|

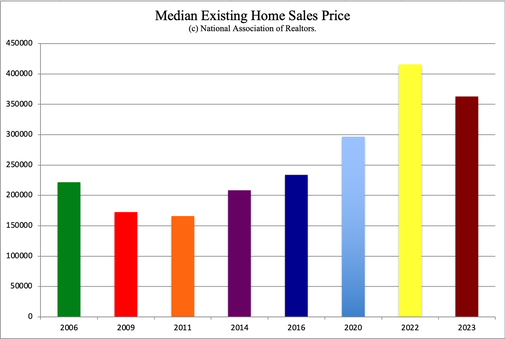

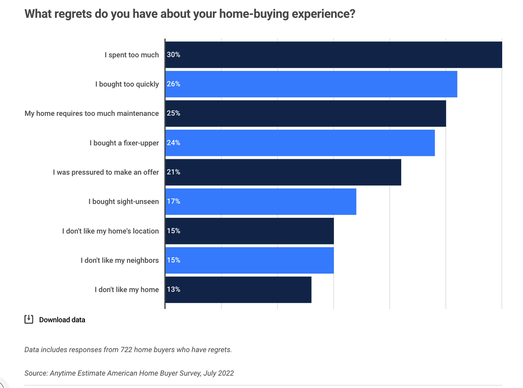

Empty Office Buildings and Malls. Frozen Housing Market. Includes 7 Real Estate Tips on Housing, REITs and Income Property Housing is under the attack of inflation and interest rates. Office buildings are still quite empty, due to the Work-From-Home trend. Malls have a lot of vacant shops, after a Retail Apocalypse that just won’t end. Existing Home Prices Lose 10% of Value Home prices dropped -10% year over year and pending sales were down -5.2% in March. However, even with the industry weakness, homes are still unaffordable in most areas of the United States. Real estate prices have soared over the last 15 years, with a pronounced jump up in shelter inflation during and after the pandemic. Even empty buildings and vacant strip malls are still carrying a high valuation. Many of the bugaboos of real estate are part of a new (and problematic) normal that are not as transient as investors are hoping high interest rates will be. (In earnings reports and all over blogs and media, we’re hearing that CEOs and investors are banking on interest rates only going up slightly this year, and then starting to lower in 2024.) That is why it is very important to have a sound and measured plan for any housing, income property or REITs investment we are looking at, or currently have. Below are 7 tips for getting on the right side of the transaction. FYI: I’ll also be hosting a Real Estate Master Class on June 3, 2023. Email [email protected] for details. 7 Real Estate Tips Real Estate is down -10% Buyer’s Remorse Date Around Before You Get Married Interview Your Home Like You Would Your Soul Mate The Buy Low, Sell High Continuum Empty Office Buildings and Shopping Malls REITs And here is more information on each. Real Estate is down -10%. In June of 2022, the median existing-home price hit a high of $416,000. Since then, prices have been decreasing – at a faster pace in the areas that heated up the most. In March of this year, the average price was $375,700. Which way will prices go in 2023 and 2024? That has a lot to do with: · Supply (which is increasing, something that causes rates to fall) · Demand (Millennials are tired of living with their parents, but…) · Affordability (most homes are still too expensive) · Loan Practices (getting tighter due to the bank failures and new standards for a lower Debt-to-Income Ratio) · Interest Rates (predicted to be 6.0% this year and 5.6% in 2024, which doesn’t help affordability and makes it less likely for a mortgage to be approved) A lot of people want to own a home. However, they are being priced out, or it is taking up too much of the budget, or they don’t qualify for a loan. That might be a blessing in disguise, however, because most recent buyers have buyer’s remorse. Buyer’s Remorse Survey after survey keep revealing the same results – buyer’s remorse is rampant among pandemic purchasers. (Click to read my blog from August 2022 on this topic.) What are people so upset about? Some overpaid, others discovered that the cost of homeownership is a lot more than they bargained for, and many felt pressured to purchase quickly or sight unseen. Again, if we consider that once we own the home (or the time-share), it’s ours, and it might not be easy to unload it anytime soon, then we might want to take our foot off the gas and make sure that we’re going to want to sleep under the same roof for the next 7-10 years to come (at minimum). Date Around Before You Get Married Owning real estate is a lot like getting married. It’s a lot more responsibility than we might realize, and once we own something, it might be ours for the rest of our life. Property is an asset that can be hard to sell, especially during recessions. While we own it, the costs of upkeep, property taxes, maintenance, insurance and other unplanned expenses continue. Interview Your Home Like You Would Your Soul Mate What kind of information will help us to make the best choice for our sanctuary home? Some of the most important and candid considerations are never going to be offered by the realtor, who is trained to stick to the ABC script – Always Be Closing. Check out the A 10-Point Checklist for Home Buyers and 7 Real Estate Case Studies in the Real Estate section of The ABCs of Money, 5th edition, to help you identify your perfect home in the housing dating pool. Read up on these considerations before taking the home and property tours. The Buy Low, Sell High Continuum A -10% discount is welcome. However, on average, we’re still paying more than double than anyone who purchased in 2011. The price is still very high on the Buy Low, Sell High Continuum. Checking the price history will sober us up. At market tops, everyone thinks that prices will never go down. At market bottoms, the opposite is the assumption. In truth, there are cycles of strength and weakness that are closely tied to business cycles, with regional areas of strength or weakness weighing in. While all real estate sank like a rock in the Great Recession, Detroit had it even worse due to the bankruptcy restructurings of General Motors and Chrysler in 2009. Are there any solutions for high shelter inflation? Buyers who think outside the box and shop in the shadow inventory can be rewarded with a price reduction of at least 1/3. These are some of the areas we’ll examine in the Real Estate Master Class on June 3, 2023. Silicon Valley Bank was based in Santa Clara. First Republic Bank has headquarters in San Francisco. Signature Bank was headquartered in New York City. All of these cities still have a lot of empty office buildings. The Work-From-Home trend has been more persistent than office building owners would have liked. While the official vacancy rates are 16.4% and 9.75% for San Francisco and New York, respectively (source: National Association of Realtors), the unused space is much higher. There are still a lot of commercial leases on the books, even in offices that are not being used. JLL says the vacancy rate is closer to 25.1% in San Francisco, which still seems low when you consider how many downtown lunch spots are still shuttered. In January of this year, the New York City REIT (symbol: NYC) changed its name to American Strategic Investment Co. to raise some much-needed money from an equity offering. Clearly the name NYC CRE was a liability in the fundraising efforts, even though all of their buildings lie in Manhattan and Brooklyn. Some companies are trying to sublease. Others are cutting their office footprint, when the lease term expires. Many employees are embracing a flex schedule of a few work days in the office and a few at home. This is redefining how space is being used, with some companies offering shared desks and work space, creating a much smaller lease footprint than in the past. REITs* *Real Estate Investment Trusts Empty office buildings are not just a problem for commercial real estate building owners, shareholders and bondholders. They are also a challenge for the banks and bondholders who loan them money. According to TREPP, Signature Bank was a significant holder of CRE debt before it was seized by the FDIC last month. Bank insolvencies in turn make CRE move vulnerable, as the failed banks occupy a lot of CRE. Investors are drawn into REITs for the yield. However, is an 8-9% yield worth it when you lose over 80% of your capital? Many commercial real estate REITs have seen their stock drop by -85% or more from the highs enjoyed before the pandemic. Mall REITs are not faring much better. Is high-yield a red flag? Is the old adage, “The higher the dividend, the higher the risk,” true? Yield is tricky. That is why I recently held a Bond Master Class and have had multiple blogs and videoconferences on the topic. There is new, short-term, fairly creditworthy debt that is paying a decent interest rate. On the other hand, there are also high-risk junk bonds that try to lure investors in with high interest rates. The older the company is, the more likely that high interest rates will be very risky. (We spend one full day on What's Safe? at our Financial Freedom Retreat, June 10-12, 2023. Office Properties Income Trust was downgraded from BBB- to junk (BB+) on March 31, 2023 by S&P Global. At the same time, Hudson Pacific Properties was put on a negative CreditWatch for its BBB- rating. Boston Properties, Brandywine, Office Properties Income Trust, Piedmont Office Realty Trust Inc., and Vornado Realty Trust were assigned a negative outlook. A downgrade from investment grade to junk status typically causes share prices to sink. According to the rating agency, “We expect office assets to underperform other real estate property types over the next two years given expected pressure to net effective rents and occupancy levels.” Another concern is that “the office sector also has relatively higher debt leverage than other property types.” Email [email protected] if you’d like to receive our CRE & Malls Stock Report Cards. All of the companies on the CRE stock report card have lost money over the past year. While housing prices are only down -10%, the real estate industry (REITs) has been one of the worst performers on Wall Street. Bottom Line Home prices are down by -10% since the median highs of $416,000 set in June of 2022. However, that doesn’t mean that real estate is a bargain, or that we should jump into a shotgun wedding, thinking we’ve landed the love of a lifetime. It’s important to sober up from any swoon we might experience and cast our vision 7-10 years in advance before deciding where and how we want to settle down, and just how much a marriage to this home is really going to cost us. A look at where prices were in 2011 could operate as a wet towel, while we drink some coffee and look deeply at why the numbers don’t add up. Will the allure look as lustrous under the unforgiving light of midday sun as it does when the realtor broker/salesmen is talking it up? With regard to housing, let’s date around before we get married. With regard to mall and CRE REITs, it’s a better idea to just say, “No.” Join us for our Real Estate Master Class on June 3, 2023 and our full money makeover retreat June 10-12, 2023. Email [email protected] or call 310-430-2397 if you are interested in learning time-proven investing, budgeting, debt reduction, college prep, ESG and home buying solutions that will transform your life and heal our planet at our next Financial Freedom Retreat. We spend one full day on what's safe, helping you to protect your wealth and reduce money stress.  Join us for our Online Financial Freedom Retreat. June 10-12, 2023. Email [email protected] to learn more. Register by April 30, 2023 to receive the best price and a complimentary private prosperity coaching session (value $600). Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. Early Bird pricing ends May 30, 2023. There is very limited availability.  Natalie Pace. Photo by Marie Commiskey. Natalie Pace. Photo by Marie Commiskey. Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest The Online Global Earth Gratitude Celebration 7 Green Life Hacks The Debt Ceiling. Will the U.S. Stop Paying Bills in June? Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Free Holiday Gift. Stocking Stuffers Under $10. Cash Burn & Inflation Toasted the Plant-Based Protein Companies Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Gold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed