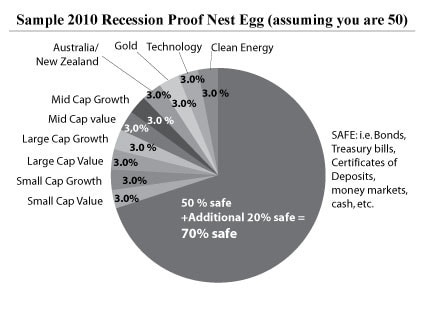

FAANG. Facebook, Amazon, Apple, Netflix and Google. The companies are hot, and their stock is on fire. Since March of 2009 (the bottom of the market), FAANG stocks have lead the NASDAQ Composite Index to double the Dow Jones Industrial Average in returns. FYI: Technology was so hot in the wake of the Recession, that I listed it as a hot slice on my nest egg pie charts. Australia, gold and technology all more than doubled. (Even clean energy had a great run in 2010.) The question now is: “Will you will be toasty with holiday returns, or burned by buying high?” All of the FAANG companies have impressive sales growth year over year. This compares to many of the Dow Jones Industrial Average components have flat or lower sales. Facebook, Netflix and Amazon all boast sales growth of 30-47% year over year. Google is close with 23.7% growth, and Apple is still posting 12% growth (after a down year). By comparison, BUMPP stocks (Boeing, United Technologies, Merck, Pfizer and Procter and Gamble) sales are by and large flat year over year. Net profit margins lean toward FAANG, as well. While Boeing, United Technologies and Merck range between 7-9% net profit, Facebook’s profit margin is 41.69%. Apple and Google are in the 20% range, while Amazon eeks out 1.19% and Netflix profits at 4.04%. If we skip over the Pacific pond to China, Alibaba’s revenue growth is an eye-popping 61%! The sales growth range of the Chinese ABCWW stocks is 28.70-72.50% (Alibaba, Baidu, CTrip, Wuba & Weibo)! The profit margins are just as impressive with Baidu, Alibaba and Weibo at 23%, 27% and 31%, respectively. Clearly technology is hot, China is hotter, and old school pharma and defense are a bit blasé. But here is where we need to apply the price test. By every measure, FAANG stocks are high (as are BUMP and ABCWW). How high? Earlier this year, Robert Shiller, Nobel Prize winning economist and Yale professor of economics, wrote, “The only time in history going back to 1881 when [price earnings ratios] have been higher are, A: 1929 and B: 2000. We are at a high level, and its concerning. People should be cautious now.” Amazon's price-to-earnings ratio is 286. Netflix is 192. Facebook and Google are both 34. If you think about it for a moment, should a company like Amazon, with $2 billion in net income, be worth over half a trillion dollars? By comparison, Wal-Mart makes $13.64 billion, and has half the market value as Amazon. Google has $20 billion in net income, with a Wall Street valuation of $720 billion. The age old adage is: “Buy, low sell high,” not “Buy high, sell higher.” Anytime we buy high, we risk getting burned, whether it is stocks, real estate, classic cars, gold or Bitcoin. At the same time, if you try market timing, and jump all in or all out, then you are more likely to lose than to win. There is a lot of manipulation going on, so it is very difficult to predict the exact point of correction. (The current bull run is fueled largely by companies borrowing money very cheaply and buying back their own stock. While this makes the markets go higher, buybacks and running prices into the astrosphere don’t make for a healthy economy – great products do.) Most people who try market timing jump out at the bottom, selling low, and jump in at the top, buying high – the exact opposite of what you know, on paper, to do. This is because they are using emotions, not a sound, time-proven strategy. That’s why my time-proven, trademarked, easy-as-a-pie-chart nest egg strategies work so well. Instead of market timing, you just underweight or overweight based upon market conditions. You’re never all in or all out, but you keep enough safe to limit your losses in corrections, and enough at risk to ensure that you’re benefiting from bull runs. (Those people, like Nilo Bolden, who used this system earned gains in the Great Recession and have outperformed the bull market in between.) Annual rebalancing is also key, which turns out to be a great system for buying low and selling high… If you'd like to try the free web app for my pie charts, go to NataliePace.com. The link is on the home page. The pie charts will make more sense if you know my system, which is outlined in my 3 bestselling books (links are available on the home page at NataliePace.com) and in my 3-day, life-transforming, investor educational retreats. So, can the stock market keep going up up up? History tells us, “No.” Headlines and politicians tell us, “Yes.” I did a little homework and discovered that the first admission that we were in a deep, horrible downturn during the Great Recession occurred in October of 2008 – when the stock market had already lost over 8000 points. In other works, if you wait for the headlines and politicians, you’re going to be too late to protect yourself. Having more FAANG and Chinese ABCWW in your nest egg, getting diversified, and keeping enough safe, while underweighting BUMPP is a good idea. However, it is just as important to know how much to keep safe, and what safe is in a Debt World. At the Investor educational Retreats, you learn how to identify hot trends, how to avoid the loser funds, lean into the hotter industries and add sizzling slices for top-notch performance. And once you do that, it’s time to look at the biggest piece of the pie for anyone over 40 – the safe side. There again are some very hot prospects. We’ve even identified thousands of dollars that the average family can save with smarter energy, budgeting and investing choices, with some of the safest hard assets there are available today. Since there is too much paper floating around in the developed world (with massive debt), getting safe requires getting creative. If you simply choose what the broker-salesman offers (more paper, like bonds, private equity REITs, etc., annuities and life insurance), it is very likely that you are vulnerable to more capital loss than you are aware, and not getting properly paid for the risk. If you’re interested in learning this easy system from me, join me at the Valentine’s Retreat in the beautiful beach town of Santa Monica, California. Click to read testimonials and discover the 15+ things you’ll learn. Only 5 seats remain available. Get the best price when you register with a friend by Dec. 15, 2017. 17/2/2019 01:40:05 am

Youre so cool! I don’t suppose I’ve read anything like this before. So nice to find somebody with some original thoughts on this subject. really thank you for starting this up. this website is something that is needed on the web, someone with a little originality. useful job for bringing something new to the internet! 20/11/2019 09:52:38 pm

The interesting stock programs and preparing for the essential marketing stock thoughts and including more info. Targeting the thoughts and market components for essential technology product history. 13/5/2020 03:26:29 am

Really impressed! Everything is very open and very clear clarification of issues. It contains truly facts. Your website is very valuable. Thanks for sharing 13/5/2020 10:34:27 am

Thanks for your comments. Ask questions. We're happy to address pressing money issues for Main Street. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed