|

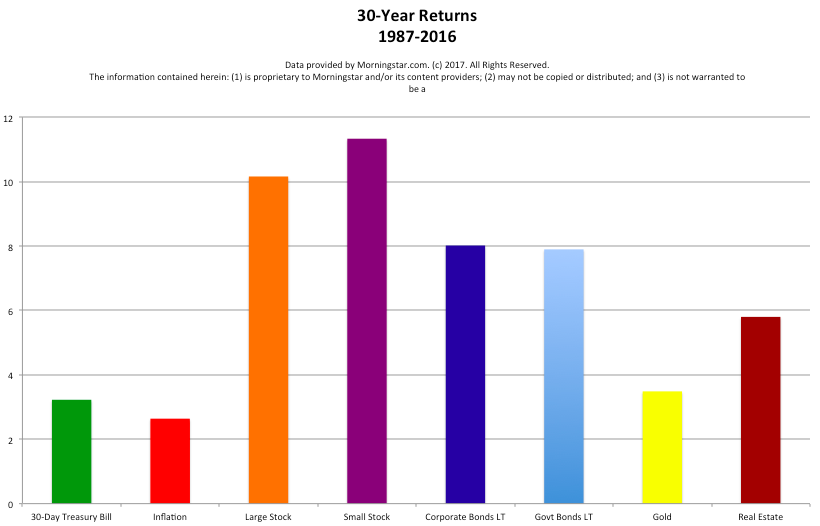

Last Wednesday night, Republicans stripped the American consumer of the right to sue banks or form class action lawsuits. This means that those people who suffered at the hands of Wells Fargo and had fake accounts set up cannot form a class action lawsuit against the bank for damages. It is also a problem for the 5.4 million Americans who are still severely underwater on their homes and the consumers who are carrying massive credit card, student loans and other forms of high-interest debt. But there are other changes to the fine print of what banks and can or cannot do that has placed your cash seriously at risk. 9 “Safe” Investments that are Riskier Than You Realize 1. FDIC-Insured Cash 2. Certificates of Deposit. 3. Predatory Lending. 4. Credit Cards. 5. Money Market Funds. 6. Life Insurance. 7. Long-term Health Care Insurance. 8. Annuities. 9. The Value of the Dollar. 1. FDIC-Insured Cash Banks are finding creative ways to earn more on your money, and to slide out from the FDIC insurance, often without you realizing it (unless you are reading all of the fine print). Here are just a few: * Changing the fees on your savings and checking, after you open the account. * Offering products that are not FDIC-insured. * Charging you to transfer money between accounts, charging egregious overdraft charges and usury interest rates that can equate to almost 30%. 2. Certificates of Deposit that are Not FDIC-Insured. Certificates of Deposit are not all FDIC-insured, particularly any higher-yielding CD, which has a risk of going down in value. Here again, you must read the fine print, and not just rely upon what the salesman (bank “specialist”) is telling you. Remember that bank specialists were pressured to set up fake bank accounts at Wells Fargo. All banks now teach tellers and others who work for them to cross sell other bank products. Few of these salesmen are properly trained on all of the fine print. If you don’t read all of the fine print, now that banks cannot be sued, you really don’t have any remedy. Arbitration almost always falls on the side of the bank, since arbitration must consider the fine print, even if you didn’t read it, understand it or if it was presented differently to you by the bank representative (something that is difficult to prove). 3. Predatory Lending. Consumer debt is higher than it has ever been, at $12.84 trillion. 5.4 million homeowners are still severely underwater on their home loans. Credit card delinquencies are as high as they were in 2009, during the Great Recession. College graduates are living with their parents, while paying off student loan debt and looking for better-paying work. While heavily indebted corporations in the U.S. can borrow at 5% or less and banks are borrowing at 1%, students and consumers are paying 7-28% interest on their debt. 4. Credit Cards. Credit cards are marketed as a great way to launch a new business. No experienced entrepreneur launches a business on 28% interest. Credit cards are also peddled to college students, who have never had to balance a budget. Far too many Americans are using credit cards to make ends meet. 5. Money Market Funds. The new tools – fees and gates –give fund boards the ability to impose liquidity fees or to suspend redemptions temporarily, also known as “gate,” if a money market fund’s level of weekly liquid assets falls below a certain threshold. In other words, you could be denied access or charged fees to the money you have in a money market fund, in the event that the bank that issued the fund is in trouble. 6. Life Insurance. One of the biggest issues with life insurance is that there is no real backstop if the insurance company goes out of business. This is the reason that AIG was the first bailout in the Great Recession – because over 50 million annuities and life insurance policies would have been worth next to nothing. Additionally, the only way that you make out with life insurance is if the worst thing happens fast, which statistically is very small. If you took the money you put into life insurance and instead funded your own retirement account, that money would be yours to keep forever. If you invested 10% of your annual income into a tax-protected retirement account, and that made a 10% return (what stocks and bonds have done over the past 30 years), you’d have more money in the account than you earn annually in 7 years, and in 25 years, your money will make more than you do. Buying life insurance is like paying rent. If you miss a payment, you get booted out. The longer you hold life insurance, the more expensive it becomes and the lower the payout will be. People always say that they can catch up and reactivate a lapsed life insurance policy. However, they are overlooking that the fact that when you are retired, you have less income, and fewer resources to do that, or that when you reactivate a policy, it is on different terms. 7. Long-term Health Care Insurance. Health savings accounts are far better than long-term health care insurance, particularly for healthy people, because the money you deposit into this tax-protected retirement account is yours to keep and the “premiums” will not rise exponentially as you age and/or face an illness. HSAs are not “use it or lose it.” They build up each year, offer massive savings on health premiums (with your higher deductible plan), and even give you a tax credit. Learn more about HSAs at IRS.gov. One more important consideration: Health is the best health insurance. 8. Annuities. Annuities are immediately worth less at the point of purchase. This is called a “surrender fee.” They act like a pension – becoming worthless to your heirs once you annuitize the payments. They are not FDIC-insured, and have no backstop if the insurance company goes bankrupt. Some can lose money, either based on market performance or with hidden fees and penalties. 9. The Value of the Dollar. The value of the dollar in purchasing power has weakened with regard to most of the asset classes (severely), and against the Chinese Renminbi, and is vulnerable to a credit downgrade from Fitch Ratings and Moody’s. (The U.S. was downgraded by Standard & Poor’s on August 5, 2011.) The U.S. stock market is at an all-time high (making stocks overvalued), and U.S. real estate is again higher than ever. The Solutions:

The first step in getting your liquid assets safe is to make sure that you keep a percentage equal to your age (at least) in FDIC-insured cash. In my nest-egg-pie-charts, I am overweighting an additional 20% safe. The second step is to start reducing as many big-ticket bills as you can. There are many ways that you can keep more of your hard-earned money without any change in lifestyle (offering the best Return on Investment available). The average American spends over $7,000 annually on car transportation (including insurance, gasoline and the car payment itself). Most Americans are spending at least $5,000 annually on utilities and gasoline, $3,000 (or more) on health insurance and more than ½ of their paycheck on housing and student loan debt. Over 5.1 million homeowners are still underwater on their mortgage. If you are getting your debt reduction, budgeting and investing strategy from the banks and insurance companies, then chances are that you are being sold into products that make them rich – many times at your own expense. Once you get safe and adopt a Thrive Budget and stop making the billionaire corporations rich at your own expense, you can start considering safe, income-producing hard assets that you purchase for a good price. Every single word in that sentence counts, particularly since stocks and real estate are higher than ever today. Think 20 years out and include the generation before and behind you. For additional ideas on these solutions, read my books, listen to the teleconference on this topic, attend a retreat and/or purchase a private, prosperity coaching session. Call 310-430-2397, or email info @ NataliePace.com to learn more. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed