Unaffordable Prices. High Interest Rates. Buyer’s Remorse. What Works in Real Estate These Days?25/1/2024

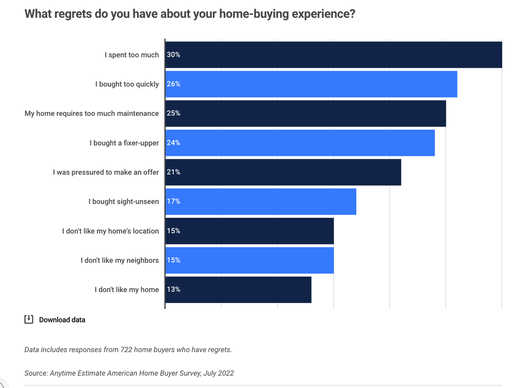

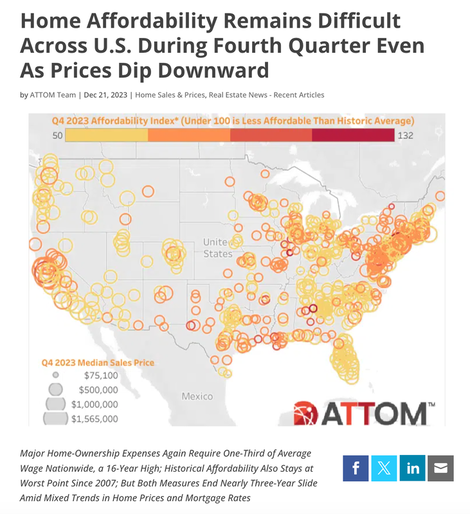

Unaffordable Prices. High Interest Rates. Buyer’s Remorse. What Works in Real Estate These Days? Pandemic Purchasers Regret Buying a Home, as Do Most Millennials. Over the past few years, we’ve seen a lot of studies revealing the same thing. Recent homeowners aren’t happy with their purchase. Pandemic purchasers felt pressured to buy sight-unseen. They weren’t aware of all of the extra costs that come along with homeownership, including closing fees, maintenance, taxes, etc. According to a new survey by Real Estate Witch, 90% of Millennials aren’t happy with their 1st home purchase. That’s not surprising when one-third of our income is required to buy these days. The reasons for buyer remorse include a bad location, bad neighbors and interest rates that are too high. So, what’s the solution for Millennials and Gen Z young adults who want to own instead of making the landlord rich? How can Baby Boomers downsize, when high interest rates make it unaffordable to buy anything – when they would end up with something smaller that is more expensive? Waiting for interest rates or home prices to become affordable can be a frustrating strategy. Home prices and interest rates have been on fire recently, and no amount of rain (war, a plunge in the personal savings rate, empty office buildings) has cast the economy into a recession or put pressure on homeowners to list. (There are 2.1 million U.S. mortgages that are seriously underwater. However, there are few incentives to give up the property if they are able to hang on, given the high prices and interest rates.) Another complicating factor is that when we wait for prices to fall, few of us have the money, liquidity and credit score to buy anything. (The reason most of us don’t buy low is that we can’t.) To complicate matters further, one of the worst financial decisions anyone can make is to buy high before prices fall, and have their mortgage higher than the value of their home. This is a disaster that ruins our credit rating for as long as our debt is higher than our assets, and makes the bank an adversary that we are beholden to. Also, we get stuck with that home, even if opportunities in other cities arise for our career, or if there are other compelling reasons to sell. If we buy too high, we might not be able to rent it out to cover costs. Despite all of those challenges, there are a few out-of-the-box solutions that help all demographics to solve housing challenges. As just one example, multigenerational housing is more popular today than it was in the Great Depression. Because real estate has expensive upkeep, including property taxes and maintenance, and is illiquid (requiring costs and time to sell), it’s very important to plan the purchase carefully. Below are a few case studies and a number of resources that will help us design a solutions-based strategy that’s right for us. Alvin‘s Off-Grid Solar Home in the Forest of British Columbia Alvin was a star circus performer in one of the major Cirque du Soleil shows (Ka) on the strip in Las Vegas for many years. After he and his wife had their son, they had second thoughts about raising their son in Sin City. A soul-changing journey to Peru cemented their commitment to live in greater harmony with our planet. Fortunately, they had purchased their home at a time when real estate prices in Las Vegas were rock bottom (2011). By 2016, they had doubled their money. They easily sold their home, purchased 16 acres in British Columbia, and moved. That was the fun part of the adventure. Living in an off-grid solar-powered RV for almost 2 years was a more difficult challenge. Ultimately, Alvin built an off-grid solar-powered house. He did most of the labor himself, which made the cost of the build far more affordable. He also researched how to properly insulate a home, and position the windows best for passive solar. Today, Alvin has become an off-grid consultant, in addition to his main income-producing gig. You can watch Alvin talk about his journey in his own words at YouTube.com/NataliePace. You can also see Alvin's short films that he created for our Earth Gratitude project. Sia donated a song for one of the films! Alvin Tam (Sia “Miracles”) video Alvin Tam Earth Gratitude video CoAbode When Carmel Boss and her husband decided to live in separate homes, she really wanted to have another adult around. That was the inception and inspiration for her business, CoAbode.org. Her son is now a young professional, and her business is more popular than ever. When two single mothers share a home together, the savings for each family can be up to $19,000 per year. Each mother also has an additional 56 hours per month for personal care. Co-Abode is expanding to serve single fathers, college students, single women and pretty much anybody who would like to save costs by teaming up to get a much bigger place, often in a better neighborhood, for far less than they would pay by going it alone. (There’s a vintage comedy, The Odd Couple, about two divorced fathers who did this.) The women’s advocate attorney, Gloria Allred shared a home when she was a young single mother, as did I. You can watch my interview with Carmel Boss on YouTube.com/NataliePace. Millennials Bought a High School Repurposing an unused property can be more affordable than just buying an apartment building or a single home. Of course, there are a lot of remodel costs involved, which might include asbestos or mold abatement (expensive). We need to be pretty good at P&L‘s and projections in order to develop property. With real estate prices so high and interest rates more elevated than they were a few years ago, developers might have a hard time turning a profit. While buying right now might not be a great idea, success is when preparedness meets opportunity. So now might be a great time to research, put together the team, and know what it is you’d love to develop, in case prices fall, and the potential to turn a profit becomes attractive. Bowtie High School had been abandoned for a decade before the remodel. The Millennials purchased the building and grounds for $100,000, and spent an additional $3.3 million turning it into a 31-unit apartment building. One more thing. the remodeled high school initially offered one bedrooms for $1400 (now offered at $1175) a month and two bedrooms for $1600 a month. This is yet another example of how getting a roommate can save us hundreds of dollars a month. Getting a 2-bedroom with a room-mate in Bowtie HS rather than the 1-bedroom equates to savings of up to $7,200/year. A Grandmother’s Unique Way of Downsizing A successful career woman with a home in a very expensive and desirable neighborhood in Southern California decided to give the house (in a trust) to her son and his wife, where they could raise their three kids. This is one of the examples of two generations of the family working together to solve housing and parenting costs and challenges, with a goal of keeping more money that would be flowing out to make the landlord rich. They remodeled the garage into an ADU*, where our VP Grandmother stays sometimes. The grandmother also keeps an efficiency flat on a friend’s large and posh estate nearby. The kids are happy to have Grandma visit, especially when she babysits, or takes on driving duties to tutors and soccer games. ADU: Additional Dwelling Unit. Many cities fast-track permits these days. Multigenerational Households Did you know that women in India are more likely to be CEO than in the U.S. – largely because of the support they receive in the home from their parents? Multigenerational households cut costs dramatically, but offer many other benefits, including food savings, alone time, afterschool care, help with cooking and chores, and having another adult in the room to bounce ideas off of. The College & Post-Grad Real Estate Plan I have seen medical school students purchase a quadruplex and rent it out to their fellow colleagues. Guess who ended up with the quarter of a million in medical school debt, and who made extra money without working. Here again is an example of thinking bigger – rather than just cozying up alone in an expensive, cubby-hole of a unit. This is easier to monetize when real estate prices are not so high. (Refer back to the paragraph where I mention the perils of buying high and having the value drop beneath your purchase price.) The 4 Ds of Real Estate It might be hard to imagine a time when prices become more affordable. However, with the 4 Ds (death, depression, disaster and divorce) ever constant in mortal existence, the cycles do turn. The challenge is to rise above the credit and cash crunch, in order to be in a position to buy when things become affordable. Preparation (getting together a down payment, at minimum) and capital preservation now is key to achieve that. Most people don’t buy low because they can’t. Cast Your Vision Out 10 Years In my research of very high net worth individuals who keep the wealth in their family for generations (sometimes centuries), I’ve discovered that these families plan a century in advance. How many of us are even thinking 10 years ahead? It’s important to cast our vision out that far in advance before we buy a home that we might be stuck with for a decade (or life). Buying sight unseen is something many people who bit the bait in the pandemic wish they had never done. Opportunities on the Horizon? Will more rental units lower rents? Will more affordable rents help ease the pent-up home buyer demand? Will stubbornly high mortgage interest rates mean few buyers qualify for a loan? How long can sellers hang onto their current homes? Can these challenges be solved by us pulling together the resources of two or three generations (like very wealthy people do) or of a few friends (like the Bowtie H.S. Millennials did)? Bottom Line There is a massive amount of wealth concentrated in Americans over 55 (72% of the nation’s wealth) versus those under 40 (just 7%). The goal is to have a seamless family transition that benefits all the generations. Otherwise, the elder generation’s wealth can end up going to healthcare costs, old folks’ homes and medical insurance, while the younger generation makes the billionaire landlord corporations rich. Adopting a family succession plan the way very affluent families do, with a vision of at least 10 years into the future will equate to a lot more money for everyone to spend on things they enjoy more than prescriptions, hospitals, rent, debt, and other basic needs. We can struggle to survive and be buried alive in bills – everyone fending for herself. Or we can team up, lighten our load and live a richer life. Many hands make for light work. Real Estate Resources I host a real estate master class once a year. The next one will be in June 8, 2024). If you’d like to register at the Early Bird price now, and receive access to our 2023 Real Estate master class as our gift to you, just email us at [email protected]. You can also join me live on Thursday, February 1, 2024, at 4 PM Pacific time for my Real Estate videoconference. That is free. Just email [email protected] with Videocon in the subject line to get the logon instructions. Below are More Real Estate Resources. There are at least 8 case studies in the Real Estate section of The ABCs of Money, 5th edition. There is also a 10-point checklist for homebuyers. Interview with Carmel Boss, founder and CEO, CoAbode. Research shows that when two households share a room, the savings can be up to $19,000 for each household. Alvin Tam shared his journey of leaving Las Vegas and building an off-grid solar home in our most recent Brain Trust meeting. His journey might spark new possibilities for you, too. Alvin Tam (Sia “Miracles”) video Alvin Tam Earth Gratitude video I have an Adulting Life Hacks 12-day videocoaching series (free). There are lots of resources and tips in this series that will inspire us to live a richer life and stop making trillion-dollar corporations rich. In one of our Brain Trust meetings, Terri Quenzer shared her plan of building a Vegan community. The ultimate intergenerational real estate experience would be to join me at our Restormel Royal Manor House Retreat March 7-14, 2025. You can watch the 3-minute video created by an attendee, and get additional information about the upcoming retreat, at the flyer. Get the best price ($500 off) when you register by Jan. 31, 2024.  Join us for our Restormel Royal Immersive Adventure Retreat. March 7-14, 2025. Email [email protected] to learn more. Register by Jan. 31, 2024 to receive $500 off the regular price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two and three 50-minute private, prosperity coaching sessions! Join us at our April 27-29, 2024 Spring Financial Freedom Retreat. Get valuable data and tools on how to best invest and monetize in real estate. Learn nest egg strategies, how to get hot and diversified (including in EVs, crypto and AI), and what's safe in a Debt World. You'll even discover how to save thousands annually with smarter big-ticket choices. Yes, it's a complete money makeover, which is a great way to start 2024! Email [email protected] to register. Learn the 15+ things you'll master and read testimonials in the flyer on the home page at NataliePace.com. Register with friends and family to receive the best price. "Ten minutes into the first day I was already much smarter about investing than I ever thought I would be in my life and I knew I was in exactly the right place at this retreat. I am amazed at how EASY and FUN it is to make my money work for me and those I love. I think this kind of information should be compulsory in schools. I wish I'd learned this sooner." CM  Join us for our Online Spring Financial Freedom Retreat. April 27-29, 2024. Email [email protected] or call 310-430-2397 to learn more. Register by Jan. 31, 2024 to receive the best price and a 50-minute complimentary private, prosperity coaching session (value $400). Click for testimonials, pricing, hours & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is are the most recent releases of these books. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Substack podcast on Apple and Spotify. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Don't Reach for Yield. Closed-End Funds. 2024 Investor IQ Test. Answers to the 2024 Investor IQ Test. Apple's Woes Drag Down the Dow. The Winners & Losers of 2023. Ozempic, Magnificent 7 & Beyond. 2024 Crystal Ball. The Underperforming DJIA, Full of Fossil Fuels and Forever Chemicals. A Spectacular Year for 3 of the Magnificent 7. The Best ROI* (Almost 40%!) & 7 Life Hacks That Save Thousands. Portugal Eliminates Tax Advantages for Ex-Pats. Holiday Gift Giving on any Budget. Including No Budget. Once in a Century Events are Happening Every Day. The Crypto Winter Enters Its 3rd Year. Earn $50,000 or More in Interest. Safely. Finally. Freebies and Deals for Black Friday and Cyber Monday. Auto Strikes End. EV Price Wars Continue. WeWork's Bankruptcy. Half-Empty Office Buildings. Problems in our Personal Wealth Plan. Solutions for Unaffordable Housing. Cruise Ships Give Freebies to Investors. Should You Take the Bait? Should You Take a Cruise? Bonds. Banks. The Treacherous Landscape of Keeping Our Money Safe. 7 Rules of Investing Air B N Bust? Santa Rally 2023 or Time to Get Defensive? Barbie. Oppenheimer. Strikes. Streaming Wars. Netflix. Monero: A Token of Trust? 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. 2023 Company of the Year Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? The Online Global Earth Gratitude Celebration 7 Green Life Hacks Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. Which Countries Offer the Highest Yield for the Lowest Risk? Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Why We Are Underweighting Banks and the Financial Industry. 2023 Bond Strategy Emotions are Not Your Friend in Investing Bonds Lost -26%, Silver Held Strong. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed