|

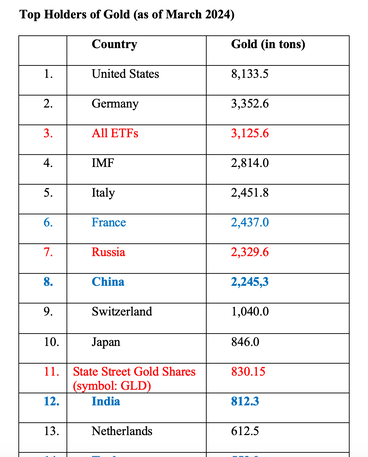

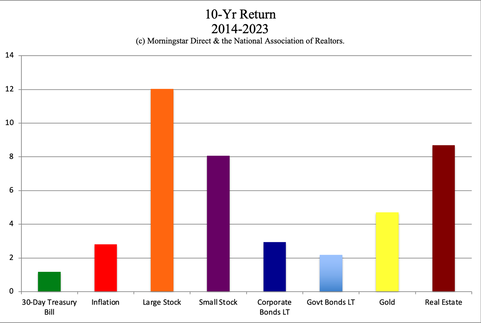

China and Russia Have Doubled Their Gold Holdings Since 2014. What does that mean for the prices of gold, silver and BRICS currency going forward? Will gold/silver mining companies like McEwen Mining benefit from this development? Be sure to check out my exclusive interview and podcast with McEwen Mining Chairman and Chief Owner Rob McEwen for his expert two cents on gold, silver and copper, and on the stellar rise in the share price of McEwen Mining over the last month. McEwen Mining (symbol: MUX) stock soared 66% after announcing earnings on Feb. 29, 2024. What has investors so thrilled? Should you dive in, too? Is now the time to take some ownership of their copper development mine in Argentina – which is designed to be the world’s 1st regenerative copper mine? Is the McEwen Mining stock undervalued? Could McEwen Mining actually hit $30/share? All this and more in my exclusive interview with McEwen Mining’s Chairman and Chief Owner Rob McEwen. Watch it back live at YouTube.com/NataliePace. Check out the vision that McEwen Mining has for its copper mine in Argentina. (Click to access.) Here are the points we’ll address in this blog. McEwen’s Huge Share Price Surge After Announcing 4Q 2023 Earnings What Lies Ahead for 2024? Los Azules Copper Mine Timeline Challenges of Development to Production The World’s 1st Regenerative Copper Mine Gold and Silver Prices. Will the End of the PetroDollar Cause Prices to Soar? Copper Prices. Up to 2021 Highs or Down to 2008 Lows? Is McEwen Mining Undervalued? And here is more color on each point. McEwen’s Huge Share Price Surge After Announcing 4Q 2023 Earnings As I mentioned at the top of this blog, McEwen Mining’s share price surged from $5.94 on Feb. 28, 2024 to $9.86 on March 28, 2024. 4th quarter revenue more than doubled year over year, and McEwen Mining earned a net profit of $54.7 million in 2023, up from a net loss of -$81.1 million in 2022. The move to profitability had a lot to do with moving McEwen Copper to its own set of books. The separation of McEwen Copper from McEwen Mining caused an accounting gain of $224 million, which was partially offset by a $37 million deferred tax impact, according to McEwen Mining CFO Perry Ing, speaking in the Q4 2023 conference call. McEwen’s mining operations are centered on gold and silver. However, a lot of the recent investor interest is associated with the copper mine. McEwen Copper has attracted investments from Rio Tinto and Stellantis, which reduced McEwen Mining’s stake in the venture to 47.7%. The copper development project in Argentina is pushing forward with a goal of completing a Feasibility Study in the first quarter of 2025. What Lies Ahead for 2024? Last year’s production was 154,600 ounces of GEOs. McEwen Mining’s 2024 projection is for 130,000-145,000. That is a reduction in output of 16%. Rob McEwen confirmed to me in our video conversation of March 28, 2024 that 1Q 2024’s earnings results could be softer than last year’s. Despite that, he still feels that McEwen Mining is undervalued. (He makes his case for this in our exclusive interview, which is available at YouTube.com/NataliePace and at https://nataliepace.substack.com/.) Gold and silver prices are rising. Gold just hit a new high of $2,256.90/ounce on Thursday, March 28, 2024. Gold began 2023 at $1857/ounce, rising to $1980/ounce by the end of March 2023. So, the rise in gold prices is a tailwind for McEwen. The majority of McEwen’s production is silver. Silver prices are flat year over year. However, with prices hovering in the $25/ounce range, there is still plenty of room to run back to the all-time high hit on March 31, 2011, of $48.70. Copper Mine Timeline The Los Azules copper mine Feasibility Study is due in the 1st quarter of 2025, after which there will be a “year of engineering before we put a shovel in the ground,” according to Rob McEwen, in the Q4 2023 conference call. Rob McEwen projects that the mine will become operational in 2029 or 2030. Challenges of Development to Production The challenges to the timeline include permitting (delays?), the political landscape (potentially disruptive), and climate and altitude (over 10,000 feet high). Chile’s copper mines became nationalized between 1967 and 1971; the country’s lithium reserves were nationalized in 2023 under leftist President Gabriel Boric. Argentina’s current President Javier Milei is an economist, so there is a lot of cautious optimism from the business community. However, legislators have blocked his reforms, and it remains to be seen how he will navigate the political environment. With copper being an essential metal in our world, in everything from computers, electric vehicles, wind, solar and electricity conduction, Argentina could potentially become the 3rd largest exporter of this important natural resource, behind Chile (#1) and Peru (#2). McEwen’s Copper mine is expected to have a 27-year lifespan. The World’s 1st Regenerative Copper Mine Rob McEwen firmly believes that responsible mining is essential. He’s fully aware that mining is hard on the environment. He is equally aware that without the natural resources provided by mining, modern life would come to a screeching halt. His solution is to create the world’s 1st regenerative copper mine. I encourage you to watch the company’s video to see how they plan to accomplish this. (Click to access the video.) I also encourage you to watch and listen to my interview with Rob McEwen, where he explains that mining has no choice but to become more sustainable, making the case as to why his mine can be one of the lowest cost mines in the industry. Gold and Silver Prices. Will the End of the PetroDollar Cause Prices to Soar? During our conversation on March 28, 2024, Rob McEwen pointed out that the end of the petrodollar was positive for gold and silver. Oil is one of the most widely traded commodities in the world. In the past, oil was traded in U.S. dollars. However, the BRICS* alliance and currency is determined to break the dollar monopoly. *Brazil, Russia, India, China and South Africa China and Russia began trading oil using the yuan, instead of the U.S. dollar, last year. According to Reuters, the yuan became the most widely-used currency for cross-border transactions in China for the first time in March 2023, above the dollar. Chi Lo, a senior investment strategist at BNP Paribas Asset Management in Hong Kong, predicted at the time that a long-term "snowball effect" would occur as more countries join the "RMB bloc" to reduce risks of dollar exposure, "especially after they've seen what the U.S.-led sanctions against Russia have done." Many of the BRICS nations have increased their holdings of gold over the last decade. Russia and China have more than doubled their holdings, to 2,329.6 and 2,245.3 ounces respectively, from 1,015.1 and 1,054.1 ounces in January 2014. India’s holdings have increased 45.7% over the same period. Copper Prices. Up to 2021 Highs or Down to 2008 Lows? The supply/demand equation is positive for copper prices to stay elevated between now and 2027. However, economic weakness can reduce demand sharply. As Rob McEwen pointed out, copper is called Dr. Copper because the prices tend to be negatively impacted in an economic slowdown or recession. Copper prices closed at $4.00/pound on Thursday, March 28, 2024. Prices rose as high as $4.71 in 2021. During the Great Recession, copper prices sank to a low of $1.40/pound. Analysts, including BloombergNEF, are projecting that increased demand and reduced supply could result in copper prices topping out again near or above the 2021 high, by 2027. Is McEwen Undervalued? With an implied value of $7.73/share for the McEwen Mining’s ownership of the copper asset, Rob McEwen makes a strong case that McEwen Mining is undervalued at $9.86/share. He believes the assets support a price as high as $30/share. As I’ve noted above, a lot can happen over a 5-6 year period, which is McEwen Copper’s projected timeline to production. Gold and silver have been two of the worst performing investments of the past decade. Millennials and Gen Z seem to prefer cryptocurrency as a safe haven and hedge. However, countries that are looking to break free from the petrodollar, including the BRICS nations, have been increasing their gold holdings. The BRICS currency is certainly gaining traction, and the countries' commitment has been solidified in the New Development Bank. According to Reuters, the UAE has joined BRICS, while Saudi Arabia is considering joining, but has not at this time. BRICS countries want to have a solid gold portfolio backing their currency promise. This is evident in their sovereign purchases of the precious metal. Bottom Line Investing in an individual microcap ($487.5 million value) is high-risk. While the McEwen Mining share price has soared 66% in the past month, it is still down -34% on the 5-year period. At the same time, smaller companies tend to fly higher when the wind is at their back. If gold and silver come into favor, and as we hear more hype and get closer to a production date for McEwen Copper, investors could become more enthusiastic. There are a lot of ifs in those sentences. However, BRICS is definitely on a path to de-dollarize the world economy, gold is being purchased by BRICS countries, and political/economic uncertainty (such as war and bank failures) favor safe havens, such as gold, silver and even cryptocurrency. Copper has been coined “the new oil” by Goldman Sachs. Between gold and silver, while gold is trading at an all-time high, silver is still down by almost half. Therefore, it seems that silver has a lot more runway to take off should precious metals cause investors to swoon again. Full disclosure: I own shares of McEwen Mining. Join us at our April 27-29, 2024 Spring Financial Freedom Retreat. Learn how to protect your wealth, hedge against a weaker dollar, invest and compound your gains, green your retirement plan, easy and efficacious nest egg strategies, how to get hot and diversified (including in artificial intelligence and EVs), how to evaluate IPOs and other stocks, and what's safe in a Debt World. You'll even discover how to save thousands annually with smarter big-ticket choices. Yes, it's a complete money makeover. Email [email protected] to register. Learn the 15+ things you'll master and read testimonials in the flyer on the home page at NataliePace.com. Register with friends and family to receive the best price. "Ten minutes into the first day I was already much smarter about investing than I ever thought I would be in my life and I knew I was in exactly the right place at this retreat. I am amazed at how EASY and FUN it is to make my money work for me and those I love. I think this kind of information should be compulsory in schools. I wish I'd learned this sooner." CM If you’d like an unbiased 2nd opinion on your current wealth plan, email [email protected] for pricing and information.)  Join us for our Online Spring Financial Freedom Retreat. April 27-29, 2024. Email [email protected] or call 310-430-2397 to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 7-14, 2025. Email [email protected] to learn more. Register by April 30, 2024 to receive $200 off the regular price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two and three 50-minute private, prosperity coaching sessions!  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is are the most recent releases of these books. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Substack podcast on Apple and Spotify. Watch videoconferences and webinars on Youtube. Other Blogs of Interest 2024 Investment of the Year? The Reddit IPO. Meme Stock or Snap Land? Tesla's Factory in Germany Taken Offline by Activists. Bitcoin Sets a New Record High. The Importance of Rebalancing. Beyond Meat's Shares Surge. Quaker Oats' Pesticide Problem. Stocks are Flying High. Why Aren't Mine? Cut Your Tax Bill in Half. 9 Tips. Celebrity Jet CO2. Green Washing. The Facts. Some Solutions. Copper: Essential to the Clean Energy Transition. Uh. Oh. More Bank Trouble. Are Amazon, Square and Other Tech Companies Ripping Us Off? Housing. Unaffordable. What Works? Case studies and creative solutions. Don't Reach for Yield. Closed-End Funds. 2024 Investor IQ Test. Answers to the 2024 Investor IQ Test. Apple's Woes Drag Down the Dow. The Winners & Losers of 2023. Ozempic, Magnificent 7 & Beyond. 2024 Crystal Ball. The Underperforming DJIA, Full of Fossil Fuels and Forever Chemicals. A Spectacular Year for 3 of the Magnificent 7. The Best ROI* (Almost 40%!) & 7 Life Hacks That Save Thousands. Portugal Eliminates Tax Advantages for Ex-Pats. Holiday Gift Giving on any Budget. Including No Budget. Once in a Century Events are Happening Every Day. The Crypto Winter Enters Its 3rd Year. Earn $50,000 or More in Interest. Safely. Finally. Freebies and Deals for Black Friday and Cyber Monday. Auto Strikes End. EV Price Wars Continue. WeWork's Bankruptcy. Half-Empty Office Buildings. Problems in our Personal Wealth Plan. Solutions for Unaffordable Housing. Cruise Ships Give Freebies to Investors. Should You Take the Bait? Should You Take a Cruise? Bonds. Banks. The Treacherous Landscape of Keeping Our Money Safe. 7 Rules of Investing Air B N Bust? Barbie. Oppenheimer. Strikes. Streaming Wars. Netflix. Monero: A Token of Trust? 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. Do Cybersecurity Risks Create Investor Opportunities? I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? The Online Global Earth Gratitude Celebration 7 Green Life Hacks Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. Which Countries Offer the Highest Yield for the Lowest Risk? Why We Are Underweighting Banks and the Financial Industry. 2023 Bond Strategy Emotions are Not Your Friend in Investing Bonds Lost -26%, Silver Held Strong. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed