|

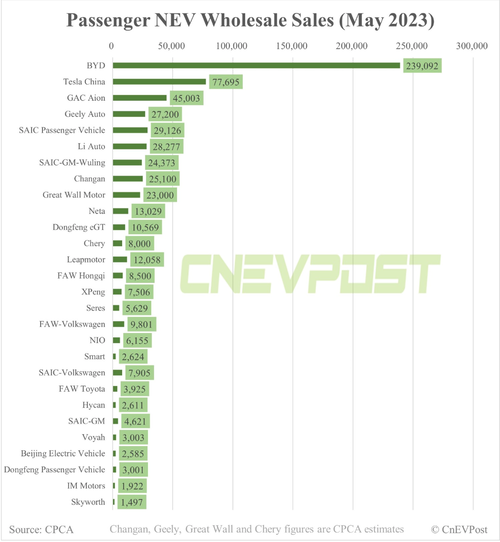

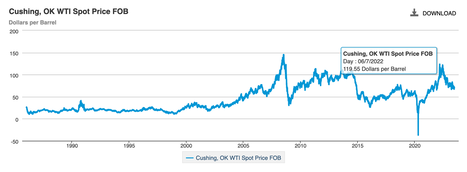

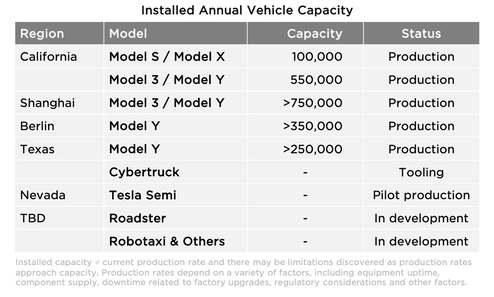

Tesla Model Y. The World’s Bestselling Car in 1Q 2023. Tesla sold 267,171 Model Ys in the first quarter of this year, of which 94,469 were sold in China, higher than 83,664 in the United States, and 71,114 in Europe, according to data provided by JATO and Reuters. However, the company still lags behind BYD, the top EV carmaker in the Chinese market. We Can Thank China for Lower Oil and Gas Prices Electric vehicle sales are on fire throughout the world. The fast growing domination of the EV is so robust that the International Energy Agency (IEA.org) is projecting that oil demand will fall by at least 5 million barrels a day by 2030. China’s robust EV adoption is one of the reasons why oil prices have dropped to $69.98/barrel, after peaking at $120/barrel on June 7 of 2022. China’s 2023 oil demand is expected to be just 1% above pre-pandemic 2019 levels. So, there are two distinct trends. EVs are the fastest growing vertical in cars, causing the oil industry to slowly, but surely, begin to lose some of its stranglehold on consumers. When gasoline prices are high, consumers struggle, and recessions are more likely, as consumer spending accounts for 68% of U.S. GDP. Oil prices plunge in recessions, as you can see in the chart above, in 2008 and 2020. The Chinese EV Market EV sales exceeded 10 million in 2022 worldwide, accounting for 14% of all new cars sold. 2023 could hit 14 million in sales, with 18% of the marketplace (source: IEA.org). That’s up from around 9% in 2021 and less than 5% in 2020. China accounted for about 60% of the 2022 total, with Europe in second, and the United States as the third largest market. China is making sure that they stay at the top of the list by extending their EV tax credits for another four years, and by adding charging facilities. The U.S. has an EV tax credit of up to $7,500 in place through 2032. However, there are plenty of rules to qualify, including price points and that there must be final assembly in North America. (Tesla's S and X models don't quality, while 3 and Y do.) So, which companies will dominate EV sales in 2023 and beyond, particularly in the largest market, China? As you can in the chart at the top of this blog, all of the top EV sellers in China are Chinese automakers, with the exception of Tesla at #2. Tesla is far behind BYD. Ford and General Motors are absent from the list. The Discount War There are so many vehicle brands vying for the Chinese EV marketplace that a discount war has broken out. As General Motors CEO Mary Barra told Reuters, “China has 100 vehicle brands vying for sales, and a 50% capacity utilization rate.” In order to compete, most companies have slashed prices. Inventories are rising. Ford has almost $10 billion finished products and $6.5 billion unfinished products and raw materials. GM has almost $18 billion in inventory. Tesla had trouble keeping up with demand last year, but had 15 days of inventory on hand as of the 1st quarter of 2023. Tesla’s year-over-year revenue growth was still 24% in the 1st quarter of this year, even with the price reductions. They are taking a hit on their net income, but are still profitable. Tesla’s net income was $2.5 billion in the 1st quarter, down -23.4% from $3.28 billion a year ago. BYD and low priced auto maker Li Auto, both Chinese, are experiencing the most robust revenue growth at 80% and 96.5%, respectively. In 2017, GM began a transition to an all-electric future by 2035. They have adopted campaign of “zero crashes, zero emissions, zero congestion.” In the 1st quarter of 2023, GM delivered over 462,000 vehicles to China in the 1st quarter and has a target of having 1/3 of the new launches to be New Energy Vehicles. In the meantime, GM’s profits are down by 25% in China (source: Reuters), and there is concern that a 2023 recession might materialize in the U.S., which can be bad for auto manufacturers. (Both GM and Chrysler had to declare bankruptcy in 2009.) China’s economy is expected to grow between 5.1% and 5.7% in 2023, which should help Tesla weather a U.S. recession. GM and Ford are looking to compete in the red-hot Chinese EV market to do the same. Tesla has a Solid Presence in China Meme Stock Darlings Nio and XPeng were meme stock darlings in late 2020 and early 2021. Both companies have seen their sales and their share prices implode. Nio and XPeng are trading in the $9-10 share price range, after soaring as high as $67 and $64, respectively. What happened? Both companies have lost market share, with XPeng reporting in the 1st quarter of 2023 that revenue had dropped by an astonishing -46%. The weakness has a lot to do with the discount wars and having so many companies vying for the same customer. Nio hopes to compete with an all new ES6 model, which started a delivery on May 25, 2023. They also have a lower priced ET5 and ET5 Touring, which they will launch on June 15. According to William Li, the founder, chairman and CEO of Nio, “Regarding the ET5, ET5 Touring, and ES6 overall volume, we believe there is an opportunity for us to still achieve a 20,000 units in one month.” That would be a substantial improvement on the 23,000-23,000 deliveries expected in the 2nd quarter for Nio. Nio is selling cars in Europe and even received the Car of the Year 2022 Award from Sweden (according to the Nio blog). Analysts are concerned about Nio’s cash burn. However, the company still has $5.5 billion, as of March 31, 2023. They’ve been forced to postpone cash breakeven to at least a year from now. XPeng has almost $5 billion in cash, restricted cash, short term, investments, and restricted time deposits. They are also launching a new model in June 2023, the G6. Dr. Hongdi Brian Gu, Honorary Vice Chairman and Co-President of XPENG, believes that the G6 will emerge as one of the most popular, bestselling models in China’s SUV market segment with the price range of $27,900-$41,800. (By comparison, Tesla’s model Y is in the $52,900 range.) According to Dr. Gu, “As the upcoming G6 launch and other new product launches fuel rapid sales growth, we expect our cash flow from operations to improve significantly.” Both Nio and XPeng are banking on their product launches of May and June to save the day in 2023 and going forward. We will know how they fare when the companies start releasing their vehicle deliveries data in the coming months. Both companies will have more bad news in the 2Q 2023 reports. Nio is projecting that its revenue will decline -9-15% year over year in the second quarter of 2023, while XPeng is expecting revenue to decrease -37-40%. This is already baked into the low share prices. All eyes will be on the monthly delivery reports to see if the turnaround is on track. The 2Q earnings reports for both of these companies will be released in late August, where we’ll get a peak of their success with the new product launches in the forward outlook. I plan to monitor the delivery reports in early July and August. So, be sure to check my Twitter feed on July 2 and August 2 for the updates. (If you aren't on Twitter, we post the feed on the home page at NataliePace.com.) Ford Motor Company Ford has announced a Ford+ plan which will “lead the electric vehicle revolution.” Despite that proclamation, over 90% of Ford’s vehicle sales come from internal combustion engines (ICE). Ford actually sold fewer electric vehicles in May 2023 than in May 2022, down -13%. It’s not surprising that Ford has been the laggard in EVs, given that the company is the most heavily mired in debt, pensions and other post-employment obligations (OPEBs). Ford is the only major U.S. auto manufacturer with a junk bond rating, at BB+ positive. The company’s debt to equity ratio is 3.29 compared to 0.07 for Tesla and 1.64 for General Motors. Ford’s total liabilities are $212.7 billion. The company’s current value is $56 billion. Last year Ford lost almost -$2 billion. The early stage Chinese manufacturers are losing a lot of money, as well. However, young companies that are building factories and investing to keep up with demand is a very different scenario than companies that are borrowing from fixed-income investors to pay off old debt. This becomes acute when a company is also losing a lot of money, as Ford did last year. The first quarter of 2023 was a lot better for Ford. The company had $1.8 billion in net income. However, they’ll need to restructure their Chinese operations and ramp up quickly to compete. With EVs growing so rapidly, it’s a question mark just how much longer ICE will keep Ford afloat… long enough for them to catch up to Tesla and GM in the race for EV dominance? Bottom Line EVs are on fire, thanks in a large part to the massive sales in China. Tesla has benefited greatly from that, while GM and Ford are lagging in the Chinese market. With the exception of BYD, which is the number one seller in China, many of the Chinese automakers have faced severe headwinds and competition. The companies that are winning the discount war, i.e. BYD and Tesla, have very high stock valuations at this time. (BYD is not traded on the Big Boards in the U.S.) Tesla is worth $818 billion, with 2022 net income of $12.6 billion, for a price-earnings ratio of 76. That’s pretty outlandish, even for a company that is increasing sales at 24.4% year over year. If Nio and XPeng are able to execute on their strategy, their share prices have a lot of room to soar. Nio’s price- sales ratio is 0.35, while XPeng’s is 0.82. (Both companies are still cash negative, so they don’t have a P/E ratio.) With the competition so fierce, a safer play could be investing in an ETF that specializes in EVs, such as the iShares IDRV. There you'll get exposure to most of the EV carmakers mentioned in this blog, including BYD. For those of you who have attended our Financial Empowerment Retreat and learned our time-proven, easy, pie chart system, this could be a hot slice. (If you haven't, join us Oct. 7-9, 2023 online.) If you would like a copy of the Auto Stock Report Card, simply email [email protected] with Auto Stock Report Card in the subject line. Full Disclosure: I have investments in some of the EV automakers listed in this blog. Email [email protected] or call 310-430-2397 if you are interested in learning time-proven investing, budgeting, debt reduction, college prep, ESG and home buying solutions that will transform your life and heal our planet at our next Financial Freedom Retreat. We spend one full day on what's safe, helping you to protect your wealth and reduce money stress. We also host sustainability adventures, where we walk in royal footsteps toward a richer life, all while living in greater harmony, by design. Click to learn more.  Join us for our Online Financial Freedom Retreat. Oct. 7-9, 2023. Email [email protected] to learn more. Register by June 30, 2023 to receive the best price and a complimentary private prosperity coaching session (value over $400). Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want! This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest 2023 Company of the Year Sell in May and Go Away? Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. The Debt Ceiling Crisis. What's at Stake? Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Empty Office Buildings & Malls. Frozen Housing Market. The Online Global Earth Gratitude Celebration 7 Green Life Hacks The Debt Ceiling. Will the U.S. Stop Paying Bills in June? Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed