|

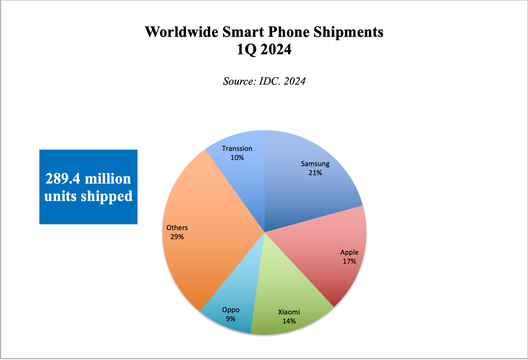

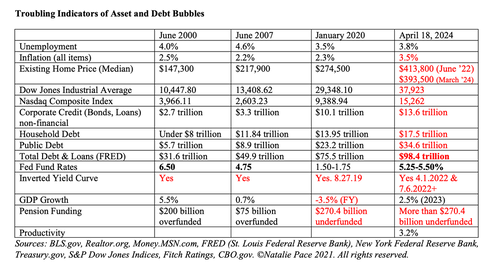

Magnificent 7: Are They Now the Fantastic 5? Which 2 Stocks Are Not So Magnificent This Year? Last year, a handful of companies took stocks to an all-time high. As I mentioned in my February 27, 2024 blog, without the help of the Magnificent 7, the S&P 500 returns would have been under 10% instead of the spectacular 26.3% total return. The average Magnificent 7 company doubled in share price in 2023. 2024 is proving to be quite different. Only three of the Magnificent 7 are offering outstanding returns. Two are riding only slightly above the general market, and two have lost money for investors. What is going on? Is the Magnificent 7 a phenomenon of the past? We will cover each of the Magnificent 7 in this blog. We will also look at election trends. Email [email protected] if you would like an updated Magnificent 7 stock report card. Nvidia Meta Microsoft Amazon Alphabet Tesla Apple Election Year Macro Trends And here is more information on each company. Nvidia Investors are manic about the future of artificial intelligence. Nvidia is smashing it in returns, with gains of 70% so far in 2024. Earnings growth at Nvidia is an impressive 265% year over year. So, why has the price dropped over the last month? Nvidia is down $157/share since the company’s all-time high, set on March 25, 2024. Could it be simple profit-taking, or is there more to the story? Nvidia continues to lead AI, with robust demand that could take the next quarter’s revenue to $24 billion – up 190% over the same quarter a year ago. However, many major technology competitors are investing in R&D to bite into Nvidia’s market dominance. It’s important to remember that with innovation, the company that comes up with the next great thing can become ten times more valuable overnight. That is basically what happened with Nvidia. It is likely that other companies will develop competitive AI products going forward, which will help with the bottleneck and prices. AI is ubiquitous. There is plenty of money to share, as Bloomberg Intelligence forecasts that generative AI will be a $1.3 trillion market by 2032. So, why are investors taking profits from the hottest company on Wall Street? This has to do with valuation and macro trends. Nvidia’s price-earnings ratio is 71. Should a company with $30 billion in net profits be valued at $2.13 trillion? Is there a way to invest in AI without buying high? A good strategy is to always have a hot slice or two in your wealth plan (that is age-appropriate and properly diversified). If you aren’t already invested in AI, consider dollar-cost averaging in. You can also smooth out the volatility of an individual company by investing in an AI fund, such as iShares TECB. We spend a full day on what’s hot at our April 27-29, 2024 Financial Freedom Retreat where you can learn more about diversifying your wealth plan to include hot industries, such as artificial intelligence. Join us! Meta Meta shares are up 45% year to date, while revenue growth is up 24.7%. The 1st quarter revenue is projected to ring in with another 20-29% year-over-year growth. Meta will report 1Q earnings in Wednesday, April 24, 2024, after the market close. Meta, a communications company (no longer in the technology sector), is heavily reliant on advertising for 96.5% of its revenue. The last two years have been surprisingly resilient for the U.S. economy. However, when CEOs start worrying about a slowdown, ad revenue spend is one of the first expenses to be cut. That is one of the reasons why Meta’s shares have had such dramatic pullbacks historically, with the 3-year low at $88/share (Sept. 2022), compared to today’s price of $510. As of the most recent Federal Reserve SEP (Summary of Economic Projections), the U.S. economy is projected to grow 2.1% in 2024 – nothing spectacular, but not a recession. While this is positive for Meta in the near-term, the 33 P/E is pricey, particularly when there are so many triggers that could slow the economy down further. Microsoft Microsoft and Alphabet have gained 12% so far this year. Microsoft’s revenue growth was 18% in the most recent quarter – quite an achievement for a $3 trillion company with $212 billion in annual revenue. Is this sustainable in 2024? Microsoft’s competitive edge is that the company can offer AI to smaller companies that are unable to integrate the benefits of AI on their own. The demand for Generative AI is still much higher than the availability, which means the trillion dollar corporations can snag up the supply first. According to Microsoft CEO Satya Nadella, “By infusing AI across every layer of our tech stack, we’re winning new customers and helping drive new benefits and productivity gains.” Over 1/3 of Microsoft’s Azure AI customers came to the company over the past 12 months, while over ½ of the Fortune companies are customers (according to the Microsoft earnings call). Microsoft’s AI advantage will continue to drive results in the foreseeable future. Like Nvidia, however, Microsoft’s valuation is expensive, at 37 P/E. Microsoft’s March quarter earnings results will be released on Thursday, April 25, 2024 at 2:30 pm PT. Amazon Amazon rallied 22.7% in 2024. Amazon continues to be the go-to online U.S. retail site, with over half a trillion in sales last year ($575 billion). Earnings was a respectable $30.43 billion in 2023, compared a net loss of -$2.72 billion in 2022. Investors love Amazon. Shares are trading very close to an all-time high of $181.76, with a lofty valuation of 1.89 trillion and a price-earnings ratio of 63. Will the U.S. consumer continue to buy buy buy online, or will rising credit card and auto loan defaults curtail spending? Though we might be tempted to buy high because everyone is doing it, here again, adopting a pie chart time-proven system, with an appropriate amount invested in the Fantastic 5, can help us to capture gains at the high and buy more at the low (rather than being on the wrong side of the trade). Alphabet Alphabet is another company that is heavily reliant on advertising, with 76% of revenue coming from Google ads. Revenue increased 13% year over year in the most recent quarter. Like Microsoft, Alphabet is promoting their competitive edge in AI cloud. According to Alphabet CEO Sundar Pichai, “In Q4, our product and gen AI leadership enabled us to win and expand relationships with many leading brands, including Hugging Face, McDonald’s, Motorola Mobility, and Verizon.” Google Cloud revenue was up 26% year over year in the December 2023 quarter. The company is also investing in Waymo and Pixel 8, their AI-first phone. Will Alphabet win business away from Microsoft Cloud? You can bet the team has their eye on this. Alphabet will report the 1st quarter 2024 results on April 25, 2024 after the markets close. Tesla After doubling in 2023, Tesla shares tanked in 2024, with losses of -40.2% so far. Tesla’s German factory was hit by an activist group on March 5, 2024, that took down their power. The successful breach caused production delays for more than a week. Red Sea attacks in January also prompted the automaker to pause production for two weeks. Sadly, the lower production in 1Q 2024, which was down -12.4% from the fourth quarter in 2023, was rather welcome news. Deliveries were down -20.2% quarter over quarter and -8.5% year-over-year. Why are deliveries down? What are the challenges that Tesla is facing? Will these challenges persist or abate this year? Electric vehicles continue to be the most exciting growth vertical of the auto industry. However, all electric vehicle manufacturers are facing price wars and fierce competition, particularly with China becoming the world’s largest exporter of autos in 2023, ahead of #2 Japan. Additionally, rising consumer debt and defaults on auto loans and credit cards could slow consumption going forward. As you can see in the year-over-year decline in Tesla’s auto deliveries, competition and weaker demand are already taking a bite into sales. As Tesla admitted in their 4Q 2023 earnings report, “In 2024, our vehicle volume growth rate may be notably lower than the growth rate achieved in 2023.” Even after a price drop of -40% this year, Tesla’s shares are still trading at an elevated 35 price earnings ratio. High growth companies can handle a higher price earnings ratio. However, 2024 is proving to be the first year that Tesla is not a growth stock. Apple Apple is still the number two smart phone company in the world, behind Samsung (in units). While the S&P500 is up 6.3% so far, Apple is down -11%. Why? One of the concerns is that China has banned Apple in their government use, while Huawei is experiencing a renaissance. (Click on the blue-highlighted words to learn more from my blog earlier this year.) Apple’s year-over-year sales growth in the first quarter of 2024 was only 2%. For the March quarter, the year-over-year comparables aren’t in favor. Luca Maestri, Apple’s CFO, alerted analysts in Apple’s earnings call that total revenue could be down -5.3%. Apple will report the March 2024 quarter earnings report on May 2, 2024 at 2 pm PT. So, Apple, like Tesla, is another company that is being heavily impacted by price wars and competition, particularly from Chinese companies. Apple is no longer a growth stock. Apple still has $173 billion in cash and marketable securities, and is the most aggressive company when it comes to corporate repurchases of their own stock, with $20.1 billion purchased in the most recent quarter. Corporate buybacks has the potential to keep the share price buoyant for Apple, though that hasn’t been the case so far this year. We’ll learn more about Apple’s capital return program when the company reports their March quarter results. However, the 27 PE is elevated for a company that is no longer a growth company, and the company’s debt load is $108 billion – quite elevated among its Silicon Valley peers. Election Year Macro Trends April is typically a good month for returns, with an average gain of almost 3% annualized over the past five years. However, the S&P500 is down -4.5% so far this month. Is this a temporary glitch that will reverse with the first central bank rate cut? That’s what most investors are hoping for, although recent comments by several Federal Reserve Board governors, combined with persistently high inflation, have put a June rate cut into question. According to CME’s FedWatch tool, the market still expects a rate cut in June, with futures pricing data factoring in an 85% probability of a cut. All eyes will be on Jerome Powell’s press conference on May 1, 2024 and on the advance 1Q 2024 U.S. GDP report, which will be released on Thursday, April 25, 2024, at 8:30 am ET. Over the past ten years, the election year trend looks positive, with an average annual return of 13% – giving the markets more run room if the year stacks up to that average. However, the longer-term annualized trend is less favorable, with returns of under 3%. It’s important to remember that 2000 was the beginning of the Dot Com slide (with losses of up to -78% in the NASDAQ Composite Index). 2008 ushered in the Great Recession (with Dow Industrial Average losses of up to -55%). The U.S. market has surprised analysts with its ability to absorb higher interest rates. However, the cost has been unprecedented levels of debt. At some point, something has to give. Bottom Line We use technology almost every moment of our lives, and artificial intelligence is now imbedded in pretty much everything technology touches. If we want to add performance to our wealth plan, it’s important to have a large cap growth fund and to consider adding a separate hot slice of break-through technology (such as the TECB iShares fund). (If you didn’t earn 26% gains in stocks in 2023, then you might be missing these funds or investing too heavily in long-term bonds. Email [email protected] or call 310-430-2397 to receive an unbiased 2nd opinion to determine what is causing your wealth plan to lag the general market.) Funds help to smooth out the volatility of individual stocks. Dollar-cost averaging in our initial purchase is a good idea since AI stocks are trading at elevated valuations. Tesla and Apple are global premium, beloved brands. However, China is competing at home and abroad with more affordable products, and in Apple’s case, with outright restrictions. For these reasons, the Magnificent 7 is better thought of this year as the Fantastic 5. With stocks still close to all-time highs, debt at astronomical levels, wars and rising geopolitical tensions, and a contentious election on the horizon, April might be a great month to capture gains. (You’ve heard the market aphorism, “Sell in May and go away.” Rebalancing and proper diversification is a good application of this seasonal trend.) If you haven’t rebalanced recently, or if you’re not leaning into the hottest areas of the economy, now is the perfect time for a little Spring cleaning of your financial house. Join us at our April 27-29, 2024 Spring Financial Freedom Retreat. Learn how to protect your wealth, hedge against a weaker dollar, invest and compound your gains, green your retirement plan, easy and efficacious nest egg strategies, how to get hot and diversified (including in artificial intelligence and EVs), how to evaluate IPOs and other stocks, and what's safe in a Debt World. You'll even discover how to save thousands annually with smarter big-ticket choices. Yes, it's a complete money makeover. Email [email protected] to register. Learn the 15+ things you'll master and read testimonials in the flyer on the home page at NataliePace.com. Register with friends and family to receive the best price. "Ten minutes into the first day I was already much smarter about investing than I ever thought I would be in my life and I knew I was in exactly the right place at this retreat. I am amazed at how EASY and FUN it is to make my money work for me and those I love. I think this kind of information should be compulsory in schools. I wish I'd learned this sooner." CM If you’d like an unbiased 2nd opinion on your current wealth plan, email [email protected] for pricing and information.)  Join us for our Online Spring Financial Freedom Retreat. April 27-29, 2024. Email [email protected] or call 310-430-2397 to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 7-14, 2025. Email [email protected] to learn more. Register by April 30, 2024 to receive $200 off the regular price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two and three 50-minute private, prosperity coaching sessions!  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is are the most recent releases of these books. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Substack podcast on Apple and Spotify. Watch videoconferences and webinars on Youtube. Other Blogs of Interest 9 Inflation, Budgeting, Debt Reduction and Investing Solutions. China & Russia Double Their Gold Holdings. 2024 Investment of the Year? The Reddit IPO. Meme Stock or Snap Land? Tesla's Factory in Germany Taken Offline by Activists. Bitcoin Sets a New Record High. The Importance of Rebalancing. Beyond Meat's Shares Surge. Quaker Oats' Pesticide Problem. Stocks are Flying High. Why Aren't Mine? Cut Your Tax Bill in Half. 9 Tips. Celebrity Jet CO2. Green Washing. The Facts. Some Solutions. Copper: Essential to the Clean Energy Transition. Uh. Oh. More Bank Trouble. Are Amazon, Square and Other Tech Companies Ripping Us Off? Housing. Unaffordable. What Works? Case studies and creative solutions. Don't Reach for Yield. Closed-End Funds. 2024 Investor IQ Test. Answers to the 2024 Investor IQ Test. Apple's Woes Drag Down the Dow. The Winners & Losers of 2023. Ozempic, Magnificent 7 & Beyond. 2024 Crystal Ball. The Underperforming DJIA, Full of Fossil Fuels and Forever Chemicals. A Spectacular Year for 3 of the Magnificent 7. The Best ROI* (Almost 40%!) & 7 Life Hacks That Save Thousands. Portugal Eliminates Tax Advantages for Ex-Pats. Holiday Gift Giving on any Budget. Including No Budget. Once in a Century Events are Happening Every Day. The Crypto Winter Enters Its 3rd Year. Earn $50,000 or More in Interest. Safely. Finally. Freebies and Deals for Black Friday and Cyber Monday. Auto Strikes End. EV Price Wars Continue. WeWork's Bankruptcy. Half-Empty Office Buildings. Problems in our Personal Wealth Plan. Solutions for Unaffordable Housing. Cruise Ships Give Freebies to Investors. Should You Take the Bait? Should You Take a Cruise? Bonds. Banks. The Treacherous Landscape of Keeping Our Money Safe. 7 Rules of Investing Air B N Bust? Barbie. Oppenheimer. Strikes. Streaming Wars. Netflix. Monero: A Token of Trust? 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. Do Cybersecurity Risks Create Investor Opportunities? I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? The Online Global Earth Gratitude Celebration 7 Green Life Hacks Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. Which Countries Offer the Highest Yield for the Lowest Risk? Why We Are Underweighting Banks and the Financial Industry. 2023 Bond Strategy Emotions are Not Your Friend in Investing Bonds Lost -26%, Silver Held Strong. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. 27/4/2024 02:00:16 pm

The development of VR technology has led to advancements in related fields such as augmented reality and mixed reality. AR overlays digital information onto the real world, while MR combines elements of both VR and AR to create hybrid experiences. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed