|

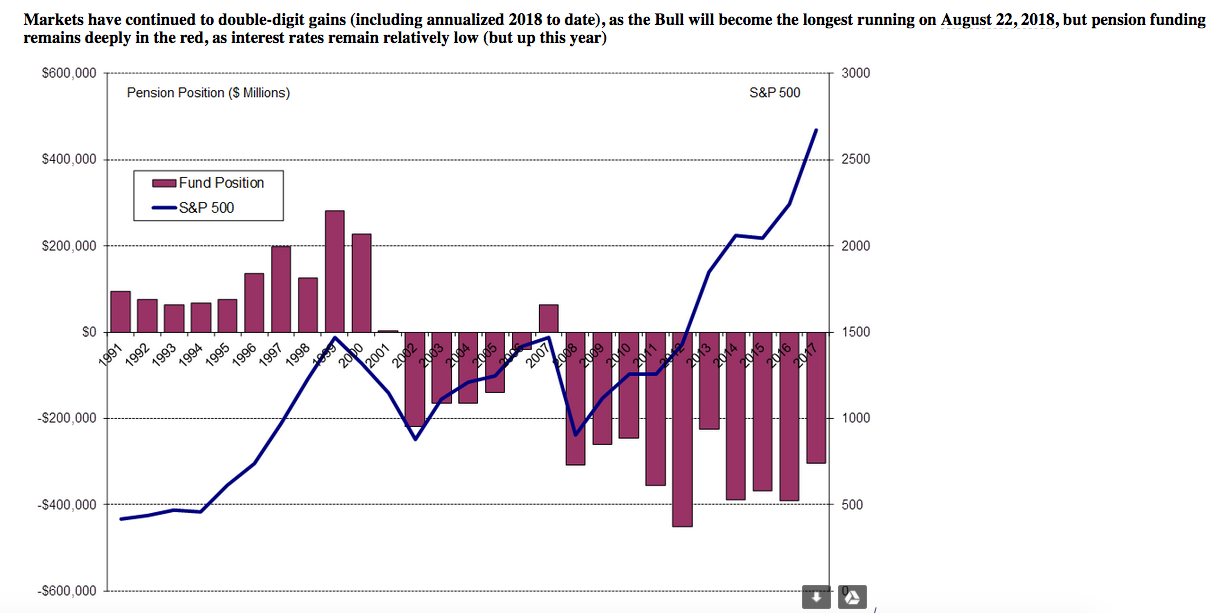

Pensions In Peril. Verizon & AT&T Top the Underfunded OPEBs List. Teamsters & UFCW. New Jersey, Kentucky & Illinois. The Pension and Health Care Crisis. Are You Banking on a Broken Promise? 160 multiemployer pensions have received notices from the Department of Labor notifying the trustees that the plans are in critical or endangered status, with some plans predicted to dry up in just a few years. (Click to check if yours is one of them.) The Pension Benefit Guaranty Corporation, the U.S. government agency that steps in when plans fail, is also expected to become insolvent in just a few years – by full year 2025 (7 years). S&P500 Corporations are underfunded on their Pension and Other Post Employment Benefits by almost half a trillion dollars, at $453.6 billion (source: S&P Dow Jones Indices). Social Security and Medicare have also announced insolvency dates of 2034 (16 years) and 2026 (8 years), respectively. So, are you banking your future on a promise that is likely to be broken? 2017 was a great year for stocks. The Dow Jones Industrial Average rewarded investors with over 25% returns. That improved things somewhat, but not as much as you might expect out of the longest bull market ever. This year, so far, the returns have been rather tepid, at just 2.5% in the DJIA, as of August 10, 2018. That and actuary projections have prompted many pension funds to lower their expectations for returns going forward, with CalPERS planning on 6.2% annualized returns over the next decade. Lower returns mean that increased employer contributions have to pick up the slack, which might actually exacerbate the problem. According to a CalPensions press release on April 16, 2018, “The new rates may force some service cuts, employee reductions, tax increases and test the “sustainability” of current pensions.” CalPERS services 3000 local governments – over half of which are schools. Another problem is that if your fund does fail, and the PBGC picks up the slack, your benefits are likely to be cut dramatically. United Airlines pilots discovered this in 2005. The maximum monthly payment for 65-year-olds of a single-employer plan is $5,420 in 2018. If you are in a multiemployer plan, like the Teamsters or the Radio Television and Recording Arts Pension Fund, the PBGC payout for 30 years of service is substantially lower, at a paltry $12,870 per year or less. So, it pays to make sure that your union’s pension is not on life-support. Once it is, you will not be able to receive a pay-out, and may receive a very large pay-cut. In addition to the pension problems, there is even greater underfunding in Other Post Employment Benefits, such as health care. Pensions in the S&P500 were 85.6% funded in 2017, while OPEBs were only funded at a level of 32%. The companies most underfunded on their Other Post Employment Benefits in 2017 were: Verizon ($18.3 billion), AT&T ($18.1 billion), Exxon Mobil ($7.7 billion), General Motors ($6.4 billion) and Ford ($6.2 billion). The public sector is in an even more perilous situation than the private sector. Only Wisconsin is fully funded on its pension promises. New Jersey, Kentucky, Illinois, Connecticut and Colorado had less than 50% in their coffers for pensioners in 2017 (source: Bloomberg). Politicians are trying to find piecemeal solutions for the endemic crisis that stems from people living longer, with medical care costs that have soared astronomically since 1980. The pension system was created after World War II, when the average life expectancy was 65 in the U.S. Today, people are living to 78 on average in the U.S. (Higher in Canada). Corporations have given up making these promises, leaving individuals with the task of funding their own self-directed retirement plans. It is the older corporations, the public sector and the union-based multiemployer plans with legacy promises that are struggling, and sometimes failing, to keep their pension and OPEB promises. What can you do about this crisis? Perhaps one of the most important remedies is to start funding health savings accounts and retirement funds for yourself and for the younger generation, who will have little to no safety net going forward. Educate them on the importance of this, and how the tax credits can lower their tax bill (meaning this is not an extra burden on their budget). Downsize now to make sure that your lifestyle is sustainable with less income. (You can learn how to save thousands in your budget with smarter big-ticket choices in my books, my coaching and at my retreats.) Consider supporting legislation that eliminates the current age limits on contributing to your own traditional retirement and health savings accounts*. You might also weigh the benefits of taking a buyout from your pension provider, if it is still possible. According to the LA Times, LAPD police chief Michel Moore received a $1.27 million DROP payment for retiring as chief of operations, then returned to the same job at the same pay a few weeks later, before he accepted the top position at the police force. If he had not done this, he would have had to choose between accepting the million-dollar-plus retirement package or becoming police chief. There are arguments made for both sides of this dilemma. However, clearly if everyone gamed the system in this way, pensions and OPEBs only race more recklessly toward demise. “For individuals, the impact of personal wealth depletion – via diminished home equity, low-yield savings and fixed income investments, prolonged high unemployment, lower paying jobs and reduced pensions and OPEB – has left retirees with little ability to retire,” according to Howard Silverblatt, the senior index analyst of S&P Dow Jones Indices. Howard disclosed in this year’s pension report that he has his two kids contributing to their Roth IRAs already, in preparation for a future without a public safety net. *You can contribute to a 401k and a Roth IRA, regardless of age. You can’t make regular contributions to a traditional IRA in the year you reach 70½ and older. After retirement, and beginning with the first month that you are enrolled in Medicare, you are no longer eligible to make contributions to an HSA. Other Articles of Interest Unaffordability: The Unspoken Housing Crisis in America How a Strong GDP Report Could Go Bad. 5 Harbingers of Recessions. And how you can protect yourself. Cut Your Health Care Costs in Half. Interest Rates Keep Rising. Should you lock in a fixed? Social Security and Medicare Warn of Depletion. If you'd like a second opinion on your current budgeting and investing strategy, call 310-430-2397. Attend Natalie Pace's next life transformational Investor Education Retreat to protect what you have, earn money while you sleep and save thousands annually with smarter big-ticket choices. Watch how fast your life transforms when wisdom and time-proven strategies are the foundation of your fiscal health! Call 310-430-2397 or email Heather @ NataliePace.com to learn more now. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed