|

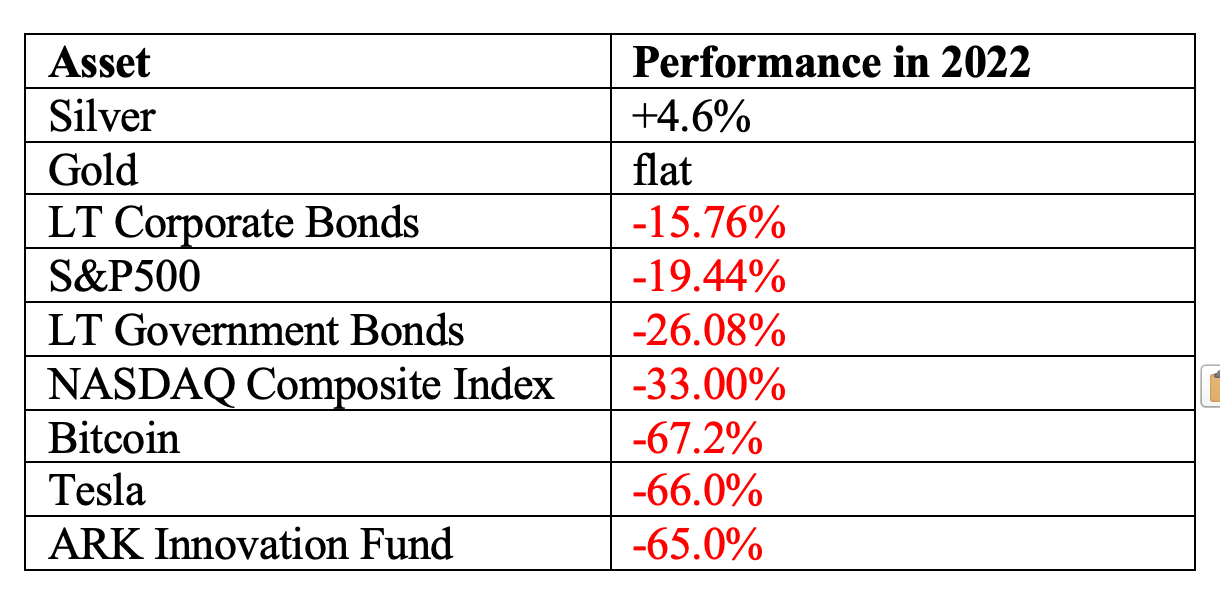

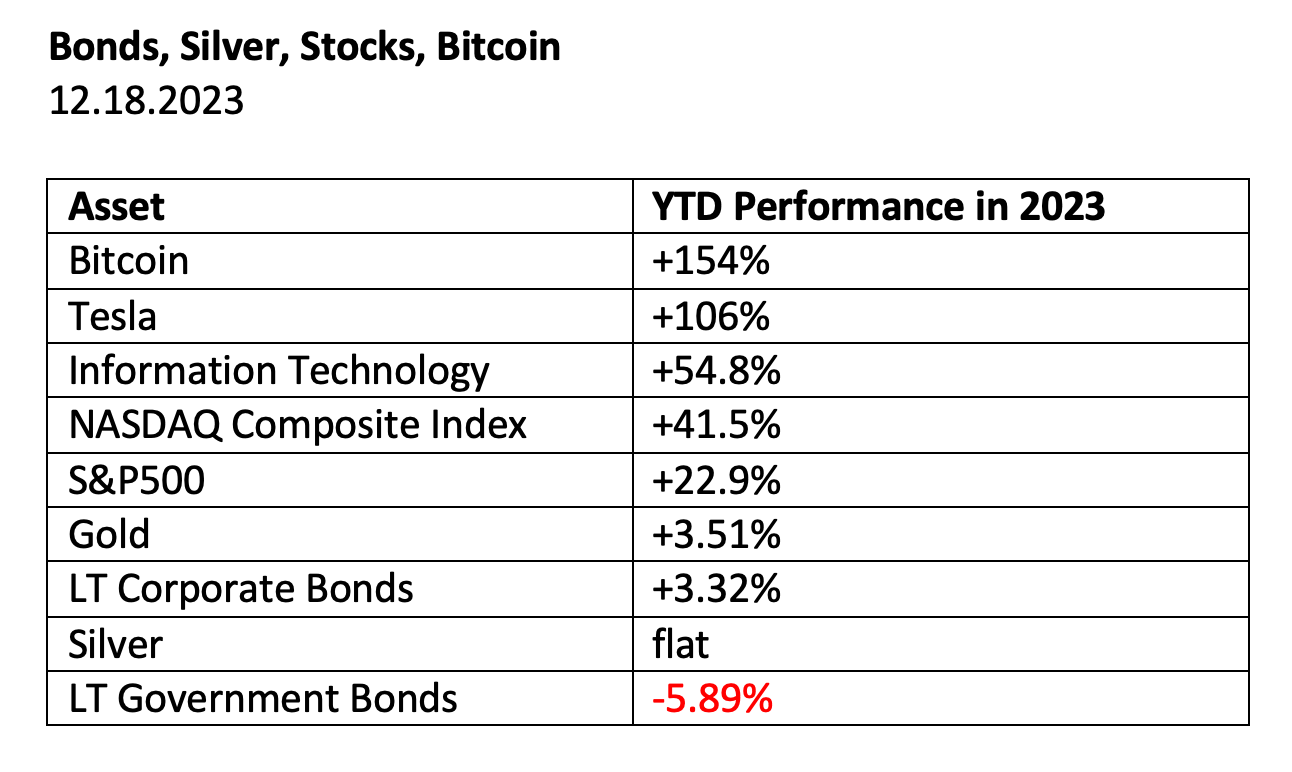

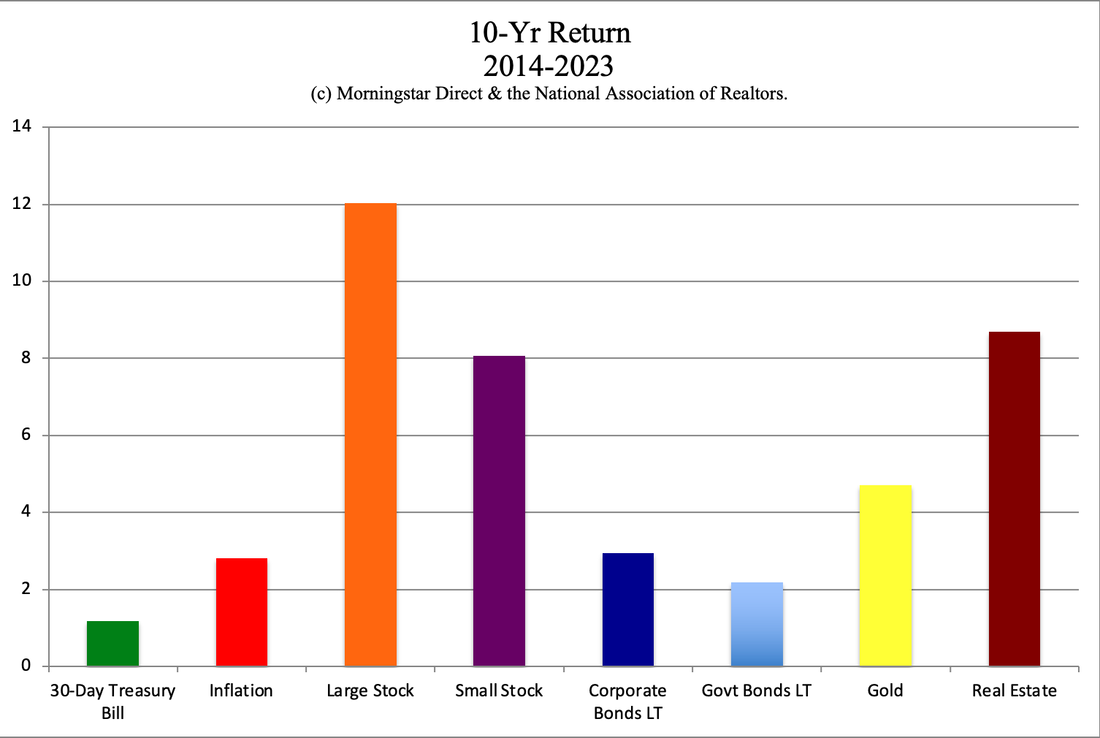

AI, Gold and Copper are on Fire. Sunpower Doubles. The last year and a half have been on fire for Wall Street. However, as I’ve mentioned a lot this year, the gains were concentrated in just a few companies, all with a strong technology presence. The Fantastic 5 include: Alphabet (Google), Amazon, Meta (Facebook, Instagram), Microsoft and Nvidia. Breakthrough technology, including artificial intelligence and led by AI’s powerhouse Nvidia, has more than doubled the returns of the Dow Jones Industrial Average this year. If you don’t have large cap growth or technology-targeted fund, your portfolio is lagging the S&P500. The iShares Breakthrough Technology ETF (TECB) has almost doubled off of its 2022 low, while the S&P500 has performed at half the speed, and the DJIA rose 35%, over the same period. (All of the gains are quite impressive, until you factor in the 2022 losses. Keep reading.) Other stronger performers include copper, gold, silver, cryptocurrency, and this week’s new meme stock phenomenon, Sunpower Corporation. Incidentally, breakthrough technology, artificial intelligence, copper, silver, clean energy and crypto have all been identified as hot industries for years in our Financial Freedom Retreats. Hot slices add performance to our wealth plan – particularly if we are smart about proper diversification and 1-3 times a year rebalancing. Here are the industries we’ll discuss in this blog. Most are outstanding performers. However, I’m also going to address a few of the hots of bygone years, which have performed dismally of late (and what you might do about that). We’ll also discuss key dates for our rebalancing. Breakthrough Technology and Artificial Intelligence Copper Gold/Silver Cryptocurrency Biotechnology Cannabis Clean Energy ETFs: Solar & Sunpower Key Dates for Rebalancing our Wealth Plan And here are the details on each point. Breakthrough Technology and Artificial Intelligence Without the gains of the Magnificent 7 last year, the S&P500 would have returned under 10% instead of the spectacular 26% total gains. A lot of people, especially those with retirement plans or accounts that are managed by conservative money managers, have lagged the indices because they are missing large cap growth. “Conservative” plans are not living up to their name in today’s Debt World because long-term government bonds lost even more than stocks did in 2022, with -26% losses. LT bonds did very little to make up those losses last year, with only a 2% rise off the dive. An important thing to remember about the fever around artificial intelligence and technology is that most of the spectacular performers of 2023 were the stark losers in 2022. The hottest industries on Wall Street have seen extreme peaks and plunges, especially since the pandemic. We have a plan for managing volatility that is quite literally as easy as a pie chart. It doesn’t require day trading or taking on a second career, although being the boss of your money and making sure that your plan is age-appropriate, properly diversified, protected and rebalanced is one of your most important jobs (rather than having blind faith that someone is doing this for you). When we employ our pie chart system, with once, twice or three times a year rebalancing, we are prompted by the system to do what we should do – capture gains at the high and buy more at a lower price when equity prices fall. (Headlines quite consistently prompt us to do the opposite of what we really should be doing.) If you don’t have any breakthrough technology or large growth in your current wealth plan, dollar-cost-averaging in (since equities are near an all-time high) is a good tool to use. You can learn how to do this at our June 8-10, 2024 Financial Freedom Retreat. Get the best price when you register by Wednesday, May 15, 2024. Email [email protected] or call 310-430-2397 for prices, information and to register now. Copper Copper prices are at their 5-year high. It’s human instinct to want to buy high when something gets this hot. The industry fundamentals for copper are strong. Goldman Sachs calls copper the New Oil because it is essential to the clean energy revolution. There is exceptionally strong demand for copper, and a few of the producers are off-line this year, which is constraining the supply a bit. We have seen copper mining stocks, as well as the ETFs of countries that are rich in copper, soar this year. However, there is more to consider. Copper is called Dr. Copper on Wall Street because the prices tend to be the first to fall when an economy skids towards a recession. The US economy has been resiliently strong over the past few years, growing in spite of economic warnings that high interest rates could spark a contraction. However, there are a lot of alarming factors that could trip up the trend, including persistent inflation, wars, supply chain disruptions, natural disasters, excessive debt, half empty office buildings, low credit quality in over ½ of the S&P500 companies, or consumers pulling back on their spending. It is certainly possible that copper prices will go even higher than they are right now. However, since business cycles hit copper first historically, it’s a good idea to capture gains, while prices are high. This is not about divesting everything at the high. If we still believe that copper is essential going forward (it is), we would trim it back to an age-appropriate hot slice of our wealth plan. Keeping our money (by selling high) makes it easy to add more at the low, if prices fall. If the prices keep rising, we’re still invested and profiting. In the pie chart system, when our slice becomes two slices because it has doubled in value, we can sell high and trim it back to one. The pie chart system with regular rebalancing is a buy low, sell high plan on auto pilot. It prompts us to do what we should be doing. (You can read about how to do our pie chart strategy in The ABCs of Money, or learn and implement it at our Financial Freedom Retreats.) Gold/Silver Silver is up 30% in the last three months. However, gold and silver have really lagged stocks over the past decade. What is causing the interest in gold and silver this year? A lot of the demand has to do with the BRICS currency, and China wanting to have enough gold to back their yuan with the precious metal. Historically, silver runs in tandem with gold, which is why we are seeing silver rising, too. (Read my recent blogs by clicking on the blue-highlighted words.) Below is a chart of the top holders of gold. I have highlighted countries in blue that have purchased more gold over the past year. (Red means the country has sold in the past year.) Silver’s high was $48.70 in 2011. At a current price of $28.44, it would be gaining 71% if it returns to its all-time high, which is why silver has a potential to outperform gold. Gold is already trading at an all-time high, and is only 23.6% higher than its 2011 peak. Both gold and silver can be a hedge against inflation and weakness in equities. The fever around artificial intelligence reminds me of the Gold Bug frenzy of 2011, when investors wanted to pull out of stocks and pile into gold (a disastrous decision as you can see from the 10-year performance chart above). Here is where having a few hot slices can be a tool to protect us from ourselves. Whenever anything gets hot, we are tempted (by opportunists, marketers, salesmen and scam artists) to think that we have to dive in with all we’ve got. There is no shortage of YouTube videos, influencers, emails and financial advisors who will encourage us to put all of our eggs in one basket. If we really believe in something, use it as a hot slice or two of our age-appropriate, diversified wealth plan. This protects us from gambling too much on one thing, while rebalancing prompts us to be on the right side of the trade during periods of volatility. Cryptocurrency Cryptocurrency is another perceived safe haven that experiences great volatility. Cryptocurrency was by far the best performer in 2023, and it was also one of the biggest losers in 2022. (See the charts above.) Capturing gains at the highs of 2021 would have given us the liquidity and the emotional fortitude to buy low when Bitcoin plunged -66% in 2022. Instead of shivering through the Crypto Winter and finally crawling back to even, we would be elated with the 171% 2023 returns. Are you interested in cryptocurrency as a hot slice? Wondering which brokerage account you should use, which coin you should buy, and whether an ETF is the best plan? I discussed all this and more in my free Crypto videoconference. Go to YouTube.com/NataliePace to watch it back. Biotechnology In 2020, after getting approval for its vaccine, Moderna showed the most spectacular year-over-year revenue growth that we have ever seen, at 23,000%. Now that we’re on the backside of the pandemic, the company has seen its revenue plunge by -64%, from $19.3 billion in 2022 to $6.85 billion in 2023. Moderna was yet another example where taking gains early was essential. We named Moderna the Company of the Year on May 18, 2021 at $160/share. When the stock hit $437.67 on Sept. 21, 2021, we encouraged readers to capture spectacular gains of 174%. The stock is now at $128.32. One way to manage this type of volatility is to purchase a biotechnology ETF, instead of the individual companies. If you prefer to look at your investments once or twice a year, rather than babysitting them and learning how to be a great stock picker, this is an important distinction to make. I just hosted a Stock Master Class this month, teaching Main Street investors how to evaluate the forward outlook and the potential of an investment, rather than letting our emotions get the best of us. Emotions will always put us on the wrong side of the trade, prompting us to sell low and buy high, until we learn how to employ due diligence, wisdom and right action. (Again the pie chart with regular rebalancing require no stock picking and is a time-proven, 21st Century strategy.) If you have a lot of individual stocks that are trading very low, rather than just selling low because you think they’re never going to rise again, it’s important to evaluate what the best strategy is now and going forward. Can that money be invested elsewhere for a better return, or are we just selling low? I offer an unbiased portfolio analysis in my private coaching program. This is a great way to redecorate your financial house. Once the interior design of your wealth plan is beautiful, regular rebalancing and Spring cleaning will be much easier. Email [email protected] or call 310-430-2397 for pricing and information on my private coaching. Cannabis Cannabis, like GameStop, Bed, Bath and Beyond and even Blackberry, were all meme stocks. The difference with cannabis was that the rapid trend of legalization and decriminalization showed great promise for companies that were developing CBD beverages, in addition to other adult use recreational products. (Gamestop, BBB and Blackberry were getting killed by the competition.) So what happened to cannabis and why are so many companies restructuring their debt, going out of business or expanding their product line into other things? Even though cannabis is only illegal in 4 states, there is still a huge demand for the black market. That is the biggest competition. When people purchase gummies, buds or other weed products at a dispensary, they have to show their identification. They pay more. Celebrities and business leaders, as well as regular folks, do not want others to know their private business. (You don’t have to do this to buy alcohol or cigarettes.) They prefer to have their weed delivered to their doorstep at half the price, with complete anonymity, in other words, through the black market. Tilray has pivoted to selling craft beer, whiskey and hemp-based health supplements at Whole Foods, in addition to its CBD beverages, medical cannabis and adult use products. Tilray purchased Shock Top from Anheuser-Busch on August 7, 2023, and has acquired many craft breweries and distilleries over the past few years. This has resulted in year-over-year revenue growth of 29.36%, while Canopy Growth saw a decline in revenue of -22.44% from a year ago. As Irwin D. Simon, Tilray Brands’ Chairman and Chief Executive Officer, stated in the 3Q fiscal 2024 earnings press release, “Over the past several years, our playbook of expanding our cannabis business to complementary markets such as beverages and hemp-based consumer products has positioned us well to navigate the current environment and to benefit from future growth opportunities.” At the same time, Tilray stock is still being hammered, and is trading at an all-time low of $2.09/share. Tilray lost -$105 million in the most recent quarter, and has $226 million in cash and cash equivalents. Email [email protected] if you’d like to receive our most recent Cannabis Stock Report Card. Clean Energy ETFs: Solar & Sunpower Sunpower is the latest meme stock. This week, influencers are promoting Sunpower as a YOLO HODL short squeeze (ala Gamestop?). How high will it go? The stock has more than doubled in the last five days. The short squeeze aficionados are hoping that this Friday’s options expiration date could send the stock soaring into the stratosphere. The facts are that Sunpower is struggling. The company narrowly averted bankruptcy, and will restate 2023 earnings. Their 1Q 2024 earnings report will be late. 2023 was a year that saw a net loss of -$247.11 million. The 4th quarter saw a year-over-year drop in revenue of -28%, from $498 million in 2022, to $357 million in 2023. Of course, both AMC and Gamestop had bleak outlooks when meme stonk Wall Street gamers took the companies to the moon. A safer bet that could yield delightful returns would be to invest in a Clean Energy ETF that is rich in solar. Solar is projected to provide 41% more electricity in 2024 than it did in 2023, according to EIA.gov. Yet the iShares Clean Energy ETF ICLN is trading at a -58% discount from its Jan. 2021 high of $33/share. Of course, this is definitely an industry that could suffer if a fossil-fuels friendly President is elected in November. (You’re the boss of your money; you can choose your own hot industries.) Clean energy is another industry, such as breakthrough technology, cryptocurrency, gold/silver and even copper, that experiences wild volatility. Between the $8.70/share lows of the pandemic and the $33/share highs in January of 2021, ICLN tripled in share price. Regular rebalancing is key to realizing that outstanding performance. Key Dates for Rebalancing our Wealth Plan The Spring Rally The Santa Rally Back to School Stock Sales Each of the above market trends make for good times to do our rebalancing. If there are strong Spring and Santa rallies, we can rebalance and capture gains at the end of April and the end of December. There is a market aphorism that reminds us to do this: Sell in May and go away. September tends to be the worst performer of the month. So, if we do our rebalancing at the end of September, we might find some areas of opportunity to buy at a lower price. Bottom Line Now (at the end of April) is a great time to rebalance our plan and make sure that it is properly protected, diversified, and age appropriate. Regularly balancing helps us to capture gains and increase our wealth, instead of just riding them up and down. What’s hot and what’s safe change every year. For this reason, a lot of our volunteers attend the retreat at least once a year to peer into what opportunities and challenges lie ahead. This helped retreat attendees to lean in to real estate as early as 2009, while avoiding the devastating plunge during the Great Recession (with our stark warning in April of 2005 to avoid real estate). We’ve had breakthrough technology, artificial intelligence, clean energy, and Peru (a copper rich country) on our hot list for years. Investors weren’t getting paid to take on the risk of long-term bonds, and have been paying for that decision in losses for the past decade. (Our safe plan warned to avoid the losses, and lean into real estate, which more than doubled.) Join us at our June 8-10, 2024 Financial Freedom Retreat. Learn how to protect your wealth, hedge against a weaker dollar, invest and compound your gains, green your retirement plan, easy and efficacious nest egg strategies, how to get hot and diversified (including in artificial intelligence and EVs), how to evaluate IPOs and other stocks, and what's safe in a Debt World. You'll even discover how to save thousands annually with smarter big-ticket choices. Yes, it's a complete money makeover. Email [email protected] to register. Learn the 15+ things you'll master and read testimonials in the flyer on the home page at NataliePace.com. Register by May 15, 2024 to receive the best price. "Ten minutes into the first day I was already much smarter about investing than I ever thought I would be in my life and I knew I was in exactly the right place at this retreat. I am amazed at how EASY and FUN it is to make my money work for me and those I love. I think this kind of information should be compulsory in schools. I wish I'd learned this sooner." CM If you’d like an unbiased 2nd opinion on your current wealth plan, email [email protected] for pricing and information.)  Join us for our Online June 8-10, 2024 Financial Freedom Retreat. Email [email protected] or call 310-430-2397 to learn more. Register by May 15, 2024 to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 7-14, 2025. Email [email protected] to learn more. Register by May 30, 2024 to receive $200 off the regular price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two and three 50-minute private, prosperity coaching sessions!  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is are the most recent releases of these books. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Substack podcast on Apple and Spotify. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Sell in May and Go Away? What About the Election? Vacations that Color Our World Forever. The Magnificent 7 Drop to the Fantastic 5 9 Inflation, Budgeting, Debt Reduction and Investing Solutions. China & Russia Double Their Gold Holdings. 2024 Investment of the Year? The Reddit IPO. Meme Stock or Snap Land? Tesla's Factory in Germany Taken Offline by Activists. Bitcoin Sets a New Record High. The Importance of Rebalancing. Beyond Meat's Shares Surge. Quaker Oats' Pesticide Problem. Stocks are Flying High. Why Aren't Mine? Cut Your Tax Bill in Half. 9 Tips. Celebrity Jet CO2. Green Washing. The Facts. Some Solutions. Copper: Essential to the Clean Energy Transition. Uh. Oh. More Bank Trouble. Are Amazon, Square and Other Tech Companies Ripping Us Off? Housing. Unaffordable. What Works? Case studies and creative solutions. Don't Reach for Yield. Closed-End Funds. 2024 Investor IQ Test. Answers to the 2024 Investor IQ Test. Apple's Woes Drag Down the Dow. The Winners & Losers of 2023. Ozempic, Magnificent 7 & Beyond. 2024 Crystal Ball. The Underperforming DJIA, Full of Fossil Fuels and Forever Chemicals. A Spectacular Year for 3 of the Magnificent 7. The Best ROI* (Almost 40%!) & 7 Life Hacks That Save Thousands. Portugal Eliminates Tax Advantages for Ex-Pats. Earn $50,000 or More in Interest. Safely. Finally. WeWork's Bankruptcy. Half-Empty Office Buildings. Problems in our Personal Wealth Plan. Solutions for Unaffordable Housing. Cruise Ships Give Freebies to Investors. Should You Take the Bait? Should You Take a Cruise? Bonds. Banks. The Treacherous Landscape of Keeping Our Money Safe. 7 Rules of Investing 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) Lithium. Essential to EV Life. Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Are There Any Safe, Green Banks? 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. Which Countries Offer the Highest Yield for the Lowest Risk? Why We Are Underweighting Banks and the Financial Industry. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed