The Winners and Losers of 2023. From Ozempic and Real Estate to The Magnificent 7 & Beyond.2/1/2024

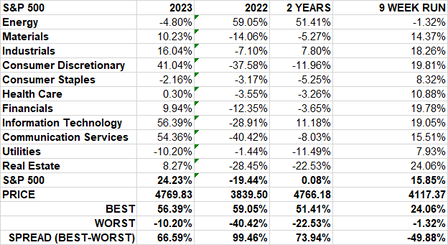

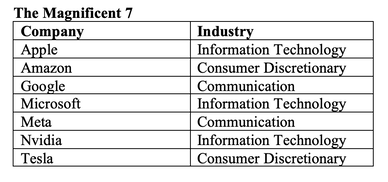

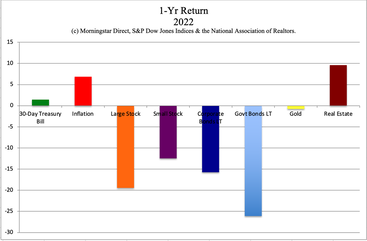

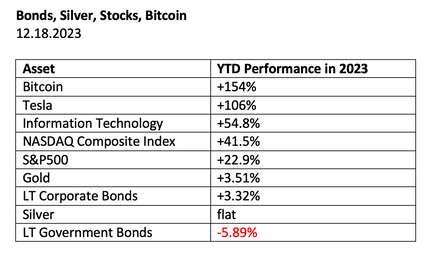

The Winners and Losers of 2023. From Ozempic and Real Estate to The Magnificent 7 & Beyond. The S&P500 soared 24.23% in 2023. However, the performance was concentrated in only a few winners, namely the Magnificent 7, with average returns of 104.7% each. Without them, the 2023 return of the S&P500 was just 9.94%. The Dow Jones Industrial Average lagged the race, with 13.9% gains, while the technology-rich NASDAQ Composite Index rocketed up an impressive 43.4%. Here’s the 2023 S&P500 sector performance chart. 2023 Super Performers All things Magnificent 7 Ozempic Crypto That’s pretty much it Still Down Over the 2-Year Period The 2-year performance of the S&P500 is flat, after -19.44% losses in 2022. The industries that are still down over the 2-year period are: Materials Consumer Discretionary Consumer Staples Health Care Financials Communication Services Utilities Real Estate Only Energy, Industrials and Information Technology are up over the 2-year period. 2023 Losers Energy Consumer Staples Utilities Let’s dive deeper into the industries themselves. The Magnificent 7 Ozempic & Biotech Real Estate Financials Energy Materials Utilities & Consumer Staples Bonds And here is more information on each industry. The Magnificent 7: Information Technology, Communication Services and Consumer Discretionary The Magnificent 7 was responsible for the best performing industries of 2023, with gains of 41.04% in consumer discretionary, 56.4% in information technology and 54.5% in communication services. If our portfolio didn’t have large cap growth in 2023, then our performance was likely lackluster. If we were heavy on energy, utilities, health care or consumer staples, then we might have lost money. In our Sample Pie Charts and at our Financial Freedom retreats, we have encouraged leaning into the Magnificent 7 in the Hot Slices, in funds like iShares TECB, as well as in our large growth slice. Annual rebalancing helps us to keep our portfolio growing (by capturing gains). So, when we’ve had a spectacular year in large growth and/or our Magnificent 7, now’s a great time to capture gains and trim slices back to an appropriate diversification based upon our age. Learn more about the Magnificent 7 in our recent blog. Ozempic & Biotech Ozempic (a weight loss drug) inspired gains in their parent company Novo Nordisk, of 49% in 2023. However, despite a new variant of COVID, most pandemic-related companies watched their revenues plunge, which took share prices down with them. Moderna, Pfizer and Johnson & Johnson are all trading at their pre-pandemic lows. The iShares Biotechnology Fund (IBB) is still down -21.6% from its Sept. 2021 high. Real Estate Real estate is down -22.53% over the 2-year period, but was up 8.27% in 2023. Investors are betting that rate cuts in 2024 will fire up the marketplace, since there is so much pent-up housing demand. However, the story is more complicated than that, particularly since home prices are near all-time highs and are unaffordable in most of the U.S. High prices and unaffordability in housing make this industry vulnerable. When costs of purchasing a home are 1/3 or more of our salary, few of us can qualify for a loan. Without the support that has been offered to assist homeowners and student loan borrowers, real estate would have been a lot weaker in 2023. Learn more in our 2024 Crystal Ball blog. Commercial real estate is one of the areas of greatest weakness in the economy, and is being monitored by the Treasury and Federal Reserve Board’s Financial Stability Committees. Financials The Federal Reserve’s special Bank Term Funding Program is responsible for the gains of 9.94% in the financial industry for 2023. There were three very high-profile (and expensive) bank failures in the first half of 2023, with two more folding in July and November 2023. Without the BTFP, which takes the bond losses (on paper) off the books for a year, more banks were at risk of failing. The commercial real estate industry will continue to plague banks and insurance companies in 2024. Insurance companies can now defer their losses through 2025, according to a new rule proposed by National Association of Insurance Commissioners. The BTFP will continue to offer support to qualifying banks until at least March 11, 2024, with a term of one year. The federal support should keep FDIC seizures and insurance company implosions at bay until after the 2024 Presidential election. Will the programs be extended in 2025? We have value replacement funds in our sample pie charts because leaning into other countries offers diversification, superior credit ratings and often double the dividend than the U.S. value funds that are heavily weighted toward financials. Learn more at our Jan. 13-15, 2024 Financial Freedom Retreat. Energy Energy was on fire in 2022, after Russia invaded Ukraine. However, oil prices are down to $76/barrel (WITI), after soaring above $120/barrel in March of 2022. The shift to clean energy, electric cars, and work-from-home/hybrid commute trends have reduced demand expectations for oil prices. China’s shift toward EVs has been particularly robust. OPEC has been trying to get oil prices above $80/barrel by cutting production. However, unless there is another major shock to the industry, prices could stay in the current range. Materials Materials like copper and lithium are essential to the Clean Energy Revolution. Copper has been dubbed “The New Oil” by Goldman Sachs. We’ve listed a few strategic materials-rich countries for our small and mid-cap value replacement funds. Learn more at our Jan. 13-15, 2024 Financial Freedom Retreat. Utilities & Consumer Staples Utilities and consumer staples were weak spots of 2023, with losses of -10.20% and -2.16%, respectively. However, in 2022, when the S&P500 dropped -19.44%, these industries remained buoyant, with a drop of just -1.44% and -3.17%, respectively. Still, there is a difference between the old-school companies, which tend to be slow growth and weighed down by debt, and those younger, leaner, high-growth companies that are leaning into a cleaner, greener tomorrow. That difference is easy to see in the underperforming DJIA, and is something we focus on at our Financial Freedom Retreat. Join us Jan. 13-15, 2024. Bonds Long-term government bonds continued to lose value in 2023. However, there is now an opportunity to earn $50,000 on a million fairly safely (5%). FYI: Some of the best-performing bonds are those where we think outside the box, purchase assets that are not offered by our broker/salesman, and toss bills out the window. Due to the tricky nature of the “safe” side of our nest egg, we spend one full day on What’s Safe at our Financial Freedom Retreat. Bonds lost more than stocks in 2022 and 2023. The safe side of our wealth plan is not supposed to lose money. Bottom Line Past performance is no reliable gauge for tomorrow. However, if we understand the underlying causes of strength or weakness in various industries, and how to protect ourselves from risk while leaning into performance, then we can continue to protect and grow wealth in any environment. Since economic growth in 2024 is expected to slow dramatically worldwide, down to 1.5% in the U.S., 1.6% in Canada and 4.2% in China, now is a great time to know exactly what we own and why. We want to make sure that we are properly protected and diversified. Taking a look at the annual returns of our plan in 2023, and comparing them to the spectacular 24.23% performance of the S&P500 is a good place to start to understand how our plan measures up. Considering that 2-year returns are flat and long-term bonds are still losing value, it’s a great idea to get forensic about what we own – something we can learn how to do at the Jan. 13-15, 2024 Retreat and the Rebalancing Master Class on Jan. 20, 2024. Doing this now – before the first weak GDP report is published, is a great idea. Email [email protected] or call 310-430-2397 to learn more. I'll be interviewing Howard Silverblatt, the senior index analyst of S&P Dow Jones Indices (the S&P500) on Jan. 11, 2024. You can watch that interview at YouTube.com/NataliePace. Be sure to subscribe there so you're never miss any of our important interviews and free monthly videoconferences. Join us at our Jan. 13-15, 2024 New Year, New You Financial Freedom Retreat. Get valuable data and tools on how to best invest and monetize in real estate. Learn nest egg strategies, how to get hot and diversified (including in EVs, crypto and AI), and what's safe in a Debt World. You'll even discover how to save thousands annually with smarter big-ticket choices. Yes, it's a complete money makeover, which is a great way to start 2024! Email [email protected] to register. Learn the 15+ things you'll master and read testimonials in the flyer (link below) and on the home page at NataliePace.com. Register with friends and family to receive the best price. "Ten minutes into the first day I was already much smarter about investing than I ever thought I would be in my life and I knew I was in exactly the right place at this retreat. I am amazed at how EASY and FUN it is to make my money work for me and those I love. I think this kind of information should be compulsory in schools. I wish I'd learned this sooner." CM  Join us for our Online New Year, New You Financial Freedom Retreat. Jan. 13-15, 2024. Email [email protected] or call 310-430-2397 to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is were released in 2021. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Substack on Apple and Spotify. Watch videoconferences and webinars on Youtube. Other Blogs of Interest 2024 Crystal Ball. The Underperforming DJIA, Full of Fossil Fuels and Forever Chemicals. A Spectacular Year for 3 of the Magnificent 7. The Best ROI* (Almost 40%!) & 7 Life Hacks That Save Thousands. Portugal Eliminates Tax Advantages for Ex-Pats. Holiday Gift Giving on any Budget. Including No Budget. Once in a Century Events are Happening Every Day. The Crypto Winter Enters Its 3rd Year. Earn $50,000 or More in Interest. Safely. Finally. Freebies and Deals for Black Friday and Cyber Monday. Auto Strikes End. EV Price Wars Continue. WeWork's Bankruptcy. Half-Empty Office Buildings. Problems in our Personal Wealth Plan. Solutions for Unaffordable Housing. The Magnificent 7 Drag NASDAQ into Another Correction Cruise Ships Give Freebies to Investors. Should You Take the Bait? Should You Take a Cruise? Bonds. Banks. The Treacherous Landscape of Keeping Our Money Safe. 7 Rules of Investing Air B N Bust? Santa Rally 2023 or Time to Get Defensive? Barbie. Oppenheimer. Strikes. Streaming Wars. Netflix. Monero: A Token of Trust? 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. 2023 Company of the Year Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? The Online Global Earth Gratitude Celebration 7 Green Life Hacks Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. Which Countries Offer the Highest Yield for the Lowest Risk? Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Why We Are Underweighting Banks and the Financial Industry. 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed