|

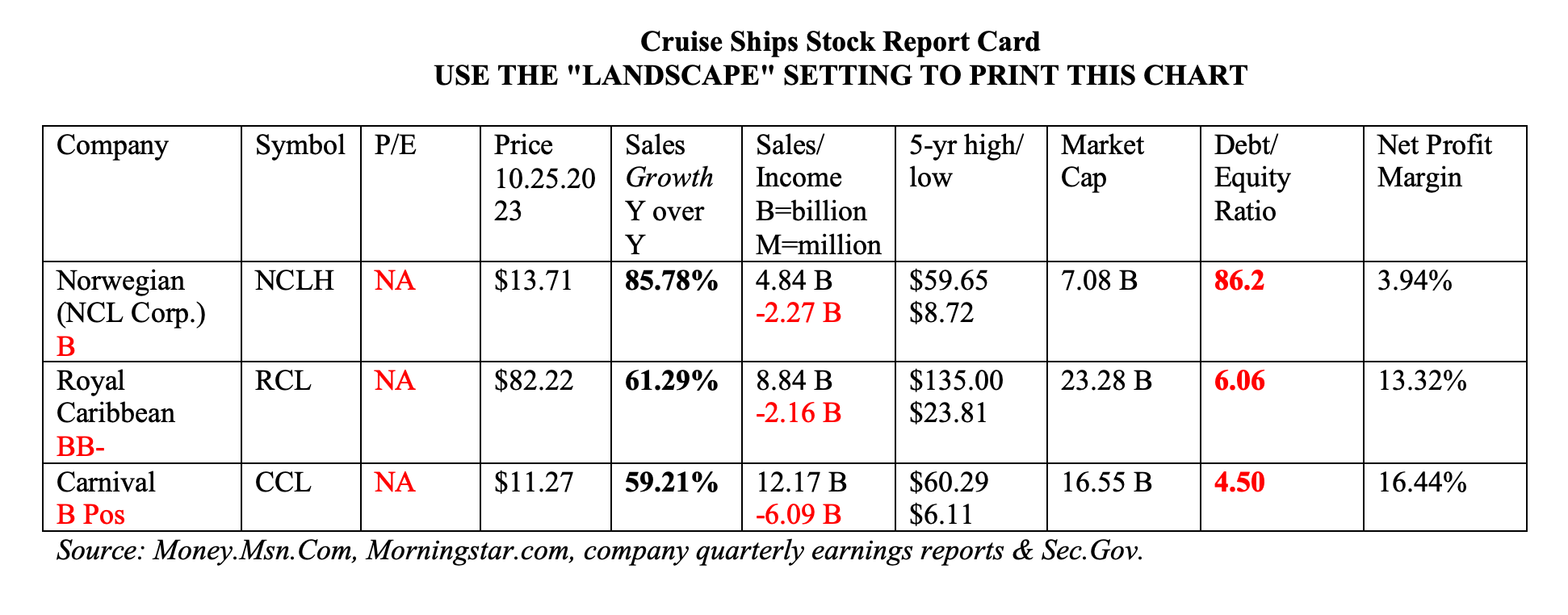

Cruise Ships Reward You for Investing. Is it Worth It? Cruise ships give shareholders spending money. Should you take the bait? Or is it more like those free vacations, where you go home with a timeshare (money pit) that you didn’t know you wanted, and can’t get rid of? Are cruise ships an adventure, a treasure trove, a great investment, CO2 horrors or a huge money pit? Revenue Growth Cruise ships are definitely back in business. According to the Royal Caribbean blog, when cruise ships started up after the pandemic, occupancy rates were sometimes as low as 30%. Today, the Big 3 (Royal Caribbean Group, Norwegian Cruise Line Holdings, and Carnival Corporation) are all at 100% capacity. If we line up the revenue, the business looks downright exciting, with year-over-year revenue growth of 60-86%. 2023 annual revenue should be close to the pre-pandemic highs in 2019. Cruise ships are turning a profit this year for the first time since 2019 – before the pandemic. The companies are buying new ships (to retire old ones), are setting out asea with all of their cabins full, and are reducing debt. The goal for many of the companies is to return to investment grade in their credit rating. However, before we get excited and slide into a pool of the mandatory 100+ shares for an extra $100-$250 of spending money on our next cruise, it’s important to understand some of the significant challenges that cruise ships face. In this blog, we’ll take a closer look at how they survived the pandemic and what rules, regulations and debt are part of the industry’s post-pandemic world. Here are some of the things we’ll cover. Operating in the Red Junk Bonds & High Fuel Costs Natural and Unnatural Disasters Carbon Footprint Stock Volatility And here is more information on each point. Operating in the Red Norwegian and Royal Caribbean both lost over $2 billion in 2022, while Carnival lost over $6 billion. The 2023 revenue growth and full-to-capacity cabins will help the 2023 margins to recover. However, the entire industry is heavily indebted – spending more on interest than on fuel, which is typically the largest line-item. Junk Bonds & High Fuel Costs The Top 3 cruise ship companies all carry junk bond ratings. Interest rates on their debt can run as high as 11.5%. Gasoline costs for Royal Caribbean are expected to be $1.14 billion this year, with interest at $1.27-$1.28 billion. The top three companies have over $60 billion in debt, with Carnival carrying the largest load at $29.5 billion in long-term debt. Oil prices are very high, at $85.35 a barrel. With so much war and economic uncertainty in the world, and with OPEC cutting production, the U.S. Energy Information Administration is forecasting $95/barrel oil prices in 2024. Higher fuel prices could raise fuel costs by 11% in 2024, which amounts to a hundred million dollars or more for each company – if the EIA projections are spot on. This will make it challenging for cruise ships to return to investment grade – particularly if anything causes occupancy rates to fall. The low credit quality, massive leverage and rising fuel costs are likely the culprits that are causing the share prices of Carnival and Norwegian to trade close to their 5-year low. Royal Caribbean has a slightly higher share price on the 5-year range, and also a slightly higher credit rating, at BB- (still junk status). Natural and Unnatural Disasters Cruise ships are a very safe form of travel. However, having every cabin full and people packed in can also be a breeding ground for viruses. The pandemic was one of the worst disasters to hit the cruise ship industry since the sinking of the Titanic, when passengers were marooned and confined to their cabins before the industry was ultimately shut down. However, cruise ships have also made headlines for food poisoning (salmonella and e coli) and violent storms. (Click to see a report of a torrential downpour that flooded hallways and made many passengers very nauseated from May 29, 2023.) There has also been a post-pandemic spike in the Cruise Ship Virus – Norovirus – that causes diarrhea outbreaks, according to the CDC. While everyone is excited at the first profits cruise ships have shown since 2019, could the cause of profits (people packed into every square inch) also come with health risks? We’ve seen an increase in very severe storms in the Caribbean and elsewhere. Will this negatively impact voyages during Hurricane Season, cutting into revenue forecasts? Carbon Footprint Not only is gasoline expensive on a balance sheet, it’s very, very hard on the planet. (Greta Thunberg took a sailing ship when she came to speak at the UN about climate crisis.) Cruise ships use almost half a million gallons of gasoline for a 7-day cruise for 3000 people. While a 747 averages about 91 mpg/passenger, a cruise ship is more like 14 mpg/passenger. Will potential customers be put off by the CO2 footprint? On a cruise ship, a lot of the time is spent on the ship doing things that you might do in Vegas – eating, gambling or playing in a swimming pool. In a lot of ways, it’s just Vegas on water. For many cruises, the port of call stops last only a few hours – meaning you’re limited to tourist destinations near the harbor, rather than immersing yourself in the local culture. Sure, you get to gaze out at sea, if you want to brave the high winds to do that – something most people avoid. Is there an adventure we might take with friends, family and our sacred beloved that is affordable and planet-friendly – one that will become a treasured memory? Are we just jumping onboard the cruise ship because we think it is low-cost? Have we added in all of the mandatory taxes, tips and port fees, and “extras,” like costs for specialty restaurants, alcoholic drinks, excursions, exercise classes and even WIFI? Stock Volatility Cruise ships aren’t the only companies to offer incentives to their shareholders. Berkshire Hathaway has a bazaar at its meetings, where many of the companies owned by BH offer discounts on their products. However, an investment in Berkshire is trading close to its 5-year high, while many of the cruise ship stocks are down -40% (Royal Caribbean) to -75-80% (Norwegian and Carnival). Are we being penny wise and pound foolish in purchasing cruise ship shares for a cash credit on our vacation? Bottom Line While 2023 is a recovery year for cruise ships and the first year of profits since 2019, it’s not all smooth sailing for the companies or their shareholders. The headwinds for the industry include hurricanes, pandemics, foodborne and airborne diseases, massive debt, high fuel costs and an astonishingly high CO2 footprint. Join us at our Jan. 13-15, 2024 New Year, New You Financial Freedom Retreat. Learn nest egg strategies, how to get hot and diversified, and what's safe in a Debt World. You'll even discover how to save thousands annually with smarter big-ticket choices. Yes, it's a complete money makeover. Email [email protected] to register. Learn the 15+ things you'll master and read testimonials in the flyer (link below) and on the home page at NataliePace.com. Register by Halloween (10.31.2023) to receive the best price and a complimentary 50-minute private prosperity coaching session (value $400). Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human capital  Join us for our Online New Year, New You Financial Freedom Retreat. Jan. 13-15, 2024. Email [email protected] or call 310-430-2397 to learn more. Register by Halloween to receive the best price and a complimentary 50-minute private prosperity coaching session (value $400). Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Wynne Pace is an Advocate for SustainabilityFinancial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is were released in 2021. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Bonds. Banks. The Treacherous Landscape of Keeping Our Money Safe. 7 Rules of Investing Air B N Bust? Santa Rally 2023 or Time to Get Defensive? Barbie. Oppenheimer. Strikes. Streaming Wars. Netflix. Monero: A Token of Trust? 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World Summer Sweepstakes 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. Tesla's Model Y is the Bestselling Car in the World. 2023 Company of the Year Sell in May and Go Away? Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. The Debt Ceiling Crisis. What's at Stake? Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Empty Office Buildings & Malls. Frozen Housing Market. The Online Global Earth Gratitude Celebration 7 Green Life Hacks The Debt Ceiling. Will the U.S. Stop Paying Bills in June? Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed