|

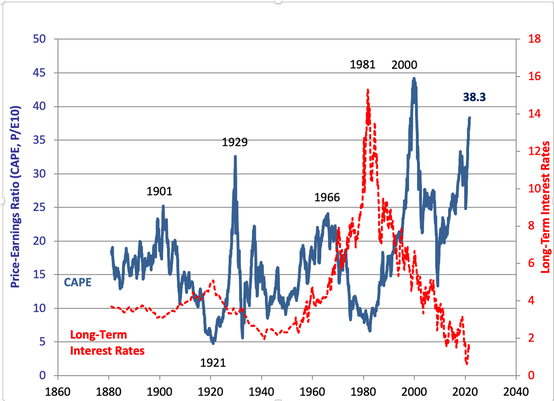

Late yesterday, on September 21, 2021, The U.S. House of Representatives passed legislation that would suspend the debt ceiling through Dec. 16, 2022, and fund the government through Dec. 3, 2021. (The bill is called the “Extending Government Funding and Delivering Emergency Assistance Act,” H.R. 5305.) It still must pass the Senate. Republicans, led by Mitch McConnell, have vowed to prevent it from passing there. The issue here is a very technical one. Over the years, the debt ceiling has been suspended, with no specific amount attached to it. Once the period of suspension is over, the debt limit is adjusted. For example, the debt limit was suspended in August of 2019 (under the Trump Administration). At the time of the suspension, the U.S. public debt was at $22.46 trillion. By the time the suspension ended on July 31, 2021, the debt was at $28.5 trillion. Yes, these numbers are astronomical, and the U.S. must reduce it. (The debate is about when and how.) Both parties contributed to it, so raising the Debt Ceiling is not a partisan issue. In fact, most of the debt under the last suspension was added under the prior Administration. The debt was at $27.8 trillion on January 20, 2021, the last day of Trump’s Presidency. Even before the pandemic, the debt was increasing at a faster level under President Trump than it did under President Obama. In Treasury Secretary Janet Yellen’s September 19, 2021 Wall Street Journal Op-Ed she wrote, “Raising the debt ceiling doesn’t authorize additional spending of taxpayer dollars. Instead, when we raise the debt ceiling, we’re effectively agreeing to raise the country’s credit card balance, and in this case, 97% of that balance was incurred by past congresses and presidential administrations.” Suspending the debt ceiling has been a bipartisan endeavor in prior administrations. However, with the Senate Republicans refusing to vote for a raise and demanding that the Democrats go it alone, there would have to be a dollar amount attached to the ceiling, rather than the suspension. Clearly that would not have worked in 2019, when an unimaginable $6 trillion was needed. With the pandemic still upon us, and economic hardship still a challenge to the U.S. and the world, that strategy is risky. It is also a political weapon. What’s the Risk? With only six working days in Congress before the government shuts down, and only a few weeks before the Treasury will have to treat the U.S. finances like a piggy bank, the risks are so great that Moody’s issued an 11-page summary of how the financial meltdown would occur, warning that: If lawmakers are unable to increase or suspend the debt limit before the Treasury fails to make a payment, the resulting chaos in global financial markets will be difficult to bear. The U.S. and global economies, which still have a long way to go to recover from the recession caused by the pandemic, will descend back into recession. In times past, lawmakers have taken strident warnings like these to heart, and acted. Let us hope they do so again. Soon. U.S. AAA Credit Rating The U.S. AAA credit rating, which is still in effect with Fitch Ratings and Moody’s, is also at risk. Fitch Ratings has the U.S. on a Negative Outlook, but advised on July 13, 2021, that a downgrade was unlikely in 2021. The economic growth expectations, currently at 7.0%, were too strong to warrant any action. There was an assumption that the debt limit would be raised without any hoopla. That was the rationale for Moody’s affirmation to the AAA rating, as well. Fitch noted that failure to raise the debt limit was a “meaningful but remote tail risk to the rating.” What Happened in 2011? Today's crisis is a page out of the playbook in 2011, when Republicans refused to raise the Debt Ceiling under the Obama Administration. Congress waited until August 2, 2021 (the day the Treasury was predicted to default) to raise the Debt Ceiling. Standard and Poor’s (now S&P Global) downgraded the U.S. credit rating to AA+ (on August 5, 2011), even though the ceiling had technically been raised in time. Gold and silver soared to all-time highs. Stocks began sliding in April, a few months before the downgrade, and bottomed out at the end of September. The Dow Jones Industrial Average ended 2011 up an anemic 2.1%, after the rollercoaster ride. This time around, cryptocurrency could join gold and silver in the flight to “safety” party. Of the three, silver and altcoins remain the better bargains. Stocks are Very Expensive One other issue is that stocks are very expensive. To put things into perspective, the Federal Reserve has noted that forward P/Es are almost as high today as they were before the Dot Com Recession. The NASDAQ Composite Index dropped an unimaginable -78% between March of 2000 and October of 2002. The CAPE graph below, which is a 10-year average P/E created by Professor Robert Shiller, reveals that the only time stock prices were higher was in the Dot Com Recession. The Great Depression has fallen to the 3rd position. Bottom Line No one thought the politicians would let things get to this point – just days away from missing payments and risking the U.S. AAA credit rating. Stocks have been high because investors are jaded and accustomed to brouhaha and then last-minute deals. However, the Pandemic 2020 Recession showed us that when sentiment turns, stocks can plunge without warning. The 38% drop in the S&P500 between February 19, 2021, and March 23, 2021, was the fastest that Wall Street had ever turned to bear from a bull market. The 2011 Debt Ceiling debacle and the TARP wrangling in 2008 remind us that when the politicians play chicken with the economy, it can have significant, negative, long-lasting effects. So, what is your best protection? Reading tea leaves and trying to market time things doesn’t work. Being properly diversified, adding in some hot industries (perhaps assets that can go up if stocks go down) and knowing what is safe in a Debt World, accompanied by regular (1-3 times a year) rebalancing is a time-proven 21st Century strategy. You can read about it in the 5th edition of The ABCs of Money. You can learn and implement it at our Oct. 23-25, 2021 Investor Educational Retreat. You can also contact our office at [email protected] to receive an unbiased 2nd opinion on your current plan. Wisdom is the cure. Now is the time.  Natalie Pace Financial Empowerment Retreat. Oct. 23-25, 2021. Call 310-430-2397 or email [email protected] to learn more. Families and friends registering together receive the best price. Click for testimonials & details. If you'd like to learn how to learn how to invest in great companies, how to protect your wealth and how to manage volatile industries, like gold, cannabis and crypto, then join me for our 3-day Investor Educational Retreat. Our Company of the Year has tripled in just four months. We've had many Shoot the Moon stock picks in 2020 and 2021. You will also learn how to earn money while you sleep with a time-proven, 21st Century plan. Wisdom is the cure. It's time to become the boss of your money. Call 310-430-2397 or email [email protected] to learn more now. Other Blogs of Interest The Robinhood IPO. Will the Crypto Crash Hit Tesla, Square & Coinbase? China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! 2021 Financial Freedom Sweepstakes Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed