|

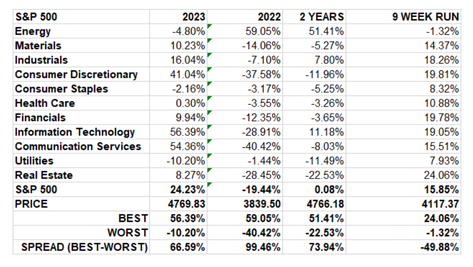

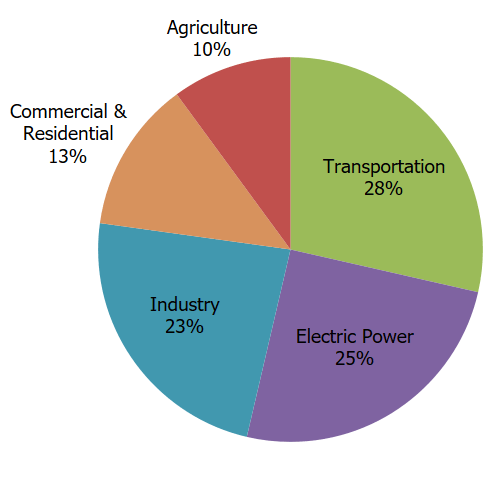

Beyond Meat’s Shares Surge. Quaker Oats’ Pesticide Problem. Beyond Meat’s shares jumped almost 40% after it announced earnings on February 27, 2024. Is this a renaissance of the brand? What about Quaker Oats’ pesticide problem? What’s interesting about Beyond Meat’s rally is that it didn’t happen because the company is selling more product. In fact, Beyond Meat is having to cut prices to compete with animal protein. Investors pushed the stock up on a promise from the CEO to stop losing money in 2024. Revenue actually dropped -8% year over year. Sales could sink another -24% in the first quarter of 2024. Quaker Oats has made headlines because a pesticide that is linked to infertility in animals has been found in 92% of samples of non-organic Quaker Oats and Cheerios and in the humans who eat them. This toxic pesticide requires very special handling by farmers. It is not legal for food use in the U.S. The loop-hole is that the fertilizer is approved for imported oats. Pepsico owns Quaker. How will this impact the parent company and the consumer staples industry? FYI: In a year where the S&P500 had 24.23% gains (26.3% total return in 2023), the consumer staples industry lost -2%. Here are the Things We’ll Discuss in This Blog Beyond Meat Shares Surged 38.8% After Reporting Earnings on Tues. Feb. 27, 2024 Meat Price Wars (Tyson Foods Way Down, Too…) Historical Context Climate Considerations: Plant-Based Meat vs. Animal Protein Regenerative Agriculture vs. Pesticides and Inputs Cash Bleed vs. Cash (Tyson is Cash Negative, Too) Forward Outlook And here is more information on each point. Beyond Meat Shares Surged 38.8% After Reporting Earnings on Tues. Feb. 27, 2024 While Beyond Meat’s commitment to a pathway to profitability is important, the company has very tempered expectations for 2024 based on weak demand, inflation, the cost of borrowing and concerns about a slowing economy. Beyond Meat expects their gross margins to be in the mid to high teens range in 2024. With only $206 million in cash and cash equivalents, stopping the cash bleed is vital, especially since the price of animal protein has been below plant-based protein of late. Meat Price Wars (Tyson Foods Way Down, Too…) Net revenues were $73.7 million for Beyond Meat, down -7.8% year over here. According to the company’s 4Q 2023 earnings report, the decrease was largely due to a 14.6% drop-in net revenue per pound. Tyson Food’s net revenues were flat year over year. Tyson lost $648 million in fiscal year 2023. If you’d like a Protein Stock Report Card, email [email protected]. Historical Context During the pandemic, some meat factories had to be closed. People were hoarding everything. Oftentimes there just wasn’t any animal protein (or toilet paper) available at the store. Grocers began placing plant-based protein in their butcher counters. People started stocking their freezers with that, too. Beyond Meat’s all-time high of $240/share was in 2019. It was down to $158/share in January of 2021. Shares closed this week at $9.77/share. Once the butcher shop was full of animal protein again, at a price that was more affordable than plant-based protein, non-vegetarians went back to meat. Of course, there are plenty of vegans and vegetarians in the world, who are always going to be looking for plant-based options. However, during the pandemic, when plant-based protein was all that was available, meat-eaters were buying it, too. Climate Considerations: Plant-Based Meat vs. Animal Protein Industrialized cattle raising is very heavy on CO2. Rain forests are razed, emitting CO2, and also wiping out one of the most valuable ways to draw down CO2 – ancient trees. Additionally, the cattle are often fed grain instead of grazing on grasslands. The grain is trucked in from far away. Animals are often farmed in foreign countries, such as Brazil or India, and then flown, shipped and trucked to consumers around the world. When anyone says that cows emit more pollution than cars, the statement is inaccurate, as you can see quite clearly in the CO2 emissions chart below. However, the industrial farming model is very hard on the environment largely due to the transportation pollution and forest and soil depletion noted above. It’s important to be aware of the fact that just 20 oil and gas companies (and the consumers who purchase their products) are responsible for over 1/3 of the CO2 in the atmosphere. That doesn’t give us a pass on eating a pound of flesh at every meal. The general consensus is that eating less meat protein is good for the planet, and a balanced diet that is rich in rainbow-colored produce is better for personal health. Additionally, it’s important to eat local and organic/regenerative meat and produce. Regenerative Agriculture vs. Pesticides and Inputs Quaker Oats made headlines this week because studies have found pesticides in Americans that are well above where they were just a few years ago. Food grown organically with regenerative agriculture practices does not rely upon pesticides, herbicides, or chemical fertilizers. So if you still want to eat oats, you might just consider an organic oat option. Quaker Oats is owned by Pepsico. The company accounts for about 4% of Pepsi’s revenue, so this is unlikely to be a brand killer. In fact, just a few days before the pesticide problem was reported by the Journal of Exposure Science and Environmental Epidemiology, Pepsico launched a new campaign in Canada and Latin America to promote Quaker Oats. Chlormequat is not approved for use on food in the U.S. However, the FDA does allow the importing of oats grown with chlormequat from other countries. According to an NIH white paper published in 2020, in addition to inhibiting reproduction, “Maternal exposure to chlormequat chloride during pregnancy disrupts the embryonic growth.” Despite these risks, the EPA is considering allowing farmers to use chlormequat to increase their crop yields. Eastman Chemical is a major manufacturer of chlormequat. Some important new documentaries are educating us on the importance of regenerative agriculture, and how this approach is healthier for the planet, people and the farmers. The Common Ground film is in select theaters now. You can also watch our Earth Gratitude interview with Farmer Gabe Brown and the co-directors of Common Ground at our Earth Gratitude YouTube channel. Also, check out the documentary Kiss The Ground, which is available to watch on Netflix. What scientists have discovered is that regenerative agriculture can draw down CO2 very effectively. Farmers can save hundreds of dollars per acre on input costs, while growing nutrient-dense, delicious food, and ensuring that their soil is healthy and doesn’t turn to dust. There are a lot of reasons for optimism and hope that are outlined in these documentaries, and I encourage everyone to watch them. It’s time to educate ourselves about the many benefits of regenerative agriculture, and how we can support regenerative farmers with our consumer choices, and also by writing to our congressmen to have regenerative agriculture supported in our Farm Bill. Again, shopping for organic/regenerative meat and produce at Farmers Markets and grocery stores goes a long way to reducing the amount of harmful toxins in our bodies. Cash Bleed vs. Cash (Tyson is Cash Negative, Too) A lot of food companies lost money last year. Tyson Foods lost -$648 million. Oatly lost -$393 million. Beyond Meat lost -$338 million. Hain Celestial lost -$117 million. The consumer staples industry itself was one of only a few industries to lose money on Wall Street last year, when the S&P500 had a total return of over 26%. Consumer staples were down -2.16%. Energy was down -4.8% and utilities were down -10.2%. Compare this to the cash-rich Magnificent 7 doubling their share price. Food companies typically have low profit margins. Inflation is hurting the industry, and competition makes it difficult to pass the costs along to the customer. Outlook Beyond Meat is expecting another drop in revenue in the first quarter of 2024, from $92.2 million in 2023 to $70-$75 million in 2024. That’s a drop of almost -25%. The 2nd half of 2024 might strengthen. The company expects $315 million to $345 million in annual revenue, which would be similar to 2023’s $343 million (at the top end of the range). Bottom Line Inflation is hitting all industries. Those industries like artificial intelligence and technology that are able to increase prices, have robust profit margins, a treasure trove of billions of dollars in cash, and very low debt are in a great position to continue operating without having to borrow money at today’s higher interest rates. However, many food companies have very low margins of profitability, which put a lot of them in the red last year. Be careful chasing gains on Beyond Meat just because you hear that the company’s share price jumped or their margins are expected to improve this year. One of the ways that we are, addressing the very elevated levels of debt in the United States, and the weakness in some value fund industries, such as consumer staples and banks, is to use value fund replacements. This is part of the curriculum offering in our Financial Freedom Retreat. Join us at our April 27-29, 2024 Spring Financial Freedom Retreat. Learn how to invest and grow your wealth, green your retirement plan, easy and efficacious nest egg strategies, how to get hot and diversified (including in artificial intelligence), and what's safe in a Debt World. You'll even discover how to save thousands annually with smarter big-ticket choices. Yes, it's a complete money makeover. Email [email protected] to register. Learn the 15+ things you'll master and read testimonials in the flyer on the home page at NataliePace.com. Register by Feb. 29, 2024 to receive the best price. "Ten minutes into the first day I was already much smarter about investing than I ever thought I would be in my life and I knew I was in exactly the right place at this retreat. I am amazed at how EASY and FUN it is to make my money work for me and those I love. I think this kind of information should be compulsory in schools. I wish I'd learned this sooner." CM If you’d like an unbiased 2nd opinion on your current wealth plan, email [email protected] for pricing and information.)  Join us for our Online Spring Financial Freedom Retreat. April 27-29, 2024. Email [email protected] or call 310-430-2397 to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 7-14, 2025. Email [email protected] to learn more. Register by April 30, 2024 to receive $200 off the regular price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two and three 50-minute private, prosperity coaching sessions!  Natalie Pace learning about organic and regenerative farming from David Wilson, the former Home Farm manager of H.M. King Charles III. Natalie Pace learning about organic and regenerative farming from David Wilson, the former Home Farm manager of H.M. King Charles III. Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is are the most recent releases of these books. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Substack podcast on Apple and Spotify. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Stocks are Flying High. Why Aren't Mine? Cut Your Tax Bill in Half. 9 Tips. Celebrity Jet CO2. Green Washing. The Facts. Some Solutions. Copper: Essential to the Clean Energy Transition. Uh. Oh. More Bank Trouble. Are Amazon, Square and Other Tech Companies Ripping Us Off? Housing. Unaffordable. What Works? Case studies and creative solutions. Don't Reach for Yield. Closed-End Funds. 2024 Investor IQ Test. Answers to the 2024 Investor IQ Test. Apple's Woes Drag Down the Dow. The Winners & Losers of 2023. Ozempic, Magnificent 7 & Beyond. 2024 Crystal Ball. The Underperforming DJIA, Full of Fossil Fuels and Forever Chemicals. A Spectacular Year for 3 of the Magnificent 7. The Best ROI* (Almost 40%!) & 7 Life Hacks That Save Thousands. Portugal Eliminates Tax Advantages for Ex-Pats. Holiday Gift Giving on any Budget. Including No Budget. Once in a Century Events are Happening Every Day. The Crypto Winter Enters Its 3rd Year. Earn $50,000 or More in Interest. Safely. Finally. Freebies and Deals for Black Friday and Cyber Monday. Auto Strikes End. EV Price Wars Continue. WeWork's Bankruptcy. Half-Empty Office Buildings. Problems in our Personal Wealth Plan. Solutions for Unaffordable Housing. Cruise Ships Give Freebies to Investors. Should You Take the Bait? Should You Take a Cruise? Bonds. Banks. The Treacherous Landscape of Keeping Our Money Safe. 7 Rules of Investing Air B N Bust? Barbie. Oppenheimer. Strikes. Streaming Wars. Netflix. Monero: A Token of Trust? 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. Do Cybersecurity Risks Create Investor Opportunities? I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? The Online Global Earth Gratitude Celebration 7 Green Life Hacks Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. Which Countries Offer the Highest Yield for the Lowest Risk? Why We Are Underweighting Banks and the Financial Industry. 2023 Bond Strategy Emotions are Not Your Friend in Investing Bonds Lost -26%, Silver Held Strong. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed