|

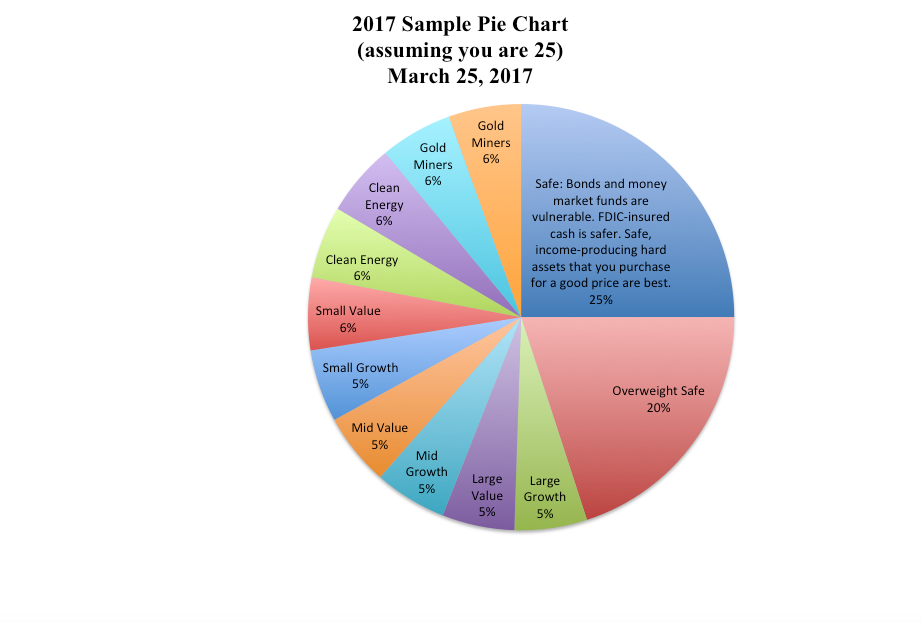

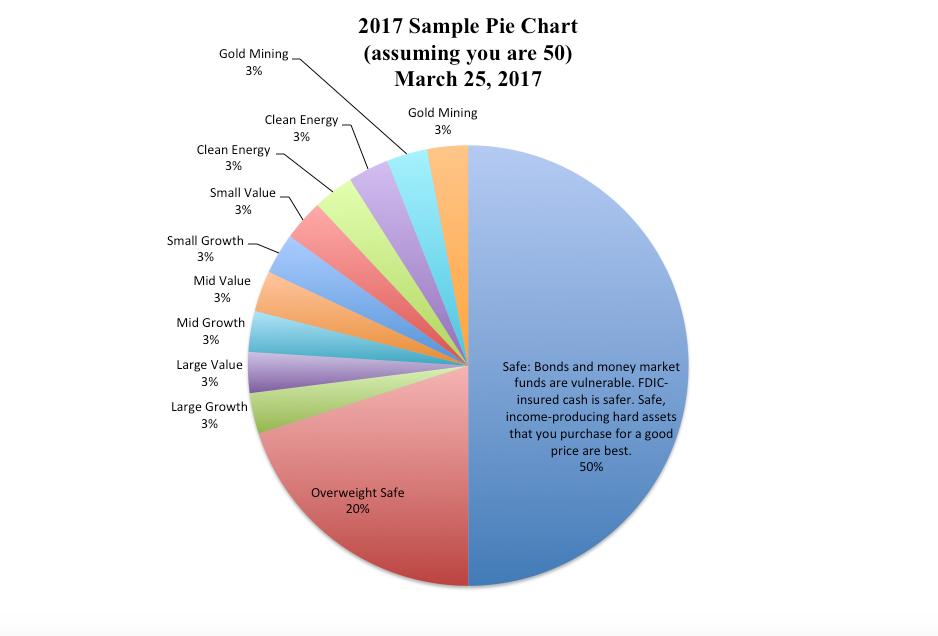

Dear Natalie: Are there any basic rules of investing? I just don’t know which boxes to check in my 401(k)? Signed Clueless Dear Smart Enough to Ask (Instead of Remaining Clueless): There are tried and true rules of investing, and a few things that used to work, which no longer work. You should always keep a percent equal to your age safe because as you get older you can’t afford the risk of the stock market. Then diversify your “at risk“ portion into small, medium, large, value and growth. I like to add in hot funds, as well, for improved performance. So, for instance, if you think that gold is hot, then have a slice of gold. If you think technology, China, Chile, Australia or another country or industry is hot, then have a slice of that, too. You really only need 10 funds to be diversified, and ten is easy to work with as a mathematical number. If you have pages and pages of stocks and bonds in your financial plan, then you have more risk and expenses than you realize, and you likely are not as diversified as you should be – despite all of the pages of investments. Every year you get a year older, and your investments will have some gains or some losses. So every year it is a good idea to print out what you have in your 401(k), and mock up what you should have, based on keeping a percent equal to your age safe and diversifying into 10 funds. Then you simply make what you do have look like what what you should have. The cool thing about annually rebalancing your 401(k) and investments is that it is a plan that allows you to buy low and sell high on auto-pilot. When a slice is much bigger than it should be, then you sell a little (selling high) and get more into your safe side. When a slice is thinner than it should be, then you might buy a little more at a lower price (buying low), or you might replace it with another fund that might perform better. Here are sample nest egg pie charts. At my investor educational retreats, I teach you a few more very important tricks of the trade to fine-tune your investments. What’s hot and what’s safe changes every year. It’s important to learn what’s safe in a world where there is far too much debt floating around, since, for anyone over 50, the safe side of our investments is the largest piece of the pie. This year, it is more difficult than ever to get safe, because bonds are in a bubble, money market funds have redemption gates and liquidity fees and many bank products, such as high-yield CDs and index based annuities or term life policies, are not as safe as you think. You could be vulnerable to losing money when the stock market goes down. Safe investments are supposed to protect you from stock market losses. Below is a good check list. 8 Basic Rules of Investing

If you don’t know how to do each of these 8 things, or if you’d like to dive deeper into what’s safe and what’s hot, then learning the ABC’s of Money that we all should’ve received in high school is your best investment. As Benjamin Franklin says, “If you think education is expensive, try ignorance.” The cost of ignorance in the Great Recession was that most Americans lost more than half of their retirement. Can you really afford to lose half again? About Natalie Pace Natalie Wynne Pace is the co-creator of the Earth Gratitude project and the author of the Amazon bestsellers The Gratitude Game, The ABCs of Money and Put Your Money Where Your Heart Is (aka You Vs. Wall Street). She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical). Wondering if your plan is vulnerable to losing more than half again? Natalie Pace is also available for an unbiased second opinion on your current budgeting and investing strategy, through her private prosperity coaching. Call 310-430-2397 or email info @ NataliePace.com to learn more about her coaching and pricing, and if you are interested in learning more about our Investor Educational Retreats. Important Disclaimers

Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. 8/3/2021 08:57:09 am

thanks for helpful share about these basic rules of investing. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed