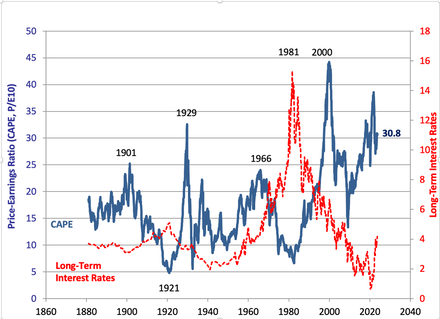

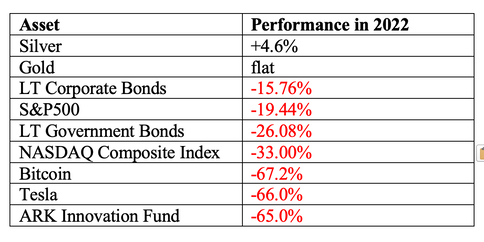

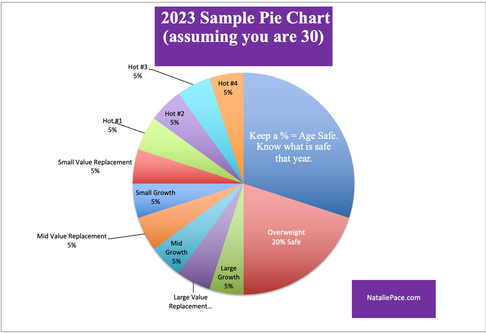

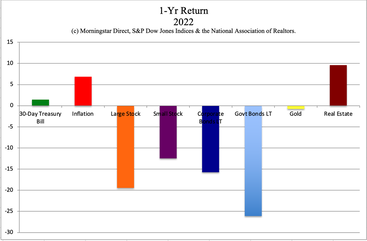

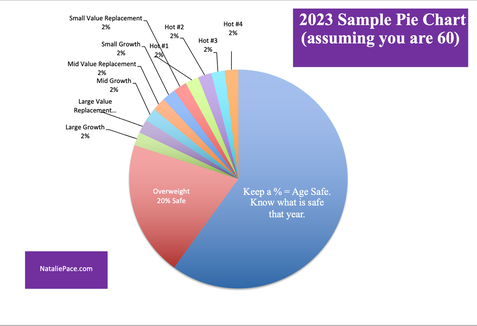

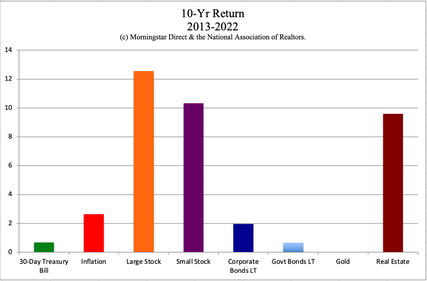

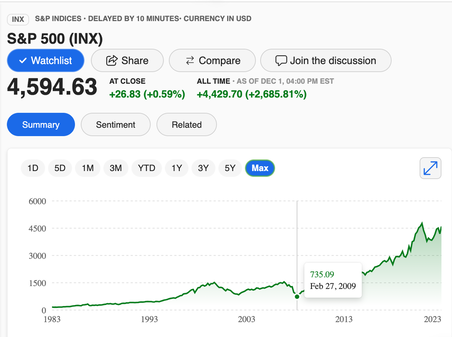

The global COVID-19 pandemic of 2020 was unprecedented. It brought many cities to a standstill. People were quarantining in place, and were limited as to when and how they could leave their dwelling -- sometimes by law, but also by fear. Hubbubs of tourism, like Times Square on New Year's Eve, were empty and quiet. Photo by Natalie Wynne Pace. Taken on my Apple iPhone on 12.31.2020. “Once in a Century” Events are Happening Every Day. Over the past few years, we have seen numerous “once in a century” events. The pandemic. The longest secular bull market in history. The shortest about-turn from bull to bear in history (Feb. 19, 2020). The shortest recession in history (the 2020 pandemic). The U.S. credit was downgraded by Fitch Ratings (to AA+) on August 1, 2023. The Federal Reserve Board hiked interest rates to 5¼ to 5½ percent for the quickest tightening cycle seen since Federal Reserve Board Chairman Paul Volcker in 1979. (The Fed Fund rate was zero in March 2022.) The Great Recession’s (2008) very name harkens back to the Great Depression (1929). 4 banks failed again this year. During the Dot Com Recession (2000-2002), NASDAQ stocks lost 78% of their value and took 15 years to recover. The only two times that stocks have been more expensive than they are today (according to Robert Shiller’s CAPE Ratio) were in the Dot Com Recession (2000-2002) and the Great Depression (1929-1939). Here’s what 2022 looked like from an investing perspective. Investing in such circumstances can feel like surfing in a hurricane. If you’ve wiped out and been washed up on shore, maybe it’s time to switch metaphors (and plans). A good wealth plan doesn’t have you getting battered and swamped by 30-foot waves. It also doesn’t have you losing principal on the safe side… The principal losses of long-term bonds are at the heart of the bank failures, and are often put on the “safe” side of our own managed portfolio. Win the Game, Even if You Strike Out We can strike out on some investments, and still win the game. Were our “losses” a small or large piece of our nest egg? Did we perform on par with, below or better than the S&P500 over the past 5, 10 and 15 years? If it’s game over, then we put too much at risk. There is an easy plan that protects us from the volatility on Wall Street, and the bond risk that caused the banks to fail, while allowing us to hit homeruns in the bull markets. With this plan, we don’t focus on “winning” or “losing” with every at-bat investment. Instead think of it like having strong players in their key positions. Some are defensive to keep our nest egg intact. Others are all-stars that increase our performance. When a homerun hitter strikes out, rather than shrug our shoulders and think we lost, a more successful strategy is to ask, “Is the cold streak temporary? Do we need a pinch hitter? Is the setback still part of a great batting average?” Folding our investments into the big picture helps us to harness our emotions and make sound decisions. Below are a few things we discuss in this blog. What Strategy Wins the Game? Volatility Bonds Lost More than Stocks Last Year 5% Yield on the Safe Side The Hottest Stocks of 2020 and 2021 Were the Worst of 2022 Portfolio Performance Gold. Silver. Crypto. Safe Havens? China and our Hot Slices Small Caps Value Irrational Markets Wait and See? And here is more information on each point. What Strategy Wins the Game? During Crypto Winters, sadly, we often hear about devastated investors getting wiped out, depressed or even contemplating suicide. If crypto were just one or two hot slices of a diversified wealth plan, there is no ruination during the downturns. In fact, if we are rebalancing our diversified plan regularly, 1-3 times a year, we are being prompted to sell high and buy low, which improves the performance. Crypto is volatile. Betting the farm on any one thing, especially when an asset makes headlines, is akin to putting your pitcher in as the cleanup batter. It’s just a bad idea. Regular rebalancing of a diversified plan is a time-proven 21st Century strategy that earned gains in the Dot Com and the Great Recessions, when most investors lost half or more of their wealth. "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human Volatility 2021 was a banner year on Wall Street, with the S&P500 up 26.9%! 2022 gave up a lot of the gains with losses of -19.33%. 2023 has once again recovered most of last year’s losses, with a rise of 18.4% year to date. That’s about 8.7% annualized gain over the 3-year period (not bad at all). This might lead you to believe that Buy & Hope is a good strategy. However, Modern Portfolio Theory diversification (which is easy as a pie chart and less time, and money than those 18-page managed plans) with regular rebalancing (1-3 times a year) prompts us to capture gains in the rallies and buy low in the routs. This increases our wealth, rather than just riding the Wall Street rollercoaster. When we are properly protected, we limit our losses in downturns. (Nilo Bolden actually earned gains in the Great Recession, while those around her lost half or more of their wealth.) Devastating losses are a regular feature of 21st Century recessions (sadly). Using years of a bull market to crawl back to even isn’t a great plan – particularly as we get closer to retirement. Bonds Lost More Than Stocks Last Year We’ve been warning that we weren’t getting paid to take on the risk of bonds for over a decade. Prior to 2022, you’d have to go into junk bond status to get above 4%, and most savings accounts offered pennies on thousands. From 2009 until about 2015, we were suggesting that real estate was safer than bonds, and could produce as much or more income. Many investors who heeded that guidance doubled their money. The safe side of our portfolio is where we are supposed to earn interest without losing our principal. However, if bonds are losing more than stocks, that defensive strategy is quite flawed right now. (Even the pros at the banks are having issues with this, as seen with the bank failures and the paper losses.) 5% Yield on the Safe Side If we have $1 million on the safe side, we could earn $50,000 pretty safely. However, it’s tricky. There remains duration risk and credit risk. Over half of the S&P 500 is at or near junk bond status. Elevated debt is one of the reasons Fitch Ratings just downgraded the USA sovereign credit to AA+. Click to access my free blog and videoconference on this topic. Good rules of thumb are to keep the terms short and the creditworthiness high. It’s important to know what we own and be the boss of our money. Sometimes what we’re being told isn’t even true, something we can clearly see if we take the time (and know how) to read the fine print. As just one example (there are many), one of my clients had been told that he was earning 5-7% yield on his portfolio, and that his safe investments protected him from all of the losses in stocks. The statement itself revealed that this was not the truth at all. Due to the losses in the value of the bonds, the return was 1.7% year to date (not 5-7%), compared to 13.9% ROI in stocks. Click to learn more in my Bonds blog. The Hottest Stocks of 2020 and 2021 Were the Worst of 2022 Meme stocks were all the rage during the pandemic. And as you can see in the chart at the top of this blog, many of them suffered the greatest losses in 2022. Tesla, Ark’s Innovation Fund, Bitcoin and more all crash landed last year, underperforming the S&P500®. Bed, Bath and Beyond went belly-up. The last three years have seen a pandemic, supply chain disruptions, hostility toward China, gold/silver doldrums, lockdowns, wild rides of commodity prices and much more. Many states legalized cannabis only to find that customers still prefer anonymity and the Black Market. These are very abnormal times... which is why diversification is key. With the pie chart system, the majority of our money would be safe, and the hot slices would be a small piece of the overall total. We want our hots to outperform, that is the area where we are taking on higher risk for potentially higher gain. Higher risk also increases the chance of losing. So, we must be sure to keep the full game in mind, rather than be obsessed with one or two no-run innings. Portfolio Performance A good defensive strategy is to always keep a percent equal to our age safe. We’re also overweighting an additional 20% safe right now because of the economic storms on the horizon. Stocks and funds tend to be more volatile, but perform better. The “safe” side is a way to preserve liquidity, while earning some interest. If we have one particular stock we invested in that didn’t do very well, such as buying Tesla at a top price of $407/share, that’s still a very small piece of our portfolio in this strategy. If we are earning a 5% interest rate on the biggest part of our portfolio, which is also protecting us from the volatility of the stock side, then we might have net positive performance, even though 2022 was a pretty ugly year for most people. For example, if we are 60, overweighting 20% safe, and our 20% at risk drops by -19.33%, that net -3.9% drop is made up by our 80% safe net earnings of 4%. As we get older keeping our wealth safe becomes vital. Gold. Silver. Crypto. Safe Havens? “Safe Haven” investments have been in the doldrums. Gold and silver have been some of the worst performers of the last decade, but helped tremendously last year when stocks, bonds and crypto tumbled. The Crypto Winter is entering its third year. A lot of that has to do with the resilience of the stock market. Even with last year’s pull back, stocks are still up 12.2% percent annualized over the 15-year period. We’ve been in a secular bull market since March of 2009. Never confuse a bull market with wisdom! Recessions are a part of the business cycle, and in the 21st Century recessions can be very expensive for Main Street investors who are overexposed. China and our Hot Slices American investors made lot of money on their Chinese investments for most of the 21st Century. However, since 2018, tensions with China have escalated. Chinese stocks have tanked in the U.S. Our hot slices should be re-evaluated annually. If we had something that is no longer in favor, then perhaps we’d rather lean into artificial intelligence, cyber security, silver, breakthrough technology, clean energy or biotech companies next year. Some of these funds are trading near their 10-year low, while others are trading very close to all-time highs. So before purchasing, it’s important to do a price analysis to determine whether or not we’re buying low, or should take a slow, dollar cost averaging approach to filling up the slice. The performance of the iShares Clean Energy fund (ICLN) illustrates why rebalancing regularly is important. Between the bottom of the pandemic and January 2021, ICLN more than tripled. The fund is now trading near its 52-week low. Small Caps Small cats have had a rough go of it over the past few years. Typically, small caps outperform large caps. When slices get smaller, they are prompting us to buy low. We protect ourselves from volatility and weakness by overweighting safe, rather than putting the kibosh on diversification. Value Due to the overconcentration of low credit quality in the US at this time, combined with elevated stock prices, we’re looking outside of the United States for our value replacement funds. Value means on sale. As you can see in the CAPE Ratio chart at the top of this blog, U.S. equities are definitely not on sale. Elevated equities are correlated with oversized price plunges. NASDAQ Composite Index stocks dropped -78% and took 15 years to come back to even after the highs of March 2000. You know what happened in the Great Depression. We discuss opportune countries at our Financial Freedom Retreat. There is one country in particular that has a higher credit rating than the U.S., and pays double the yield. Irrational Markets 2020 and 2021 were strong years on Wall Street, despite lockdowns and the pandemic. 2022 was a terrible performer, even though the economy didn’t experience a recession (according to the Feds and NBER). Commercial real estate is trying to maintain its property valuations, even though many office buildings and malls are half empty. AirBNB hosts are hoping to weather more supply, competition and vacancies without lowering their prices. Many of these hopes and dreams are at odds with fundamental economic rules (such as supply and demand) and business cycles. 4 banks failed this year. Things have stabilized, and the Feds assure us that the banking system is “sound and resilient.” However, in the minutes of the Nov. 1, 2023 FOMC meeting, we learned that FOMC participants had more concerns than are reflected in the assurances being offered. Many participants commented that unrealized losses on assets resulting from the rise in longer-term interest rates, significant reliance by some banks on uninsured deposits, and increased funding costs at banks warranted monitoring. Many participants also commented on risks associated with a potential sharp decline in CRE valuations, which could adversely affect some banks and other financial institutions. Market timing doesn’t work. Diversification with regular rebalancing allows us to see and capture gains – growing our nest egg, and protecting us from losses. Due to the heightened uncertainty in today’s economy, we are overweighting 20% additional safe in our sample pie charts. Keeping enough safe gives us the liquidity needed to buy low when markets tumble. Most people don’t buy low because they can’t. They’ve lost too much, and now must hope and pray to crawl back to even. Wait and See? When we wait for the headlines, it’s too late to protect our wealth. As you can see in the charts below, most people lose almost half of their equities before the recession is official. It’s important to fix the roof while the sun is still shining. It took NASDAQ stocks 15 years to recover after the Dot Com Recession. It took the Dow Jones Industrial Average almost 7 years to come back after the Great Recession. Bottom Line My mission is to provide the news, information, time-proven systems and education to make it easier to navigate through all the noise, hullabaloo and traps. Rather than expecting perfection, it’s a better idea to understand that striking out at a few at-bats is part of investing. The key is to have strong players in the position where they perform best, along with a defensive strategy to prevent Wall Street whales from eating our lunch. Losing a lot on one investment, whether it is cannabis, crypto or China, is more like losing an inning than the game, when our plan is properly set up. We are the boss of our money and life, whether we take ownership or not. Most of us have far more wealth in our retirement accounts than we can earn in years of working. We need to know how all of the players in our wealth plan are performing, including the head coach (our fiduciary financial broker/salesman), if we have a managed plan. Now is the time to learn the life math that we all should’ve received in high school and college, so that we are confident our game plan is safe, protected, hot, and diversified, and that we can win on Wall Street. You can learn this easy system by attending our New Year New You January 13-15, 2024 online Financial Freedom Retreat, or by getting an unbiased second opinion from me personally, through our private coaching program. Wisdom is the cure, and the time is now. Email [email protected] or call 310-430-2397 now to learn more and register. Join us at our Jan. 13-15, 2024 New Year, New You Financial Freedom Retreat. Learn nest egg strategies, how to get hot and diversified (including in EVs, crypto and AI), and what's safe in a Debt World. You'll even discover how to save thousands annually with smarter big-ticket choices. Yes, it's a complete money makeover. Email [email protected] to register. Learn the 15+ things you'll master and read testimonials in the flyer (link below) and on the home page at NataliePace.com. Register with friends and family to receive the best price. "Ten minutes into the first day I was already much smarter about investing than I ever thought I would be in my life and I knew I was in exactly the right place at this retreat. I am amazed at how EASY and FUN it is to make my money work for me and those I love. I think this kind of information should be compulsory in schools. I wish I'd learned this sooner." CM  Join us for our Online New Year, New You Financial Freedom Retreat. Jan. 13-15, 2024. Email [email protected] or call 310-430-2397 to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is were released in 2021. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Substack on Apple and Spotify. Watch videoconferences and webinars on Youtube. Other Blogs of Interest The Crypto Winter Enters Its 3rd Year. Earn $50,000 or More in Interest. Safely. Finally. Freebies and Deals for Black Friday and Cyber Monday. Auto Strikes End. EV Price Wars Continue. WeWork's Bankruptcy. Half-Empty Office Buildings. Problems in our Personal Wealth Plan. Solutions for Unaffordable Housing. The Magnificent 7 Drag NASDAQ into Another Correction Cruise Ships Give Freebies to Investors. Should You Take the Bait? Should You Take a Cruise? Bonds. Banks. The Treacherous Landscape of Keeping Our Money Safe. 7 Rules of Investing Air B N Bust? Santa Rally 2023 or Time to Get Defensive? Barbie. Oppenheimer. Strikes. Streaming Wars. Netflix. Monero: A Token of Trust? 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. 2023 Company of the Year Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? The Online Global Earth Gratitude Celebration 7 Green Life Hacks Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. Which Countries Offer the Highest Yield for the Lowest Risk? Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Why We Are Underweighting Banks and the Financial Industry. 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed