|

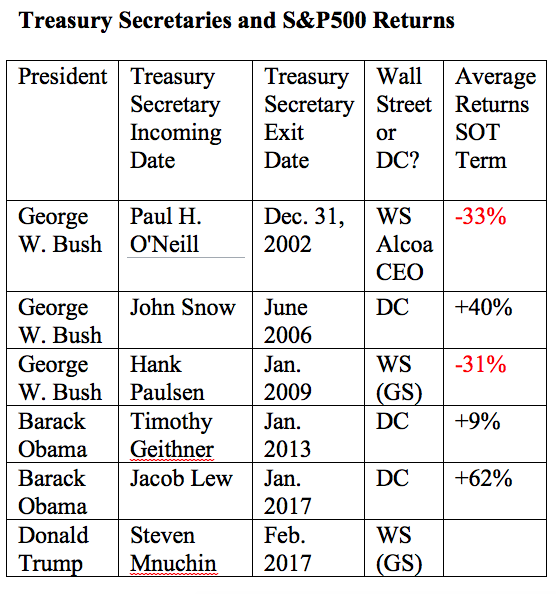

What’s The Smart Money Doing? Basic supply and demand tells you that prices decline when people sell en masse, and increase when there is colossal buying. Knowing what the big money is doing can help the Main Street investor get it right. So, what’s the smart money doing these days? The Federal Reserve Board The Federal Reserve Board announced that they will begin divesting themselves of the bonds they are carrying in a timely manner “relatively soon,” assuming the economy doesn’t tank. They are selling their long-term Treasury bonds and their mortgage-backed securities. Kathy A. Jones, SVP and the chief fixed income strategist of Charles Schwab Inc. & Co. believes this will impact interest rates on mortgages, and encourages everyone who is able to secure a fixed-rate on their mortgage to do so now (from my interview with her on July 19, 2017). Corporations The stock market gains of the last few years have been thanks to cheap, easy money. The Feds kept interest rates at zero. Companies, even heavily indebted companies, could borrow almost free capital, and buy back their own stock. Thus, stock buybacks were robust, just as they were prior to 2007 (the year before the Great Recession). Buybacks have come to a screeching half of late. Buybacks were down 17.7% year over year in the first quarter of 2017. As Howard Silverblatt, the senior index analyst for S&P Dow Indices wrote on June 21, 2017, “Companies may need to make money the old-fashioned way – earn it.” (For information on how companies can push up earnings by buying back their own stock, read my blog on “Financial Engineering.”) Less insider buying also means less price support. Companies are relying upon future push-ups in stock price to come from investors. The bottom line is that the corporate “smart money” has pulled back on purchases of their own stock. What Happens When Wall Street Invades Washington? A 17-year Goldman Sachs veteran is the Secretary of the Treasury. A hedge fund owner is now the head of communications at the White House. Is it “smart” for someone who earns in the multi-millions annually to lop two zeroes off of his income and take a job in government that pays $170,000 or less? The answer is yes, sometimes. When someone is willing to take that kind of pay cut, Main Street should be alarmed and take note. First of all, here’s how the math works. A salary of under $200,000 doesn’t come close to funding the lifestyle of a one-percenter! How can they even afford to do this? Hmmm… What few Americans realize is that at the top of a bull market, taking the government job and being forced to sell high (when otherwise there might be constraints on how much they can sell, and when) and having the taxes on that sale deferred can be the biggest payday of all. As one example, Henry Paulsen was “forced” to sell over $500 million of Goldman Sachs stocks to become the Treasury Secretary in June of 2006. He was allowed to use the proceeds to purchase government bonds, under a Certificate of Divestiture, which means he paid no taxes on the sale of that half a billion (or more) in stock. When he sells the T-bills, he’ll be liable for the capital gains then. However, the sale can be spaced out, and the tax rate on long-term capital gains is currently 20%, roughly half of what the earned income tax rate can be. So, guess how closely correlated market losses are with having a Wall Street Treasury of the Secretary? As you can see in the chart above, since 2000, Wall Street rallies were all under the tenure of Treasury Secretaries who came from politics. The crashes occurred under the aegis of the one-percenter Wall Street veterans. It just doesn’t pay for Wall Street executives to take a salary that is a rounding error of their earning potential during bull markets. The payday comes when they get to sell en masse high without taxes, while their colleagues are vulnerable to losses, and would go to jail if they tried to dump all of their insider holdings at once. Not surprisingly, Anthony Scaramucchi is seeking a federal tax break for his sale of Skybridge Capital. He calls it “taking a mega-opportunity cost for getting rid of all of your assets.” Others might see it as selling high and keeping all of the money, while deferring taxes, which can be the biggest payday of all, particularly if the markets head south. The bottom line is that having so many Wall Street guys (i.e. the “smart money”) willing to take a meager salary for a job on Capitol Hill is not a good sign for investors. They don’t do that unless it adds up. Remember that market timing doesn’t work. The systems that I’ve taught in my Investor Educational Retreats have outperformed the bull markets and earned gains in the bear markets since 1999, at a time when most people have lost more than half in two of the worst recessions the U.S. has seen since the Great Depression. Call 310-430-2397 to register for my Old West Financial Empowerment and Healing Retreat, which will be held in Arizona Oct. 13-15, 2017. Register by Monday, July 31, 2017 to receive the lowest price.

Prashant Shah

20/8/2017 07:25:39 am

Very timely and well explained blog. 21/8/2017 06:35:16 am

Thanks Prashant Shah. If you'd like additional information on how to protect yourself, reach out to my office at 310-430-2397 or [email protected]. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed