The Underperforming Dow Jones Industrial Average. Full of Fossil Fuels and Forever Chemicals.21/12/2023

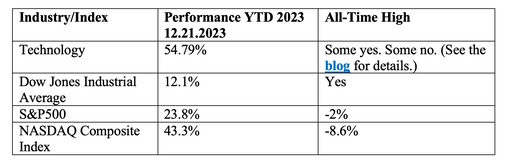

The Underperforming Dow Jones Industrial Average. Full of Fossil Fuels and Forever Chemicals. In last week’s blog, we talked about the Magnificent 7 being largely responsible for the gains in 2023 – yes, just 7 stocks. The technology-rich NASDAQ Composite Index was far and away the winner on Wall Street this year. Meanwhile, energy, consumer staples, healthcare and utilities are all down. The Dow Jones Industrial Average was the laggard of the 2023 pre-election year rally. This has a lot to do with the older companies in the index that are laden with legacy debt and having to borrow money at a high interest rate, all while experiencing a slowdown in revenue growth. (Email [email protected] if you’d like to receive a Stock Report Card of select Dow components.) However, there is another issue with the “leading blue chip” index. It has a lot of old-school companies that are in the business of fossil fuels, either as a producer or as a top customer – something the world agreed to transition away from at COP28. Fossil Fuels in the DJIA Email [email protected], if you’d like to receive our chart of the 30 companies of the Dow Jones Industrial Average, along with some points about their respective fossil fuel dependency. A lot of the technology companies of the DJIA (Apple, Cisco, IBM, Intel, Microsoft and Salesforce) have goals of powering with renewables 70-100% by 2025. However, 13 of the 30 companies, 43.3%, are leading producers or customers of oil, gas, plastic and other petrochemical products. Here are a few examples…

Dow Inc., 3M, Chevron, Nike, Honeywell, Johnson & Johnson, Procter & Gamble, Verizon, and Walgreens are some of the 30 companies of the Dow Jones Industrial Average that are losing value and dragging down the performance of the index. The spectacular performance of Microsoft, Apple, Intel, IBM and Salesforce is responsible for the gains. Oil/Gas & Chemicals Stock Report Card All of the oil and chemical companies I analyzed have lower revenues this year. Most of the chemical companies have elevated levels of debt. Due to the toxic nature of their products, and the deleterious effects they have on water and soil, many chemical companies face ongoing fines and lawsuits. Email [email protected] if you’d like to receive a Stock Report Card of chemical or oil/gas companies. Palestine, Ohio Toxic Train Derailment The toxic oil-based petrochemicals that were spewed across the air, soil and water of Palestine, Ohio on February 3, 2023, included the following. If you look at what the toxins are used to make, you’ll notice that they touch almost every aspect of our lives, from what our things are packaged in, to what we wear and even our laundry detergent. 3M and Dow Inc. (both in the DJIA) are leading manufacturers of these petrochemicals.

ESG Investing is Missing the E As I mentioned in my blog, ESG investing is missing the E: environment. There are no companies that are involved in renewable energy or other planet-healthy products or services in the S&P Global ESG Index. At least 15 of the companies in the index are oil and gas related. Just 20 of the world’s largest fossil fuel companies are responsible for over 1/3 of the CO2 in the atmosphere – and many are included in the ESG Index. Click to read the blog. Our Retirement Accounts Because the DJIA is widely touted when we think of Wall Street, most of us have DJIA companies in our retirement plans and even our managed brokerage accounts – unless we’ve done a forensic dive to know exactly what we own and why. Many broker-salesmen will put us into ESG funds if we say we want to be more conscious about what we invest in. Getting our portfolio more in line with gains and green requires a little education and some remodeling of our financial house. Fortunately, this is as easy as a pie chart, once we learn the life math that we all should have received in high school and college. It’s our money, and making sure that we keep it is our job – even if we have someone else “managing it.” Bottom Line Whether you are pro-gains or pro-planet, the Dow Jones Industrial Average Index was a problem in 2023. The debt and core business models of many of the companies in the index could continue to be a challenge on profitability and revenue growth in the years to come. These are a few of the reasons why we have been underweighting the DJIA and using value replacement funds in our sample pie charts. (These are just a few of the things you’ll learn at our Financial Freedom Retreat.) For daily money tips, follow me at @nataliewynnepace on my Instagram Broadcast Channel. Join us at our Jan. 13-15, 2024 New Year, New You Financial Freedom Retreat. Get valuable data and tools on how to best invest and monetize real estate. Learn nest egg strategies, how to get hot and diversified (including in EVs, crypto and AI), and what's safe in a Debt World. You'll even discover how to save thousands annually with smarter big-ticket choices. Yes, it's a complete money makeover. Email [email protected] to register. Learn the 15+ things you'll master and read testimonials in the flyer (link below) and on the home page at NataliePace.com. Register with friends and family to receive the best price. "Ten minutes into the first day I was already much smarter about investing than I ever thought I would be in my life and I knew I was in exactly the right place at this retreat. I am amazed at how EASY and FUN it is to make my money work for me and those I love. I think this kind of information should be compulsory in schools. I wish I'd learned this sooner." CM  Join us for our Online New Year, New You Financial Freedom Retreat. Jan. 13-15, 2024. Email [email protected] or call 310-430-2397 to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is were released in 2021. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Substack on Apple and Spotify. Watch videoconferences and webinars on Youtube. Other Blogs of Interest A Spectacular Year for 3 of the Magnificent 7. The Best ROI* (Almost 40%!) & 7 Life Hacks That Save Thousands. Portugal Eliminates Tax Advantages for Ex-Pats. Holiday Gift Giving on any Budget. Including No Budget. Once in a Century Events are Happening Every Day. The Crypto Winter Enters Its 3rd Year. Earn $50,000 or More in Interest. Safely. Finally. Freebies and Deals for Black Friday and Cyber Monday. Auto Strikes End. EV Price Wars Continue. WeWork's Bankruptcy. Half-Empty Office Buildings. Problems in our Personal Wealth Plan. Solutions for Unaffordable Housing. The Magnificent 7 Drag NASDAQ into Another Correction Cruise Ships Give Freebies to Investors. Should You Take the Bait? Should You Take a Cruise? Bonds. Banks. The Treacherous Landscape of Keeping Our Money Safe. 7 Rules of Investing Air B N Bust? Santa Rally 2023 or Time to Get Defensive? Barbie. Oppenheimer. Strikes. Streaming Wars. Netflix. Monero: A Token of Trust? 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. 2023 Company of the Year Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? The Online Global Earth Gratitude Celebration 7 Green Life Hacks Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. Which Countries Offer the Highest Yield for the Lowest Risk? Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Why We Are Underweighting Banks and the Financial Industry. 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed