|

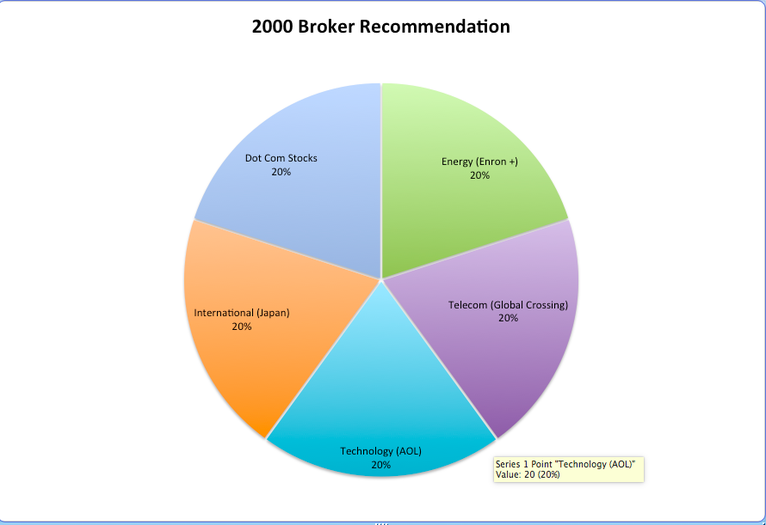

In August of 2000, a stockbroker from a major bank tried to hard sell me into stocks and funds that he said were diversified and trading for a good price. Here’s what his plan looked like.  . If I had invested in his plan, I would have lost everything. Dial-up connections destroyed Dot Coms. Enron went belly-up. Japanese stocks imploded. The telecommunications industry went bankrupt when long distant rates fell from 45 cents a minute to 10. Most of these problems were easy to see. However, with pundits blathering on about a “New Economy,” far too many fell for the sales pitch and ignored their own wisdom. I didn’t know that the broker/salesman had a conflict of interest and was just selling me those funds to make his own mortgage payment. However, I was adamant that I wasn’t going to invest my hard-earned money until I was presented with a plan that I had confidence in. My money stayed in an FDIC-insured Certificate of Deposit, earning 4.5% interest. Cash was the top-performing asset in 2000. The NASDAQ lost 78% of its value between March of 2000 and October of 2002. In August of 2001, I invested in a few companies that I believed strongly in (after much research), which were trading at rock bottom prices. I cashed out in December of 2001 – just three months after 911 – having almost tripled my money. That experience, and all of the research that I did to create it, formed the foundation of the simple pie chart system that I developed. It worked great in the Dot Com Recession, but how did the system perform in the Great Recession? Listen to Nilo Bolden describing how it worked for her. This rather simple system has worked in two of the worst recessions the U.S. has seen since the Great Depression. Buy and Hold has investors on a Wall Street rollercoaster. You can’t afford to lose more than half of your money every eight years. It takes a decade to crawl back to even (even if the markets rebound). One million becomes $450,000. With an annualized gain of 10%, or $45,000, you have to wait 12 years to get back where you started. The Nest Egg Pie Charts earn gains in recessions and outperform the bull markets in between. The Nest Egg Pie Chart Strategy

So, why isn’t this system taught in school and sold at brokerages? It isn’t as profitable for the broker/salesman as putting all of your dough into funds. Buy and Hold hasn’t worked since 2000, but it is still standard in the industry because it’s the only way that a broker/salesman can manage 600 or more clients. The Department of Labor advises that $19 billion is lost every year due to a conflict of interest in the financial services industry. (Credit card loans are another problem for another blog.) And here’s additional important information on the time-proven Nest Egg Pie Chart Strategy.

Over the years, we’ve identified many great hot industries that have sparked amazing returns. Between 2009 and 2011, gold miners tripled. We removed gold miners at the highs in 2011. Australia, Chile and Latin America soared in the wake of the Great Recession. The NASDAQ doubled the Dow – so we listed NASDAQ as a hot in 2011. Safe, income producing hard assets that you purchase for a good price are the best “safe” investment in today’s astronomically high debt world. Paper assets of all kinds are vulnerable to inflation, credit risk and currency moves. FDIC-insured cash is better than bonds as an interim move. However, BREXIT repriced the British pound and the euro overnight. If you wait for the headline, you’ll be late. Are You Beng Sold Down the River in Your Annuity, REIT, Dividend-Paying Stock? Annuities and insurance plans are offered by banks, brokerages and insurance companies that would be out of business if they hadn’t been bailed out eight years ago. There is no guarantee on these products. Most banks, brokerages and insurance companies have only a fraction of the capital to make good on their promises, and owe multiples more than their value. Annuities often have fees and complicated rules (with no guarantee). Everyone I know who is over the age of 60 has either lost their insurance policy or is now paying 4X the premiums for 1/4 of the coverage. Over the decades, if you'd saved and invested that money yourself, you'd have tens, if not hundreds, of thousands of dollars. Greek bonds, Detroit bonds, automaker bonds, airline bonds, etc. are not just a fluke. They are the result of high debt and borrowing from Peter to pay Paul. U.S. public debt is $20 trillion, with total U.S. debt ringing up to an eye-popping $63+ trillion. Many blue chips owe more than they are worth. Many dividend-paying REITs have been cash-negative for years. The higher the dividend the higher the risk. Sadly, there will always be a great pitch that costs you an arm and a leg. In 2000, it was the New Economy. In 2008, that bailing out the banks, insurance companies and brokerages would save the world. Meanwhile, 7 million Americans lost their homes, while over six million are still underwater. Today, unsuspecting retirees are being sold into high-risk REITs as a safe, income-producing investment, without being warned that the higher the dividend, the higher the risk. I examined the REITs sold to one 80-year-old woman. All had been cash negative for more than 3 years. The only solution to the conflict of interest that is inherent in the financial services industry is wisdom – The ABCs of Money that we all should have received in high school. If you want to make sure that you are:

Then join me at my Valentine’s Investor Educational Retreat. Click on the flyer below to learn more. Call 310-430-2397 with your questions and to register now, while there is still availability. (Only a handful of seats are still available.) You receive the best price when you register by December 15, 2016. Two Free Gifts Get your own Thrive Budget and sample nest egg pie charts at the links below. The Thrive Budget http://old.nataliepace.com/pie/thrive.php Nest Egg Pie Charts http://old.nataliepace.com/pie/pie.php

Sterling

5/12/2016 07:58:00 am

is Natalie going to blog about what's hot for 2017? Will the Trump election change the business climate significantly...

Sterling

19/12/2016 02:42:18 pm

thanks Heather...did have one more quick tangential question...Natalie had mentioned "Chile" during a coaching call with me...and I was wondering what the specific ETF would be for investing in chile. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed