|

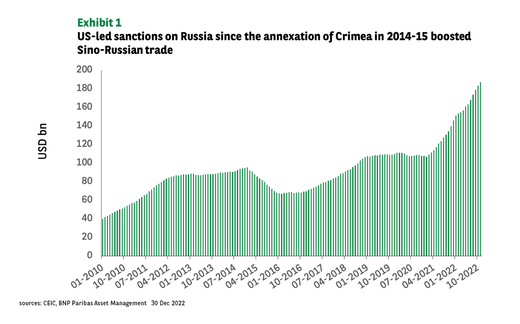

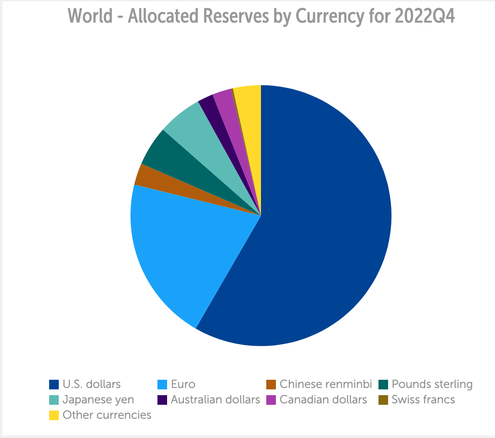

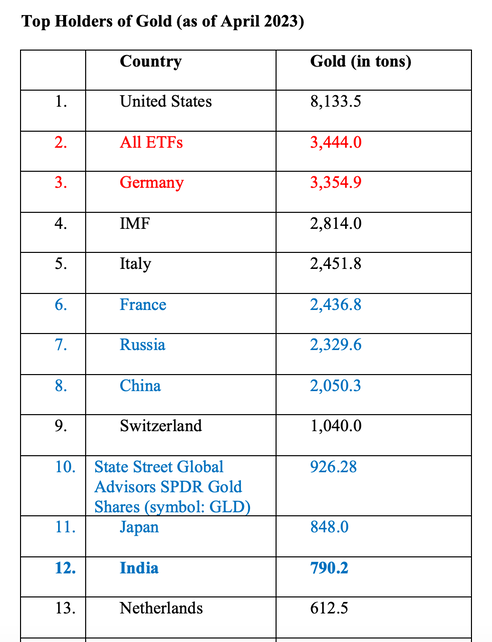

Yuan Overtakes Dollar in Chinese Cross-Border Transactions This was the headline that came into my email a few days ago. A week ago, someone sent me a link to a videoconference where the premise was that the dollar was going to become “extinct.” Someone else emailed saying that they heard on the “news” that BRICS was forming a new currency that would put the dollar out of business. So, what’s real, what are sensationalized headlines and what is an outright ruse? Let’s dig in and discover. Below are a few of the areas we’ll plumb. Yuan Overtakes Dollar in Chinese Cross-Border Transactions The PetroYuan Global Reserve Currencies Is the Dollar on the Brink of Extinction Will There be a BRICS Currency? Global Tensions and Uncertainty Bank Failures And here is more color on each of these topics. Yuan Overtakes Dollar in Chinese Cross-Border Transactions It was reported by Reuters on April 26, 2023, that the Chinese yuan overtook the dollar in Chinese cross-border transactions in March. Who is trading with China using the yuan? (Russia, Iran, Venezuela, Indonesia and Argentina) Does this have anything to do with Russian sanctions? (yup) How does this stand in the global marketplace? (small) Is the yuan on a path to dominate the world’s reserve currency? (not yet) Keep reading… The PetroYuan For more than a decade now, China and Russia have been building up their reserves of gold. The goal was to establish a gold-backed currency that could be used for trading, particularly with regard to the hottest and most widely traded commodity on the world market, oil. We’ve been writing about this for years. (See below for a list of some of the relevant blogs.) This came in quite useful when Russia was banned from SWIFT. According to Reuters, "The yuan's share of Russia's currency market has leapt to 40% to 45%, from less than 1% at the start of last year. Its share of world trade financing, according to SWIFT, has increased to 4.5% in February from 1.3% two years ago. The dollar's is 84%." Global Reserve Currencies Since the trading of the yuan is new to the global stage, China and Russia wanted to assure potential customers that using the petroyuan would be secure, and that paper assets could be traded in for gold upon demand. However, it hasn’t yet translated to a meaningful challenge to the petrodollar. According to the IMF, the Chinese renminbi made up less than 3% of the world’s currencies in the 4th quarter of 2022. Many countries are still reticent to use the petroyuan. Why? The dollar is freely convertible and highly liquid, while the yuan is not. According the Washington Post, there are also concerns about the yuan being a “managed currency produced by an opaque and unpredictable financial machine.” So, just how much gold does China have? As you can see in the chart below, the United States treasure trove of gold is almost double that of Russia and China combined. Is the Dollar on the Brink of Extinction YouTube videos are going viral about an impending extinction of the dollar. While the Chinese renminbi is crawling toward a greater global share of the reserve currency, it is still one of the most thinly held and traded. It is crawling forward in relevancy, from not present at all just a few years ago. Russia, a country that is having great difficulty trading with many other countries, is the biggest customer. Will There be a BRICS Currency? The European Union managed to create the euro, so can Brazil, Russia, India, China, and South Africa do the same? At this point it appears that only Russia, Iran, Venezuela, Indonesia and Argentina are trading with China using the yuan. China is courting Saudi Arabia. However, if the reports are to be believed, there’s little interest in the Middle East to switch from settling in dollars to settling in yuan. India is a democracy, and the two countries have a border dispute in the Himalayas. While China is India’s biggest trading partner, Reuters just reported that India has directed traders not to settle purchases of Russian oil and coal in yuan. It’s difficult to imagine India and China being part of the same central currency. There is just so much difference between the styles of governance, and the tensions can run pretty hot between those two countries. So, who is the person talking up a BRICS reserve currency? He is Alexander Mikhailovich Babakov, a man who is very friendly with the current President of Russia, who is currently under EU, Canadian, Swiss and U.S. sanctions. He received the Order of Merit to the Fatherland (Russia) in 2020, and has received a number of other awards from his Presidential friend. (Someone you might entrust with your money?) The Russian propaganda machine is quite effective. How many people who are hearing about the BRICS currency know the “news” is coming from Babakov? (How many hucksters are capitalizing upon his statements to scare people into buying their scams?) Another question that one might ask is why would anyone want to use a BRICS reserve currency? Russia is under heavy sanctions for what many people in the world have characterized as an illegal war. Neither China nor Russia is revered around the world as icons of personal freedoms, where we’d all love to move to. And the collective gold reserves of the BRICS block would be 20% of what is held by the United States and the European Allies. While anything is possible, it would be an extremely dystopian world when the country that is now being the most heavily sanctioned becomes the world’s reserve currency. It’s a feat of social media gaming by Babakov to make this unlikely alliance sound plausible. Global Tensions and Uncertainty We’re all keenly aware that there are alarming global tensions, war and uncertainty in the world. There’s far too much debt. The pandemic isn’t fully behind us. Central governments are raising interest rates to cool inflation. However, companies that have enjoyed free borrowing for so long are now facing serious trouble. Over half of the S&P500 is at or near junk bond status. There is a lot of fuel for the fire of conspiracy theories. Bank Failures The fate of First Republic Bank will likely be announced early this week. The Federal Reserve has set up a system to help banks keep from having to mark down the unrealized losses on their bond portfolios, which keeps their earnings looking better than they would otherwise look. However, it’s too soon to say that the crisis is behind us. Bottom Line There is truth in to the supposition that China and Russia would like to have their own reserve currency, and break the dominance of the U.S. dollar on the world stage. However, the larger question is whether or not the rest of the world wants to dive in. So far, interest in trading in the Chinese yuan is limited to less than 5% of trades. It’s unlikely that the U.S. dollar becomes extinct or the Chinese yuan replaces the euro and all of the other basket of currencies as the world’s reserve currency -- at least not in the foreseeable future. Too many people enjoy the liquidity and stability of the euro, pound and dollar, and the adventures to be enjoyed in Europe, the United Kingdom and the United States. Freedom is at the top of our list of democratic ideals. It is really fear that fuels these conspiracy theories. If we want to dampen the threat a BRICS currency might pose in the future, we’ll need to kick our oil addiction (that fuels the Russian economy) and stop using China as the factory to the world. Over half of each barrel of oil is used for plastic, polyester, the vinyl seats in our cars, rubber tires, the asphalt on our roads and other petrochemical products. Oil touches every aspect of our lives. Click to read a blog to discover how we can break our dependency on oil. (It’s not as easy as just buying an electric car.) The petrochemicals that spilled all over Palestine, Ohio are used to make quotidien products, even our tableware. So What is the Cure? The cure is admittedly complicated. We must know what is safe in the world that is drowning in debt, where long-term bonds are losing as much or more as stocks. We must know how to take a measured approach to hedges like gold, silver, and/or crypto (rather than be lured to dive all in with BRICS bait). We must have a system for rebalancing and capturing gains. Our Thrive Budget® is a system to stop making everyone else rich at our own expense, including the landlord, the debt collector, the taxman, the gasoline station, the insurance salesman, the utility company, and more. Our easy-as-a-pie-chart investing with regular rebalancing is a time-proven, 21st Century plan that earned gains in the Great and Dot Com Recessions, and outperformed the bull markets in between Safe income-producing hard assets that you purchase for a good price will hold their value better in a Debt World. When we stop reading sensational headlines and drown out the nightmarish noise, we can put our emotions on the right side of the trade. This may sound difficult, but it costs less time and money than most of us spend. That is why we call it the life math that we all should’ve learned in high school. The sooner we implement it the better we’ll sleep at night, and the faster our lives transform. Other Russia/China Blogs of Interest Russia Sold U.S. Treasuries. Bought Gold. Why OPEC Really Cut Oil Production Join us for our Real Estate Master Class on June 3, 2023 and our full money makeover retreat June 10-12, 2023. Email [email protected] or call 310-430-2397 if you are interested in learning time-proven investing, budgeting, debt reduction, college prep, ESG and home buying solutions that will transform your life and heal our planet at our next Financial Freedom Retreat. We spend one full day on what's safe, helping you to protect your wealth and reduce money stress.  Join us for our Online Financial Freedom Retreat. June 10-12, 2023. Email [email protected] to learn more. Register by April 30, 2023 to receive the best price and a complimentary private prosperity coaching session (value $600). Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. Early Bird pricing ends May 30, 2023. There is very limited availability.  Natalie Pace. Photo by Marie Commiskey. Natalie Pace. Photo by Marie Commiskey. Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Empty Office Buildings & Malls. Frozen Housing Market. The Online Global Earth Gratitude Celebration 7 Green Life Hacks The Debt Ceiling. Will the U.S. Stop Paying Bills in June? Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Free Holiday Gift. Stocking Stuffers Under $10. Cash Burn & Inflation Toasted the Plant-Based Protein Companies Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Gold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.

Corrie

30/4/2023 11:04:53 pm

Thanks Natalie for your detailed investigation... Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed