Should You Sell in May and Go Away? As we enter the 9th year of the current bull market (something akin to unicorns, historically), it’s definitely time to ask ourselves, “Should I sell in May and go away on holiday?” Is this the time to take profits, count blessings, get a little defensive and take an epic vacation? Below are a few considerations.

And here are details on each of these considerations.

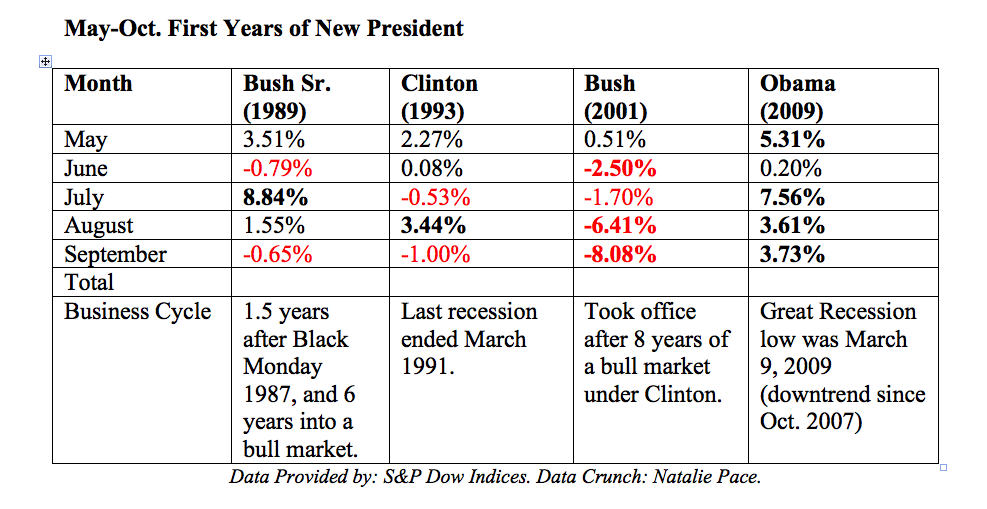

2. How Do the Markets Perform May-October Under First Time Presidents? As you can see from the chart below, the performance is more affected by the business cycle, than it is by the President. President George W. Bush had a terrible time his first year. However, he inherited an economy that was ripe for a recession. The U.S. had experienced eight years of prosperity under President Clinton. NASDAQ was a bubble that was ready to pop. When President Obama took office, the U.S. was near the bottom of the Great Recession (the exact bottom was March 9, 2009). There was nowhere to go but up. This year marks the 9th year of the current bull market – a difficult time for market gains, historically. 3. How’s the Economy Doing These Days? The predictions are for very slow growth, at just 2.1% GDP growth for 2017. (No one ever predicts a recession.) The 1st quarter 2017 GDP growth was the lowest it has been in years, at 0.07%. Other issues include: $20 trillion in public debt, over $66 trillion in total U.S. Debt and Loans, and business, governments and people who are borrowing from Peter to pay Paul to try and make ends meet. 4. What Positive or Negative Events Are on the Horizon? The current Budget funds government only through September 30, 2017. The U.S. Treasury Secretary is currently using extraordinary means to pay bills because the Debt Ceiling has been hit again. If the Debt Ceiling isn’t raised before the U.S. runs out of money to pay bills, then Fitch Ratings might downgrade the U.S. credit. The new budget and Debt Ceiling will have to be resolved in September to avoid all of this. The last time that Congress raised the Debt Ceiling, House Speaker John Boehner lost his job. He had to enlist the support of Democrats to get the Debt Ceiling raised. While the bipartisan Budget that was just passed makes it seem possible that all of this can get done, everyone is mum on the issues. If you wait for the headlines this fall, and they turn out to be contentious or problematic, it will be too late to protect yourself. 5. What’s Fueling the Bull Market? Free, easy money (for corporations and countries, but not individuals or small businesses). Corporate buybacks. Financial engineering. For more on this, tune into my May 25, 2017 teleconference. Get call in instructions and listen back 24/7 on demand at http://www.BlogTalkRadio.com/NataliePace. 6. What Other Opportunities Exist for Investors? The best opportunities today are safe, income-producing hard assets that you purchase for a good price. Real estate is more expensive in many areas than it was before the real estate bubble burst in the Great Recession. So, income property is not necessarily a good price right now (although it might be in some areas that have not experienced a return to the pre-Recession highs). Most of the best areas of opportunities lie in purchases you can make now to reduce the money that you spend monthly on big ticket items like housing, transportation, electricity, insurance, medical insurance, etc. (This is another major area of focus at my Investor Educational Retreats.) 7. What’s at Stake? The last two times that the U.S. economy went 8 years without a correction, the economy crashed. Investors lost more than half in the Great Recession (and over 7 million people also lost their homes), and more than 3/4ths in the Dot Com Recession. This economy is far more fragile than it was in either of those two recessions, with all of the debt that abounds. Performance of the Dow Jones Industrial Average Index from Oct. 2007 to March 2009 Performance of the NASDAQ Composite Index from March 2000 to October 2002. Access my teleconference, "Should You Sell in May and Go Away?" at http://www.BlogTalkRadio.com/NataliePace/2017/05/05/sell-in-may-and-go-away. About Natalie Pace Natalie Wynne Pace is the co-creator of the Earth Gratitude project and the author of the Amazon bestsellers The Gratitude Game, The ABCs of Money and Put Your Money Where Your Heart Is (aka You Vs. Wall Street). She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 year (in its vertical). Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed