What WeWork’s Bankruptcy and Half-Empty Office Buildings Have to Do With Our Personal Wealth Plan.9/11/2023

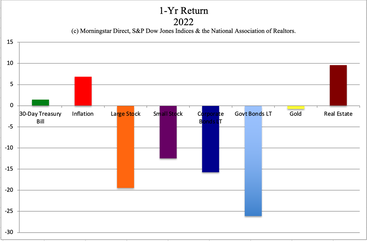

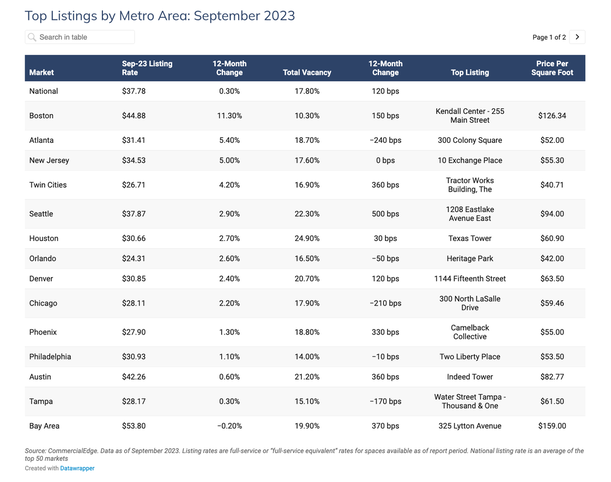

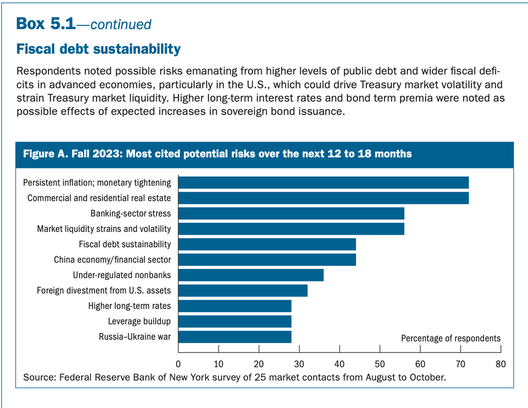

What WeWork’s Bankruptcy and Half-Empty Office Buildings Have to Do With Our Personal Wealth Plan. WeWork is the first major crack in the frozen commercial real estate market. What other companies will fall in and sink? Is this dangerous for our own wealth plan or the overall economy? With all that is going on in the world (prayers for peace continue), you might not have heard that WeWork filed for bankruptcy on Nov. 6, 2023. The company will continue operating, but will restructure its debt and use the Chapter 11 filing to exit its underperforming leases. According to David Tolley, the CEO of WeWork, “Now is the time for us to pull the future forward by aggressively addressing our legacy leases and dramatically improving our balance sheet.” Since WeWork was the largest tenant in New York City, this could have a major ripple effect on other commercial real estate companies, at a time when the industry is already in distress. In a report earlier this year, S&P Global warned that “fundamentals in the office real estate market are deteriorating, pressured by longer-term secular headwinds from remote working and near-term cyclical risks from a slowing economy and weaker job growth.” The rating agency downgraded Hudson Pacific Properties to junk (BB+, outlook negative) on June 28, 2023. (WeWork was always a junk bond – even before its failed IPO.) Most CRE corporations are at the lowest rung of investment grade or speculative status. Why should this matter to the Main Street investor? Banks, insurance companies and pension providers loan on a long-term basis to commercial real estate companies, and these problematic loans and bonds are losing value. As we’ve been reporting all year, long-term bonds lost more than stocks in 2022. Since financial planners (even fiduciaries) typically invest the safe side of our portfolio in bonds, this problem impacts many of us (who might not realize it, if we are not forensic about reviewing our holdings). CRE exposure and long-term bonds were also at the heart of the bank failures earlier this year. Whether we have uninsured deposits or annuities, are counting on a pension, or just want to ensure that the “safe” side of our wealth plan is protected from capital losses, it’s important to understand the issues of CRE, why we’re underweighting the industry in our sample pie charts, and what each one of us can do to steer clear of the risk. (Consider joining us for our New Year, New You Retreat or getting an unbiased 2nd opinion through my private coaching program. Email [email protected] for pricing and information.) Here are the topics we’ll cover in this blog. Recent Downgrades to Junk Suspended Dividends (HPP) Empty Office Buildings Stalled-Out Projects (Google: One Westside) Valuations Debt Banks, Insurance Companies, Pension Plans And here is more information on each point. Recent Downgrades to Junk Before Hudson Pacific Properties was downgraded to speculative status on June 28, 2023, the company was trading at $15/share with a yield of 19%. It’s now trading in the $5/share range, with a suspended dividend. Be careful of taking the bait of high yield. It can result in major capital loss. In the case of a bankruptcy like WeWork, it is common for existing stock to become worthless, and for the company to reissue new shares when it emerges from bankruptcy. Suspended Dividends Hudson Pacific Properties suspended their dividend on September 7, 2023. Vornado postponed their dividends on April 26, 2023. At the end of the year, the company will determine whether the dividend will be paid in cash or cash and securities. We don’t get advance notice before the action takes place. Typically companies announce after the market close, which causes the stock to gap down in after-hours trading. (In the case of GE, Warren Buffett magically exited the stock just a few months before the company slashed their dividend by half.) By the time that most Main Street investors learn of the bad news, they’ve already lost a great deal of money. There have been many lessons over the years on dividends. Click for a history lesson on what happened when General Electric cut its dividend in Nov. 2017. FYI: We also warned about WeWork when the IPO was first announced. Empty Office Buildings Work From Home has changed the inner city landscape. Gone are the bustling business centers and the crowded taco stands, lunch counters and restaurants that serviced office staff. Vacancies are up, and many corporations are looking to downsize their office footprint. Alphabet (Google) booked $2.6 billion in charges related to workforce and office space reductions in the 1st quarter of 2023. Many other companies, including technology, banking and more, are reducing their office space and switching to hybrid work-from-home schedules for their staff. When we hear Jamie Dimon and other bank CEOs yelling that people have to come back to the office or else, one of the underlying reasons is that banks have a lot of exposure to those empty office buildings. HENRYs fled expensive cities to work from home in more affordable suburbs and towns. With housing still largely unaffordable in the very areas with the highest office vacancy rates, it’s difficult to see this situation resolving itself without more bloodbaths like WeWork – no matter how red in the face exacerbated CEOs get. Stalled-Out Projects (Google: One Westside) In January 2019, Google signed a 14-year lease as the sole tenant of One Westside, a mall renovation project owned 75% by Hudson Pacific Properties and 25% by Macerich. Everyone was excited by this ambitious attempt to give new life to an outdated shopping center. And then the pandemic hit. All three companies (Macerich, Hudson and Alphabet) have been radio silent on when or if Google is going to move into One Westside. However, the building is completely fenced in. and there was no construction activity when I visited the site in September and again in November. When I visited on Nov. 7, 2023, I was greeted at the gate by a construction supervisor who told me there was still a lot of work to do before any tenant could occupy the space. Valuations Transactions have been down significantly in CRE of late. Sales this year are about 1/3 of the volume of transactions last year (source: CommercialEdge). Hanging on to hopes that outdated valuations would hold worked out during the pandemic, when money was flowing free and easy. However, now monetary policy is tight and expensive. Many loans and covenants are coming due in 2024. With a frozen market, the valuations that the CRE companies and banks are clinging to may not be representative of what the buildings are truly worth. We got a glimpse of that on Oct. 10,, 2023 when a downtown Boston office building sold for $4.1 million. It had been purchased for $16 million in 2018. The potential for large losses on commercial real estate is currently one of the most cited risks to financial stability in the U.S. Debt Commercial real estate has been on a lifeline of leases and federal support since 2020. However, as leases come up and are not renewed, as companies fail (WeWork), or as large corporations (such as Alphabet) are willing to take a huge financial hit to extricate themselves from their leases, all of which are happening, CRE companies are forced to borrow money to make ends meet. Many already have speculative credit, or reside at the lowest rung of investment grade. Borrowing today with a low credit score is expensive. High vacancies complicate things even further. The older the building, the least likely it is to be one of the chosen few for the new work environment, which trends toward communal space and sustainability over cubicles and a big CO2 footprint. Banks, Insurance Companies, Pension Plans According to the Federal Reserve’s Oct. 2023 Financial Stability Report, “Higher interest rates, declining property prices, and structural shifts in demand for office space may prompt large realized losses.” Small and regional banks are the most vulnerable to CRE weakness. However, insurance companies are also large holders of commercial mortgage-backed securities (CMBS). “Life insurers continued to allocate a high percentage of assets to risky instruments, such as leveraged loans, high-yield corporate bonds, privately placed corporate bonds, and alternative investments,” according to the Financial Stability Report. Bottom Line It’s important to look forensically at the holdings in our wealth plan, even if it is professionally managed. Telling our financial advisor broker/salesman to get us “safe” is not guaranteed to achieve what we desire, especially if we don’t know or understand what we own. (I do a great deal of 2nd opinions and have seen losses and heard many alarming misrepresentations in “conservatively” allocated wealth plans! Click to read about a few.) The safe side of our portfolio is not supposed to be vulnerable to capital losses. While digging into the details might sound laborious or complicated, it’s actually less time and money (there is quite a lot at stake money-wise) once we learn the life math that we all should have received in high school and college. Wisdom is the cure and the time to be the boss of our money and future is now. I’ll be discussing this in greater detail in my Thursday videoconference (Nov. 9, 2023). Email [email protected] with VIDEOCON in the subject line if you’d like to join us live. (You’ll receive the logon instructions automatically if you’re already on the list.) Email [email protected] with CRE Stock Report Card in the subject line if you’d like an updated Stock Report Card. Join us at our Jan. 13-15, 2024 New Year, New You Financial Freedom Retreat. Learn nest egg strategies, how to get hot and diversified, and what's safe in a Debt World. You'll even discover how to save thousands annually with smarter big-ticket choices. Yes, it's a complete money makeover. Email [email protected] to register. Learn the 15+ things you'll master and read testimonials in the flyer (link below) and on the home page at NataliePace.com. Register by Nov. 30, 2023 to receive the best price. Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human capital  Join us for our Online New Year, New You Financial Freedom Retreat. Jan. 13-15, 2024. Email [email protected] or call 310-430-2397 to learn more. Register by Nov. 30, 2023 to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Wynne Pace is an Advocate for SustainabilityFinancial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is were released in 2021. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Solutions for Unaffordable Housing. The Magnificent 7 Drag NASDAQ into Another Correction Cruise Ships Give Freebies to Investors. Should You Take the Bait? Should You Take a Cruise? Bonds. Banks. The Treacherous Landscape of Keeping Our Money Safe. 7 Rules of Investing Air B N Bust? Santa Rally 2023 or Time to Get Defensive? Barbie. Oppenheimer. Strikes. Streaming Wars. Netflix. Monero: A Token of Trust? 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World Summer Sweepstakes 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. Tesla's Model Y is the Bestselling Car in the World. 2023 Company of the Year Sell in May and Go Away? Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. The Debt Ceiling Crisis. What's at Stake? Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Empty Office Buildings & Malls. Frozen Housing Market. The Online Global Earth Gratitude Celebration 7 Green Life Hacks The Debt Ceiling. Will the U.S. Stop Paying Bills in June? Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed