|

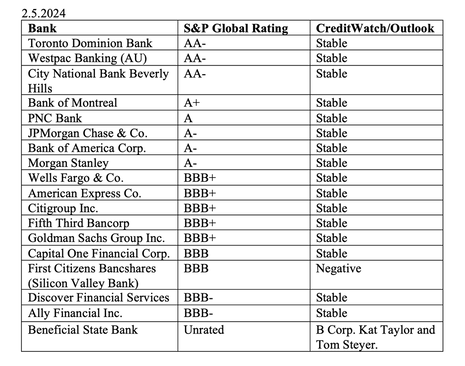

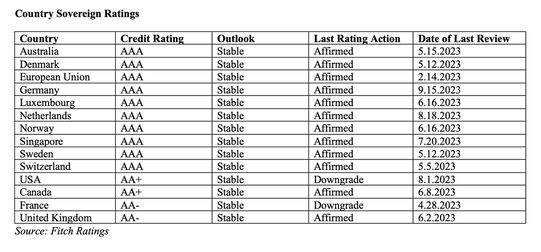

Uh Oh. More Bank Trouble. Last February 10, 2023, we published a blog advising everybody that we were underweighting the financial industry. Little did we know that the first bank failure of 2023 was only a month away! Silicon Valley Bank was seized by the FDIC on March 10, 2023. That was followed very quickly by the failure of Signature Bank on March 12, 2023. First Republic Bank was rescued by JP Morgan on May 1, 2023. Since then, news about banks has been fairly quiet, although there have been two more failures, one in July and another on November 3. The bank that began having troubles last week is the same one that took over Signature Bank – New York Community Bank. Today, Moody's downgraded NYCB to junk. Here are a few things we’ll cover in this blog. New York Community Bank If You Wait for the Headlines, It’s Too Late Low Credit Quality in U.S. Banks Financial Engineering Our Own Checking, Savings & CDs The High Cost of Debt (More than Defense) Bottom Line And here is more information on each point. New York Community Bank On Wednesday, January 31, 2024, the New York Community Bank released their fourth quarter and full year 2023 earnings at 7 AM before the market opened. By the time the market did open two and ½ hours later, the bank’s share price had already lost a third of its value. What happened? If You Wait for the Headlines, It’s Too Late What were investors so worried about? One of the concerns was that the dividend was slashed from $0.17 a share in the third quarter to just five cents a share, so that the company could “build capital.” As we saw with General Electric in 2017 and countless other troubled companies since, the higher the dividend we are receiving, the higher the risk that we are taking on. If the dividend gets slashed, there is a gap down in the share price before most Main Street investors can react. NYCB closed with a share price of $10.38 on Jan. 30, 2024, and opened on Wall Street the following morning at $7.12. The current price is $4.20 – down almost -60% on the week. Rather than being cut on the wrong side of the blade (errr trade), it’s better to be protected before the trouble occurs. One way of protecting ourselves is to underweight U.S. financials in our wealth plan. Below are a few reasons why. Low Credit Quality in U.S. Banks We’ve also been warning about the commercial real estate industry. CRE and long-term bonds are two of the major challenges of banks today. WeWork declared bankruptcy on November 6, 2023, but there are many other CRE REITs in distress. As we indicated in our November 9, 2023 blog, the vacancy rate in office buildings remains heightened in a post-pandemic, work-from-home world. Some of the most vulnerable cities are experiencing vacancy rates that are higher than 20%. New York City is one of the areas in the throes of the CRE crisis, which is at the heart of the downgrade of New York Community Bank today. According to Moody’s, “NYCB's core historical commercial real estate lending, significant and unanticipated loss on its New York office and multifamily property could create potential confidence sensitivity.” A report last year by JP Morgan warned that small banks are the most vulnerable. CRE loans can make up 29% of assets in regional community institutions, compared with only 6.5% at the big banks. So, it’s important to underweight small cap U.S. financials, too. Commercial real estate isn’t the only bugaboo for banks. Because interest rates were so low for so long, and money was so cheap and easy, a lot of banks borrowed and borrowed and borrowed, and let their own credit rating drop to the lowest rung of investment grade. Below are the current ratings of some major U.S. banks. I’ve also included two Canadian banks, and one Australian bank. By comparison, Canadian and Australian banks tend to have more risk aversion than their U.S. counterparts. They fared a great deal better during the financial meltdown of the Great Recession than the U.S. and European banks did. Australia still has a AAA sovereign credit rating, whereas the U.S. and Canada are both AA+ (source: Fitch Ratings). In addition to higher credit quality, the Australian ETFs tend to pay higher dividends – often double what the U.S. and Canada pay in their value funds. Country diversification can add a layer of both protection and performance to our portfolio. It’s also important to remember that when the U.S. (or China) sneezes, the rest of the world catches a cold. Incidentally, First Citizens Bancshares, the company that purchased Silicon Valley Bank in receivership, is at the lowest rung of investment grade: BBB with a negative outlook (source: S&P Global). Financial Engineering Earnings reports in the financial industry can be quite misleading. The New York Community Bank and First Citizens Bancshares look like rock stars on the Bank Stock Report Card, with year-over-year revenue growth of 54% and over 100%, respectively – due to their acquisitions of the failed banks. (Email [email protected] with BANK STOCK REPORT CARD in the subject line, if you’d like a copy.) However, there is a great deal of financial engineering going on that helps the banks look better on earnings reports than might be the full story – something the dividend slash of The New York Community Bank reminds us of in spades. The bank failures didn’t stop last year because all of the risk went away. They stopped because the Federal Reserve set up a facility that allowed banks to borrow against their paper losses in long-term bonds, to gave them time to figure out how to raise more capital, diversify their assets and strengthen their balance sheets. The Bank Term Funding Program will stop making new loans on March 11, 2024. As one example of how financial engineering works, The New York Community Bank reported $2.3 billion in net income for 2023, compared to just $617 million in 2022. However, when you read the fine print, you see that the income wasn’t as exciting as we might think. $2.2 billion of the 2.3 billion net income was a one time “bargain purchase gain“ from the Signature Bank transaction. In fact, it wasn’t enough to keep the company from slashing their dividend. In the 4th quarter of last year, NYCB posted a net loss of -$260 million. Our Own Checking, Savings & CDs Bond and CRE exposure are challenges for the banks, but so are uninsured deposits. When uninsured depositors get wind of issues, they move quickly to protect their money. 85% of Silicon Valley Bank’s depositors were uninsured. The FDIC created a special exemption to cover those people. However, it wasn’t with immediate access to their cash. It was with “receivership certificates for the remaining amount of their uninsured funds.” The SVB exemption isn’t one that will be applied across the board. It’s important to do our best to observe federally insured limits in our personal checking, savings and Certificates of Deposit, and to lean into banks with higher credit quality. The High Cost of Debt (More than Defense) In my recent interview with Howard Silverblatt, the senior index analyst of the S&P 500, he predicted a 4-6% rise in the S&P500® in 2024. (The S&P500 is already up 3.9%. Will the rest of the year be volatile, but only slightly up, or will the market prove him wrong on the upside or downside?) While pre-election years can be gangbusters on Wall Street, election years tend to be pretty tepid. Sometimes they are horrifying, as they were in 2000 (the onset of the Dot Com Recession) and 2008 (the onset of the Great Recession). Silverblatt also noted that the interest being paid on the U.S. public debt, which is currently at $34.16 trillion, is costing too much. The CBO projects that net interest outlays this year are going to be 2.4% of GDP rising to 3.6% by 2033. Defense takes up about 3% of GDP. That puts pressure on the Federal Reserve Board to cut interest rates. Federal Reserve Board Jerome Powell has been firm about another pause in interest rates in the March 19-20, 2024 FOMC meeting (no rate cut). In his interview with 60 Minutes on Sunday, Powell stressed that policy would be driven by the data. In the December 2023 meeting, the FOMC projected that 2024 could see rate cuts that would bring the Fed Fund rate down to 4.6%, from 5.25-5.50% where is stands today. The economic projections will be updated on March 20, 2024. While rate cuts are predicted, 4.6% is still much higher than interest rates have been over the last 15+ years. It will still be hard for a lot of potential home buyers to qualify for loans or afford housing at current prices. Corporations that need to raise capital will still be paying a lot more in interest. The potential rate cuts will not be enough to recover the massive losses that long-term government bonds saw in 2022, or to offset the continued problem of duration risk and low credit quality. Bottom Line Economists are still holding out hope that there will be no recession in 2024, or that if there is one, it will be quite brief and mild. Main Street investors are still high on the headlines of 26.3% gains in the S&P 500 for 2023. (How many are aware that without the Magnificent 7 doubling in value, the gains would have been half that, or that 1/3 of the Dow Jones Industrial Average companies actually saw their share price fall last year?) There continues to be a lot of risk on Wall Street today, including debt, bank trouble, elevated share prices, low credit quality, bond losses and duration risk, which is why we are overweighting safe in our sample pie charts. In a Debt World where banks are still failing and reeling from bond losses (on paper), we are also stressing that everyone needs to know what they hold on the safe side of their plan. We spend one full day on What’s Safe at our Financial Freedom Retreats. With the amount of exposure that regional banks have to the distressed CRE market, we might start seeing a lot more dividend cuts and gap downs in share price. The FDIC, Federal Reserve Board and Treasury Department are all putting pressure on banks to shore up their reserves. In our sample pie charts, we continue to underweight financials of all sizes. As we indicated, the risk is even more heightened in small and mid-cap regional banks. Since a lot of the U.S. value funds have a great deal of financials in them, it’s a great idea to consider value substitution funds and leaning into country diversification, where we can often get a higher yield with lower risk. This is actually pretty easy to self-direct once you learn our pie chart system. Even if you have someone managing your plan, it’s important to know what you own and why, and to be the boss of your money. Join us at our next Spring Financial Freedom Retreat April 27-29, 2024. Get the best price when you register by February 29, 2024. Friends and family can join you for a great discount! Join us at our April 27-29, 2024 Spring Financial Freedom Retreat. Learn nest egg strategies, how to get hot and diversified (including in artificial intelligence), and what's safe in a Debt World. You'll even discover how to save thousands annually with smarter big-ticket choices. Yes, it's a complete money makeover, which is a great way to start 2024! Email [email protected] to register. Learn the 15+ things you'll master and read testimonials in the flyer on the home page at NataliePace.com. Register by Feb. 29, 2024 to receive the best price. "Ten minutes into the first day I was already much smarter about investing than I ever thought I would be in my life and I knew I was in exactly the right place at this retreat. I am amazed at how EASY and FUN it is to make my money work for me and those I love. I think this kind of information should be compulsory in schools. I wish I'd learned this sooner." CM  Join us for our Online Spring Financial Freedom Retreat. April 27-29, 2024. Email [email protected] or call 310-430-2397 to learn more. Register by Feb. 29, 2024 to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 7-14, 2025. Email [email protected] to learn more. Register by April 30, 2024 to receive $200 off the regular price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two and three 50-minute private, prosperity coaching sessions!  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is are the most recent releases of these books. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Substack podcast on Apple and Spotify. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Are Amazon, Square and Other Tech Companies Ripping Us Off? Housing. Unaffordable. What Works? Case studies and creative solutions. Don't Reach for Yield. Closed-End Funds. 2024 Investor IQ Test. Answers to the 2024 Investor IQ Test. Apple's Woes Drag Down the Dow. The Winners & Losers of 2023. Ozempic, Magnificent 7 & Beyond. 2024 Crystal Ball. The Underperforming DJIA, Full of Fossil Fuels and Forever Chemicals. A Spectacular Year for 3 of the Magnificent 7. The Best ROI* (Almost 40%!) & 7 Life Hacks That Save Thousands. Portugal Eliminates Tax Advantages for Ex-Pats. Holiday Gift Giving on any Budget. Including No Budget. Once in a Century Events are Happening Every Day. The Crypto Winter Enters Its 3rd Year. Earn $50,000 or More in Interest. Safely. Finally. Freebies and Deals for Black Friday and Cyber Monday. Auto Strikes End. EV Price Wars Continue. WeWork's Bankruptcy. Half-Empty Office Buildings. Problems in our Personal Wealth Plan. Solutions for Unaffordable Housing. Cruise Ships Give Freebies to Investors. Should You Take the Bait? Should You Take a Cruise? Bonds. Banks. The Treacherous Landscape of Keeping Our Money Safe. 7 Rules of Investing Air B N Bust? Santa Rally 2023 or Time to Get Defensive? Barbie. Oppenheimer. Strikes. Streaming Wars. Netflix. Monero: A Token of Trust? 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. 2023 Company of the Year Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? The Online Global Earth Gratitude Celebration 7 Green Life Hacks Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. Which Countries Offer the Highest Yield for the Lowest Risk? Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Why We Are Underweighting Banks and the Financial Industry. 2023 Bond Strategy Emotions are Not Your Friend in Investing Bonds Lost -26%, Silver Held Strong. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed