|

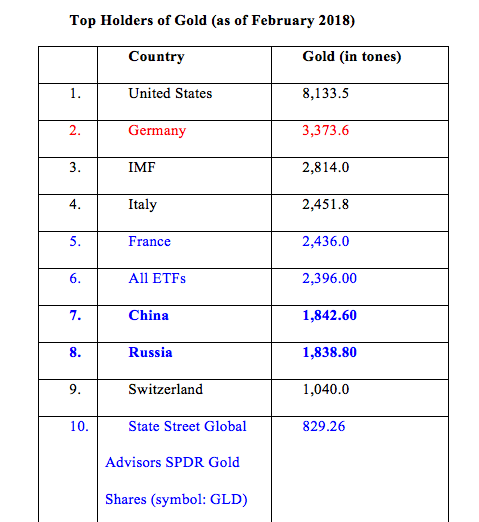

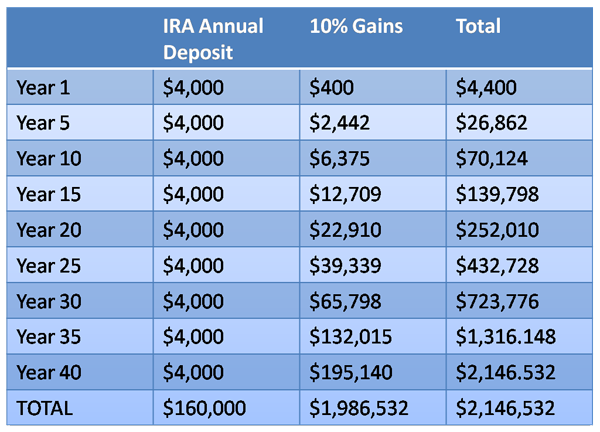

1. What is the most important question you should ask your Certified Financial Advisor before hiring him/her? "How much of my portfolio should I keep safe?" This question will help you to determine whether you are dealing with a trusted professional who is looking after your best interest, or a salesman who is looking to make a quick buck. The answer to this question in the 10th year of a bull market is, "A percentage equal to your age for sure. But this deep in the bull run, we might consider overweighting even more safe." Get 12 questions and answers to help you interview your Certified Financial Planner candidates in Put Your Money Where Your Heart Is (aka You Vs. Wall Street in paperback), in the chapter "Brokers are Salesmen, Not Surgeons." 2. What are 3 red flags that your financial plan is in peril? *If you lost 30% or more in the Great Recession and you haven’t made any changes, you’re as vulnerable (or more) today as you were then. *If you have 18-pages of holdings in your financial plan, your gains could be destroyed in fees and commission. *The NASDAQ is up almost six times the low of March 9, 2009. The Dow Jones Industrial Average is up about 3.5 times. If your returns are lackluster, your plan needs revising. Now is the time to do this assessment because Alan Greenspan, Warren Buffet and Robert Shiller are all saying that stocks and bonds are in a bubble, and the last two times we had corrections (2000 and 2008), most people lost more than half of their retirement. 17 million homes have been auctioned or repossessed by banks since 2006. The Dow Jones Industrial Average October 2007 - March 9, 2009 The NASDAQ Composite Index March 2000 - October 2002 If you’d like a second opinion on your current plan from an unbiased analyst with a time-proven track record of saving homes and nest eggs and earning the ranking No. 1 stock picker, call 310-430-2397. 3. How much of your nest egg should you keep safe? A percentage equal to your age. Consider overweighting more safe when times look pretty perilous or a bull market is going into its 10th year (as is the case in 2018). This simple strategy helped followers of Natalie Pace earn gains in the last two recessions. The trick in today’s world is to know what’s safe when bonds are in a bubble (and risky) and money market funds have redemption gates and liquidity fees. 4. What's safe? Hard assets will outperform paper assets in a world where there is too much monopoly money and broken pension promises floating around. So, the mantra is “safe, income-producing hard assets that you purchase for a good price.” However, you also need liquidity and cash flow. That is why some of the best investments are those that reduce your monthly expenses (for life). That is why I spend one full day on What’s Safe at the Investor Educational Retreats. Call 310-430-2397 to learn more. 5. What is the average return of stocks over the last 10 and 30 years? Large cap stocks earned 8.5% annualized over the last decade and 10.70% over the 30-year period. Small cap stocks performed at 9.36% and 12.09%, respectively. 6. What is the average return of gold over the last 10 and 30 years? Gold returned 3.79% annualized over the 10-year period and 3.29% over the last 30 years. While gold doesn’t look like much on paper, gold mining stocks doubled in 2016. The all-time high of $1,895/ounce in gold occurred in September of 2011, the month after Standard and Poor’s downgraded the U.S. credit. 7. What is the average return of real estate over the last 10 and 30 years? Real estate prices higher than they were before the Great Recession – meaning real estate is largely unaffordable in many areas, particularly for Millennials and the middle class. How does that play out in returns for homeowners? If you started owning your home 30 years ago, you’ve made 9.3% annualized – outstanding! If you purchased a decade ago, you might have been a victim of more than 17 million auctions and bank REOs (repossessions). Over the last decade, real estate has performed at 2.66% annualized. 8. What was the top performing investment in 2017? Bitcoin rose almost 14X in 2017. (In 2018, it’s been off by as much as 50% from the highs.) NASDAQ (29%), the Dow Jones Industrial Average (25%), gold mining stocks (12%) and oil prices (12%) all rose. Companies have been borrowing cheap money and buying back their own stock – fueling the bull market. Rising interest rates are predicted to stop that flow. 9. How long will it take for you to have a nest egg as big as your annual salary if you put 10% of your income into a tax-protected (and financial predator proof) individual retirement plan and invest in stocks and bonds*? 7 years. Based upon 10% average annualized returns of stocks and bonds over a 30-year period, which is below what those assets have done from 1988-2017. 10. How long will it take for your nest egg to earn more than you earn, if you put 10% of your income into a tax-protected (and financial predator proof) individual retirement plan and invest in stocks and bonds*? 25 years. Based upon 10% average annualized returns of stocks and bonds over a 30-year period, which is below what those assets did from 1988-2017. 11. What’s the best investment strategy in a slow-growth, high-debt world? Hard assets hold their value better than paper assets when there is too much paper floating around. Market timing doesn’t work, and you still need liquidity. So, learn how to diversify properly (you don’t need 18-pages of holdings), avoid the Bailouts, add in hot industries, keep enough safe, overweight safe in volatile times and rebalance 1-3 times a year. 12. Which countries hold the most gold? The United States is the top holder of gold worldwide, by far, with over 8,133 tons, followed by Germany, the International Monetary Fund, Italy, France, ETFs, China and Russia. China and Russia have been on a gold buying spree since 2008. There are multiple reports that the U.S. banks and brokerages have been selling their client’s gold assets (sometimes without permission), which has kept gold prices very tepid, perhaps artificially so. Deutsche Bank settled a lawsuit, and agreed to name names of other banks on Dec. 2, 2016. 13. Are annuities safe? Insurance products, including life insurance and annuities, aren't covered by the FDIC. If we had not bailed out AIG in 2007, more than 50 million annuity holders would have been in real trouble. Your annuity product is only as safe as the insurance company that is selling it to you. Insurance products are like being a renter. If you can’t pay, you get tossed out. Many people pay for life insurance their entire working life, and then can’t pay when they retire – when they are really most in need. If you put that money into your own tax protected account, you could save on taxes, compound your gains, and it would be there for you when you retire. Recessions are hard on insurance companies. Compounding Gains is the Key to Wealth 14. What is the 3-Ingredient Recipe for Cooking up Profits? 1. Start with what you know and love 2. Pick the Leader 3. Buy low; sell high (easy to say; hard to do) This recipe, along with my Stock Report Card, Four Questions, market strategies and data drilling are how I earned the ranking of number one stock picker. The recipe is easy. Learning to use it requires practice and learning how to find and use the data from a master. Come to my next Investor Educational Retreat to learn firsthand (from me) how easy and effective this strategy is, and why it has worked through bull and bear markets for more than a decade, while most strategies have bankrupted investors. 15. What are the Four Questions for Picking Winning Stocks? The Four Questions for Picking Winning Stocks. 1. What’s the product? 2. Who’s the customer? 3. Can the company continue to make superior product going forward and get it to their customer at the best price before the competition? 4. Who’s the CEO and can s/he motivate the employees to make the best product faster, better and cheaper than the competition? As you can see, three out of four questions can be answered by being a good customer of the company, and the 3rd question can be answered by completing a Stock Report Card. So, the more you know about a company (ingredient #1 of the recipe for Cooking Up Profits), the easier it is to pick the leader. In Put Your Money Where Your Heart Is, I used these questions and tools to compare two companies – one that became one of the most successful IPOs of all time (Google) and the other that went bankrupt (General Motors). FYI: I identified both of these trends years before they occurred by using the strategies outlined in Put Your Money Where Your Heart Is. The book was written in 2006, three years before GM went bankrupt. 16. What were the top performing and the worst months for stocks over the past five years? October, February, November, July and March performed best over the 5-year period (in that order). August, January and June were negative months. If you’d like a chart of the top performing months over the last 5, 10 and 20 years, call 310-430-2397 or email info @ NataliePace.com. 17. What was the top performing 4-month period for stocks over the past five years? February, March, April and May – the Spring Rally – with 6.98% gains over the 4-month period, on average. October, November and December saw cumulative monthly gains of 5.98%, followed by a 1% loss in January. Understanding seasonal trends can help you with your annual rebalancing in your nest egg, and with your selling strategy for your trading. I teach this and more in my Investor Educational Retreats. 18. What was the worst investment in 2017, NASDAQ, gold, the Dow Jones Industrial Average, bonds or real estate? Over the past few years, bonds have been the worst performers. If you held Greek, Detroit, Stockton, American Airlines, Hostess, or even oil bonds, you have lost quite a lot of dough. If you hold bonds or bond funds, both Warren Buffett and Alan Greenspan are warning that bonds are overpriced and in a bubble. You could be vulnerable to losses. There are safer ways to earn gains and protect your assets. I spend one full day at the Investor Educational Retreats on What’s Safe and How to Get Safe. Call 310-430-2397 or email info @ NataliePace.com to learn more. 19. Which year is expected to perform better, 2018 or 2019, based upon historical returns of election years? 2019. Pre-election years are rock stars historically, boasting average annual gains of 15.6% over the last three decades. However, since 2000, we live in a new world where pre-election and election years are the worst performers. 2000, an election year, was the beginning of the Dot Com Recession. 2008, an election year, ushered in the devastating Great Recession. 20. How many companies are in the Dow Jones Industrial Average? 30 companies. Many are household brands. And many are carrying far more debt than the value of the company. Click to access the names of the 30 companies. The Dow Jones Industrial Average was launched in 1896. 21. How many Dow Jones Industrial Average companies were bailed out or went bankrupt in the Great Recession? Most don't realize that 20% of the companies of the Dow (6 companies: AIG, American Express, Bank of America, Citi, JP Morgan and General Motors) were bailed out or went bankrupt in the Great Recession. Others, like General Electric, received support. New Chips are far safer, and higher performing, than Blue Chips. Learn more about that at the Investor Educational Retreat and in The ABCs of Money. *All highlighted phrases are explained in great detail at the Natalie Pace Investor Educational Retreats. Call 310-430-2397 or email [email protected] to learn now. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Data Sources: (c) 2018 Morningstar Direct and The National Association of Realtors. All rights reserved. Used with permission. The information contained herein: (1) is proprietary; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar, the National Association of Realtors, Natalie Pace, nor any content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

paul

8/3/2018 10:56:33 pm

intersting, like to dress some topics, but not for the public. 9/3/2018 07:10:37 am

Hi Paul. Feel free to email our office at [email protected]. You can also call 310-430-2397. Have a lovely day. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

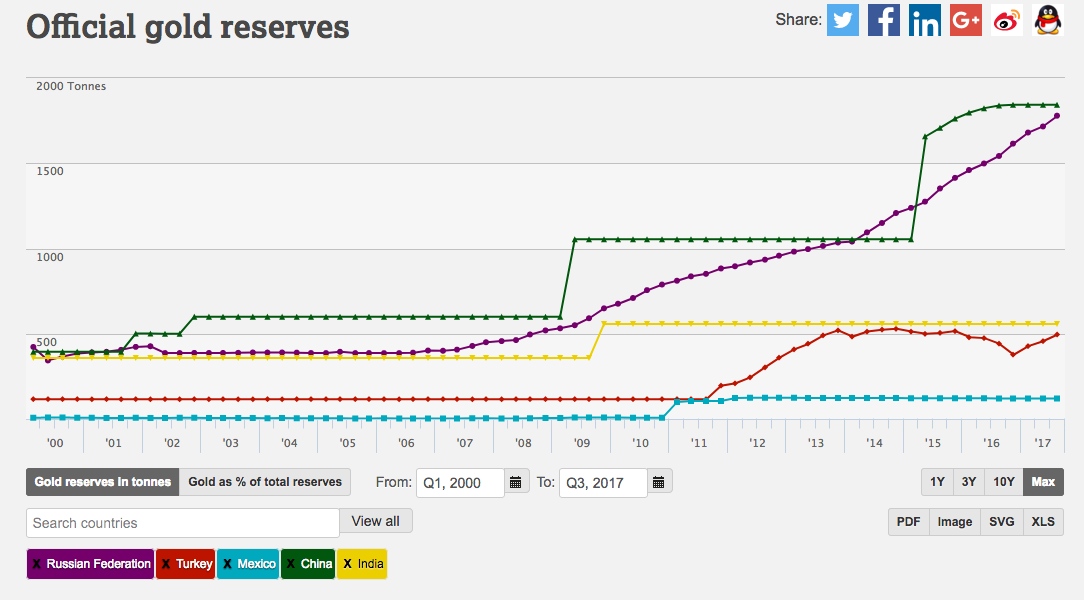

RSS Feed