|

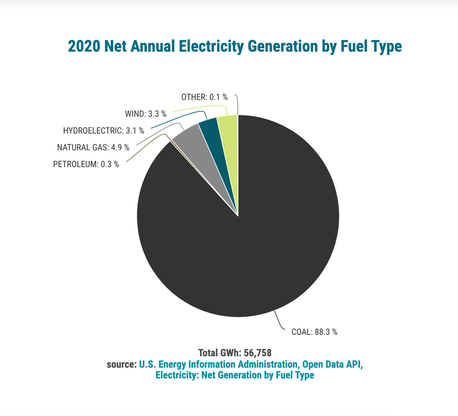

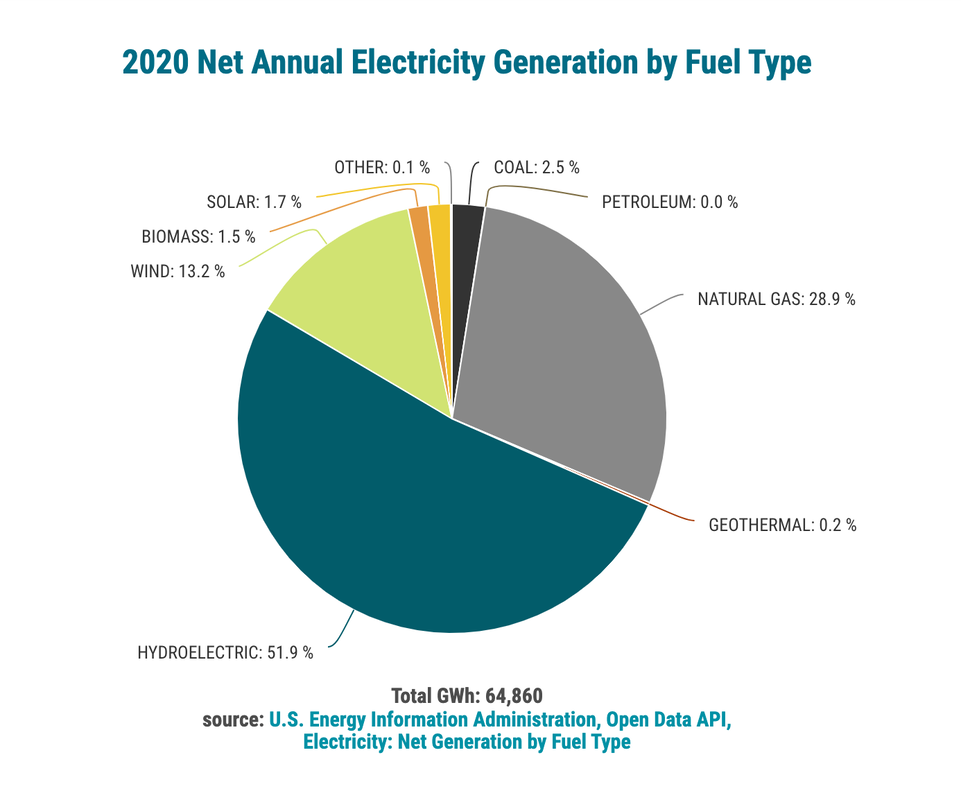

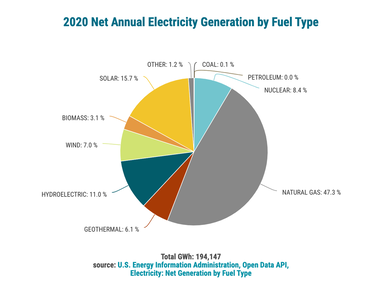

Is it Solar’s Turn to Shine? Will the Winds Blow Favorably for Clean Energy? After COP26 in November 2021, the Glasgow Climate Act warned that greenhouse gas emissions must fall by 45% from 2010 levels by 2030 (just 8 years from now) in order for global warming to be maintained at 1.5°C above preindustrial levels. Why is this so important? 40% of Americans who experienced a climate emergency in 2021 understand, as do 80% of the country that experienced unprecedented heat waves. Imagine what happens as the world gets hotter and hotter. Global warming will end lives. Species will go extinct. Sea levels will rise. Storms will become more fierce and frequent, as will fires and droughts. Under the existing emissions reduction pledges agreed to act COP26, emissions will be nearly 14% higher in eight years. If countries do not meet their 2030 targets, we’re on track for temperatures to rise 2.4°C above preindustrial levels by the end of the century. There is a tipping point where we’ll all need to be much better swimmers and desert survivalists. This is not something in the distance (of 8 years). Here and now, climate disasters cost lives and a lot of money. Swiss RE projects that climate change will reduce the global economy by up to 18%. The National Flood Insurance Program is underwater again after being bailed out in 2017, when Congress canceled $17 billion of its debt. The leaders at COP26 all know what’s at stake, as do CEOs, Senators, Presidents and NGOs. So, will countries meet their targets? Will an emphasis on clean energy mean that it is solar power’s time to shine? Will the winds blow favorably for other renewable energy projects, such as wind, anaerobic digestion, biofuel and more? To see how clean energy stocks might receive tailwinds from climate action, I took a brief look at the policies of Canada and the United States. Currently, the U.S. and Canada have some of the highest CO2 footprints in the world, at 14 metric tons per person. Australia’s is 15 per capita. That compares to 4.85 in the United Kingdom (and most of Europe), 2.8 for Mexico and under 1 for most of Africa. China is the world’s biggest polluter (with 7.4 metric tons per capita), followed by the U.S. and India (1.77 per capita). If Europe can have a CO2 footprint that is 65% lower than the U.S. and Canada per person, clearly there is a great need for reducing our reliance on fossil fuels. We can’t see what happens in the rooms where decisions are made, but we can follow the money, and dig into the comments of the Joes who are in charge of climate policy. Here in the U.S., climate change policies have been hindered by one senator, namely Joe Manchin. Joe Manchin is the Democratic senator from West Virginia. West Virginia has the dirtiest electrical grid in the United States with about 93.5% of its electricity derived from fossil fuels. West Virginia’s grid is powered 88.3% by coal, with natural gas at 4.9% and petroleum at 0.3%. Clean energy makes up just 6.4% of the grid with hydro & wind. Senator Manchin makes a lot more money from the coal industry, through his investments, than he does by being a Senator. Additionally, since coal is one of the main drivers of the West Virginian economy, he’s beholden to a lot of fossil fuel business leaders, including the billionaire coal baron who happens to be the governor of West Virginia, Jim Justice. Governor James "Jim" Justice (R) was worth $1.2 billion in 2020, according to Forbes. Justice is West Virginia’s only billionaire. In April 2021, he agreed to pay the federal government $5 million for coal mine violations (source: Forbes). When asked about his recalcitrance to champion clean energy projects, particularly since Manchin is the chairman of the Senate's Energy and Natural Resources Committee, Senator Manchin told CNN on Oct. 19, 2021, "The transition's already happening. So, I'm not going to sit back, and let anyone accelerate whatever the market's changes are doing.” Manchin has been quoted as saying that clean energy is unreliable and will cost ratepayers more money. Thankfully a lot of clean energy solutions come at the state and local level. There are incentives for utilities to increase the renewable mix, and there are tax credits for homeowners to power with solar and to improve the energy efficiency of their homes (26% this year and 22% in 2023). State level solutions are why California is powered 43% by renewables and Oregon’s grid is almost 70% clean, while many Gulf States and West Virginia are still heavily reliant on fossil fuels. Despite Congressional gridlock, Richard Sansom, the Head of Commodities Research at S&P Global Market Intelligence, believes that 2022 will be a big year for clean energy. In a report released on November 10, 2021, Sansom wrote, “It’s going to be a record year for renewable energy development in the U.S. in 2022, with 44 GW of solar and 27 GW of wind power set to be installed alongside more than 8 GW of battery storage.” Canada’s Clean Energy Commitment Steven Guilbeault is the Canadian Minister of Environment and Climate Change. Guilbeault was a director and campaign manager for Greenpeace for 10 years, and is a founding member of Quebec’s largest environmental organization. It’s not too difficult to bet that Canada reaches its climate targets before the United States does. Leadership can make swift and powerful changes. Uruguay went from having its electric grid only 40% clean a decade ago to almost 100% today. Costa Rica is 95% powered by renewables. Sweden has a goal of being the world’s 1st fossil fuel free nation. Power to the People While leaders can shape policy and fund projects, consumers have more power than we realize. We could switch off the electricity when we don’t need it and save a lot. We could take public transportation and micro mobility for at least our local errands. We could work from home. We can make a commitment to stop being addicted to oil and gassing up so frequently. We can even install our own rooftop solar, particularly if we live in a sunny state. When the pandemic forced us to stay home, global CO2 emissions dropped further than any time since World War II, at -7% below 2019 globally and down -12% in the U.S. Tax credits make rooftop and commercial solar far more affordable. Some solar companies, such as Sunpower, are providing the financing for the project. Prices are low. The benefits are fantastic for homeowners who live in sunny states (who can save thousands annually on their electric bill) and for the planet (lowering CO2 emissions might heal our home). If you’re interested in greening your portfolio, many solar and wind companies are trading at very low prices, especially compared to last year. Below is a quick rundown of the companies and what they specialize in, along with some of the math on their business. If you’d like a copy of my Solar & Wind Stock Report Card, simply email [email protected] with Solar & Wind Stock Report Card in the subject line. Daqo (symbol: DQ) is a polysilicon manufacturer based out of China. Sales growth is an astonishing 367% year over year. Their products are in very high demand. Meanwhile, the share price is the $40 range, whereas it traded above $130/share last year. Having a company with this kind of astronomical growth trading at a price-earnings ratio of just 4 is a rare and potentially wonderful buying opportunity. Sunrun (symbol: RUN) is a rooftop solar provider based in San Francisco. California is a sunny state, so it’s not surprising that sales are more than doubling year over year. Sunrun’s share price is trading at a discount of 2/3 from its 52-week high. Renesola (symbol: SOL), based out of Connecticut, is a global solar provider. The company handles both large and community-based solar projects in the United States, Europe, Canada and China. Renesola’s sales are up 57% year over year, while the share price is down over 80% from its 52-week high. If S&P Global’s projections that solar power generation will increase by 44 GW turn out to be accurate, Renesolar should benefit. Canadians might prefer to bet on the domestic solar provider Canadian Solar (symbol: CSIQ). (Americans can invest, as well.) Canadian Solar’s revenue growth is about 36% year over year. However, with a new Canadian climate czar in charge, CSIQ should see brighter days. Canadian Solar has a very low price-sales ratio and is trading at a 52-week low. AMSC (symbol: AMSC) is a company that specializes in wind power, among other product lines. Wind had a challenging 2021. However, in AMSC’s most recent earnings call, AMSC’s CEO Daniel McGahn said, “We are in position for growth through the reemergence of our wind business, which we see coming as early as next fiscal year.” One of AMSC’s other divisions is its Resilient Electric Grid technology (REG). As McGahn explains it, “The REG system can be a critical asset for utilities in helping them deal with an evolving and more complex distribution grid” (a grid where multiple different sources are providing the power). AMSC’s REG system is in place in Chicago, with the potential to expand into other major utility providers. AMSC sales were up about 32% in the most recent quarter compared to the prior year. AMSC’s share price is down by 2/3. An additional 27 GW of wind power generation in the US in 2022 will also benefit TPI Composites (symbol: TPIC), a maker of wind turbines that is based out of Scottsdale, Arizona. Supply chain issues continue to be headwind for this company. The company sales are flat year-over-year. However, if the wind business accelerates and supply chain bottlenecks get unclogged, TPIC could see a better second half of 2022. TPIC’s share price is down 80% on the year’s high, and is trading at a very low price-sales ratio. Sunpower (symbol: SPWR) is the #1 U.S. solar company, with over 35 years in the industry. The company is vertically integrated, with a solar panel manufacturing division, rooftop solar installation, homeowner financing and large-scale projects. The company’s panels are highly efficient and have helped many collegiate teams win the Solar Decathlon over the years. The company also powers commercial campuses for Toyota, Johnson and Johnson, JFK Airport and Mt. Rushmore. Sunpower’s year-over-year sales growth was 18% in the most recent quarter. Having a marketing specialist as their new CEO could bode well for the company’s rooftop expansion – particularly now that they have their own financing division. Homeowner solar tax credits are 26% in 2022 and 22% in 2023. If their sales team is successful, Sunpower could shine in 2022. Sunpower is another clean energy company that has seen its share price sink by 2/3 from its 52-week high. If you’re more interested in dividends, then you might look into a few utilities that have been leading the clean energy revolution for many years – National Grid (symbol: NGG) and Portland General Electric (POR). Both companies have share prices near their 52-week highs. (So, have a dollar-cost-averaging plan for your purchase.) National Grid’s dividend is a little higher. Sunpower, National Grid and Portland GE all have elevated debt. I didn’t mention Enphase, First Solar or JinkoSolar in this blog. However, I did include them in the Stock Report Card. I'm also giving away 21 Days of Green video coaching (free) to anyone who is interested in living a more planet-friendly life and reducing your personal CO2 emissions. Email [email protected] with 21 Days of Green for your free gift from us. Full Disclosure: I have investments in some of the companies mentioned in this blog. If you're interested in protecting your wealth, earning money while you sleep, the power of compounding gains, how to invest tax-free or how to construct and evaluate your own Stock Report Card, join us for our Financial Empowerment Retreat February 11-13, 2022 online. Email [email protected] with Retreat in the subject line or call 310-430-2397 to learn more and to register now. Access additional information, including pricing, curriculum and testimonials, by clicking on the banner ad below.  Join us for our New Year New You Financial Empowerment Retreat. Feb. 11-13, 2022. Email [email protected] to learn more. Register with a friend or family member to receive the best price. Click for testimonials & details. Other Blogs of Interest What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions Will There Be a Santa Rally? The Dangerous Debt Ceiling Game The Robinhood IPO. Will the Crypto Crash Hit Tesla, Square & Coinbase? China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! 2021 Financial Freedom Sweepstakes Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed