|

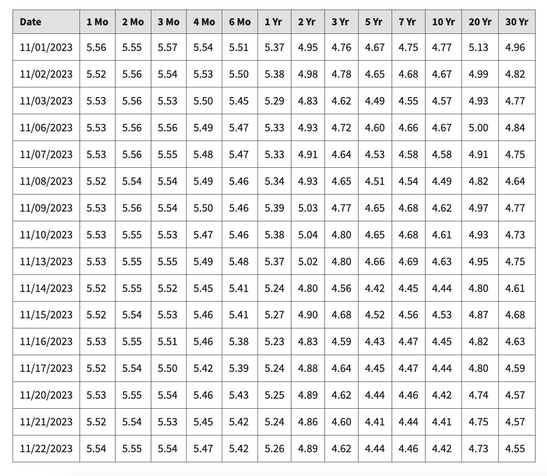

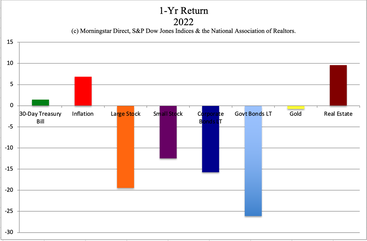

You Could Be Earning up to $50,000 (or more) in Interest (Finally) Is that enough to retire? One-year treasury bills are paying 5.25% these days. If you have $1 million on the safe side, you could be earning $50,000 in interest annually. The US is still an AA+ rated country, so the risk is pretty low on short-term treasuries. The one-year note is actually paying a higher interest rate, then two years or beyond. So keeping the terms short, and the creditworthiness high is not only a sound policy, it’s also giving us a higher yield. Bonds are tricky these days, so there are a few things to get right in order to earn this income (which is long overdue). Also, if you’re close to retirement, is it going to fill-in the gap between your earned income and what your Social Security and/or pension is going to pay you? Will 5% interest rates still be around next year? Below are a few things we will go over in this blog. Can you earn enough interest to retire? 5% of $1 Million Social Security Benefits Medical Costs Align your mortgage payoff date with your retirement date Reducing Expenses Increasing Income Will interest rates go higher or lower? Keep the terms short and the creditworthiness high Bond Funds And here’s more information on each point below. Can you earn enough interest to retire? A recent retiree was accustomed to earning $150,000 a year. Her Social Security was going to provide her with less than $45,000. She had no pension. The company she worked for was giving her a lump sum of about $250,000. All told, if her expenses and spending stay where they are, she could easily burn through that in 2 1/2 years. Add in the additional $600,000 she has in her other retirement accounts, and she wouldn’t last a decade. It’s a good idea to do the math before we retire, especially in today’s inflationary world! With 5% interest rates, we can finally earn some passive income without too much risk of capital loss. And there may be other ways to reduce expenses and increase income – both of which will be necessary. 5% of $1 Million The retiree mentioned above had closer to $800,000 which would bring her $40,000 annually, if she was earning a 5% interest rate. That’s still about $65,000 shy of what she was accustomed to earning, but it is at least moving in the right direction. Her bills, excluding Medicare, prescriptions and doctor visits, remain above $70,000 a year. That’s still flying too close to the trees for an $85,000 annual income. It doesn’t leave any room for fun or travel. If she has a major plumbing, roof or landscaping repair, or a health crisis, she might be forced to rely on credit cards to get her through. One word of warning. I have coaching clients who have been told that they are earning 5-7% on their “conservative” investments. Since bonds lost more than stocks did last year, those claims might not be truthful. The real return (under 2%, or perhaps even bond losses, once the losses are factored in) is written in the fine print of the statement. Long-term bonds that are low credit quality are the most problematic. (Click to learn more.) Another client was sold into a “safe,” high-yield, private placement REITs (oxymorons & red flags galore!). Read their story in their own words in our blog, “They Trusted Him. Now He Doesn’t Return Phone Calls.” Rather than earning almost 10% yield, they lost -18% of their investment. Again, bonds are tricky (but worth it!), which is why we spend one full day on how to get a safe yield at our Financial Freedom Retreat. Social Security Benefits The interesting thing about Social Security benefits is that there are ways to get more than you think you might, and waiting for the larger amount when you hit 72 doesn’t always add up. if your spouse (or ex-spouse) earned a lot more income than you did, and you were married for longer than 10 years, and you never married again, you might qualify to get up to half of what your spouse or ex is receiving. When considering exactly when you should start taking your Social Security, you also want to factor in the money you’ll miss by waiting until you get the full benefit amount. There are a few things in the fine print that you’ll really want to go through forensically when deciding when the time is right to start drawing on your Social Security benefits. Medical Costs Medical costs are the biggest expenses as we get older, and are the leading cause of bankruptcies in the U.S. (66.5%, source: NIH). Healthcare in the United States makes up 18% of GDP ($3.8 trillion in 2019). Many people are paying a good portion of the small amount of Social Security they receive back to the government for their Medicare premiums. This is one of the reasons that we encourage younger people who are healthy to consider setting up a health savings account for themselves. Health savings accounts offer tax credits, save thousands annually on health premiums, and are also the best long-term healthcare plan in retirement. It’s a great idea to have your own healthcare nest egg for your retirement, which also rewards you throughout your professional life with thousands annually that you don’t spend making the health insurance company and the taxman rich. If you’re close to retirement, and you didn’t establish a health savings account, then it becomes even more imperative that you adjust your expenses to your new income as quickly as possible (downsize). Burning through your 401k and IRAs to stay in a lifestyle that you can no longer afford is a perilous position to put yourself in. Also, remember that health is the best health insurance. Eat right, exercise and have fun to stay strong and spend less money on the doctor. Align your mortgage payoff date with your retirement date Almost everyone earns a lot less in retirement than they did in the workplace. So, before we retire, it’s a really good idea to try to get rid of as many bills as possible. One of the biggest bills is our mortgage payment. So for most of us, it’s going to make a lot of sense to pay off our mortgage before we retire. (if you purchased your home recently or still owe a lot of money on your home loan, then your circumstance might require additional considerations.) Reducing Expenses Reducing our expenses will make retirement bucks go further. Free housing for a home that you own free and clear (with only property taxes, maintenance and upkeep to pay) can save tens of thousands of dollars annually. If we have that HSA, then our medical insurance premiums will be much lower. If we live in a sunny state and have solar, our electric bill could be under $500 a year. Energy efficiency upgrades could cut our electric bill in half. Rethinking transportation could save us $8000 or more annually. We spend one full day on safe, income-producing hard assets that we can purchase for a good price. Many of them pay us a better return on investment than any bond could hope to do (15% annualized or higher). One coaching client is saving about $7,200/year on her utility bill from her $26,700 investment in solar. She’s receiving $8000 in tax credits and will pay off the panels in under three years. Thereafter, she is essentially receiving 38.5% ROI on her solar investment every year, in money that she no longer pays the utility (that she can now spend or invest on things she likes more). Additionally, sometimes the best way to downsize is to think bigger and factor in our family. The goal is always to keep the money in the family, and stop making everyone else rich at our own expense. Increasing Income We’ve talked about how getting a 5% interest-rate on the safe side of our portfolio through a carefully designed plan of short-term, creditworthy bonds or treasury bills can augment our income. Putting a spare bedroom or ADU* on Traveling Nurses or Airbnb could be worth thousands annually (though you’ll have extra work to keep your space desirable and booked). *Auxiliary Dwelling Unit One retiree had a novel approach. She rented out her big house, and then downsized to an efficiency condo. The income from the rental combined with her pension and her 401(k) offered her almost the same annual income that she earned as a professional. With the same income and a dramatically reduced cost of living, she now spends about six months out of the year traveling to her bucket list vacation destinations. Should your kids spend tens of thousands of dollars on rent? Or could that money go toward remodeling and upgrading (or paying off) the family home? There are many case studies examined in the Real Estate section of The ABCs of Money, 5th edition. Will interest rates go higher or lower? Prior to the rate hikes last year, interest rates spent over a decade in the doldrums. You would have to swim in the risk of junk bonds to get a 5% interest rate. And there you risk drowning in losses of your principal, which defeats the purpose of having a safe side of your wealth plan. Forecasters are predicting that interest rates could go lower as soon as next year. That may make it tempting to reach for yield, or take on longer terms. However, this must be done very strategically. Over half of the S&P500 is at or near junk bond status. Banks were failing earlier this year, and not all of the financial services industries are out of the woods. Some sectors, like commercial real estate are already facing dire straits. Read my 'WeWork Files for Bankruptcy' blog for more information. Keep the terms short and the creditworthiness high Getting 5% is very tricky. The newer issuances with shorter terms are paying a higher interest rate with more credit quality and less risk. So a good rule of thumb is to keep the terms short and the creditworthiness high. We’re still not getting paid to reach for yield, when you consider that long-term bonds lost 26% of their value last year and pay a lower interest rate than short-term. We need to be mindful about yield, as we’ve been alerting our retreat attendees and readers for more than a decade now. Yield is back, but it is very tricky. There is still a great deal of duration and credit risk. That won’t abate without some pain and potentially more bankruptcies. There remains a danger of negative yields (from valuation losses and fees), losses in principal and illiquidity (no one would want to take it off your hands without a large discount). Many investors try to salve the wounds of their bond losses by saying they’ll just hold to term. However, we’re seeing terms that are well beyond lifespans. One 70-year-old coaching client had a junk bond that wouldn’t pay him back until 2074. Bond losses were at the heart of the bank failures in 2023. The professionals are having problems! Many of us hold these same troublesome assets in our own nest egg (whether we know it or not). This makes it essential to know exactly what we own and why and to be the boss of our money, rather than having blind faith that someone else is protecting us. Bottom Line There are certain years when protecting our wealth becomes our most important job. Most of us have more in our retirement accounts than we can earn in many years of working. Others need to do the math before we retire or allow ourselves to be furloughed. This is going to require learning the life math that we all should have received in high school and college. Whether you get this information by attending our New Year, New You Financial Freedom Retreat, or by receiving an unbiased 2nd opinion through our private coaching, now is the right time to start the process. When we wait for the headlines that the economy is in troubled times, most people have already lost -40% or more of their wealth. It’s time to fix the roof while the sun is still shining. Join us at our Jan. 13-15, 2024 New Year, New You Financial Freedom Retreat. Learn nest egg strategies, how to get hot and diversified (including in EVs and AI), and what's safe in a Debt World. You'll even discover how to save thousands annually with smarter big-ticket choices. Yes, it's a complete money makeover. Email [email protected] to register. Learn the 15+ things you'll master and read testimonials in the flyer (link below) and on the home page at NataliePace.com. Register by Nov. 30, 2023 to receive the best price. Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human capital  Join us for our Online New Year, New You Financial Freedom Retreat. Jan. 13-15, 2024. Email [email protected] or call 310-430-2397 to learn more. Register by Nov. 30, 2023 to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Wynne Pace is an Advocate for SustainabilityFinancial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is were released in 2021. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Substack on Apple and Spotify. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Freebies and Deals for Black Friday and Cyber Monday. Auto Strikes End. EV Price Wars Continue. WeWork's Bankruptcy. Half-Empty Office Buildings. Problems in our Personal Wealth Plan. Solutions for Unaffordable Housing. The Magnificent 7 Drag NASDAQ into Another Correction Cruise Ships Give Freebies to Investors. Should You Take the Bait? Should You Take a Cruise? Bonds. Banks. The Treacherous Landscape of Keeping Our Money Safe. 7 Rules of Investing Air B N Bust? Santa Rally 2023 or Time to Get Defensive? Barbie. Oppenheimer. Strikes. Streaming Wars. Netflix. Monero: A Token of Trust? 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. 2023 Company of the Year Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? The Online Global Earth Gratitude Celebration 7 Green Life Hacks Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. Which Countries Offer the Highest Yield for the Lowest Risk? Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Why We Are Underweighting Banks and the Financial Industry. 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.

JOAN FRIESE

27/11/2023 06:53:35 am

Please unsubscribe me from all emails Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed