|

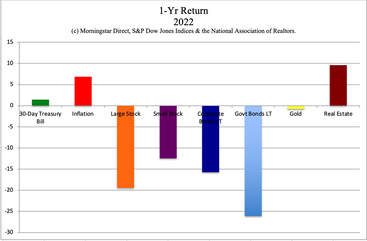

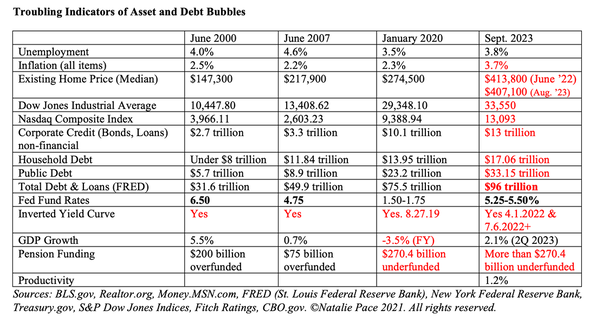

Santa Rally or Time to Get Defensive? Can the economy hold up with Brent oil prices at $95/barrel? The S&P500® is up 11.8% on the year – making back some of the -19.33% losses of 2022. However, the market trend over the past two months has been negative, with stocks shedding -6.9%. Long-term bonds lost even more than stocks last year, with -26% returns, and continue to be problematic with elevated credit and duration risk. Will there be a Santa Rally, or will the stock slide continue? How do we protect our wealth when bonds can lose principal and be illiquid? Learn why Apple’s choices may be the determining factor in the Santa Rally, and why getting a decent yield on the safe side of our wealth plan without the risk is so tricky. In this blog we’ll cover: · Pros and cons of a more defensive plan · Why we must know what we own even it is professionally managed We’ll also outline time-proven 21st Century strategies that: · Earned gains in the Dot Com and Great Recessions (when most people lost more than half of their wealth), · Are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, · Steer clear of toxic bond losses, and, · Make buying low and selling high as easy as a pie chart Here is additional information on each point. Pros and Cons of Adopting a More Defensive Plan Cons: There is almost no downside in acting our age in our wealth plan. A lot of people think an aggressive pedal-to-the-medal approach is going to earn more gains. However, that can result in a very volatile ride on the Wall Street Rollercoaster – one that can jack our emotions around to the point that we do the opposite of what we’re supposed to do. We get disgusted with losses and sell low. Our exuberance and hope that stocks will shoot the moon entices us to buy high. On the other hand, a well-diversified plan can include hot industries that increase performance, while a regular rebalancing plan prompts us to capture gains high and buy low. We can even get a reasonable interest rate these days, though navigating the credit and duration risk is tricky. A time-proven, 21st Century system based on Modern Portfolio Theory takes emotions out of the picture. This easy strategy earned gains in the Dot Com and Great Recessions, when most people lost more than half of their wealth, and outperformed the bull markets in between. Pros to a Defensive, Diversified Plan: When we: · Keep a percent equal to our age safe, · Understand what is safe in a Debt World, · Are properly diversified, · Rebalance regularly to remain properly diversified, and, · Consider overweighting safer when there are economic storms on the horizon, We can keep earning gains, even in recessions. Wealth is like health. Eating right and exercising goes a long way to keep our bodies healthy. Smart fiscal habits create a rich life. How Did Nilo Earn Gains in the Great Recession? Overweighting safe when we are concerned about the economy or the stock market heading south means that we could actually earn gains (like Nilo), when most people lose half or more of their wealth. In December 2007, I sent out an email to our subscribers warning that the coming recession was looking to be very stark. We suggested overweighting an additional 20% safe. A 60-year-old overweighting 20% safe, would only have 20% at risk in equities. If stocks lose half, that plan loses 10% on the at-risk side, and earned 8% or more on the bond side. As importantly, there was enough cash on hand to buy stocks low. This is one of the most important benefits of keeping enough safe. Most people don’t buy low because they can’t. They are out of cash. They have to hope and pray that their plan crawls back to even – something that took almost seven years in the Great Recession, and 15 plodding years in the Dot Com Recession. Life without cash is dire, and our FICO score hits rock bottom to boot. We Must Know What We Own Getting a defensive plan isn’t as easy as asking for one. One of my coaching clients sent over her holdings for a 2nd opinion. Even though she had told her financial advisor that she had very little risk tolerance, she was actually invested as if she were a teenager with most of her assets (87%) in stocks. This plan would have lost -61% in the Great Recession. As we get closer to retirement, we can’t afford to lose half or more of our wealth and then hope and pray for years to earn back losses. So, rather than having blind faith that someone else has set up a defensive plan for us, it’s important to know exactly what we own and understand the risk levels that we are exposed to, and what a truly, safe, diversified and defensive plan looks like. (I offer an unbiased 2nd opinion through our private coaching program. Email [email protected] for pricing and information.) Learn Time-Proven 21st Century Strategies Buy and Hold has become a popular mantra again, largely because we have been in a secular bull market since the bottom of the Great Recession (March 2009). However, it’s important to never confuse a bull market with wisdom. In the pandemic, the Dow Jones Industrial Average plunged -35% in just five weeks (between Feb. 19 and March 23, 2020) before the first restrictions were announced – before Main Street knew what was going on. (The big money always moves first.) Of course, the U.S. Treasury Department and Federal Reserve, along with reserve banks around the world, printed up a lot of cash/debt to keep the world from falling into a Great Depression during the pandemic. That is not going to happen the next time around. In fact, the U.S. Congress is currently at risk of a government shutdown on October 1, 2023, and the Federal Reserve Board is continuing to tighten monetary policy, with another potential rate hike in November or December. There is a very hot debate with policymakers on how to reduce the debt, balance our budgets better and get on a path to better fiscal husbandry. The debt, combined with political chaos, has caused two rating agencies to strip the U.S. of our AAA rating (Fitch Ratings on August 1, 2023 and S&P Global on August 5, 2011). The Santa Rally Typically, the last quarter of each year is positive on Wall Street. However, December 2018 was the worst performance of that month (-9.2%) since the Great Depression. What happened? Apple: Lessons from 2018. Recently, Apple made headlines when the Chinese government restricted the use of iPhones in their government agencies. Since 19% of Apple’s revenue comes from Greater China, this is putting the company at risk of a revenue decline greater than the -1.4% percent they saw in the most recent quarter’s earnings. This is an issue because the stock market is heavily reliant on Apple’s share repurchases. The cold shower investors took in December 2018 had a lot to do with Apple curtailing their buybacks without any warning. In 2018, Huawei became the #2 smart phone maker (by units) behind Samsung and ahead of Apple. As a result of Huawei’s popularity in Asia, Europe and most countries around the world (outside of North America), Apple’s Christmas quarter in 2018 saw revenue decline by 5%. Will Huawei’s resurgence dip into Apple sales and profits this Christmas, too? (Learn more in my Apple blog; click to access.) However, Apple’s woes in China are not the only risk factors that could put coal in investors’ stockings this Christmas. The risks to the economy include the following: · $95/Barrel Oil · FOMC Rate Hike (Nov. or Dec.) · Student Loan Payments Start Up Again on October 1, 2023 · There is a risk of a Government Shutdown in the U.S. effective October 1, 2023 · Inverted Yield Curve (100% correlated with recessions) · Union Strikes – SAG-AFTRA, UAW, hotel workers are all on strike · Recent credit Downgrades of the USA & Banks, with 3 high-profile bank failures · Bonds: Duration and Credit Risk · Empty Office Buildings and Malls, with High Borrowing Costs · BRICS Currency and Alliance · When the U.S. Sneezes, the World Catches a Cold The current predictions of 2.1% GDP growth in 2023 weren’t banking on $95/barrel oil or a government shutdown. High oil prices are highly correlated with recessions. Again, rather than trying to market time or Buy & Hold, proper diversification and strategic rebalancing will keep us safe, hot, protected and diversified. Of course, we must also know how to navigate a world where bonds are losing more than stocks. Long-Term Debt Risks Credit risk and duration risk remain a problem in bonds and dividend-yielding stocks. Over half of the S&P500® is at or near junk bond status. The traditional ways of getting safe, including bonds, money market funds, CDs, or annuities, are not as risk-free as we might be hoping. That is why we spend one full day on What’s Safe at our Financial Empowerment Retreat. Getting safe is tricky, but doable. There are a number of steps that we can take to protect our wealth on the safe side of our liquid portfolio, which is not supposed to lose principle. NASDAQ Stocks Took 15 Years to Recover As we get closer to retirement, we just can’t afford to lose half or more of our wealth. $1 million caved into $450,000 (-55%) in the Great Recession, and sank to a low of $220,000 (-78%) in NASDAQ stocks during the Dot Com Recession. It took almost 7 years for the Dow Jones Industrial Average to crawl back to even in the Great Recession. It took 15 years for NASDAQ stocks to recover back to their highs set in March of 2000. Again, having a diversified plan that we rebalance once, twice or three times a year means that we are able to capture gains in the bull market, while also protecting ourselves from the losses of the bear market. Bottom Line Losing half or more of our wealth makes it hard to make ends meet, plunges our FICO score, and might even make us vulnerable to losing our lifestyle and home. The economic horizon remains too murky, with too many risks, to see clear skies and smooth sailing into the Santa Rally. Fortunately, rather than gambling on an uncertain tomorrow, we can embrace a recession-proof, economic-storm-resistant wealth plan today. It’s important to fix the roof while the sun is still shining. When we wait for the headlines, it’s too late. "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human capital When someone says, “let me do it for you,” prepared to be oppressed. When someone says, “let me teach you how,” prepare to fly. Join us at our Oct. 7-9, 2023 Financial Freedom Retreat. Learn nest egg strategies, how to get hot and diversified and what's safe in a Debt World. You'll even discover how to save thousands annually with smarter big-ticket choices. Yes, it's a complete money makeover. Email [email protected] to register. Learn the 15+ things you'll master and read testimonials in the flyer (link below) and on the home page at NataliePace.com.  Join us for our Online Financial Freedom Retreat. Oct. 7-9, 2023. Email [email protected] or call 310-430-2397 to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Wynne Pace is an Advocate for Sustainability Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is were released in 2021. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Barbie. Oppenheimer. Strikes. Streaming Wars. Netflix. Monero: A Token of Trust? 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World Summer Sweepstakes 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. Tesla's Model Y is the Bestselling Car in the World. 2023 Company of the Year Sell in May and Go Away? Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. The Debt Ceiling Crisis. What's at Stake? Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Empty Office Buildings & Malls. Frozen Housing Market. The Online Global Earth Gratitude Celebration 7 Green Life Hacks The Debt Ceiling. Will the U.S. Stop Paying Bills in June? Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed