|

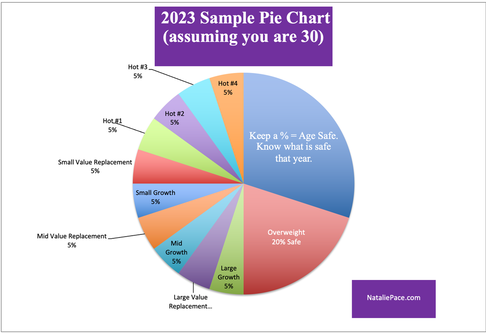

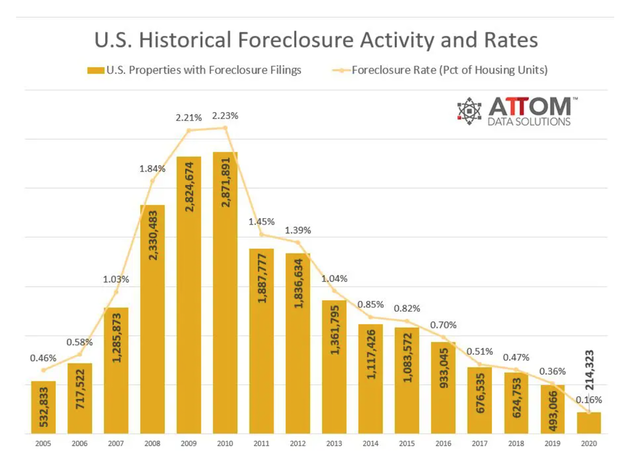

Hundreds of Thousands of Dollars in Losses. Investors Ask Natalie. Recently our team received an email from someone who had over one hundred thousand dollars of losses over the past year and a half. She had been referred by someone who received a 2nd opinion from me back in 2018, who is grateful that our strategies have protected her wealth and given her “sanity and peace.” The request was to help her understand why she was losing so much money, and how to prevent further losses – particularly as she had previously always just invested in whatever her father’s advisor told her to. Are You in a Similar Position? Have you lost $100,000 or more in your retirement plan, or your managed brokerage account? Have you checked on the performance of your portfolio? Are you afraid to face the truth? Are you hoping that someone else is protecting you, without any checks and balances or oversight? 2022 Was a Terrible Year for Stocks and Bonds With long-term government bonds losing -26% and stocks losing -20% last year, a $1 million portfolio could’ve lost $200,000 or more. If this is what happened to your plan, then it’s riding the Wall Street rollercoaster – winning in bull markets and losing a lot in bear markets. (There’s a better plan. Keep reading.) While it’s tempting to just want to hang on and hope to make up losses, history teaches us that recessions cost investors a great deal more than that. (There is a recession predicted in 2023. The powers that be always say that it will be mild, until, of course, banks start failing and contagion sets in.) The Dot Com Recession shaved 78% off of the value of the NASDAQ Composite Index 78%, and then took 15 years to recover. The Great Recession cost the Dow Jones industrial Average 55% of its value, and then took about seven years to recover. During the pandemic, the S&P500 dropped 38% in less than five weeks. What Works in a Recession? During the Dot Com and the Great Recessions, simply overweighting safe allowed investors to earn gains instead of losing more than half of their wealth. Bonds were performing quite well, and kept the portfolio buoyant. This time around, bonds are losing even more than stocks, which makes a potential recession even more problematic for investors. (Bond and mortgage-backed securities losses have played a large role in the failures of Silicon Valley Bank, Signature Bank, First Republic Bank and Credit Suisse, and could start impacting insurance companies, hedge funds and other financial services corporrations.) Though protecting our wealth on the safe side is tricky, it is doable. A carefully crafted plan will also help us to save thousands annually in our budget, to boot. 2023 Recession-Proof Strategies to Protect & Outperform So, what can we do to protect our wealth, even if we have already experienced losses in our portfolio. Is it too late? It’s no fun to have losses of 20%. However, doing nothing could put half of our wealth (or more) at risk. The truth is: the sooner that we adopt time-proven strategies, the better. Rather than rely on a whistle and a prayer, or blind faith that somebody else is protecting our wealth for us (when the losses suggest otherwise), we can learn the life math that we all should’ve received in high school, and create a future that is healthier for us personally, as well as our collective well-being. Below are just a few ways that we can do this. Adopt a Thrive Budget® Protect and Diversify Our Retirement Plan Know What We Own and Why Know What is Safe Anticipate Volatility And here is more information on each of these points Adopt a Thrive Budget® The Thrive Budget® is rather easy to follow in terms of the math, but requires brave choices. If we want to fly in this life, we have to lighten our load. The truth is, if we follow the conventional path of getting a college degree, securing a job, buying a house, paying our student loan debt, investing in our 401(k), then buying life, car and home insurance – our budget doesn’t add up. We might have to put food on credit cards. Did you know that most people under 40 are spending 30-50% of their income on housing alone! That is unaffordable and unsustainable. A lot of conventional personal finance books chastise us for buying too many café lattes and avocado toast, while overlooking the fact that basic needs in today’s world just don’t add up. Of course, if you’re drinking a $5 coffee every single day, you could save over a thousand dollars a year by not doing that. However, the real problem is the tens of thousands of dollars (or more) that we spend on health insurance, housing, transportation, gasoline, utility bills – basically all the things that we think of as our basic needs. Many of us are essentially slaving away at our jobs to make the landlord, the tax man, the gasoline station, the health insurance company, the insurance salesman, the utility provider, the car manufacturer and other companies rich, while we spin on the hamster wheel of life not getting ahead. HENRY (High Earner, Not Rich Yet) has been coined to describe this sad phenomenon. Smarter choices on the big-ticket spending allow us to clean up this Augean Task. You can read about the various tools that promote our fiscal health, and lead to living a richer life in the Thrive Budget® section of The ABCs of Money, 5th edition. I will be hosting a special free videoconference on this topic, June 8, 2023, at 5 PM ET, 2 PM PT. If you’d like to join us live, just email [email protected] with VIDEOCON in the subject line. You can watch it back at https://www.youtube.com/nataliepace. Whether we are a young professional, a college student, parents who are living in the sandwich generation, or someone who is getting ready to retire, now is the time to set up our financial house, so that we can withstand any economic storms on the horizon. Protect and Diversify Our Retirement Plan A properly diversified investment plan protects us from losses, while allowing us to participate in bull runs and hot trends. If your portfolio lost 20% or more last year, that’s a sign that your portfolio is not properly protected and diversified. Our time-proven, 21st-century strategies actually earned gains in the Dot Com and the Great Recession, and outperformed the bull markets in between. It’s a little trickier this time around with bonds being the worst performers on Wall Street. However, while tricky, it is doable to protect your wealth from losses, especially if there’s a recession, by making some strategic adjustments to your plan now. This plan is less time and money than most of us spend worrying and obsessing over the dire headlines, or being enticed by too-good-to-be-true schemes. Our time-proven, 21st Century strategy is literally easy-as-a-pie-chart, with regular (1-3 times a year) rebalancing. You can read about these strategies in the Stocks and What’s Safe sections of The ABCs of Money, 5th edition. You can learn them and implement them at our next Investor Empowerment Retreat, which is scheduled for June 10-12, 2023. You can also reach out and get your own unbiased 2nd opinion. Email [email protected] for pricing and information. The June Retreat will likely be the last retreat before October. Summers are typically weak on Wall Street. So it’s a good idea to batten down the hatches of our financial house before we head out on vacation, so that we can have a great time, free from worry and stress, and return home, knowing that we don’t have a giant problem waiting for us. Testimonial "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics Know What We Own and Why Learning the life math that we all should’ve received in high school means that we don’t have to have blind faith that somebody else is protecting our wealth for us. Most managed brokerage accounts ride the markets. It’s easy to make money in bull markets and easy to lose a lot very quickly in bear markets. Once we know the basics of a healthy investment strategy, then the foundation of our wealth plan is established. We can keep building and learning throughout our lives, knowing that the base is solid and secure. Learning the ABCs of money that we all should’ve received in high school is easier than algebra. It allows us to be the boss of our money. Whether we start with an unbiased 2nd opinion on our current plan, or with the 3-day retreat, as Benjamin Franklin said, “An investment in knowledge pays the best interest.” When everything is at risk, we can have devastating losses. Those losses affect everything we own. FICO scores plunge, causing interest rates to soar – if we can get any loan other than on a credit card. The reason most people don’t buy low (a well-known investment rule) is that they can’t. They lose too much money in the recession and are barely hanging on. Buying low is out of the question. Did you know that over 20 million homes were foreclosed on directly before and after the Great Recession? When we wait for the headlines that the economy has turned, it is too late to protect our wealth. Typically, we’re much closer to the bottom of the bear, so acting at that time would be selling low. It’s a much better idea to fix the roof while the sun is still shining. Know What is Safe At a time when banks are failing, when insurance company products, like annuities, are not FDIC-insured, and bonds are losing more than stocks, it’s important to have a carefully designed strategy for protecting our future. The safe side of our plan is not supposed to lose principal value, and yet, as mentioned at the top of this blog, long-term bonds were the worst performers on Wall Street in 2022. Protecting our wealth by knowing what is safe in a Debt World where there is far too much leverage, assets are overvalued and financial services companies are vulnerable is tricky, but doable. That’s why we spend one full day on what’s safe at the Investor Educational Retreat. Anticipate Volatility Recently, one of my coaching clients talked to me about the stocks in his portfolio. He had lost about $30,000 of his $3 million in liquid assets. It’s easy to look at the red minus signs, and fret that we’re a terrible stock picker and perhaps shouldn’t invest at all. However, when we put the $30,000 in stock losses in context of his entire portfolio, he lost 1% of his portfolio, at a time when many folks lost 20% or more. Having the appropriate amount invested (and overweighting safe) protected him from losses, while positioning him to buy low. (Market timing doesn’t work. Most people are too late getting in or out, and end up buying high and selling low.) A properly diversified plan is one where we don’t expect to be perfect. We anticipate that equities might be weak in a recessionary year, and overweight an additional amount safe as protection against a downturn. This preserves our capital for future purchases, and protects us from losses. We are currently overweighting 20% safe in our sample pie charts. We must also understand why banks are failing, why insurance companies could also be a problem, and protect our safe side from weakness in all of the financial services providers. This plan takes us out of FUD (Fear. Uncertainty. Doubt.) and into a successful strategy. The task then becomes to drown out the nonstop financial noise, and focus on staying true to the plan – to “stick to our knitting.” We offer free Thrive Budget® and Easy-as-a-Pie-Chart® investing web apps. Just email [email protected] to receive the links. Bottom Line The price of 21st Century recessions can be devastating. Hoping to earn back losses in the bull market isn’t a smart idea; it’s just riding the Wall Street rollercoaster. This could be a disaster at any stage in life, but is particularly problematic the closer we get to retirement. Fortunately, a time-proven, 21st Century strategy that earns gains in recessions and outperforms the bull markets in between is easy as a pie-chart (which is why it is enthusiastically recommended by Nobel Prize winning economist Gary S. Becker). Email [email protected] or call 310-430-2397 if you are interested in learning time-proven investing, budgeting, debt reduction, college prep, ESG and home buying solutions that will transform your life and heal our planet at our next Financial Freedom Retreat. We spend one full day on what's safe, helping you to protect your wealth and reduce money stress.  Join us for our Online Financial Freedom Retreat. June 10-12, 2023. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. This is likely the last retreat before Oct. It's a great idea to protect your wealth before you go on summer vacation.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. Early Bird pricing ends May 30, 2023. There is very limited availability.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. The Debt Ceiling Crisis. What's at Stake? Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Empty Office Buildings & Malls. Frozen Housing Market. The Online Global Earth Gratitude Celebration 7 Green Life Hacks The Debt Ceiling. Will the U.S. Stop Paying Bills in June? Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Free Holiday Gift. Stocking Stuffers Under $10. Cash Burn & Inflation Toasted the Plant-Based Protein Companies Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Gold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed