|

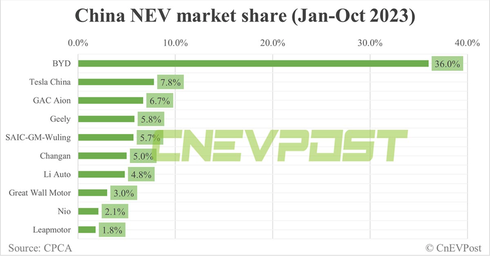

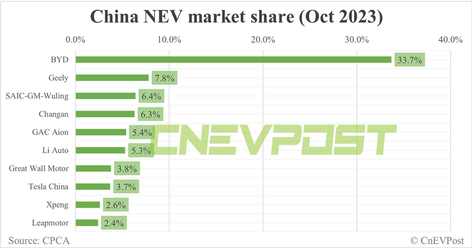

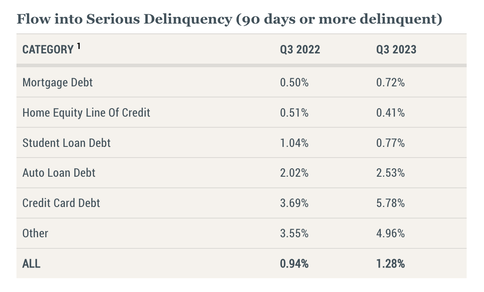

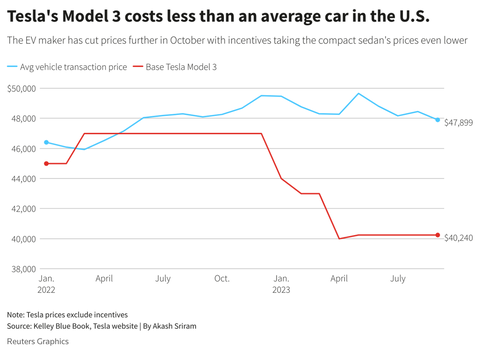

Electric vehicles are the fastest growing vertical in the auto industry, and China is the biggest auto market in the world. Tesla and General Motors are the both on the Top 10 Chinese New Energy Vehicle list. Tesla is 2nd behind BYD Auto year to date, with 7.8% and 36.0% market share, respectively (source: CNEVPost.com). However, GM’s joint venture, SAIC-GM-Wuling, just soared to #3 in October, while Tesla sank to #8, with 6.4% and 3.7% market share on the month, respectively. Recently, despite the rapid growth of EVs, both Ford and GM moderated their tone on a move from ICE* to electric. Why is that, and what does that mean for the future of Ford and General Motors? Why are these companies pumping the brakes on their EV launches? *Internal Combustion Engines Will the EV price wars, inflation and uncertain economic times cause struggling or cash-bleed startups to go belly-up? Can Rivian keep losing $32,595 for every vehicle sold? We’ll also cover the following in this blog. Competition is Fierce Chinese EVs Valuations are Volatile Tesla And here is more information on each point. Why are Ford and General Motors pumping the brakes on their EV launches? Both companies have indicated that the price wars, inflation and profitability lie at the heart of a more moderate approach to their EV transition. Electric vehicles made up less than 5% of Ford’s revenue in the most recent quarter. Ford’s CFO John Lawler put a positive spin on the slower adoption. In the company’s 3Q earnings press release, he wrote, “Ford is able to balance production of gas, hybrid and electric vehicles to match the speed of EV adoption in a way that others can’t. That’s obviously good for customers, who get the products they want – and good for us, too, because disciplined capital allocation and not chasing scale at all costs maximizes profitability and cash flow.” What Lawler didn’t mention is that retooling factories from ICE to EV is an expensive game, particularly when your credit rating is at the lowest rung of investment grade (BBB-), and your current liabilities are almost four times the company's cash on hand. Meanwhile, General Motors delivered 541,000 EVs in China in the 3rd quarter of 2023, mostly through its joint venture with SAIC-GM-Wuling (295,000 units). However, GM CEO Mary Barra is dialing back the company’s previously pledged plan of an all-electric future. In the 3Q 2023 Letter to Shareholders of Oct. 24, 2023, Barra wrote, “We are moderating the acceleration of EV production in North America to protect our pricing, adjust to slower near-term growth in demand, and implement engineering efficiency and other improvements that will make our vehicles less expensive to produce, and more profitable.” GM is rated BBB by S&PGlobal. GM’s cash vs. current liabilities is in a similar situation to Ford’s. Both Ford and GM have union labor, pensions and other post-employment benefits weighing on their margins – challenges that Tesla and the Chinese companies do not have (yet). The transition to electric vehicles is similar to the instant switch the world made from ICE to hybrids in 2004 – when the Toyota Prius was named Car of the Year by Motor Trend. After Toyota changed the game with the Prius hybrid, the Big 3 Detroit automakers suffered greatly. Both Chrysler and GM eventually had to declare bankruptcy in 2009. Their stronghold on ICE vehicles helped GM and Ford keep their revenues above $150 billion in 2022 – keeping them in the Top 4 in sales worldwide, behind Toyota (#1) and Stellantis (#2). (Ford Motor Company posted a net loss of -$1.98 billion in 2022.) EVs made up 7.9% of U.S. total industry sales in the 3rd quarter of 2023. The industry has a great ways to go before it puts ICE out of business. Meanwhile the Chinese automakers dominate revenue growth. Li Auto surged 271.6% year over year, Nio gave a strong showing in the 3rd quarter with a 75.4% annual increase in deliveries, Xpeng enjoyed its best month ever in October 2023 with 20,002 deliveries , which will be three times 4Q 2022, if the company continues apace. BYD continues to enjoy the top NEV sales spot, with year-over-year revenue growth of 38.5%. Email [email protected] with Auto Stock Report Card in the subject line if you’d like an updated report. Will the price wars, inflation and uncertain economic times cause struggling or cash-bleed startups to go belly-up? Can Rivian keep losing $32,595 for every vehicle sold? The startup had impressive revenue growth of 149.4% in the most recent quarter. However, Rivian also lost $6.75 billion in 2022. They talk about a pathway to profitability, but can this expensive EV truck (starting at $75,000) get there? Tesla is profitable, but is having its margins squeezed due to the price wars. The company’s net profit was $1.85 billion in the 3rd quarter of 2023, down -44% from $3.29 billion a year ago. Most of the younger EV companies are cash negative. WM Motors, a Chinese EV startup, filed for a pre-restructuring process on October 7, 2023. It hopes to continue operating. Fisker delivered 1097 Ocean vehicles in the third-quarter, which was their first full quarter of deliveries. While that’s impressive, at the same time, the company slashed production by 26%. The price wars, inflation and economic uncertainty are forcing all automakers to conserve capital and manage production, so they don’t build up too much inventory. Competition is Fierce China is already competing in the EV space in other countries. Moody's predicts that China will overtake Japan as the world's #1 exporter of vehicles by the end of this year. Nio cars have won awards in Germany, Sweden and Norway. They are also competing to have the smartest car, the best charging network (or battery swap), the safest vehicles and even the most productive showrooms and sales teams. Europe is so concerned about the Chinese dominance of EV exports that the European Union launched an anti-subsidy probe in September of 2023. With much lower labor costs, the Chinese automakers have the ability to keep prices low and competitive, forcing other carmakers, including Tesla, to lower prices to compete. Because interest rates are now a major consideration in the monthly payment, and most people finance their vehicle purchases, even Tesla has become more measured in its projections, mentioning the phrase “uncertain times” at least five times in their most recent earnings call. Serious delinquencies on credit card debt and auto loans in the U.S. are still low, but are starting to creep up. Chinese EVs As you can see in the chart at the top of this blog, BYD is by far the most popular EV brand in China. Li Auto is doing great with its plug-in hybrid. An emerging preference for hybrids has come about perhaps because drivers just don’t want to queue up at charging stations. Nio makes its charging stations available to other customers, but prioritizes their own customers during high demand. While both Nio and XPeng struggled over the last year, they have completed their new launches with flying colors. Xpeng delivered 40,008 vehicles in the third quarter, which is an increase of 72.4% sequentially and 35.3% year over year. Nio delivered 55,432 vehicles in the third quarter, which is an increase of 75.4% year over year, and more than double the deliveries in the second quarter. Valuations are Volatile Valuations on all EV automakers are very volatile. Tesla’s 52-week range is $100-$300/share. It has soared and plunged to a valuation of over a trillion and a low of $300 billion (still massive compared to its peers). Nio and XPeng are trading very close to their five-year lows. In addition to the various challenges that all auto manufacturers have faced since the pandemic, including rising interest rates, supply chain issues, and the price wars, the Chinese companies have fallen out of favor on Wall Street. Although there is hope that the accounting standards are in better shape than originally thought, not all of the Chinese companies have recovered from the negative sentiment. Tesla Tesla vehicles are beloved around the world. The company had revenue of $81.46 billion, with net income of $12.58 billion, in 2022. The Tesla Model 3 has become more affordable than its ICE competitors, once you factor in tax incentives. Add in gasoline savings and you're really saving money. More recently, however, Tesla's sales growth has slowed to 9% YOY, and net profit margins are getting squeezed. While analysts and investors place a lot of hope for Tesla’s expansion into Mexico and the cyber truck, Elon is tempering expectations on both of these. He believes that it is possible to hit deliveries of a quarter of a million cyber trucks perhaps by 2025, but warns that profitability is a problem with this particular product. High interest rates were another concern touched on repeatedly in the Tesla third quarter 2023 earnings call. According to Elon, “informing people of a car that is great but they cannot afford doesn't really help. So, that is really the thing that must be sold, is to make the car affordable, or the average person cannot buy it for any amount of money.” A lot of American companies, particularly companies in hot industries like electric vehicles and artificial intelligence, are being priced at very high valuations. Tesla’s price earnings ratio is 68. Essentially investors are assigning a value of $772 billion to a company that only had $12.6 billion in net income last year, and is likely to have less in 2023. Bottom Line Electric vehicles, and the emphasis on artificial intelligence and smart cars in this industry, are exciting. EVs continue to be the fastest growing vertical in autos. However, capitalizing as an investor is quite tricky with the squirrelly valuations, price wars, expensive share prices, and the fact that a lot of people are burning through their personal savings to stay afloat in today’s inflationary world. Automakers always suffer greatly when the economy slows down or hits a recession, since 70% of U.S. GDP is directly linked to consumption. Even though Tesla is a clear leader, with brand pizazz, beloved products, and strong sales, that’s already more than priced in. A better choice for many investors, including more passive investors, might be an ETF that targets EVs, such as the iShares IDRV product. That ETF offers exposure to Tesla, BYD, Rivian, XPeng, Li auto and more. Using a dollar-cost-averaging approach, with our pie chart system and regular rebalancing, will help us to stay on the right side of the trade. Join us at our Jan. 13-15, 2024 New Year, New You Financial Freedom Retreat. Learn nest egg strategies, how to get hot and diversified (including in EVs and AI), and what's safe in a Debt World. You'll even discover how to save thousands annually with smarter big-ticket choices. Yes, it's a complete money makeover. Email [email protected] to register. Learn the 15+ things you'll master and read testimonials in the flyer (link below) and on the home page at NataliePace.com. Register by Nov. 30, 2023 to receive the best price. Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human capital  Join us for our Online New Year, New You Financial Freedom Retreat. Jan. 13-15, 2024. Email [email protected] or call 310-430-2397 to learn more. Register by Nov. 30, 2023 to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Wynne Pace is an Advocate for SustainabilityFinancial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is were released in 2021. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest WeWork's Bankruptcy. Half-Empty Office Buildings. Problems in our Personal Wealth Plan. Solutions for Unaffordable Housing. The Magnificent 7 Drag NASDAQ into Another Correction Cruise Ships Give Freebies to Investors. Should You Take the Bait? Should You Take a Cruise? Bonds. Banks. The Treacherous Landscape of Keeping Our Money Safe. 7 Rules of Investing Air B N Bust? Santa Rally 2023 or Time to Get Defensive? Barbie. Oppenheimer. Strikes. Streaming Wars. Netflix. Monero: A Token of Trust? 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. 2023 Company of the Year Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? The Online Global Earth Gratitude Celebration 7 Green Life Hacks Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. Which Countries Offer the Highest Yield for the Lowest Risk? Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Why We Are Underweighting Banks and the Financial Industry. 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed