|

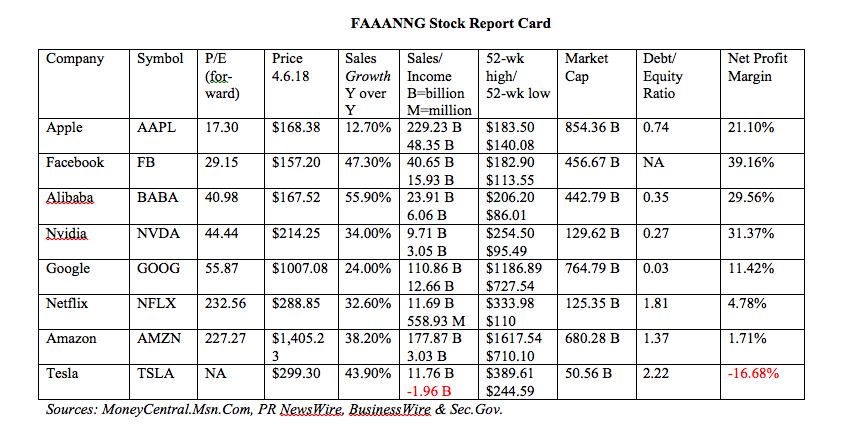

With Facebook facing Congressional inquiry and Amazon enduring the Tweet wrath of the White House, will these two kingpins of the amazing FAANNG* spin out and spiral down the NASDAQ Composite Index? NASDAQ has doubled over the last five years – even with the 2.28% pullback on Friday. (By comparison, the Dow Jones Industrial Average is up 61% over the same period.) However, is the party over? *Facebook, Amazon, Apple, Netflix, Nvidia and Google. It’s difficult for Americans to break their addictions. Despite the threatening eye of Washington on Facebook and Amazon, consumers continue to post their pics and order their flicks, books and gifts on these colossal platforms. There’s just no viable alternative. We’re hooked in, and everything is too easy and comfortable to leave. With Facebook, it’s almost like being a battered wife. We know better than to play around with those silly personality profiles, and aware that our information is going to be passed around and exploited, but hope that somehow the company will clean up and act differently (despite little evidence of that). “I have years of photos that don’t exist anywhere else, and many many friends and relatives I would have no other way of staying in touch with on a consistent basis,” one of my Facebook friends said, when asked if she would stay or go elsewhere. That doesn’t mean that NASDAQ investors are going to be back in the money anytime soon. Before these scandals broke, there was already ample evidence that these stocks were overpriced. Facebook is worth $457 billion, on net income of only $6 billion (and a price-to-earnings ratio of 29). Amazon is worth almost $700 billion on net income of $3 billion, and a PE of 227. According to Nobel Prize winning economist and Yale professor Robert Shiller, “The only time in history going back to 1881 when [stock prices have] been higher are, A: 1929 and B: 2000. We are at a high level, and its concerning. People should be cautious now.” FAANNG companies boast impressive revenue growth year over year, ranging from 13% (Apple) to 47% (Facebook). Nvidia and Facebook have almost unbelievable profit margins of 39% and 31%, respectively. However, the shadow truth of all of those sales is that companies are borrowing cheap money for their spending (consumers are borrowing at a high cost on credit cards) – and no one can continue borrowing from Peter to pay Paul forever. With consumer debt, public debt and asset prices higher than ever (yes, higher than before the Great Recession), we may be nearing the end of the free money party. That is certainly what the Federal Reserve is promoting with their current plan of deleveraging and raising interest rates. Facebook is projecting a deceleration in revenue growth in 2018, with a massive increase (up 45-60% over 2017) in total expenses – reversing the trends of 2017. Capital expenditures are projected to be in the range of $14-$15 billion. By comparison, full year cap ex in 2017 was $6.7 billion. Data centers, servers, office space and network infrastructure will all be a focus of the increased spending. The FAANNG companies have a market value of over $3 trillion. They are pretty much here to stay, and will continue to gobble up (acquire) their competition as long as they can. (Facebook owns Instagram, WhatsApp and other platforms.) When you are thinking about revenue growth, Amazon will continue to outperform Wal-Mart and Facebook will continue to dominate Twitter and Snap. However, that doesn’t mean that their share prices can’t weaken, particularly at the lofty PEs we’ve seen of late. Remember that investing should never be about market timing. Almost everyone is too late getting out and back in when they try jumping in and out on headlines -- essentially buying high and selling low when you let headlines and worry dominate your strategy. Diversifying, rebalancing, avoiding the bailouts, adding in hots, knowing what is safe in a world where bonds are in a bubble – this is a time-proven, superior strategy that is easy-as-a-pie-chart. That is why I call it the ABCs of Money that we all should have received in high school. Call 310-430-2397 to learn more. About Natalie Pace:

Natalie Pace is the author of The Gratitude Game and the Amazon bestsellers The ABCs of Money and You Vs. Wall Street (aka Put Your Money Where Your Heart Is in hard cover). Natalie has been saving homes and nest eggs for 14 years, while at the same time earning the ranking of No. 1 stock picker. Natalie Pace is a repeat guest on national television and radio shows such as Good Morning America, Fox News, CNBC, ABC-TV, Forbes.com, NPR and more. As a strong believer in giving back, she has been instrumental in raising tens of millions for public schools, financial literacy, the arts and underserved women and girls worldwide. Follow her on Twitter.com/NataliePace and Facebook.com/TheABCs of Money. For more information please visit NataliePace.com. Click to access a longer bio on Natalie Pace. IMPORTANT DISCLAIMER (PLEASE READ): Please note: NataliePace.com does not act or operate like a broker. We report on financial news, and are one of the most trusted independently owned and operated financial news corporations in the U.S. This article is intended to educate and inform individual investors, and, thus, to give investors a competitive edge in their personal decision-making. The publicly traded companies mentioned in this article are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be using the Hot News on Cool Stocks list or the Cooling Off list to trade their nest eggs. Your retirement plan should reflect a long, safe strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. IMPORTANT DISCLAIMER: Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. 26/10/2018 01:19:39 am

Why not, there ought to be a subject of the process course for each class. Each body should think about the utilization of the in the examination and how one idea can be explained with points of interest and precedents with the assistance of the PC. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed