|

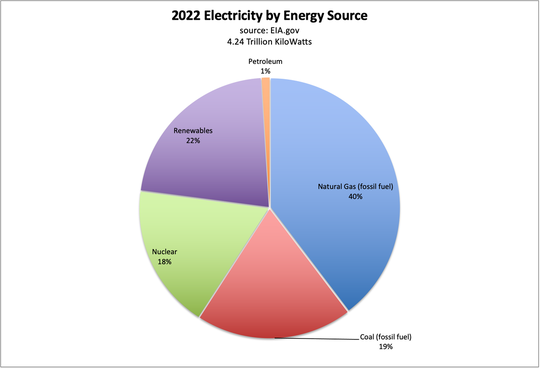

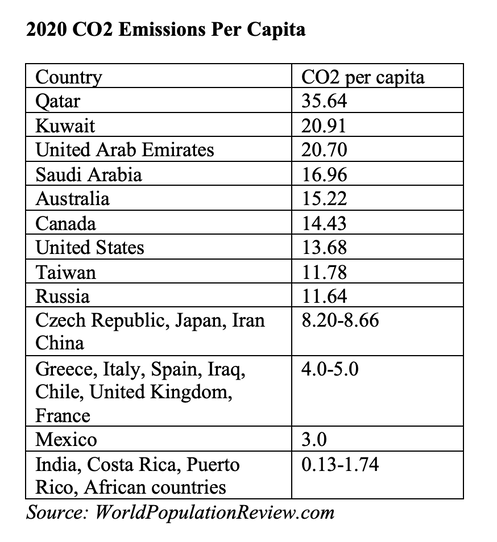

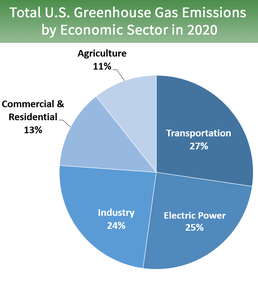

Polyester, Plastic, Gasoline, Natural Gas and Other Petrochemical Products Fossil fuels have become so pervasive in our lives that few of us are aware of just how many times we touch the pollutant daily. We take elevators, power our electronic devices, enjoy heating and cooling, and turn on light switches without acknowledging that 60% of the U.S. is still powered by fossil fuels. This varies state by state. Click to check on the source mix of your state’s power. Natural gas cooks most of our food. Many of us wear polyester clothing, and peel plastic off of our fresh produce. We step into our gasoline-powered vehicle, sit on vinyl seats and drive on asphalt – all oil derivatives. It’s not too far a stretch to say that most of our waking hours are spent touching or using fossil fuels. Many of us are learning which banks and financial services companies loan money to oil and gas companies and which politicians vote for drilling, and yet never look into the mirror to see just who is purchasing all of their wares. Divesting our lives of petrochemical products isn’t impossible. It begins with awareness and then requires bold choices and just saying “no” to oil. When we stop voting for fossil fuels with our purchasing dollars, companies will be forced to find another source of revenue. The real power lies in 8 billion consumers making informed, green choices. Until then, the companies that profit by selling us petrochemical products know that we don’t really mean it, no matter how many times we drive to a protest. Below is some of the crucial information we must become aware of to start the journey. The Biggest Polluters Oil and Gas Companies Plastic and Chemical Companies Textile Companies Greening Our lives Greening Our Investments And here is more color on each topic. The Biggest Polluters According to the Climate Accountability Institute, over 1/3 of all carbon emissions on the planet has come from just 20 companies in the fossil fuels industry. The list is topped by Saudi Aramco, followed by (in order) Gazprom (Russia), Chevron, ExxonMobil, National Iranian Oil Co., BP, Royal Dutch Shell, Coal India, Pemex (Mexico), PetroChina, Petroleos de Venezuela, Peabody Energy, ConocoPhillips, Abu Dhabi National Oil Co., Kuwait Petroleum Corp., Iraq National Oil Co., Total SA (France), Sonatrach (Algeria), BHP Billiton (Australia) and Petrobras (Brazil). Oil and Gas Companies Most of the companies above produce oil, gasoline and/or natural gas, which is still used to power most of our vehicles, heating, cooling and cooking. Transportation is the largest CO2 emitter in the U.S., and is the main reason why the Middle East, Australia, Canada and the United States has a larger CO2 footprint than the rest of the world – 2-3 times or more than most of Europe. Plastic and Chemical Companies Over half of each barrel of oil is used to produce plastic, polyester, rubber, vinyl, asphalt and other petrochemical products. Sadly, vinyl chloride was one of the cancer-causing toxins that was spewed all over Palestine, Ohio during the February 3, 2023 train derailment. This chemical is used to make vinyl seats in cars and plastic kitchenware. Other chemicals that were spilled are used to make plastic, printing ink, paint and household cleaners, and as resins to cover paper. The blame for the spill and cleanup costs are currently falling on Norfolk Southern (the train), which is being sued by the Department of Justice, on behalf of the U.S. Environmental Protection Agency (EPA). However, just because the companies that owned the chemicals on board have been kept out of the news and are virtually impossible to identify with an online search, doesn’t mean that they won’t eventually be held accountable for the health consequences of polluting the land and water in Palestine. On December 20, 2022, 3M announced that the company will end producing “forever chemicals,” at a cost of up to $2.3 billion. Perfluoralkyl and polyfluoroalkyl substances (PFAS) do not break down quickly and have in recent years been found in dangerous concentrations in drinking water, soils and foods. PFAs are used to make smart phones, semiconductors, Teflon, non-stick cookware, dental floss and even makeup. Dupont and 3M were both sued by the California Attorney General in November of 2022. In addition to horrifying accidents, cancer, water pollution and legal costs, plastics and other petrochemical companies are facing increased costs of raw materials, combined with reduced demand. You might have noticed that more of our disposable flatware is now paper-based. All of the plastics and chemical companies I examined for this blog lost revenue in the 4th quarter from the same period a year ago. Debt and leverage are elevated. That can be a lethal combination in a rising interest rate environment. Which companies produce the most plastic? You might be surprised to learn that ExxonMobil does, according to the Stockholm Institute. However, there are 20 companies that are responsible for more than half of all of the single-use plastic that is thrown away globally, including Dow Inc. In addition to the plastic manufacturers, fast food and snack companies that thrive on throw-away culture, including Coca-Cola, Pepsi, McDonalds, Starbucks, are equally culpable. Oil companies, the suppliers of the feedstock for petrochemical products, are doing spectacularly. ExxonMobil lags the industry’s growth and profit margins, largely due to lackluster performance in the chemicals division, but remains the juggernaut (and the biggest polluter). Natural gas prices and refining margins were superstars on the most recent earnings report. Sadly, thanks to the war in Ukraine and the recent production cut by OPEC, oil, gasoline and natural gas prices are expected to remain elevated. The industry is one of the top performers of the S&P500, and will continue there as long as demand remains high and geopolitical conflicts (like the war between Russia and Ukraine) continue. Email [email protected] for a Petrochemical or Oil Stock Report Card. Textile Companies Did you know that the earliest polyester textile mills were often located at small gas stations, or that oil and gas companies began purchasing textile mills in the 1960s? Why? Because polyester fabric is composed of chemicals found in petroleum. Dupont, Reliance Industries and Eastman Chemical are some of the top producers. Greening Our Lives If we want to prevent more disasters like the Ohio train derailment, the BP Oil Spill and thousands of smaller, underreported calamities, then we must realize our power as consumers. If we refuse to buy these petrochemical products, the companies will race to find what it is that we do wish to buy and sell it to us. It’s not impossible to choose cotton clothing and other natural fibers, such as wool, alpaca and silk. While viscose and rayon are made from wood pulp, the process of converting them into fabric uses more water and energy than cotton, wool and silk. When natural fibers become the choice of consumers, the textile manufacturers and fashion designers will respond. One example of the power of consumers is the trend in electric vehicles, which is the fastest growing vertical in auto manufacturing. General Motors committed to an all-electric fleet by 2035 – after Tesla virtually put both GM and Ford out of the sedan business with its Model 3. Tesla couldn’t keep up with demand, and is still backordered after opening up two more factories in Germany and China. We can also just say no to plastic. We can choose to walk and ride our bikes more, which is healthier for us and the planet. There is no excuse for single use anything. When I forget to bring my reusable container, I just wait until the next time for my espresso, or find a café that has porcelain cups instead of drink-and-toss. My backpack is something I never leave home without – in case I need to pick up a few things on my walk. In the beginning these choices are breaking habits – so they feel inconvenient or even annoying. And then they become the new habit. Greening Our Investments There are only 30 companies in the Dow Jones Industrial Average. Of those 30, seven are involved in profiting from and promoting fossil fuels and plastics – almost ¼. Similarly, the ESG (environmental, social and governance) index is missing the E: Environment. Over 20% of the companies in ESG funds are associated with fossil fuels, and none are actively promoting harmony or the healing of our planet. Including the E in these funds is essentially false advertising. (This is certainly not the 1st time that we’ve seen false advertising in the names of investment funds.) Getting all of the polluters out of our portfolio will be challenging initially. However, we can start by avoiding Dow Jones Industrial Average index-linked funds. At our Financial Empowerment Retreat, you’ll learn how to see which companies are in all of the funds that you own in your retirement and managed brokerage accounts. Once we know what we own, we can make conscious choices and changes. Until then, we are invested in and profiting from the polluters. Bottom Line Whether we are interested in sustainability, or just profits, there is a case to be made for jettisoning companies that pollute our planet, and carry the potential liabilities and costs of those actions. If we want to stop the polluters, we have to stop buying the products. We must be the change our planet needs to heal. You can learn more about how to reduce your personal CO2 footprint in my book The Power of 8 Billion: It’s Up to Us. The ebook will be free for 5 days, starting on Earth Day (April 22nd). You can green your portfolio with the tools you gain by attending our April 22-24, 2023 Financial Empowerment Retreat. Join us for an immersive Sustainability Adventure in Poundbury, England (one of the most sustainable communities in the world) on Sept. 20-27, 2023 to step into new possibilities that will change your way of thinking, living and investing forever. Click on the blue-highlights to access the flyers, where you will learn more. Email [email protected] or call 310-430-2397. We’re happy to answer your questions and to register you. Email [email protected] or call 310-430-2397 if you are interested in learning time-proven investing, budgeting, debt reduction, college prep and home buying solutions that will transform your life and heal our planet at our next Financial Freedom Retreat. We spend one full day on what's safe, helping you to protect your wealth and reduce money stress.  Join us for our Online Financial Freedom Retreat. April 22-24, 2023. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Join us for an immersive sustainability adventure in Poundbury, England, March 20-27, 2023. Email [email protected] to learn more. Register by April 24, 2023 to receive the best price. Click for testimonials, pricing, hours & details.  Photo by Brian McLernon. Photo by Brian McLernon. Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Free Holiday Gift. Stocking Stuffers Under $10. Cash Burn & Inflation Toasted the Plant-Based Protein Companies Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Gold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.

Polyester, plastic, gasoline, natural gas, and other petrochemical products are essential to daily life, used in clothing, packaging, fuel, and energy production. While crucial, their production and use require careful management to mitigate environmental impacts and promote sustainability. 6/6/2024 07:16:51 am

Dear Robert, Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed