|

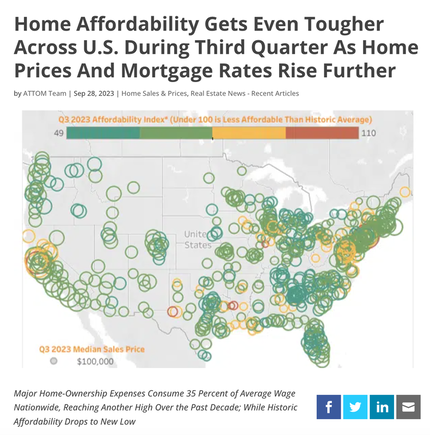

Housing is Unaffordable. Here Are Some Solutions and Warnings. The housing market is virtually frozen. Airbnb hosts are experiencing longer periods of unoccupancy. More apartment buildings have been constructed. However, many sit empty because the owners are unwilling to lower their prices. Meanwhile, report after report comes out stating that housing is virtually unaffordable. “The dynamics influencing the U.S. housing market appear to continuously work against everyday Americans, potentially to the point where they could start to have a significant impact on home prices,” said Rob Barber, CEO for ATTOM. “We clearly aren’t there yet, as the market keeps going up… But with basic homeownership now soaking up more than a third of average pay, the stage is set for some potential buyers to be priced out, which would reduce demand and the upward pressure on prices. We will see how this shakes out as the peak 2023 buying season winds down.” High prices, and the need to charge high rents, puts homeowners, commercial real estate, homebuyers and renters all in an untenable position. If you are a homeowner who is in distress, then private coaching might be very helpful. (Email [email protected] for pricing and information.) At minimum, read the Real Estate section of The ABCs of Money, 5th edition. This blog offers solutions for anyone who finds themselves in a position of paying 30% or more of their income on housing. Drowning in basic needs means we cannot invest in our own future. When we put essentials like food and clothing on credit cards that is a disaster waiting to happen. The only solution is to make brave choices about the big-ticket bills as quickly as possible, in order to get ahead in a world that simply doesn’t add up at this time. Here are the 4 Tips and 3 Warnings we’ll discuss in this blog. Think Bigger Keep the Money in the Family Partner Up The 4 D’s Warnings Are You Buying High? Know Your Neighborhood Do Your Own Math And here’s more information on each point Think Bigger Singles and one-bedrooms are far more expensive than two, three or four-bedroom lodging that you might split with a few friends. If a one bedroom (in a more affordable city) costs $1200 and a two bedroom costs $1400, the saving amounts to about $500 a month which is $6000 a year. Of course, in big cities rents are a lot more expensive than that. However, the savings of thinking bigger tend to be substantial there, as well. If you are a homeowner who is spending 30% or more on your home costs, then is there a way to start earning some income? Can you put in an ADU* and have your aging parents stay there, with everyone contributing to the housing costs? (Why not have them pay you instead of making the landlord rich?) If your parents aren’t the right answer, could you provide lodging for a traveling nurse or Ph.D. student? *additional dwelling unit Keep the Money in the Family We all think about family money when someone passes, and the will of the estate is being parceled out. However, how much more money would we have if we all thought about keeping the money in the family? (This is the way that very wealthy people think.) Yes, this could mean living with your parents as an adult. The Prince of Wales has inherited a lot of land and money. However, for most of his life, he lived in apartments in his Grandmother’s castles and estates. His salary as an air ambulance helicopter pilot wouldn’t have paid for all of his expenses. I know one mother who is close to retirement, who gave her kids the big house and remodeled an ADU in the back for her mother-in-law unit. Family solutions are happening all across the United States. According to a Harris Poll for Bloomberg, about 45% of young adults between the ages of 18 and 29 now live with their parents. For many of them that is a savings of $10,000 or more annually that they would be giving to a landlord. Partner Up Another way of saving money on housing is to partner up. As a young single mother, I moved in with another single mother. I experienced savings of about 30% on rent, thousands of dollars on child care that I didn’t have to spend, and cut my food bill in half because we would switch off weeks that we cooked. There is a pretty funny Neil Simon play and vintage TV show, The Odd Couple, about two divorced dads who move in together to save money. What kind of community will serve you best? The 4 D’s While the housing market is currently frozen, the 4 D’s can be relied upon to dislodge the stalemate. What are the 4 D’s? Death, divorce, depression (recession) and disaster. Sadly, in today’s world, we can count on one of these tragedies occurring. Things become a grave hardship when two or more happen at the same time. Currently, everyone is still hoping that the Federal Reserve Board will achieve a soft landing and start cutting interest rates. What is missing from that rationale is that the Feds don’t cut interest rates until economic conditions have become strident. Cutting interest rates is the medicine administered when unemployment skyrockets, equity prices plunge, foreclosures abound, and corporate bankruptcies escalate. While 0% interest rates have been the norm since the Great Recession, they encourage speculation and discourage savings, which has exacerbated the pickle we’re in today. Those homeowners who wanted to get rich quick or land a treasure trove as an Airbnb host are now hanging on for dear life. Warnings Are You Buying High? Are you tempted to buy now? Are you aware that you’re buying at an all-time high? Are you being seduced into that situation with the bait that you could buy something for less than you’re renting, or with the promise of capital gains or rental income? Did you know that that simple math is excluding a great deal of homeownership expenses and could add up to hard life lessons and expensive losses? Buying high is rarely a good idea, and can destroy your financial life for a decade if home prices fall severely below your mortgage. The reason few people buy low is because they can’t. They have all their money tied up in investments that have lost too much value. There is no liquidity remaining. Matters are made worse because our FICO score plunges as well. In recessions, most people spend years of the recovery hoping and praying that they crawl back to even. Know Your Neighborhood It’s tempting to run off to the suburbs, or some smaller city where prices might be more affordable, particularly if we believe that we can work from home. However, have we factored in the extra expense and time of our commute? Do we really know what the benefits and challenges are of the neighborhood or city that we are moving into? Are there downsides that tourists are simply not aware of? Are these our people? Will you and your neighbors bicker or support one another. There are seven tips for considering where your ideal home should be in the Real Estate section of The ABCs of Money, 5th edition. Do Your Own Math The first time that we buy a house, we are often looking at the price, and then focusing on whatever numbers the real estate broker salesman provides us with. The fine print might include the closing fees and property taxes, but rarely spells out the actual cost of remodeling, the maintenance on the home, and many other expenses that renters rarely experience. While prices are currently at all-time highs is in the United States and many other developed world countries, the real estate broker/salesman will be steering our gaze towards the gains that have been made over the past decade, without warning that in recessions, prices plunge. It is very important to know where the value of your home sits on the Buy Low, Sell High continuum over the past decade. That is far more important than how many gains have been made by sophisticated investors who purchased when the price was much lower. Bottom Line New studies are showing that almost half of people under the age of 30 are living with their parents. While previously this would’ve come with a derisive comment about slackers, it is now being acknowledged as a way to keep the money in the family instead of making the landlord rich. Millennials who are ready to start a family might be sick of this situation and rightfully so. However, the solution is not going to be buying high and trying to ride through the downturn. Losing that much money, and being underwater on a large mortgage, can be very hard on a marriage and is definitely terrible for our FICO score. A little patience in planning to allow the frozen market to thaw could yield smooth sailing ahead. You can learn about more solutions in the Thrive Budget and Real Estate sections of The ABCs of Money, 5th edition. There are lots of ways that we can save thousands of dollars annually with smarter big ticket choices. Few of us are shopaholics who eat avocado toast at restaurants every night (the budget solutions outlined by so many financial authors). Wisdom is the cure. Let’s stop making everybody else rich and keep the money in the family.  Join us for our Online New Year, New You Financial Freedom Retreat. Jan. 13-15, 2024. Email [email protected] or call 310-430-2397 to learn more. Register by Nov. 30, 2023 to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Wynne Pace is an Advocate for SustainabilityFinancial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is were released in 2021. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest The Magnificent 7 Drag NASDAQ into Another Correction Cruise Ships Give Freebies to Investors. Should You Take the Bait? Should You Take a Cruise? Bonds. Banks. The Treacherous Landscape of Keeping Our Money Safe. 7 Rules of Investing Air B N Bust? Santa Rally 2023 or Time to Get Defensive? Barbie. Oppenheimer. Strikes. Streaming Wars. Netflix. Monero: A Token of Trust? 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World Summer Sweepstakes 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. Tesla's Model Y is the Bestselling Car in the World. 2023 Company of the Year Sell in May and Go Away? Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. The Debt Ceiling Crisis. What's at Stake? Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Empty Office Buildings & Malls. Frozen Housing Market. The Online Global Earth Gratitude Celebration 7 Green Life Hacks The Debt Ceiling. Will the U.S. Stop Paying Bills in June? Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed