|

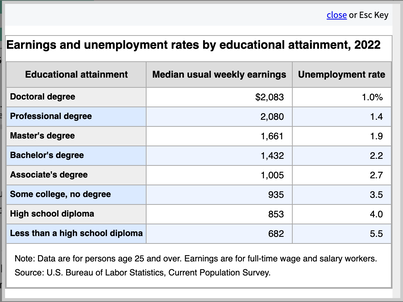

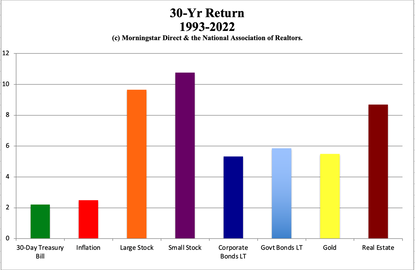

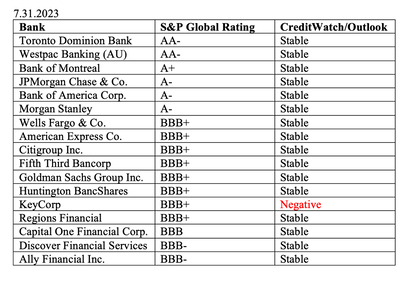

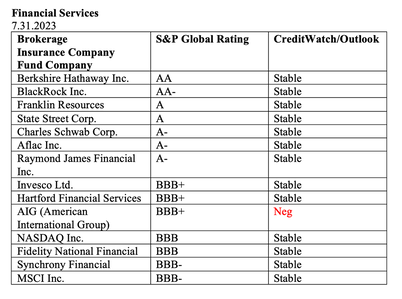

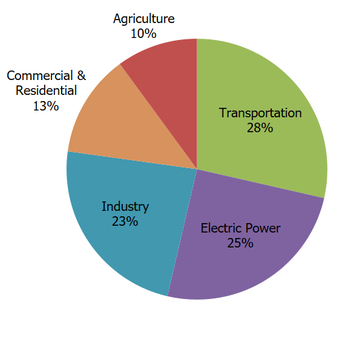

The rules are definitely stacked in the favor of those who are at the top. People don’t get rich or stay rich by accident. Most of them employ the legal means and wealth secrets listed below -- which anyone of us can adopt to live a richer life. While some nouveau riche (particularly athletes and lottery winners) fly high and crash, others can completely transform the trajectory of generations to come. (A focus on education has made Asian Americans the top U.S. household income earners.) And that brings me to Wealth Secrets #1: Education is the Highest Correlating Factor with Income. Here are the 10 Secrets We’ll Cover: Wealth Secrets #1: Education is the Highest Correlating Factor with Income. Wealth Secrets #2: Investing is the Key to Wealth. Wealth Secrets #3: Never Confuse a Bull Market With Wisdom. Wealth Secrets #4: Stop Making Everyone Else Rich. Wealth Secrets #5: Royals Don’t Buy Their Own Castles. Wealth Secrets #6: Lower Your Tax Burden. Wealth Secrets #7: Billionaires Sell Insurance. Wealth Secrets #8: Stop Making Exxon Mobil and the Automakers Rich. Wealth Secrets #9: Sustainability. Wealth Secrets #10: Protect Your Wealth From Financial Predators. And here is additional information on each secret. Wealth Secrets #1: Education is the Highest Correlating Factor with Income. As you can see in the Education Pays graph above, higher education almost guarantees employment at the highest income level. However, college isn’t for everyone. And if you graduate with an unemployable degree (absenteeism, basket weaving) and a boatload of debt, then the college experience that we dream of will turn into a nightmare of indentured servitude. In The ABCs of Money for College, you’ll learn how to: * Get a better degree for up to half the cost, * Guide (without wrangling) your child toward the career that is right for her, and * How to save and invest to cover the costs of education, trade school or even your kid’s 1st home. Parents: start the process when your kids are born. Money and mindset both compound. Wealth Secrets #2: Investing is the Key to Wealth. Earned Income is Taxed at a Higher Rate Than Passive Income You’ll never get rich at the day job, even if you’re saving. As you can see in the chart below, investing, not just saving, is the pathway to wealth. If you put 10% of your income into tax-protected retirement accounts and that earns a 10% gain, you’ll become a millionaire, even if you only earn $40,000/year. If you only save and get almost no return, then you’ll never get there. Also, rich people don’t put their money in jars. They max out their tax-protected retirement plans, including their employer 401k or RSP, their personal IRA or TSFA and their Health Savings Account. (There are advantages to having your own IRA and HSA, in addition to your employer-based retirement plan.) People who master life math, including budgeting and investing, are going to be more successful than those who have blind faith that someone else is doing everything for them. Why? Because managed wealth plans do what the market does. Additionally, almost everything that we invest in is sold to us by a commission-based broker, who can make money even if the asset isn’t right for us (or loses money). We’ve been in a secular bull market for so long (since March of 2009) that most people are not aware of Money Secret #3. Wealth Secrets #3: Never Confuse a Bull Market With Wisdom. As of August 12, 2023, stocks had made a decent recovery from the 2022 losses of -20% in the S&P500. When stocks are high, it’s easy to be complacent. Most people don’t check their statements regularly enough to be aware of the losses in bonds – the “safe” side of our wealth plan, which is supposed to keep our principal intact. (Long-term government bonds lost even more than stock last year, at -26%.) Why is it important to know what we own now – near the market high for stocks? Because 21st Century recessions have cost most investors more than half of their wealth, and then take years to crawl back to even. Using a bull market to recover losses is riding a Wall Street rollercoaster. As we get closer to retirement, we can’t afford to take on that kind of risk. A simple plan of proper diversification, based upon our age, and rebalancing at least once a year to capture gains and reallocate/align our plan is as easy as a pie chart. This plan earned gains in the Great Recession and the Dot Com Recession, when most people lost more than half of their wealth. That is why Nobel Prize winning economist Gary S. Becker wrote the forward to my 1st book, writing, "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Our next online Financial Freedom Retreat is Oct. 7-9, 2023. Email [email protected] or call 310-430-2397 now to register for this life-transformational weekend. Wealth Secrets #4: Stop Making Everyone Else Rich. The very wealthy people I know have the “stop making everyone else rich” mantra on auto-pilot for almost everything they do. They never finance anything, unless it is in their best interests. As an example, Wall Street was on a borrowing spree from 2009 through 2021, when interest rates were so low that borrowing felt almost free. Many firms, including a lot of banks, borrowed so much that their credit score fell to the lowest rung of investment grade, and they could still borrow at 5% interest or less. As a result, more than half of the S&P500 is at or near junk bond status. That is very different from the average American who has no access to the capital markets and borrows on a credit card, at 25% or higher interest, when they can’t tap their home equity. However, there are many other ways that very wealthy people keep the money in the family instead of making the landlord, the debt collector, the utility company, the insurance salesman, the gas station, the automakers, etc., rich at their own expense. Many of them are outlined in the Wealth Secrets below. Wealth Secrets #5: Royals Don’t Buy Their Own Castles. The Prince and Princess of Wales’ official residence is Kensington Palace, which has been in the Royal Family since 1689. Of course, most of us don’t have castles lying around to give each child to live in. However, think of how much money is flying out of the family wealth when every adult lives in their own apartment or small house. Getting a bigger place typically means much larger common areas and more luxurious boudoirs, with a lower cost per occupant. There can be additional savings on utilities, WIFI, streaming services and even childcare. Lots of folks in the U.S. have gotten this memo… Multigenerational housing is more widespread today than it was in the Great Depression. 25% of U.S. adults ages 25 to 34 reside in a multigenerational household, up from 9% in 1971 (source: Pew Research). Of course, this was prompted by $1.6 trillion in student loan debt and housing that is largely unaffordable. However, it is also a wealth secret that we should always be mindful of. Wealth Secrets #6: Lower Your Tax Burden. There are many tax benefits and policies that wealthy people all over the world are aware of. Though the rules are different in each country, there are typically work-arounds that put more profits in our corner, and less in the government’s kitty. In general, here are some of the areas that you want to investigate in your area…

Wealth Secrets #7: Billionaires Sell Insurance. Warren Buffett doesn’t buy insurance. He sells it. As we age, the policy terms out, or becomes more expensive with a lower payout. Also, it’s like renting. If you quit paying, you get evicted. Money you invest in owning your own home could mean that you have lodging free and clear when you retire, while your retirement plans can offer income (instead of being another bill to pay in desperation to try and keep a hoped-for payday alive). Your HSA can pay for medical costs not covered by your Medicare. One of the best things you can ever do for your kids is to fund their college dream or start their Dependent IRA early (when they get their 1st job). Sadly, I’ve known a lot more people who lost their insurance policies after decades of faithful payments, or who paid double or triple what the policies were ultimately worth, than those who became rich when a loved one died. Healthy Americans who are paying an arm and a leg for health insurance can save thousands annually with a Health Savings Plan and high-deductible insurance plan. The HSA is there if something terrible happens, and you get an annual tax credit for contributing to it. If you don’t use the money in your HSA, you can start investing it, and it acts like a retirement plan. HSAs are a great long-term health care strategy because health care costs are the biggest expense in retirement in the U.S. If we don’t have to purchase supplemental medical insurance, but instead have that covered in our personal HSA, we’ll be in a better position when we go on a fixed income, which is often much lower than we earned in our career. Check the details on the deductions that are being taken out of your wages. You might be spending a lot more on a low-deductible health insurance plan than you realize. Wealth Secrets #8: Stop Making Exxon Mobil and the Automakers Rich. The average person spends $8000 or more on transportation each year – on each car. That includes the car payment, insurance, fuel and maintenance. You can cut the fuel costs in half with an EV (more if you power with your own solar), while almost eliminating the maintenance costs. Some families find that switching out a bike for the car saves even more – even considering that you might occasionally rent a car or take a ride-share. Cities, like Amsterdam, have eliminated traffic jams, congestion, pollution and CO2 by favoring bikes over cars. In general, most Europeans have a CO2 footprint that is about 1/3 of what Americans, Canadians, Australians and those in the Middle East have – largely due to single-occupancy vehicles being predominant in the latter, while subways and shared roads are more normal in Europe. As a former Mercedes owner in a car-centric city (Santa Monica), I know that giving up a car can feel vulnerable. However, as Santa Monica Mayor Ted Winterer told me in 2019, his family of four adults has only one car and five bikes. In 2017, he and his wife spent about $2000 on ride-shares, as compared to the $7,500 or more average annual cost per car. Remember: getting rid of your car actually equates to a better lifestyle. If you’re riding a bike or walking more, you’re promoting personal health! Wealth Secrets #9: Sustainability Sustainability is fundamental to sustained success – monetization, as well as conservation and preservation. Alnwick Castle is better known as Hogwarts. Millions of Harry Potter fans visit each summer. You can have champagne high tea at Highgrove Gardens, a private home of King Charles III. In addition to earning income on their land, regenerative agriculture, clean energy, shared roads and lowered CO2 footprints are equally emphasized in the Royal Family. Poundbury, an urban extension to Dorchester, in Dorset, England, was designed to be bike/pedestrian friendly, and is powered by anaerobic digestion. The Prince of Wales is carrying on his father’s (King Charles III) commitment to healing our planet with The Earth Shot Prize. Wealth Secrets #10: Protect Your Wealth From Financial Predators Did you get the memo that Virgin Orbit ceased operations on April 4, 2023? Yet Forbes still estimates Richard Branson’s worth to be $3 billion. One of the biggest mistakes Main Street entrepreneurs make is not properly protecting their wealth from their business ventures. Maxing out our retirement plans is key, as that money is protected from almost everything – including personal bankruptcy, home foreclosure and business creditors. However, setting up the proper business accounts is also important – and keeping those accounts separate from our personal wealth. The business should stand on its own, rather than draining the wallets of the founder or Friends and Family. (Many people launch their businesses on credit cards. Some cross-collateralize their homes, or make ill-advised promises to potential investors.) According to BLS.gov, 18% of small businesses fail within their 1st year, 50% within 5 years and 65% by their 10th year in business. While being optimistic and continuously solving problems are essential to launching a business, it is also important to set things up so that if the statistics prove right, we don’t lose our home. Richard Branson didn’t. Many successful business and political leaders have had multiple business failures throughout their careers. Bottom Line Now that you know a few wealth secrets, it’s time to be brave enough to kick old habits and embrace a better plan. My complimentary prosperity coaching series can help, as can reading my books (access links on the home page at NataliePace.com). Email [email protected] to receive your 21-day video coaching program free. If you want to dive right in, to start earning money while you sleep, while protecting the wealth you already have, join us at our Oct. 7-9, 2023 Financial Freedom Retreat. Email [email protected] to register. Learn more in the flyer (link below) and on the home page at NataliePace.com.  Join us for our Online Financial Freedom Retreat. Oct. 7-9, 2023. Email [email protected] or call 310-430-2397 to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is were released in 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. Tesla's Model Y is the Bestselling Car in the World. 2023 Company of the Year Sell in May and Go Away? Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. The Debt Ceiling Crisis. What's at Stake? Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Empty Office Buildings & Malls. Frozen Housing Market. The Online Global Earth Gratitude Celebration 7 Green Life Hacks The Debt Ceiling. Will the U.S. Stop Paying Bills in June? Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed