|

Are you excited about stocks? Do you have a plan to stay on top, even if the market continues to head south? Have you been burned a few times? Are you a little worried about staying in, when the headlines scream of record 1,175 Dow point drops in one day? As with all things, the more you know, the more success you’ll enjoy. Working smarter will always produce better results that just working harder. You wouldn’t expect yourself to write an essay if you didn’t know your ABCs, or to balance your checkbook if you had never learned how to add. So, learn Wall Street secrets to improve your Money While You Sleep gains. Wall Street Secrets They Don’t Want You To Know

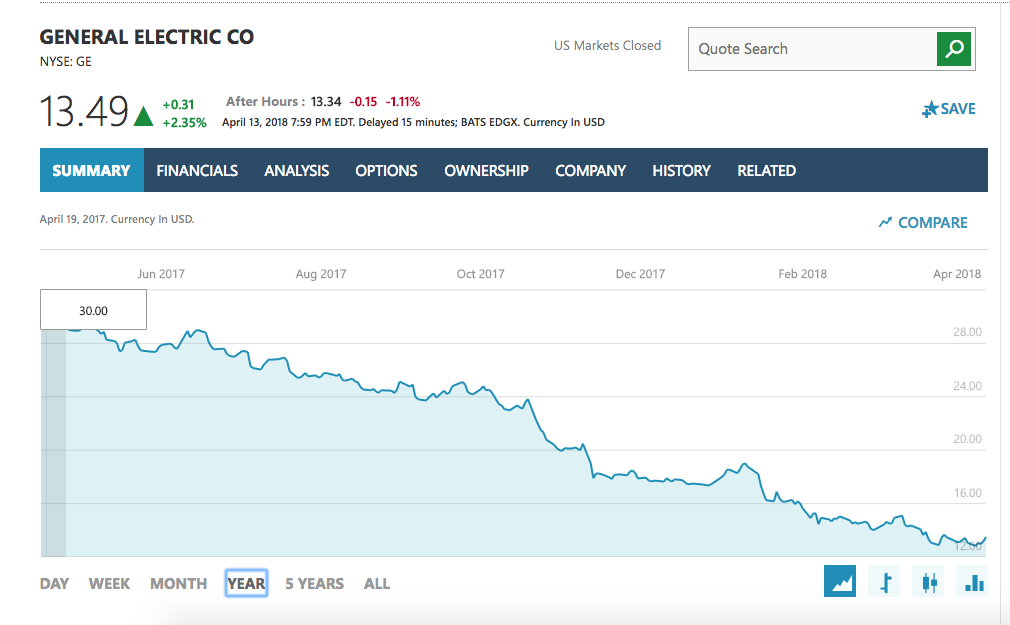

And here are the details… 1. The Dow Theory The Dow Theory has six considerations that indicate when a primary market trend change is on the horizon. 5 out of 6 of the points are indicating the beginning of a bear market. 2. The Biggest Fool Theory Many people wait for the institutional moves or analyst recommendations to make changes to their financial plan. The reasons that this strategy doesn’t work are many, including basic supply and demand principles. One of the little known Wall Street secrets, however, is The Biggest Fool Theory. Bankers, insiders, hedge fund managers and institutional investors all end up operating on the Biggest Fool theory, where everyone continues enjoying the bubble, even when there are clear indications it’s a bubble, for the profits – thinking that they’ll be the first out, and the Biggest Fool will be caught holding all of the losses. Everyone is a Big Fool for buying into a bubble. However, only the Biggest Fool doesn’t get out in time. The sad reality is that this stupid psychological greed fest lies at the heart of the bank meltdown in the Great Recession, when insiders knew that real estate was in a bubble, but the profits were so high that staying out could cost you your job. 3. The $3.2 Trillion Speculative Money Rollercoaster Hedge funds account for $3.2 trillion on Wall Street. This basically means that high frequency trading, stop losses, shorts and other derivative products will hasten the speed of any correction, making it almost impossible for the average Main Street investor to protect herself without having a solid, time-proven plan in place to begin with. Nilo Bolden used a pie chart that I drew on a napkin to earn gains in the Great Recession, when most people lost more than half of their nest egg. I used this plan in 2000, before the Dot Com Recession. In 2001, I almost tripled my money, when most people lost 78% of their NASDAQ stocks. 4. Catch a Falling Knife and Fat Fingers Secretary of the Treasury Henry Paulson first proposed financial reform (a bank bailout) to Congress on March 31, 2008. However, it wasn’t until the Lehman Bros. bankruptcy on September 15, 2008 that it became clear to the average American that the banks were failing. By Friday, Oct. 3, 2008, when President George W. Bush signed the TARP bailout, the stock market had already dropped almost 40%. The May 6, 2010 Fat Finger Flash Crash caused a trillion dollars in losses on Wall Street in just 36 minutes. This was largely caused by hedge funds using high frequency trading and order privileges to spoof the market into a downward spiral, which was designed to stop right above 10%, the point at which a market stop would kick in. Spoofing, layering and front-running were banned in 2015. However, industry experts believe that traders can still work in the shadows, despite improved monitoring, because regulators are “on bicycles, trying to catch Ferraris.” (John Bates, Traders Magazine, April 2015). The conversations that go on between bankers and regulators behind closed doors are quite different than the sound bytes (cover ups) that are spouted on TV. If you wait for the headlines that we’re in trouble, it’s too late to protect yourself. Far too many people, even very smart and educated people, sell low and buy high when listening to headlines because headlines create stomach acid and euphoria. Never let hormones run your investment strategy. 5. Think Capture Gains, Not Stop Losses Stop losses work great for brokerages, who rely upon fees for their revenue and income. However, with the seesaw volatility of stocks in the New Millennium, if you just changed your strategy to a “capture gains” strategy, you’d be profiting, instead of losing time and again. My easy-as-a-pie-chart nest egg strategies, with a few of my trademarked tricks, allow you to buy low and sell high with a simple annual rebalancing plan. In other words, a solid, time-proven plan that earns gains in recessions and outperforms the bull markets in between is less time and money than what you are currently spending. 6. Do What Warren Buffett Does, Not What He Says When the stock market weakens, you’ll find CNBC and other financial networks trotting out video of Warren Buffett saying that investors should just ignore their portfolios so they don’t screw them up. That is not what he does, however. In fact, Warren Buffett is often the first one out before bad news. In June of 2017 (or slightly before), Berkshire Hathaway sold 10.6 million shares of General Electric stock, worth $315 million. GE cut its dividend by half on November 13, 2017. Today, the company’s stock is worth less than half of what it was when Warren Buffett sold, at about $143 million. 7. Buy and Hold Doesn’t Work

Broker/salesmen who tout buy and hold are part of an old school system that is no longer relevant. Buy and Hold is a disastrous plan in today’s stagnant economy, which sees market losses of more than 50% every 8 years. While Buy and Hold investors are on a rollercoaster that costs them half of their nest egg every 8 years, Modern Portfolio Theory investors are able to enjoy profits, protect themselves from downturns, enjoy a solid plan and foundation for their wealth with a plan that costs less time and money than Buy and Hold. (When you lose half, that’s a lot of money, distress and lost sleep, and can force you to keep working, instead of retiring!) Investors like Nilo Bolden earned gains in the last two recessions, and can build upon that foundation in the years to come, instead of losing more than half and then crawling back to even. 8. Low Interest Rates Create Bubbles Low interest rates create bubbles. That is the real reason why the Federal Reserve board is increasing interest rates and tightening up money supply by selling off their Treasury Bills and mortgage-backed securities. In 2000, the bubble was Dot Com stocks. In 2008, the bubble was real estate and bank derivatives. In 2018, the bubbles are stocks and bonds, according to Alan Greenspan, the former chairman of the Federal Reserve Board. Warren Buffett agrees that stocks and bonds are too expensive (a bubble). Nobel Prize winning economists Robert Shiller says that the last two times stocks were this expensive were in 1929 and 2000, before the Great Depression and before the Dot Com Recession. 9. Brokers Are Salesmen, Not Surgeons If your financial plan is longer than a few pages (or conversely, if it is just one fund), then chances are that you are making the broker and brokerage rich, while riding the Wall Street rollercoaster up and down every eight years. Beware of REITs, annuities, dividend stocks, high-yield bonds and other funds that are paying the highest commissions these days. Salesmen tend to gravitate toward the higher commissions for personal gain. Many times their financial incentives are in opposition to their client’s needs. There is an inherent conflict of interest in the way that many (but not all) broker-salesmen are compensated. 10. Options Make the Brokerages Rich, Not the Investors Options trading has become more popular of late, with Main Street being sold into these strategies as a great second job or insurance policy. Your best insurance policy for your nest egg is a time-proven plan. Options rarely work out for Main Street investors, or other investors for that matter. In fact, Dr. Myron Scholes, one of the authors of options trading pricing, had one of the biggest hedge fund bailouts in history with his Long-Term Capital Management. However, due to the frequency of trades with options, and the extra fees charged, many online discount brokerages are making “bank” by selling you into options. 11. Trading on Headlines If you wait for the headlines to act, it is too late to protect yourself. Headlines are the reason why so many investors end up buying high and selling low. If you wait for the headline that the economy is in trouble, the markets are already low, and you end up selling low. If you buy into the headlines that the markets are at all-time highs and doing GREAT! Then you are buying high… This is clearly the opposite of what investors know to do. Buy low; sell high works, but it runs against your stomach acid, euphoria and headlines. If you want to learn and implement investing strategies that earn gains in recessions and smart budgeting choices that save thousands annually, then join me at my next Investor Educational Retreat. It’s a good idea to do this now, before the markets correct any further. You’ve got 3 to choose from, from our most affordable Wild West Retreat April 20-22, 2018, to our Space Coast Beachfront Florida Retreat June 9-11, 2018 and our Manhattan mini-retreat. Call 310-430-2397 to learn more. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed