|

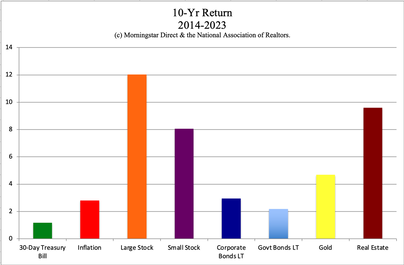

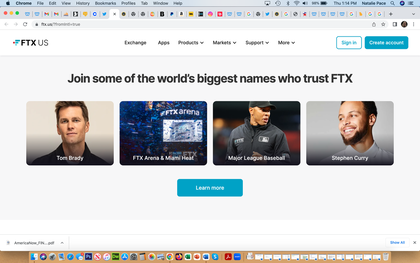

Bitcoin Sets New Record High. The Importance of Rebalancing. Updated May 31, 2024. Bitcoin’s all-time high of $69,000/coin was hit on November 9, 2021. Yesterday, Bitcoin set a new record of $69,324/coin, but has since retreated back to $67,000. That’s great news for anyone who has lived through the long Crypto Winter that began after that November 2021 high. Bitcoin dropped as low as $15,460 by Nov 20, 2022, just one year later. Total gains since that Nov. 2022 low are 333% for the best performing asset – far above the 24.3% gains in the S&P500 and the 105% gains of the Magnificent 7 in 2023. However, that’s quite a rollercoaster ride. Is HODL really the best strategy? Many lessons that apply to Bitcoin also apply to our entire nest egg. Below are a few of the things we will cover in this blog. Crypto: Currency, Safe Haven, Buy and HODL, or Get Rich Quick Scheme? Hot Industries The Importance of Rebalancing Staking The Magnificent 7 Clean Energy Which Coin is Right for You? And here is more information on each of the topics. Crypto: Currency, Safe Haven, Buy and HODL, or Get Rich Quick Scheme? Crypto is largely a trader’s platform. The average holding time of Bitcoin and Ethereum is less than three months. When we HODL, especially if we buy at the top, we are krill playing into the profits and high-frequency trading of the whales. Although a lot of people consider cryptocurrency to be a safe haven, or even the only kind of currency that will be worth anything when the dollar becomes completely worthless, you can’t have a currency that is worth $69,000 one month and $16,000 the next month. The whole point of currency is that the value will remain constant. Due to the share price volatility, the only people really using crypto as a currency are those who are operating in the shadows, with that concern being far greater than price stability. Many predators prey on our emotions, using scare tactics to prompt action, claiming that their ruse is the only cure. Another problem that prevents Bitcoin and other cryptocurrency from becoming widely adopted is the limitation on certain coin mining and the plethora of coin options to choose from. Imagine the hassle of carrying a wallet full of pounds, yen, euros and dollars. Tesla accepted Bitcoin for a hot minute, but now only accepts Dogecoin for a very limited product offering. Few other companies accept cryptocurrency at all. Additionally, crypto mining is not very planet friendly. Global Bitcoin mining consumed 173.42 TW hours of electricity between 2020 and 2021, ranking it 27th in the world if it were a country. Water usage was enough to feed 300 million people in rural sub-Saharan Africa and the land footprint was bigger than Los Angeles. Bitcoin minors are trying to address this with cleaner energy. However, the CO2 emissions are still currently a problem, and even clean energy requires a lot of CO2 to create. Because the price of crypto is so volatile, it's better to use any investment as a slice of a well-diversified, age-appropriate wealth plan. Hot Industries Safe havens, like crypto and gold, are very volatile. Gold was one of the worst performers of the last decade. After the highs of $800/ounce in 1980, gold plunged by almost half in 1981, sank down to $376/ounce by 1982 and stayed in that range until 2006 – for a doldrums that lasted a quarter of a century! (Bonds were worse; if you don't know how to preserve your wealth in a Debt World, join us at our next Financial Freedom Retreat.) When we think of an investment that can hold strong in weak economic times, it’s a better idea to consider the safe haven as a slice of our overall diversification plan, rather than the one and only thing we believe in. Whether it is crypto or gold, the swings in investor sentiment are wild, and the periods of it being out of favor can be epic. When our safe haven is a slice or two of our nest egg plan, we can preserve our wealth, while limiting the wild swings in our personal net worth. It also helps us to capture gains at the top, and add more at the low, which is a time-proven stalwart in successful investing. Regular rebalancing is another important tool. We teach this strategy at our Financial Freedom Retreat. The Importance of Rebalancing If your cryptocurrency plan loses 76% and stays there for almost 2 years, it’s more than just emotional distress. Having your $1 million go down to just $240,000 can ruin our FICO score. It prevents us from purchasing other investments (such as AI), including maybe a home. If we have started a project, such as a home remodel, we might not have the funds to finish. All of this financial distress is hard on our family, and could be enough to plunge us into a depression or worse. Simply rebalancing and capturing gains at the high affords us the liquidity and emotional fortitude to purchase more when the price tanks. Rebalancing once, twice, or three times a year is an important discipline to keep our personal wealth plan properly diversified and growing. Bitcoin is up 4.5 times from its low in Nov. 2022, and gained 171% in 2023. Whenever we see this kind of shoot the moon performance, it’s a good idea to capture gains. In the pie chart system, when one slice becomes four, it’s time to sell high and trim it back, increasing our net worth, while ensuring we take the gains off paper (and the rollercoaster) and capture them. If we’re invested in crypto because we’re sick of banks, then we can consider turning our profits into an income-producing hard asset that we purchase for a good price. (This is another strategy we teach in our Financial Freedom Retreats.) Staking Staking can tie up our access to our coins. This makes it very difficult to protect our wealth from drops in value, or to capitalize on the wild and ferocious gains that can occur over a very short period of time in crypto. The Magnificent 7 We’ve all been hearing a lot about artificial intelligence and the Magnificent 7. As I mentioned in my blog on Jan. 2, 2024, without the spectacular gains of these seven stocks, with their average 105% rise, the S&P500 would have had 9.94% gains in 2023, rather than the 24.23% rise in value and 26.3% total return. A lot of conservative wealth plans don’t have any large growth or a hot slice of AI. If your performance last year was beneath the 24% gains in the S&P500, chances are these are areas to look at adding. If your plan lost money or performed in the low single digits, long-term bonds might be the problem. (I offer unbiased 2nd opinions. Email [email protected] for pricing and information.) Clean Energy Clean energy is another industry that has very wild swings in share price. Here again is where regular rebalancing can help us to stay on the right side of the trade. At the bottom of the pandemic, the iShares Clean Energy ETF: ICLN was trading at $8.70/share. By Jan. 8 2021, the price soared to $33/share, for 3.8 times gains. Today, the price is back down to $14/share. We miss out on a lot of gains, if we’re not doing our regular rebalancing. Which Coin is Right for You? How do you know which coin is right for you? All currency is based on trust – trust that the currency will hold its value, and that the institution underwriting our holding is honest and fiscally sound. There has been a great deal of coin scams, including very high profile ones that are marketed by popular celebrities. FTX comes to mind because you’d have to be living under a rock not to have heard about SBF and his 25-year prison term. Tom Brady, Gisele Bundchen, Stephen Curry and even Larry David were caught up promoting that ruse. Kim Kardashian settled with the SEC for $1.2 million for promoting the EMAX coin – another pump and dump scheme. We also had a problem with 3 Arrows and Voyager Digital, a trading firm that claimed FIDC-insured coverage, which turned out to be false. (Click on the 6 Red Flags blog to learn more.) Other outright scams include the Trade Coin Club, which was a pyramid scheme posing as an MLM opportunity. If you’re sent an email or a social media post, that’s a red flag that it’s a marketing scheme. Is the opportunity being presented by someone under 40 with no experience in business? Should you really trust this stranger to protect your wealth? Bitcoin and Ethereum are the two most popular cryptocurrencies. iShares offers a Bitcoin ETF, and will soon begin trading an Ethereum ETF. If you purchase a fund, be sure that it is offered by a creditworthy fund company. If you purchase your coins directly, then be sure to buy them on a creditworthy and trustworthy platform. (Coinbase has averted a lot of trouble, whereas Binance's former CEO Changpeng Zhao will spend four months in prison, after pleading guilty to money laundering. Bottom Line If we’re interested in a hedge against a weakening dollar, or a safe haven against a slowing economy, cryptocurrency could be a good choice for a hot slice or two of our plan. It’s also important to rebalance regularly, so that we step off the price swing rollercoaster, and into our party suite of gains. What and where you purchase also matter. Join us at our Financial Freedom Retreats or get additional private coaching through my personal coaching practice. Email [email protected] for additional information. Join us at our June 8-10 Spring Financial Freedom Retreat. Learn how to invest and grow your wealth, green your retirement plan, easy and efficacious nest egg strategies, how to get hot and diversified (including in artificial intelligence), and what's safe in a Debt World. You'll even discover how to save thousands annually with smarter big-ticket choices. Yes, it's a complete money makeover. Email [email protected] to register. Learn the 15+ things you'll master and read testimonials in the flyer on the home page at NataliePace.com. Register with friends and family to receive the best price. "Ten minutes into the first day I was already much smarter about investing than I ever thought I would be in my life and I knew I was in exactly the right place at this retreat. I am amazed at how EASY and FUN it is to make my money work for me and those I love. I think this kind of information should be compulsory in schools. I wish I'd learned this sooner." CM If you’d like an unbiased 2nd opinion on your current wealth plan, email [email protected] for pricing and information.)  Join us for our Online Spring Financial Freedom Retreat. April 27-29, 2024. Email [email protected] or call 310-430-2397 to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 7-14, 2025. Email [email protected] to learn more. Register by April 30, 2024 to receive $200 off the regular price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two and three 50-minute private, prosperity coaching sessions!  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is are the most recent releases of these books. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Substack podcast on Apple and Spotify. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Beyond Meat's Shares Surge. Quaker Oats' Pesticide Problem. Stocks are Flying High. Why Aren't Mine? Cut Your Tax Bill in Half. 9 Tips. Celebrity Jet CO2. Green Washing. The Facts. Some Solutions. Copper: Essential to the Clean Energy Transition. Uh. Oh. More Bank Trouble. Are Amazon, Square and Other Tech Companies Ripping Us Off? Housing. Unaffordable. What Works? Case studies and creative solutions. Don't Reach for Yield. Closed-End Funds. 2024 Investor IQ Test. Answers to the 2024 Investor IQ Test. Apple's Woes Drag Down the Dow. The Winners & Losers of 2023. Ozempic, Magnificent 7 & Beyond. 2024 Crystal Ball. The Underperforming DJIA, Full of Fossil Fuels and Forever Chemicals. A Spectacular Year for 3 of the Magnificent 7. The Best ROI* (Almost 40%!) & 7 Life Hacks That Save Thousands. Portugal Eliminates Tax Advantages for Ex-Pats. Holiday Gift Giving on any Budget. Including No Budget. Once in a Century Events are Happening Every Day. The Crypto Winter Enters Its 3rd Year. Earn $50,000 or More in Interest. Safely. Finally. Freebies and Deals for Black Friday and Cyber Monday. Auto Strikes End. EV Price Wars Continue. WeWork's Bankruptcy. Half-Empty Office Buildings. Problems in our Personal Wealth Plan. Solutions for Unaffordable Housing. Cruise Ships Give Freebies to Investors. Should You Take the Bait? Should You Take a Cruise? Bonds. Banks. The Treacherous Landscape of Keeping Our Money Safe. 7 Rules of Investing Air B N Bust? Barbie. Oppenheimer. Strikes. Streaming Wars. Netflix. Monero: A Token of Trust? 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. Do Cybersecurity Risks Create Investor Opportunities? I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? The Online Global Earth Gratitude Celebration 7 Green Life Hacks Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. Which Countries Offer the Highest Yield for the Lowest Risk? Why We Are Underweighting Banks and the Financial Industry. 2023 Bond Strategy Emotions are Not Your Friend in Investing Bonds Lost -26%, Silver Held Strong. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed