|

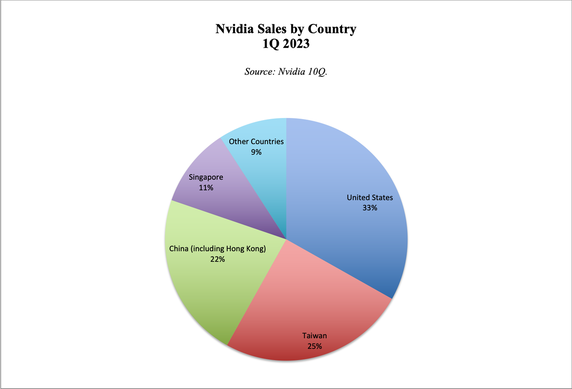

Artificial Intelligence and Nvidia’s Blockbuster Earnings Report. A new computing era has begun. Nvidia just had a blockbuster earnings report. You would have to be living under a rock not to have heard about it. However, before you jump in to AI-mania, there are quite a number of things that you want to be informed about, including the best way to capitalize on this exciting industry. Nvidia has become the poster child for AI, but it certainly is not the only company that has exciting prospects in this game-changing technological frontier. Below are a few of the things I will cover in this blog. All of them are essential to investing success in artificial intelligence. The Market Partners and Competition The China/U.S. Chip War Supply Chain Constraints Valuation Artificial Intelligence ETFs Opportunistic Marketers Who Prey on Popular YOLOs Pre-IPO Artificial Intelligence Unicorns to Keep on Our Radar And here are more details on each point. The Market Perhaps Judson Althoff, Microsoft’s EVP and Chief Commercial Officer, said it best when he described artificial intelligence’s role in technology as “remodeling every room in the house.” Satya Nadella, Microsoft’s CEO, said in the company’s 2Q 2023 earnings call, “Every customer I speak with is asking not only how, but also how fast, they can apply next-generation AI to address the biggest opportunities and challenges they face and to do so safely and responsibly.” Theoretically, AI pays for itself with the efficiency gains. Although many AI startup CEOs are complaining about the high price of GPUs that are in very short supply. Partners and Competition Sundar Pichai, the CEO of Alphabet and Google, mentioned Nvidia twice in the company’s 2Q 2023 earnings call. Nvidia definitely has a competitive lead in GPUs, which are getting a lot of publicity because of the GPU shortage happening right now. However, CPUs and TPUs are key as well, something that AMD, Google Cloud and Intel have a solid foot in. Both AMD and Intel plan to have a larger presence in GPUs. AI is rolling out across every nook and cranny of business, and you’re likely to hear the term multiple times in most company’s earnings calls, even those that are not in the technology industry. AI companies specialize in various different niches, from Veritone’s leadership on facial recognition and law enforcement, to Ambarella’s role in the advanced driver assistance system. The GPU shortage has got Silicon Valley on its head. Innovation typically comes from the small companies. However, AI startups are having difficulty getting GPUs at a price they can afford. Even the big technology companies, such as Microsoft, Google, Meta, and AWS, are having to find workarounds. Wired is reporting that Microsoft is offering financial incentives to customers who aren’t using GPUs they reserved. Nvidia is the clear GPU market leader, with 60-70% of the current market. However, Nvidia’s chips are made in China, and more than half of Nvidia‘s revenue comes from Asia. In the 2nd quarter, the company was successful in ramping up supply to start meeting the surging demand. Nvidia’s record 2Q 2023 revenue of $13.51 billion was more than double the revenue from last year. However, the China/U.S. Chip War has been escalating, and Nvidia’s CFO is warning that the situation could have a negative impact “over time.” The China/U.S. Chip War Taiwan Semiconductor makes the chips that Nvidia sells. (The Netherlands company ASML makes the machine that can manufacture wafers with imaging at small resolution.) However, the interconnected global economy of the early 21st Century is unraveling. The U.S. has banned the export of certain U.S. semiconductors, alleging national security reasons. China banned the U.S.-based semiconductor company Micron Technology citing the same concern (and in retaliation). Supply Chain Constraints China has imposed export controls on gallium and germanium, and there is a fear that rare Earth minerals could be next on the chopping block. On July 23, 2023, the Semiconductor Industry Association released a statement calling “on both governments to ease tensions and seek solutions through dialogue, not further escalation.” The SIA also urged the White House “to refrain from further restrictions until it engages more extensively with industry and experts to assess the impact of current and potential restrictions to determine whether they are narrow and clearly defined, consistently applied, and fully coordinated with allies.” Nvidia is forecasting another blockbuster earnings report for the 3rd quarter of 2023, with $16 billion in revenue (compared to $5.93 billion last year). However, the restrictions on exports to China are important, even if the impact isn’t in the near term, because investors have valued Nvidia based on what they think the company will be worth in a few years rather than what the current revenue and net income support. (A lot of analysts’ questions in the 2Q 2023 earnings call were centered on the outlook, drilling down deep to see if the company can really support the current Shoot the Moon market valuation.) Valuation Nvidia‘s net income was only $4.4 billion last year. The company is valued at $1.14 trillion. Part of the reason the share price keeps rising is that the company is buying back its own stock. Nvidia spent $3.4 billion in share repurchases and dividends in the 2Q 2023. Nvidia still has $29 billion authorized to spend on buybacks. There is no doubt that artificial intelligence has sparked a new computing era, and that Nvidia is in a great seat to capitalize on this. At some point in the future, Nvidia’s sales and net income may justify a trillion dollar valuation. However, there will be a great deal of obstacles to get through between now and a few years from now, including fierce competition, the chip wars, global tensions and wars, a potential economic slowdown (or even recession), export restrictions, supply chain disruptions and more. Having said that, there is a way to invest in artificial intelligence and Nvidia that tempers out the volatility of investing in any one stock. Artificial Intelligence ETFs iShares offers an artificial intelligence ETF (symbol: IRBO). This fund invests in Nvidia, AMD, Intel, Google, Microsoft, Ambarella, and dozens of other artificial intelligence companies. While Nvidia is the leader in GPUs, it is also one of the most overvalued companies in the fund. Other companies serve different markets, and offer a better valuation. The fund levels out the risk and the volatility – something that is very important if you don’t want to be babysitting an individual company in your portfolio. If you do not have artificial intelligence in your wealth plan yet, you might consider taking a dollar cost averaging approach over the next year for filling up a slice or two. The reason for that has to do with macro concerns (recession, supply chain disruption, chip wars) and overvaluation of the companies themselves. The potential for this industry now and in the coming years is definitely the hottest on Wall Street. If you’d like to receive an updated Artificial Intelligence Stock Report Card, just email [email protected] with Artificial Intelligence Stock Report Card in the subject line. Opportunistic Marketers Who Prey on Popular YOLOs Whenever something is making headlines, you have to have your guard up to fend off opportunistic, marketing predators, who prey on YOLOs. Over the past few decades, I have seen a great deal of stock scams, riding the waves of crypto-mania, cannabis, Gamestop and more. We’re starting to see a large number of AI snares right now. I’ll be discussing one in particular in my videoconference on Tuesday. Be sure to tune in. Email [email protected] with Videocon in the subject line, if you’d like to join us live. Otherwise, you can watch it back at Youtube.com/NataliePace. Pre-IPO AI Unicorns to Keep on Our Radar While I was researching this article, the names of these pre-IPO AI companies came up: Cohere, Jasper, Typeface, CoreWeave, Clearview AI, Modular. During disruption periods, such as we’re seeing with AI today, there can be a plethora of companies that crop up. Many bite the dust within a few years. However, the few that survive tend to become the multinational giants of tomorrow. Bottom Line Artificial intelligence is hot, hot hot (and can be at least one hot slice in our wealth plan). However, most of the popular names that you’ve heard about, including Nvidia and ASML, are already trading at very elevated prices. Buying high, hoping to sell higher (or hold for a few years while the company tries to live up to its potential) can be a losing plan for years, if not decades. We’ve seen Tesla sink from a trillion dollar valuation to $325 billion over the 12 months. (The company is currently valued at $757 billion, still down -25% from the trillion dollar valuation.) Any one of the risk drivers outlined above could cause that to happen to Nvidia. An easier way to invest in Artificial Intelligence is to purchase a fund like IRBO as one or two hot slices of your well-diversified plan. You can, of course, purchase a hot company like Nvidia. However, it’s important to have an exit strategy, and to observe the tried and true, “Buy low, sell high,” mantra. Join us at our October 7-9, 2023 Financial Freedom Retreat to learn more about what a well-diversified plan looks like, and how to develop your entry and exit strategies for hot individual companies, like Nvidia. If you want to dive right in, to start earning money while you sleep, while protecting the wealth you already have, join us at our Oct. 7-9, 2023 Financial Freedom Retreat. Email [email protected] to register. Learn more in the flyer (link below) and on the home page at NataliePace.com. FYI: We are currently hosting our Summer Sweepstakes. The grand prize is a seat at a retreat (value $895). We are also offering coaching and other prizes. Everyone who enters can receive a gift of the free video coaching series of their choice: debt reduction, The Thrive Budget or 21 Days or Prosperity Coaching. Entering is as easy as emailing [email protected] with Sweepstakes in the subject line. Sweepstakes ends 8.31.2023. Submissions must be received no later than midnight ET 8.31.2023. Winners must use their gifts by 12.31.2025. Winners will be notified on or before Oct. 31, 2023.  Join us for our Online Financial Freedom Retreat. Oct. 7-9, 2023. Email [email protected] or call 310-430-2397 to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is were released in 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Biotech in a Post-Pandemic World Summer Sweepstakes 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. Tesla's Model Y is the Bestselling Car in the World. 2023 Company of the Year Sell in May and Go Away? Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. The Debt Ceiling Crisis. What's at Stake? Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Empty Office Buildings & Malls. Frozen Housing Market. The Online Global Earth Gratitude Celebration 7 Green Life Hacks The Debt Ceiling. Will the U.S. Stop Paying Bills in June? Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed