be solid growth, at least in the craft beverage vertical. The Macro Economy Tilray has the potential to be a bright star in the industry. However, the prospects for share price growth in the industry at large remain highly correlated with the legalization (or perceived) of countries. So, a great quarter for Tilray could be tempered by the tepid expectations for the industry. We’re unlikely to see more Shoot the Moon phenomena until Germany or the U.S. decriminalizes, though a bounce off of the current depressed prices could still be notable. It’s worth it to keep an eye on Germany, since Tilray already has a 20% market share there in “flower, extracts, and dronabinol products.” Additionally, 2022 was a rough year for stocks, with the S&P500® declining -19.44%. 2023 is predicted to be another year of volatility and potential weakness. So, any time we experience a company share price that soars, it’s a good idea to take our profits early and often. A rising tide can lift all ships, and a sinking tide can certainly ground them. Even great companies with outstanding sales growth and potential can be pulled down in the market washout. Other Cannabis Companies Each one of the cannabis companies has a certain area of expertise and focus. All of them are cutting operating costs, shoring up growth potential and cutting out segments with cash burn or low margins. Each has a strategic alliance and board seats affiliated with other companies. Cronos is 41% owned by Altria, which is basically Phillip Morris, a tobacco company. Canopy Growth has a lot of ties to Constellation Brands. Sadly, they have a hangover from the founder CEO, who went on a spending spree with little regard for that important pathway to profitability. Consequently, the company lost $300 million in fiscal year 2022 with almost $4 billion lost in the four prior years. The Green Organic Dutchman vows to produce organic weed. The company‘s revenue grew 36% year over year in the most recent quarter. This company looks like the smallest, but the board of directors boasts some serious talent, with individuals from Novartis and Canopy Growth. HEXO is the 2nd most popular brand in Canada (behind Tilray), with some CBD beverage offerings that look quite delicious. Tilray has a strategic relationship with HEXO and with Medmen. Bottom Line Cannabis is a volatile industry. Stocks are expected to experience economic storms and a potential recession in 2023 (which could see most share prices go lower). However, even with that there can be sunny days. January 9th might well be one of those. However, we’ve seen that any lunar takeoffs of these brands tend to crash back to Earth pretty rapidly. You cannot set a limit order high enough for the potential rise. (Brokerages won’t allow it.) It’s a much better idea to think “capture gains” rather than stop losses or selling low, particularly with so many developed world denizens wanting full legalization of weed. So, it’s a good idea to monitor what’s going on next Monday, and to have a stock app that includes TLRY and other cannabis brands that you’re interested in. I’ll be monitoring as well. So, please check the home page at NataliePace.com for any updates that I post on my Twitter feed. Full disclosure: I have positions in some of the companies mentioned in this blog. New Year, New You Financial Freedom Retreat If you're interested in learning 21st Century time-proven investing strategies for building and protecting your wealth, investing in renewable energy, saving thousands in your budget with smarter energy choices, and managing challenging economic times (from a No. 1 stock picker,) join us for our Jan. 20-22, 2023 Financial Freedom Retreat. Email [email protected] to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master, to get pricing information and to read testimonials Get the best price when you register with family and friends. Register now to access your free 4-part Protect Your Wealth Now webinar that will get you started immediately.  Join us for our New Year, New You Financial Freedom Retreat. Jan. 20-22, 2023. Email [email protected] to learn more. Register now to receive a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Photo of Natalie Pace by Marie Commiskey. Photo of Natalie Pace by Marie Commiskey. Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Free Holiday Gift. Stocking Stuffers Under $10. Cash Burn & Inflation Toasted the Plant-Based Protein Companies Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Gold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed