|

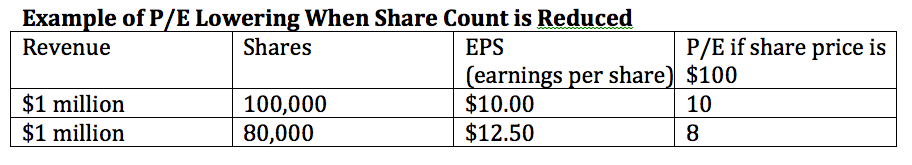

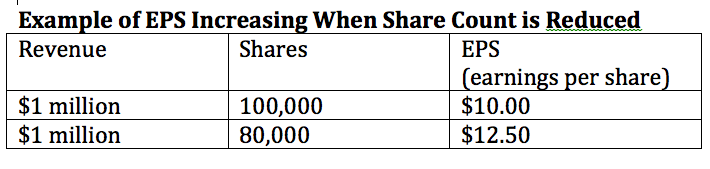

Financial Engineering. Good math goes a long way in today’s world. It has been fueling the rise in the stock market, and it is also helping to make ends meet for the U.S. Federal Government. For instance, if you wait to retire until you are 67, the Social Security Administration will give you XYZ benefit level, and even more if you wait to 70. On the face of it, waiting looks like a good idea. However, if you do the math, you’ll realize that it will take you 20 years to make up the losses of waiting until you’re 67 to retire – longer than most people live. (Something that is never mentioned in the glossy brochure or blog.) That’s great for the U.S. (and “us”), but not so good for you individually, particularly if you are 62 and out of work. And that’s the issue with stocks, too. The boom/bust economy that we’ve been embroiled in during this new Millennium can be great in the short term, but costs everyone dearly in the correction (which has been happening in an 8-year cycle since 2000). In 2000, Dot Com companies were given the cheap, easy money, resulting in a 78% correction in the NASDAQ Composite Index that took 15 years to recover from. Prior to the Great Recession, money flowed into liar loans, subprime and real estate, costing the Dow Jones Industrial Average a drop of 55%. The American taxpayer had to bail out the banks, insurance companies and brokerages, and over seven million people lost their homes. 5.4 million homes are still seriously underwater and the debt in the developed world has become astronomical (at $20 trillion in U.S. public debt and over $65 trillion in U.S. total debt and loans). This hits Main Street the hardest, since the “smart money” always moves out first. So, where is the cheap, easy money flowing these days? Who is benefiting, and what will be the ultimate cost? The short answer is that corporations are getting the bulk of the money. They are buying back their own stock, which pushes up the stock market. Just as Internet companies couldn’t get to cash break even in 2000 (despite an inflow of investment money), many legacy companies are suffering from sluggish sales and drowning in debt, pensions and other post employment benefits – something that borrowing money doesn’t correct. Large corporations have been borrowing money very cheaply and using it to push up the value of their own stock, rather than investing in new products, people or productivity. Here’s how the financial engineering works. Corporate Buybacks Look Great on Paper Because… The Share Price Stays High Earnings Look Higher Than They Are Price to Earnings Ratio Looks like a Bargain However, what is really happening is that … Share Price Stays High The share price is staying high because the company’s own buying makes it look like the stock is popular. Earnings Look Higher Than they Are Many companies buy back their own stock in order to make their quarterly earnings look good. How does this work? When you reduce the number of shares (as happens when corporations buy shares and take them out of circulation), the earnings per share goes up, even if the revenue (sales) is actually flat or even lower than it was a year ago. Price to Earnings Ratio Looks like a Bargain The Price to Earnings Ratio also looks more attractive when the share count is reduced. Investors think that the stock is on sale, and might be tempted to buy at what they perceive is a bargain price.  According to Howard Silverblatt, the senior index analyst for S&P Dow Jones Indices, corporate buybacks have boosted EPS by 20% over the last 4 years. The Smart Money Exits Quietly, First Corporate buybacks were down in 2016 and 2015, from the highs set in 2014 (which were on par with the highs set in 2007, before the Great Recession). The last two consecutive declines in buybacks occurred in 2008 and 2009 (when the Dow Jones Industrial Average dropped to a low of 6547). In spring of 2005 (two years before the subprime crisis), home builder CEOs were selling hundreds of millions of their company stock, including Angelo Mozillo at Countrywide, the Toll Brothers and the KB Home CEO. Over the last year, Apple insiders have taken profits on over $610 million in stock. Microsoft executives and directors have cashed out over $4.5 billion. Jeff Bezos (the CEO of Amazon) has sold over $1.7 billion of Amazon stock. The First Signs of Distress: Retail Bankruptcies The retail bankruptcies of the last few years have shocked consumers, but haven’t weighed on the stock markets – yet. Retailers continue to be at risk, with the threat of bankruptcy in the next 12-24 months looming for Sears Holding Company, Claire’s Stores, True Religion Apparel, 99 Cents Only Stores, Nebraska Book Company (for the 2nd time in five years), Nine West Holdings and Rue21 (source: Fitch Ratings). Payless declared bankruptcy on April 4, 2017. The loss of income for mall REITs can’t be good. Publicly traded mall REITs are heavily indebted, with Taubman Centers Inc. carrying a debt to equity ratio of 51 (source: Money.MSN.com). No One Ever Predicts a Recession In 2007, even as mortgage banks were going out of business in droves and the auto manufacturers were hanging on with backdoor borrowing from the U.S. Treasury, Treasury Secretary Henry Paulsen was still reassuring investors that the subprime mess wouldn’t affect the overall economy (source: Bloomberg, July 26, 2007). GDP growth predictions for 2009 were still 2-3% growth in June of 2008, even though Bear Stearns had already collapsed and Lehman Brothers, Washington Mutual, Merrill Lynch, AIG and many of the largest U.S. banks, insurance companies and brokerages were teetering on the edge of bankruptcy and negotiating behind closed doors for emergency capital to save their assets. Even after the bailouts, the October 2008 economic projections were still touting GDP growth. It wasn’t until January 28, 2009, just a month and a half before the bottom of the Great Recession, that the GDP growth predictions finally reflected negative growth. If you wait for the headlines that we’re in a recession, it’s too late to protect yourself. What’s Really Going On Behind the Scenes The basic analysis of what is really going on behind the scenes today is that everyone in most of the developed world (with rare exceptions), including governments, corporations and individuals, are borrowing from Peter to pay Paul. According to the Urban Institute, 1/3 of Americans with a credit score are in debt collections. It doesn’t take any amount of data to know that most of the people you know are struggling financially, buying less of everything, taking fewer vacations and being forced to come up with creative solutions for housing. Financial engineering (fuzzy math) only takes things so far. When the correction occurs, there isn’t a warning. In fact, there is always a lot of high-level rhetoric reassuring everyone, while behind the scenes the smart money is cashing in as much as they can as fast as they can. And that is why I’m encouraging everyone to make sure that you are safe and protected now. If you lost more than half in the Great Recession, and you haven’t made any changes to your strategy, you are as vulnerable today as you were then. The safe side of your portfolio is even more vulnerable. There are safe, easy, time-efficient, time-proven strategies that earned gains in the last two recessions, outperformed the bull markets in between and are easy-as-a-pie-chart. You can also save thousands of dollars every year with smarter energy, budgeting and investing choices (without a loss of life style), when you stop making the billionaires rich at your own expense. Wisdom is the cure. Call 310-430-2397, or email info @ NataliePace.com to learn more. Join me on my teleconference this Thursday at 9 am PT (noon ET) for an interactive conversation on financial engineering, where I am happy to answer your questions. If you want to protect your assets before summer (and frolic in the warm Atlantic with new friends), then join me at my June 10-12, 2017 Oceanfront Florida Financial Empowerment Retreat. Only a few seats remain available.

LYNN KEREW

16/5/2017 12:48:21 pm

EXCELLENT ANALYSIS..THANK YOU AS ALWAYS! 16/5/2017 02:21:34 pm

Dear Lynn, 18/10/2017 07:53:00 am

As this type of trading has become very popular with many people using it, there are several binary options platforms available. For this reason, it may sometimes become difficult to know which platform is the best. 1/11/2017 02:43:36 pm

Personal finance is an extremely important part of our life. It is not only our responsibility, but our duty to manage our finances better. 1/11/2017 02:58:56 pm

Well said, The Finance Genie. When we learn the ABCs of Money that we all should have received in high school, apply it to our own lives, then we can start improving everything and everyone around us (in addition to solving the very big and very real problems we face in macro economics). 9/12/2017 09:22:30 am

In today's constantly changing world, it can be hard to keep up with everything that needs to be done for sound financial planning. Luckily, with sound financial advising services, you can rest easy knowing that you have an experienced team on your side that is dedicated to saving you or your company money. Getting advice on financial matters is one of the greatest tools available to help you focus on what matters most. 3/2/2018 06:22:03 am

cloud-ico.com offers cryptocurrency cloud mining services on modern, high-efficiency equipment. 11/3/2018 05:25:31 am

Los Angeles is a city of businesses large, medium-sized and small. It is also the home of entrepreneurs. Interestingly enough, it seems as though most of these small businesses are disinclined to borrow and to risk their savings in further growth leaving the borrowing to the larger companies. 25/3/2018 10:20:37 am

Finance management or financial management is that aspect of management which involves the application of general management principles to specific financial operations. It basically entails planning within a business enterprise to ensure a positive cash flow and maximize shareholder wealth. Financial management includes a large number of complex practices and processes, including the administration and maintenance of financial aspects and identifying and managing risks. Bitcoin Mining is a peer-to-peer computer process used to secure and verify bitcoin transactions—payments from one user to another on a decentralized network. Mining involves adding bitcoin transaction data to Bitcoin's global public ledger of past transactions. Each group of transactions is called a block. 16/5/2018 12:25:55 pm

Imagine freeing yourself from the wash/dry/fold grind. ... You can sign up online if you need recurringservice or give us a call if you need a one-time pickup! 27/8/2018 11:10:17 am

Mortgage Servicers, foreclosures and hazard insurance claims. There are many processes a mortgage servicer should keep an eye on relative to their hazard insurance claims responsibilities. Being proactive and reporting claims in a timely manner can save thousands of dollars in damage to an asset. It can mean the difference between a successful loan payoff and a charge off. Here are four critical processes to consider. These are some of the most common areas that mortgage servicers should review on a regular basis. Case law changes daily, regulations change frequently and real estate investors are focusing on reducing losses wherever possible. Don't get caught short with out-dated procedures, systems and expertise. 4/11/2020 05:23:28 am

Extremely useful info specially the last part I care for such information a lot. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed