|

What are the perils of the 10-page (or more) financial plan?

How? (The devil is in the details.)

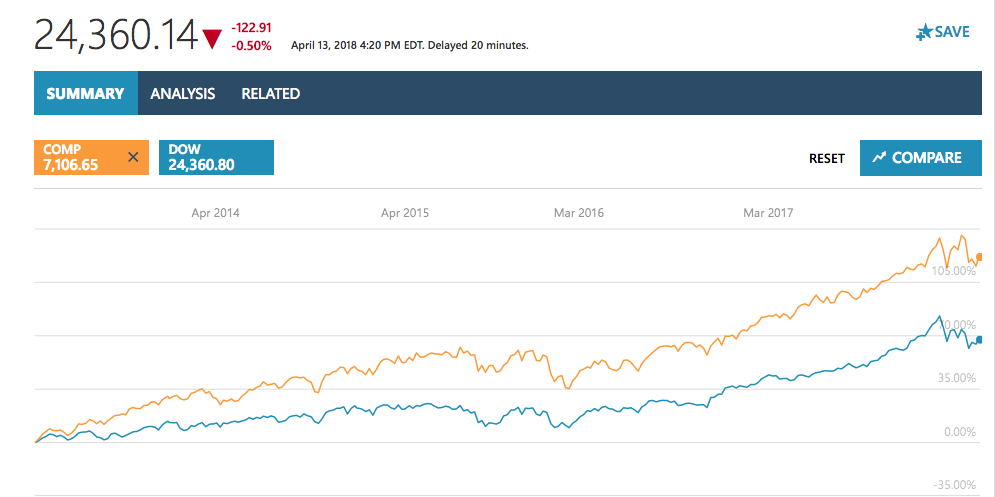

Performance of The NASDAQ Composite Index During the Dot Com Recession Chart c/o Google Finance. © Google. Used with permission.

What’s the solution? Why not get an unbiased second opinion on your current budgeting and investing strategy, now while the markets are still high? (Call 310-430-2397 to learn more.) My easy-as-a-pie-chart nest egg strategies earned gains in both of the last two recessions and have outperformed the bull markets in between. "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human capital I’m not a broker-salesman. I don’t sell financial products. My goal is to empower Main Street, so that you can be the boss of your money. And I prefer to do this now, so that you can keep what you have before the next stock downturn. If you wait for the headlines that the economy is in trouble, it will be too late to protect yourself. Many times people come to me after they’ve lost half or more, which is better than not getting this information at all. However, clearly, I’d prefer to protect your retirement and teach you easy, smart systems that can earn gains in recessions and outperform the bull markets in between. While we’re at it, I’ll also share wealth strategies of royals and billionaires, so that you can save thousands annually in your budget with smarter choices for your big-ticket budget items. Blind faith in broker-salesmen, whose interests are not always in alignment with yours, has cost many Americans half of their nest egg every eight years. In 2000, Dot Com investors lost 78% of their stocks. In 2008, blue chip investors lost 55% (or more). When you add in the fees and commissions charged (sometimes hidden or opaque on your statements), the losses are even worse. Wisdom is the cure. Call 310-430-2397 or visit NataliePace.com to learn more. Attend the Florida Beachfront Space Coast Retreat to learn and implement the ABCs of Money that we all should have received in high school, while enjoying a fabulous vacation in the warm Atlantic Ocean. Register by April 18, 2018 and you’ll receive the best price and a complimentary private, prosperity coaching session (value $300). Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed