|

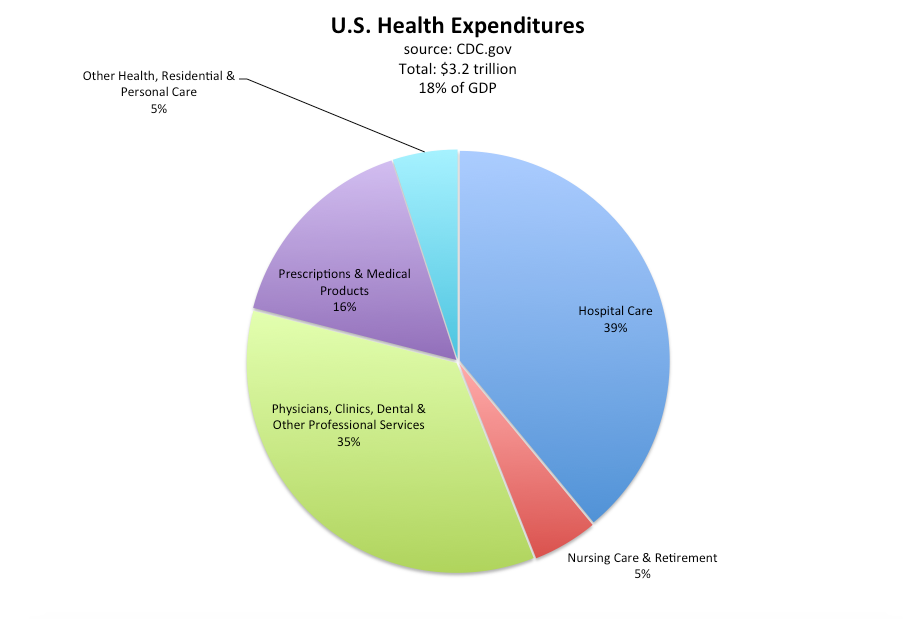

Cut Your Health Care Costs in Half. Health Insurance costs have doubled since 2013. The average person spends almost $5,000 a year on health insurance, while having the burden of a $4,000 deductible or higher! Annual family health premiums total $12,252! And that’s just the insurance side of the equation. Once you add in the cost of health care (your deductibles, coinsurances and unqualified costs), an average family could be spending $20,000 or more each year. Health care is in the top three most expensive basic needs in the family budget, alongside housing and transportation. Medical costs are the number one reason that most people declare bankruptcy, causing hundreds of thousands of bankruptcies each year. (The estimates vary widely; bankruptcies increase dramatically during recessions.) What’s clear is that staying healthy now, reducing medical insurance and medical care costs as much as you can now and preparing for retirement is key, even if you just landed your first job. When you retire, Medicare has out-of-pocket costs including deductibles, coinsurances and uncovered services (like acupuncture and long-term care), and even premiums if you want a better plan. A Fidelity study claims that the average couple will need $280,000 to cover medical bills when they retire. Fortunately, there is one simple trick that can cut medical costs dramatically, while providing far better for tomorrow. The sooner you get this information and activate it in your own life, the more you’ll save now, and the more money you’ll have squirreled away for when you need it – when you get sick or retire. (If you are already retired, you don’t qualify.) For those of you thinking the simple answer is move to a country where medical costs are more affordable, that’s not my trick (although it might work out for you). If you’re only thinking of medical costs, then moving might be a solution. Nobody spends more on health care and health insurance than Americans do. Learn more about the over-priced medical industry in the U.S. in my blog on Social Security and Medicare. However, health care is not the only consideration of retiring abroad. You also want to consider:

My one simple trick to reducing your health insurance costs and providing far better for tomorrow is the Health Savings Account. This, combined with the 3 additional strategies that are listed below, can put the odds in your favor that you can live a richer life today, promote health and even have more dough for bucket list vacations. 4 Strategies to Cut Your Health Care Costs in Half (or More) 1. Save thousands annually (tens of thousands for some) with smarter health insurance choices. 2. The best long-term health care plan. 3. Is retiring abroad a good idea for your emotional, financial and physical health? 4. Health is the best health insurance. And here are more details. 1. Save thousands (tens of thousands for some) annually with smarter health insurance choices. If you are healthy and spending an arm and a leg on health insurance, then you should consider getting a catastrophic health care plan, which could cut your health insurance expenses in half or more, combined with a health savings account. The health savings account is where you’ll start building up the funds for the ultra-high deductible. As the years add up, you’ll find that you have the money built up in your HSA for your own long-term care (something that isn’t covered by Medicare). You get a tax credit for the HSA, and can even invest the funds to earn money while you sleep. Learn more about HSAs in my blog and at IRS.gov. 2. The best long-term health care plan. The Health Savings Account is your best long-term health care plan. Health insurance cancels if you miss a payment. Your HSA stays with you through thick and thin, no matter where you work, and acts as a great supplement to your retirement account. Health care costs increase dramatically as you age, so having an HSA is an important part of your retirement plan. If you are already retired, then you’ll need to develop a financial plan for your long-term care. (Get more than one opinion on this -- not just your "financial planner," who might have a strong incentive to just sell you more insurance that might not be your best plan.) 3. Is retiring abroad a good idea for your emotional, financial and physical health? When considering retiring abroad, consider your emotional, financial and physical health, in addition to the health care costs. Are you comfortable moving so far away from family? Are there other risks to where you are moving? Political? Environmental? Natural disasters? Economic? The South of France has long been a popular place for the world’s elite to own a home and/or yacht. Over the past few years, however, there has been an exodus of ownership (after the high profile terrorist attacks). Over 11,000 Puerto Rican residents are still without power – and up to 1/3 were without power four months after Hurricane Maria. It’s easy to fall in love with a foreign destination while on a vacation. Make sure that the bliss bubble can hold up after a hurricane or during political upheaval. 4. Health is the best health insurance. The truth is that eating right and exercising goes a long way to reducing your health care costs and increasing your income. (You can’t work if you can’t get out of bed.) Almost 40% of American adults are obese, with 18.5% obese children. The price tag of obesity is over $147 billion, adding about $1500/year, at minimum, to personal medical costs. Being fit is the best way to regulate your blood pressure and can keep the pain out of vulnerable joints. Aerobic activity keeps your mind active and alert. Getting an HSA is not an extra bill. It is one of the easiest ways to put money back into your family budget by cutting your health insurance premiums (many times by half or more), while also reducing your tax bill. (HSAs offer a tax credit.) If you are healthy and spending an arm and a leg on health insurance, then you owe it to yourself to learn more. (Your health insurance salesman is not going to be the best source of this information. She has an incentive to keep you paying high premiums.) If you are interested in learning more about how to save thousands annually with smarter big-ticket choices, in protecting your retirement, in living a richer life today and providing far better for tomorrow, then request a 2nd opinion on your current budgeting/investing strategy from my office. You can also join me at one of my next Investor Educational Retreats. Call 310-430-2397 or email Heather @ NataliePace.com to learn more.

Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed