|

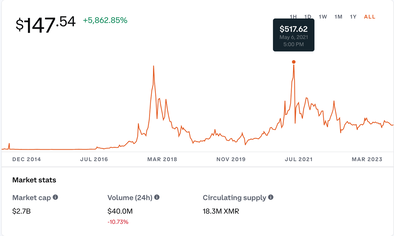

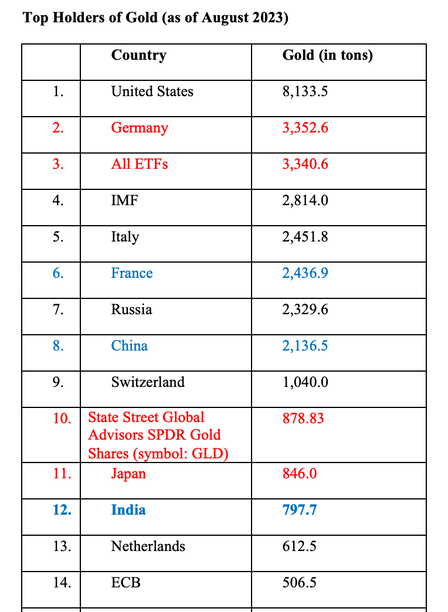

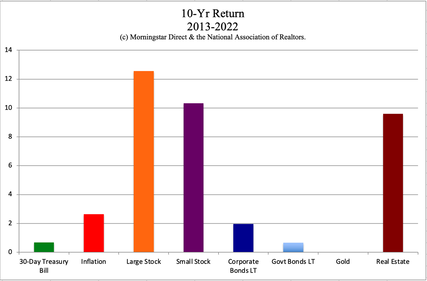

Monero: A Token of Trust? Money is a promise. Think of it as a token of trust. (It’s also a magic token of gratitude. For more on that, be sure to read The Gratitude Game.) When that promise is made by someone you don’t know, you’re vulnerable (the notoriously opaque Bernie Madoff). When that promise is made by someone who hasn’t been around very long, you’re unprotected (FTX and Sam Bankman-Fried). When that promise is made by someone who doesn’t have the means to keep the promise, you’re in trouble. Examples include a “loan” made to an out-of-work friend or family member, or a heavily indebted company that is at risk of restructuring their bonds, loans, pensions, annuities and other paper promises, such as has happened in the airlines and auto industries, but could also happen to uninsured bank depositors or with insurance company products, such as annuities and life insurance policies. With all of the risk and alarming headlines associated with “safe” products, including the banks that failed earlier this year, it’s easy to see the attraction of panacea promises. So, is crypto the cure? Should you “bank” with Monero, Bitcoin or another cryptocurrency, instead of at your low-rated local community bank or the corrupt kingmaker corporations? Let’s dive deeply into an examination of the pluses and minuses of crypto, cash and paper promises to determine the best way to keep our wealth and future safe. Below are the areas we’ll cover. Fiat Currency and Demagoguery Monero’s Team Crypto: Trading vs. Currency Protecting Our Principal Our Debt World Current Reserve Currencies & BRICS Interest Cash Cures And here is more information on each point. Fiat Currency and Demagoguery Populists and good marketers use words that stoke emotions. Once someone is on fire, it’s easier to lead them wherever you want them to go. You’ve heard the term “blind with rage.” Anger is fierce and reactionary. So, if the person on stage hammers home words that stoke fear and disgust again and again into our psyche, they can then drive our fury into the sale of their desire. In an email sent over by one of our tribe that was promoting Monero, the marketer mentioned the word “privacy” over and over again, and preached of a government plot to steal our liberty and economic freedom. There was no mention of the people behind Monero (whether they are saints, sinners or scam artists), or why anyone should trust that this relatively new crypto (less than ten years old) would protect our wealth better than banking (although, admittedly, there was a lot of ink given to the anonymous features of the coin, which appear to be true). Again, the foundation of currency is the trust that it will be protected from losses and at hand when we need to pay for something. This is something that we should be as sure as possible of. Rather than assurances (government-insured) or transparency (who is behind the operation), which was missing from the email and also from the Monero home page, the email had all of the markings of a carefully crafted paid-to-promote sales pitch. Celebrities, including Kim Kardashian, Tom Brady, Gisele, Matt Damon, and other “influencers,” have been compensated to talk up various cryptocurrencies over the past few years. In the worst case scenario, they were promoting pump-and-dump schemes or fraud. (Kim K. paid $1.26 million to settle charges by the SEC on Oct. 3, 2022.) Lesser-known influencers with fewer resources to do any due diligence rarely vet the people who are paying them to promote something. Sometimes the promoter is a serial pump-and-dump scam artist. If they get caught, they get slapped on the wrist by the SEC or another regulatory agency with a fine that is a small amount of the profits. Soon they’re back in business, with almost no downtime, sometimes under a new name or with a fresh-faced spokesperson or influencer. Monero’s Team Monero’s market cap is under $3 billion. That makes it a small company. As we teach at our Financial Empowerment Retreats, small caps are high risk investments. Risk is not a word you want to have associated with our cash. We take on risk in investments for the opportunity to earn gains and potentially a yield. In addition to being small, Monero is new – only nine years old. By comparison, Bitcoin is worth half a trillion dollars, and has gone as high as $1 trillion. Bitcoin was launched in January of 2009. All of the above concerns take Monero out of the cash column and land it squarely on the high-risk investment side of our nest egg. However, before you run off with that bet, consider that another red flag for Monero is its team. If you go to Monero’s website, you won’t find anything about the team behind the currency. However, if you do a search on the founder, you’ll quickly learn that Monero’s founder, Riccardo Spagni, was arrested for fraud and forgery in August of 2021. He has pleaded not guilty. The trial is pending. Most of the development team (aside from Spagni) choose to remain anonymous (another mark against transparency and trust). Although Monero promises privacy, there are accusations of data leaks to Interpol. And, whether you believe the reports or not, it makes sense that the only people using Monero as a currency are using it for illicit purposes. You can’t have a currency that is worth $10 one day and just $2 the next. Crypto Trading vs. Currency Another problem of relying upon cryptocurrency to replace cash is the volatility of the valuation. It’s called cryptocurrency, but it’s a better idea to think of it as crypto trading. The typical holding time for Bitcoin, the most widely held crypto coin, is 98 days – less than four months. Ethereum’s typical hold time is 51 days – less than two months. At $147.54, Monero has lost 72% from the high of $517.62/coin set on May 6, 2021. Imagine the worldwide roar and upheaval that would occur if the euro or dollar dropped by that much! The only people using cryptocurrency as a currency these days are people who are less concerned about the outlandish swings in valuation than they are with laundering their money, or with buying and selling on the black market anonymously. No business accepts crypto as payment right now, not even Tesla, a company that allowed customers to pay with Bitcoin for a couple of months in 2021. Also, think about it for a minute. The platform that promises to protect your secret identity, which might have the technological ability to do that, also surely has enough information not to do that. The founder entrusted with your faith is on trial for fraud and forgery. And the coin that you’re supposed to use instead of cash might be worth a couple of dimes instead of a full dollar, depending upon when you make your deposit and when you need to buy something. The marketing email that was sent out mentioned privacy and liberty multiple times, without once letting on about fraud, forgery, Interpol or devaluation. Protecting Our Principal The whole point of currency is that you aren’t putting your principal at risk – that you won’t lose your money. As I mentioned above, cryptocurrency is still being used for the most part as a trading platform; people (and whales) are investing in the hopes of getting rich. You don’t buy dollars or euros hoping that it’s going to soar and make you a zillionaire. And if you are trading FOREX, then you’re again investing, not saving. We always want an appropriate amount invested and an appropriate amount safe that has a low risk of losing value. As we get closer to retirement, it becomes more important to protect our wealth. Our Debt World The International Monetary Fund recently disclosed that there is $235 trillion in global debt versus only $12 trillion in foreign exchange reserves. This is unprecedented. U.S. and Swiss banks failed in the first quarter of 2023. There is a lot to be concerned about. Getting your cash and paper promises safe is so tricky that we spend a full day on it at our Financial Freedom Retreat. There are definitely some sound strategies to employ to reduce risk, keep the money in the family, stop making the billionaire corporations rich at our own expense and even save thousands annually. If we have a carefully crafted plan, we can also have an evergreen flow of income that is better diversified and protected than just stocking cash in federally-insured accounts or under the mattress. So, there is no substitute for learning what works and what doesn’t rather than having blind faith that someone else (usually a broker/salesman) is protecting us. Current Reserve Currencies & BRICS There is a new BRICS currency that was recently launched by Brazil, Russia, India, China and South Africa. It’s real. However, it’s in very early stages. None of the countries associated with the currency have built up the kind of international trust that a money token really needs to have before it is widely adopted. Yes, China, Russia and India have been increasing their gold reserves. However, as you can see in the chart below, their combined value is still much lower than the holdings in the Western world. The US has never defaulted on its debts (although the country did get a credit downgrade from Fitch Ratings to AA+ on August 1, 2023). Interest Short term U.S. treasury bills are paying 5.5% at this time. Gold, silver, and cryptocurrency do not pay interest (with the added problem of the price volatility and the possibility that you might lose your principal). Gold has been a very poor performer over the 10-year period, while silver is still worth less than half of its high of $48.70, set on April 28, 2011. Because many corporations have very low credit ratings, and there are a lot of zombie corporations, getting a safe interest rate on something that doesn’t put your principal at risk is quite tricky. That’s why we spend one full day on what safe at our financial empowerment retreat, and why I encourage everybody to have a full review of their wealth plan, including what they think are safe assets, now. Cash Cures There is no one cure for keeping our cash safe. However, there are definitely some sound strategies that will do a better job than anything you’ll receive in your email or even from your financial planner (who can only really sell you certain “safe” products that their company offers). You can learn what’s safe in a Debt World at our Financial Freedom Retreat or by getting a 2nd opinion or private coaching from me personally. Email [email protected] for pricing and information. If you are intrigued by cryptocurrency, the risk, volatility and fact that it is a trading platform and not a currency make it an investment, not a cash cure. If you are interested in a savings account or a certificate of deposit, it’s important to read the fine print, and to observe the federally insured limits. If you are being lured into an annuity, be sure to know the creditworthiness of the insurance company that is guaranteeing it because there is no backstop if the company fails. (Don’t take the bait that the company has been around for a century; AIG wouldn’t be in business, if the U.S. hadn’t bailed the company out, and we’re not supposed to do that next time.) If you have a pension, same thing. A heavily indebted company can restructure their debt, which means giving most people they owe money to a haircut on the promise. We have to pay our bills. So, we have to have cash, and we have to have cash flow. One of the ways that we address this issue in today’s Debt World is by offering solutions that reduce our bills and the amount of money that we have flying out the window each month. Don’t underestimate the power of keeping your money by not writing checks that you don’t have to write. There’s more low-hanging fruit than most of us realize in this regard. Basically we want to stop making billionaires rich, and keep thousands of that money annually, which we can then use for things we like a lot more than bills. Bottom Line Which would you rather will your children and ancestors, a home they can live in, a digital wallet that they might have trouble accessing, or a promise made by a bankrupt company? If they inherit an energy-efficient home and save thousands annually that would have made the utility company rich, imagine how much better off they’ll be in life. And if the money in the family is much more than the needs of your children and grandchildren, then think about income-producing hard assets that you purchase for a good price (housing is one). Having too much in any one thing in today’s world can be risky. Being property rich and cash poor can put your property at risk. Buying high in real estate can be one of the worst nightmares you’ll ever experience, particularly if you’ve leveraged it. Bonds lost more than stocks did last year with losses of -26%. (We saw this coming a decade ago and have been warning that we’re not getting paid to take on the risk.) Again, none of this is rocket science (because our team does the hard work behind the scenes to make it easy for our clients). Our time-proven, 21st-century track record works because it is properly diversified and rebalanced regularly. In a Debt World with so many money pits, it is essential that we are the boss of our money, that we know what we own, that we’ve allocated it accurately, and that we rebalance regularly to capture gains and keep the appropriate amount safe and diversified. The concerns are real. The solutions are actually easy as a pie chart, once you learn them. The emails that promise to protect our liberty and privacy are paid-to-promote at best and a pump-and-dump at worst, not a panacea. It's time to learn the life math that we all should have received in high school. Join us at our Oct. 7-9, 2023 Financial Freedom Retreat. Learn nest egg strategies, how to get hot and diversified and what's safe in a Debt World. You'll even discover how to save thousands annually with smarter big-ticket choices. Yes, it's a complete money makeover. Email [email protected] to register. Learn the 15+ things you'll master and read testimonials in the flyer (link below) and on the home page at NataliePace.com.  Join us for our Online Financial Freedom Retreat. Oct. 7-9, 2023. Email [email protected] or call 310-430-2397 to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Wynne Pace is an Advocate for Sustainability Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is were released in 2021. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World Summer Sweepstakes 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. Tesla's Model Y is the Bestselling Car in the World. 2023 Company of the Year Sell in May and Go Away? Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. The Debt Ceiling Crisis. What's at Stake? Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Empty Office Buildings & Malls. Frozen Housing Market. The Online Global Earth Gratitude Celebration 7 Green Life Hacks The Debt Ceiling. Will the U.S. Stop Paying Bills in June? Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed