|

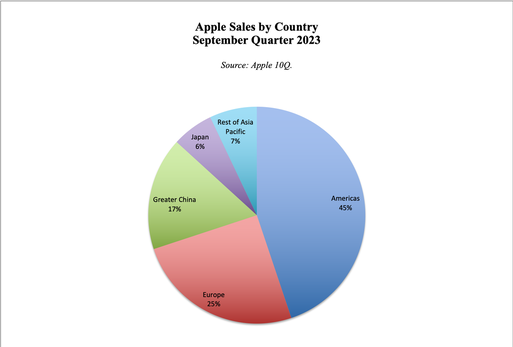

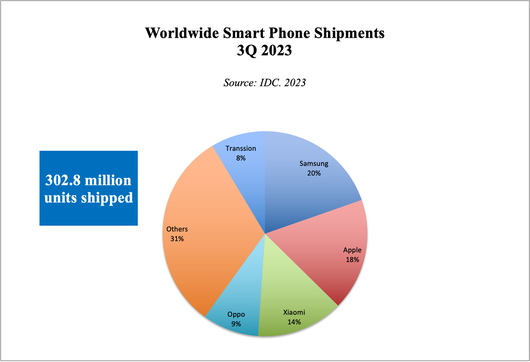

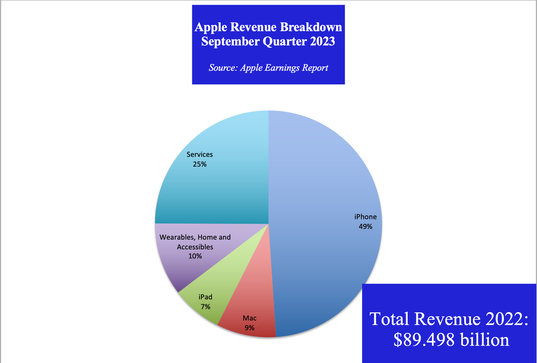

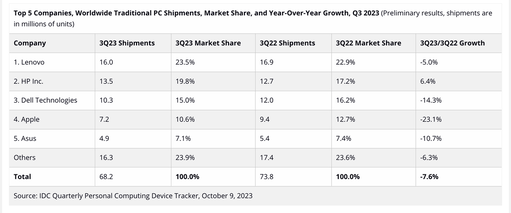

Is Huawei the Apple of China’s Eye? Apple is down 5.9% in the first four days of trading in 2024 – dragging Wall Street down with it. Is this just strategic profit-taking by Wall Street whales, or is there more at stake? Is the Huawei hype justified? What about China’s ban of iphones in government? Another potential problem is that The New York Times and multiple other outlets are reporting that the U.S. Dept. of Justice is ready to file a “sweeping antitrust suit” against Apple. In this blog, we’ll examine: China and Huawei 2023 Worldwide Smart Phone Sales Nothing: the Hot, Hyped New Phone 2024 Smart Phone Forecasts Streaming and Services Macs and iPads Corporate Buybacks And here is more information on each point. China As we reported on September 7, 2023, China has banned the use of iPhones at government agencies and for any government business. (The U.S. did this to Huawei in 2017, and expanded their attack on the company over the next few years – even having Canada arrest Huawei’s CFO in December of 2018.) During the same week of the iPhone ban in China, Huawei shocked the West by releasing their Mate 60 series made with domestic chips. (Huawei had been blacklisted from U.S. chips.) The concern is that Huawei will quickly outcompete iOS in China (and beyond), just as the company did before being banned by the U.S. TechInsights forecasts that Huawei’s HarmonyOS will surpass Apple’s iOS in China this year, taking second place behind Android. This has a bit of déjà vu to it. Apple missed earnings in the December quarter of 2018 largely due to weak sales in China and aggressive competition from Huawei. At the time, Huawei was the #2 global smartphone company (by units), behind #1 Samsung, and followed by #3 Oppo. Apple dropped to #4 by devices sold (but ranks higher in revenue). According to Counterpoint Research, Huawei experienced double-digit revenue growth in the 3rd quarter of 2023. 4Q 2023 sales data should be available from IDC next week. The reviews of Huawei’s chips and phone have been top-notch – even those by Western media. That has Apple investors concerned, particularly since the company is sporting a high price-earnings ratio of 30, while at the same time reporting an annual decline in revenue of $648 million in the September 2023 quarter (a small, but meaningful -0.72%). The greatest area of weakness was in China, where revenue was down $386 million from a year ago (-2.5%). Apple’s CFO pointed out that the decline was due to foreign exchange, with sales actually up slightly using constant currency. While Apple CEO Tim Cook was quite vague about expectations for sales in China for the December quarter, he did admit in the Nov. 2, 2023 earnings call that predictions were for the market to contract. We’ll know the details when Apple reports their December quarter earnings at the end of Jan./early Feb. Revenue in Greater China accounted for 17% of Apple’s revenue in the September quarter of 2023, so weakness akin to what happened in 2018 might require the company to revise its outlook. The company might also curtail its share repurchase program leading up to the quiet period before their earnings release, as they did in December of 2018. This could be a problem for Wall Street. In December of 2018 when Apple stopped their share repurchases, stocks experienced the worst December since the Great Depression, with losses of -9.18% in the S&P500 (source: S&P Dow Jones Indices). 2023 Worldwide Smart Phone Sales So, which companies are the top-selling smart phone brands today? Apple continues to be the premium market’s undisputed leader, according to a report released by Counterpoint Research on Jan. 2, 2024. However, Android has a much larger market share than iOS, and Samsung continues to be the #1 smartphone brand by devices. Nothing: the Hyped, Hot New Phone Apple customers tend to be very loyal, even when products are priced much lower. Nothing, a company GQ calls the “most hyped company in years,” has sold over two million products since launching in 2020. Their Android-based phone is priced at just $599, while the iPhone 15 Pro retails for $999. A friend recently purchased the Nothing phone when his iPhone stopped working. When I asked him how he liked it, he responded that “Apple is still the best. I'll probably go back to iPhone whenever this dies.” Perhaps this is why the global premium smartphone market increased 6% year over year, compared to a decline in the general marketplace. Payment plans allow more people to choose the phone they prefer, even if it costs a lot more. 2024 Smart Phone Forecasts Global sales are projected to decline -3.5% in 2023, and improve slightly next year with year-over-year growth of 3.8%. The 4th quarter of 2023 is expected to show growth of 7.3% over the same period in 2022. While this is all good news, investors are forward-thinking, and will be keen to know if Huawei will be the new Apple of China’s eye. The next few weeks will reveal a great deal. China is certainly trying to curtail Apple’s influence in the country. However, Apple had the top four selling phones in urban China last year, according to CEO Tim Cook. Reports from my family and business colleagues in Hong Kong are that everyone is still in love with all things Apple. In the September 2023 quarter earnings call, Cook said, “I just took a trip over there and could not be more excited about the interactions I had with the customers and employees and others.” Of course, Cook wasn’t able to meet with President Xi Jingping during his trips to China in 2023. The Huawei Wars have undoubtedly hampered their relationship. Meanwhile, President Xi praised Bill Gates in a meeting in Beijing on June 16, 2023, calling him “an old friend.” Streaming and Services iPhone accounts for almost half of all Apple revenue, at 49%. However, a surprising second is their services category with a 25% share. The services category includes Apple TV+, Music, apps, AppleCare, iCloud and more. While Apple TV isn’t displacing Hulu, Disney+ or the plethora of platforms that are all starting to charge for streaming, the studio has made impressive strides. Ted Lasso was a darling of Emmys and audiences, while Martin Scorsese's Killers of the Flower Moon secured 7 Golden Globes nominations, including Best Motion Picture (Drama). Coda, another Apple release, won Best Picture at the 2022 Academy Awards. Macs and iPads Mac and iPad both experienced noteworthy revenue declines in the September quarter of 2023, at -34% and -10.2%, respectively. According to IDC, global sales of personal computing devices declined 9.9% in Q3 of 2023. The IDC press release explained why Apple’s losses were so much more, writing, “Apple's outsized decline was the result of unfavorable year-over-year comparisons as the company recovered from a COVID-related halt in production during 3Q22.” Apple’s market share for PCDs was 10.1% in the 3rd quarter. 2024 is expected to recover, with growth of 4.1% in PCDs. Corporate Buybacks Apple purchased $15.5 billion of its shares in the September quarter, with $5.5 billion purchased in an accelerated program in August (the month before the Chinese government restrictions and the Huawei launch). While their robust buyback plan remains at the top of Wall Street, with $77.550 billion worth of buybacks over the past 12 months, this is behind the pace of the previous year’s purchases of $89.402 billion. With total debt of $111 billion, net cash of $51 billion and a commitment to net cash-neutral, Apple’s buybacks are likely to continue at a solid pace in 2024, though perhaps less robust than the record highs of 2022. Bottom Line There are plenty of headwinds for Apple, including a Department of Justice investigation into antitrust, foreign exchange, a strong dollar, increased competition and restrictions in China, a slowdown in the U.S. economy and a high price-earnings ratio. However, the company is still beloved by Apple aficionados and has been very successful in their Halo Effect, client stickiness and quality. Apple devices work seamlessly together, making it very difficult for iOS devotees to swap out the smartphone or the iPad/Mac for Android or PC without an interface nightmare. (We are spoiled by having all of our devices speak and share with each other so effortlessly.) Apple is embedded in the daily lives of hundreds of millions of people around the world, with $383.3 billion in revenue and $97 billion in net profit last year. With a market value of $2.83 trillion, the company can buy their way out of a great deal of problems. However, Apple shares are priced very high for a company that is hitting headwinds, in an economy that is expected to slow down. Therefore, profit taking (share price weakness) is likely to continue. Shares could take a dive if any negative headline hits the airwaves, whether it is a lawsuit with the U.S. government, a slip to third in smart phone sales in China, or double-digit sales for Huawei. Those who have been long on Apple might consider selling high and trimming their exposure back to a more diversified plan – or even moving out of the individual stock altogether in favor of a fund that is anchored by the Magnificent 7 (which includes Apple, but also has Meta, Microsoft, Amazon, Alphabet, Nvidia and Tesla). iShares has a breakthrough technology fund, TECB, and their large cap growth funds, are rich in information technology and communication services. Join us at our Jan. 13-15, 2024 New Year, New You Financial Freedom Retreat. Get valuable data and tools on how to best invest and monetize in real estate. Learn nest egg strategies, how to get hot and diversified (including in EVs, crypto and AI), and what's safe in a Debt World. You'll even discover how to save thousands annually with smarter big-ticket choices. Yes, it's a complete money makeover, which is a great way to start 2024! Email [email protected] to register. Learn the 15+ things you'll master and read testimonials in the flyer (link below) and on the home page at NataliePace.com. Register with friends and family to receive the best price. "Ten minutes into the first day I was already much smarter about investing than I ever thought I would be in my life and I knew I was in exactly the right place at this retreat. I am amazed at how EASY and FUN it is to make my money work for me and those I love. I think this kind of information should be compulsory in schools. I wish I'd learned this sooner." CM  Join us for our Online New Year, New You Financial Freedom Retreat. Jan. 13-15, 2024. Email [email protected] or call 310-430-2397 to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is were released in 2021. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Substack on Apple and Spotify. Watch videoconferences and webinars on Youtube. Other Blogs of Interest The Winners & Losers of 2023. Ozempic, Magnificent 7 & Beyond. 2024 Crystal Ball. The Underperforming DJIA, Full of Fossil Fuels and Forever Chemicals. A Spectacular Year for 3 of the Magnificent 7. The Best ROI* (Almost 40%!) & 7 Life Hacks That Save Thousands. Portugal Eliminates Tax Advantages for Ex-Pats. Holiday Gift Giving on any Budget. Including No Budget. Once in a Century Events are Happening Every Day. The Crypto Winter Enters Its 3rd Year. Earn $50,000 or More in Interest. Safely. Finally. Freebies and Deals for Black Friday and Cyber Monday. Auto Strikes End. EV Price Wars Continue. WeWork's Bankruptcy. Half-Empty Office Buildings. Problems in our Personal Wealth Plan. Solutions for Unaffordable Housing. The Magnificent 7 Drag NASDAQ into Another Correction Cruise Ships Give Freebies to Investors. Should You Take the Bait? Should You Take a Cruise? Bonds. Banks. The Treacherous Landscape of Keeping Our Money Safe. 7 Rules of Investing Air B N Bust? Santa Rally 2023 or Time to Get Defensive? Barbie. Oppenheimer. Strikes. Streaming Wars. Netflix. Monero: A Token of Trust? 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. 2023 Company of the Year Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? The Online Global Earth Gratitude Celebration 7 Green Life Hacks Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. Which Countries Offer the Highest Yield for the Lowest Risk? Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Why We Are Underweighting Banks and the Financial Industry. 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed