|

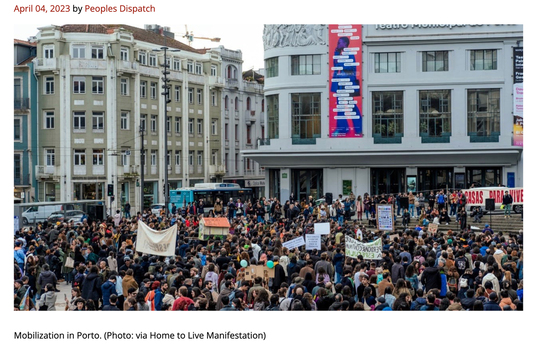

Portugal Eliminates the Tax Advantages for Ex-Pats We all know someone who has purchased a place in Portugal. The Portuguese government was keen to attract foreign investment and reduce its deficit and debt, after enduring hardship, austerity and near bankruptcy in the wake of the Great Recession. (Portugal was one of the infamous PIGS countries during the Financial Crisis of 2008, and still has a Debt to GDP of 119%.) As part of its economic recovery plan, foreigners could get a golden VISA by investing and creating jobs in Portugal, and there was a special 10-year tax break for “non-habitual residents.” (Portugal is a socialist country. The personal income tax rate in Portugal can run as high as 48%.) Policies have changed dramatically this year, however. The Golden VISA has new restrictions, and there is a bureaucratic log-jam on processing them. There is a ban on new Airbnb licenses, except in rural areas. On November 29, 2023, the Portuguese Parliament voted to phase out the NHR tax breaks. Anyone already in the plan will continue through their 10-year period. However, beginning on January 1, 2024, new residents will no longer be eligible. Why the Change? While the tax and VISA incentives did indeed attract foreign investment in droves, it also sparked soaring home prices. Over the last eight years, home prices are up 137% (source: Reuters/Confidencial Imobiliario). Rents have rocketed up 65% or more. Portugal is one of the more modest countries in terms of income. The spike in housing costs have forced some workers to live in tents, rather than pay all of their income for rent. Locals are taking to the streets in protest, with many dressed up as the Monopoly mascot, shouting, “Housing is a right.” On November 29, 2023, the ousted Prime Minister António Costa defended the policies of his government, saying, “Throughout these eight years, we turned the leaf on austerity and took the country from a situation of excessive deficit to one of solid and peaceful budgetary stability that now broadens the freedom of political choices.” Costa resigned on November 7, 2023, over allegations of corruption. A Special Election is scheduled for March 2024. The Socialist Party has the majority of seats in Parliament. The political and unaffordable housing crises, along with higher interest rates, has economists projecting a slowdown in GDP in Portugal from 2.2% in 2023 to 1.5% in 2024. Everyone Wants to Move to Portugal. Should You? Pluses Portugal is one of the most affordable countries in Europe Food is cheap Great public transport Wonderful weather Beautiful beaches Property rights and judicial effectiveness score high on the Index of Economic Freedom Crypto-friendly Minuses Housing is unaffordable for the locals. (This creates political instability and can cause clashes with tourists.) New Airbnb restrictions. (If you’re a part-timer trying to rent out your place, this may be unavailable to you.) Chasing gains. (Buying high is rarely a good idea, especially when home prices are unaffordable and the tax incentives for ex-pats have dried up. Less demand puts downward pressure on prices.) Socialist country. (High taxes.) Political uncertainty, protests and tighter policy toward ex-pats and digital nomads. Bottom Line Every soul has her own geography. If Portugal is your place, and you’ve fallen in love with the land, the locals and the language, then navigating through the new tax, hosting and VISA laws could be worth it. If you’re looking to make a quick buck, you may be on the wrong side of that trade. Before making any real estate purchase, which can be illiquid and requires capital to maintain, it is very important to answer the 10-Point Checklist that is featured in the Real Estate section of The ABCs of Money, 5th edition. I’ll be discussing all of this in greater depth in my December 14, 2023 free videoconference. Email [email protected] with VIDEOCON in the subject line to join us live. (You’ll automatically receive the logon instructions if you’re already on the list.) Join us at our Jan. 13-15, 2024 New Year, New You Financial Freedom Retreat. Get valuable data and tools on how to best invest and monetize real estate. Learn nest egg strategies, how to get hot and diversified (including in EVs, crypto and AI), and what's safe in a Debt World. You'll even discover how to save thousands annually with smarter big-ticket choices. Yes, it's a complete money makeover. Email [email protected] to register. Learn the 15+ things you'll master and read testimonials in the flyer (link below) and on the home page at NataliePace.com. Register with friends and family to receive the best price. "Ten minutes into the first day I was already much smarter about investing than I ever thought I would be in my life and I knew I was in exactly the right place at this retreat. I am amazed at how EASY and FUN it is to make my money work for me and those I love. I think this kind of information should be compulsory in schools. I wish I'd learned this sooner." CM  Join us for our Online New Year, New You Financial Freedom Retreat. Jan. 13-15, 2024. Email [email protected] or call 310-430-2397 to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Pace at the Ritz Carlton, Powerscourt, Ireland. Photo by: Marie Commiskey. Natalie Pace at the Ritz Carlton, Powerscourt, Ireland. Photo by: Marie Commiskey. Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is were released in 2021. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Substack on Apple and Spotify. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Holiday Gift Giving on any Budget. Including No Budget. Once in a Century Events are Happening Every Day. The Crypto Winter Enters Its 3rd Year. Earn $50,000 or More in Interest. Safely. Finally. Freebies and Deals for Black Friday and Cyber Monday. Auto Strikes End. EV Price Wars Continue. WeWork's Bankruptcy. Half-Empty Office Buildings. Problems in our Personal Wealth Plan. Solutions for Unaffordable Housing. The Magnificent 7 Drag NASDAQ into Another Correction Cruise Ships Give Freebies to Investors. Should You Take the Bait? Should You Take a Cruise? Bonds. Banks. The Treacherous Landscape of Keeping Our Money Safe. 7 Rules of Investing Air B N Bust? Santa Rally 2023 or Time to Get Defensive? Barbie. Oppenheimer. Strikes. Streaming Wars. Netflix. Monero: A Token of Trust? 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. 2023 Company of the Year Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? The Online Global Earth Gratitude Celebration 7 Green Life Hacks Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. Which Countries Offer the Highest Yield for the Lowest Risk? Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Why We Are Underweighting Banks and the Financial Industry. 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed